Shadow less Surgical Lights Market Report Scope & Overview:

Get More Information on Shadow less Surgical Lights Market - Request Sample Report

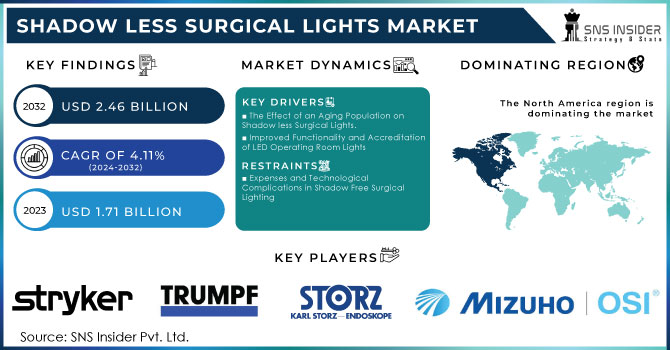

The Shadow less Surgical Lights Market Size was valued at USD 1.71 Billion in 2023. It is expected to grow to USD 2.46 Billion by 2032 and grow at a CAGR of 4.11% over the forecast period of 2024-2032.

The shadow-free surgical lights market has seen strong growth, primarily due to improvements in LED technology, which has revolutionized medical lighting. LEDs provide better brightness and concentrated lighting, important for accuracy in surgeries, and have a lifespan of up to 50,000 hours, much longer than standard halogen lights, which only last about 2,000-3,000 hours. This longer lifespan decreases maintenance expenses and operational downtime, and the energy efficiency of LEDs, which use at least 75% less energy than incandescent lighting, helps save money and promotes worldwide energy conservation objectives. It is expected that the increased use of LED technology will lead to a reduction in energy consumption by up to 569 TWh per year by 2035 in the United States, which is equivalent to the electricity generated by more than 92 large power plants. LED lights produce very little heat compared to halogen bulbs, which release approximately 90% of their energy as heat, helping to create a comfortable atmosphere in operating rooms. These elements, along with the rising global surgical procedures and the drive to update healthcare facilities, are driving the market's growth. Incorporating advanced options like adjustable brightness levels and color temperatures increases the effectiveness and attractiveness of shadow less surgical lights. Government efforts and business analyses emphasize the influence of LED technology in enhancing surgical lighting, affirming its increasing importance in contemporary medical procedures.

The shadow less surgical lights market is growing quickly because of the crucial role these lights have in today's operating rooms, where precise lighting and efficiency are essential. With a growing emphasis on improving surgical settings, there has been a rise in the need for more sophisticated surgical lighting systems in hospitals. Crucial for this development is the need for surgical lights to offer the best possible lighting, usually reaching a minimum of 150,000 Lux to replicate natural light conditions, with adjustable settings between 40,000 to 100,000 Lux. This ensures that vision is not affected by too much brightness, while also preventing glare that can lead to eye strain and fatigue. A surgical environment that is conducive requires an overall illuminance of 1,000 Lux or higher in the operating room. Additionally, it is important to have shadow less effects; any presence of shadows can block a surgeon's vision, highlighting the importance of achieving a flawless shadow less effect as a key indicator of performance. Surgical lights that are considered optimal are created to maintain a minimum shadow-to-light ratio of 10%, which is accomplished by a thoughtfully designed configuration of various lamps and reflectors to guarantee a consistent and shadow less light emission. Moreover, it is essential to limit temperature increases to 10°C to avoid heat impacting the surgical area or the surgeon. This is achieved by blocking infrared light to maintain a suitable operating temperature. Good color rendering is important for surgical lights, which should have a Color Rendering Index (CRI) near 100 and a color temperature of about 6,000K to accurately show the colors of blood and tissue. As healthcare facilities focus on these requirements to enhance surgical results and productivity, the market for shadow less surgical lights is expanding, showing the industry's dedication to improving surgical technology and patient well-being.

Shadow less Surgical Lights Market Dynamics

Drivers

- The Effect of an Aging Population on Shadow less Surgical Lights.

The increasing elderly population worldwide is a key factor driving growth in the market for shadow less surgical lights. The World Health Organization (WHO) predicts that by 2030, there will be 1.4 billion people aged 65 and above, up from 727 million in 2020 - WHO - Ageing. This change in demographics has a significant effect on the need for surgical procedures, as the elderly are more commonly facing age-related health problems like orthopedic conditions, heart diseases, and cancer. For example, the increasing occurrence of hip and knee replacement operations, caused by osteoarthritis and other deteriorative ailments, requires sophisticated surgical lighting options in order to guarantee accuracy and safety throughout surgeries. As noted by the WHO, this shift in population demographics necessitates holistic adjustments in different fields, such as healthcare. Good surgical lighting is essential for meeting these requirements, offering proper lighting of up to 100,000 Lux, and creating a flawless shadow-free effect to improve the clarity of the surgical area. The increasing need for shadow less surgical lights is directly tied to the rising number of surgical procedures needed by an aging population. Furthermore, with the global population aged 60 and above projected to grow from 1 billion in 2019 to 2.1 billion by 2050, this shift will lead to more progress and funding in surgical lighting technology according to WHO - Ageing. These factors highlight the important role of effective surgical lighting in addressing the changing requirements of an aging population and achieving the best surgical results.

- Improved Functionality and Accreditation of LED Operating Room Lights

Advancements in LED technology and strict certification standards, like the U.S. Department of Energy's LED Lighting Facts program, are key factors boosting the demand for shadow less surgical lights in the market. Sponsored by the DOE, this project offers detailed and precise data on the photometric capabilities of LED lighting products via its LED Lighting Facts label. This tag assists purchasers in assessing important qualities like brightness, color temperature, and energy efficiency, allowing them to choose the best lighting options for their requirements. The program ensures that only high-quality LED surgical lights with verified performance data are able to gain market traction, thereby improving their competitive advantage. Moreover, TÜV SÜD, an accredited testing facility for the LED Lighting Facts program and ENERGY STAR program, boosts the market with comprehensive testing and certification services. TÜV SÜD's certifications ensure that LED surgical lights meet strict requirements for performance and safety, including crucial features like precise color rendering and low heat emission. These certifications guarantee adherence to regulations and establish consumer confidence in the dependability and effectiveness of LED lighting products. Focusing on accurate performance metrics and supporting well-known certification organizations are key factors driving the growth of the shadow less surgical lights market by enabling the use of advanced lighting solutions in operating rooms. As LED technology advances and certification standards become stricter, the need for top-notch, certified surgical lighting solutions is projected to rise, emphasizing the significance of performance validation in this industry.

Restraints

- Expenses and Technological Complications in Shadow Free Surgical Lighting

The market for shadow less surgical lights is hindered by various factors, mainly due to the expensive nature and advanced technology. Sophisticated surgical lights without shadows, especially those that use LED technology, require a considerable amount of money to be invested because of their high-quality design and manufacturing processes. The starting price of these lights may be too expensive for numerous healthcare facilities, especially in developing areas with stricter budget limitations. Industry reports suggest that the cost of top-notch LED surgical lights can vary from USD 5,000 to more than 20,000 per unit, based on factors like light intensity, color rendering, and extra features. The expensive price can restrict the availability and use of these modern lighting systems, especially in smaller or underfunded healthcare facilities. Furthermore, the high level of technological intricacy presented by these lights creates an additional obstacle. Creating shadow less surgical lights that adhere to strict performance standards demands advanced engineering and constant innovation to ensure precise lighting, optimal shadow minimization, and minimal heat output. This intricacy not just raises production expenses but also requires substantial technical skills for setup and upkeep. Additionally, adhering to different international standards and certifications increases both complexity and expenses. The collective influence of these factors may impede the broad acceptance of shadow less surgical lights, especially in markets where financial limitations are a major issue. Consequently, despite the evident technological advantages of advanced surgical lighting, the market growth and accessibility are hindered by the substantial costs and technical requirements.

Shadow less Surgical Lights Market Segment Analysis

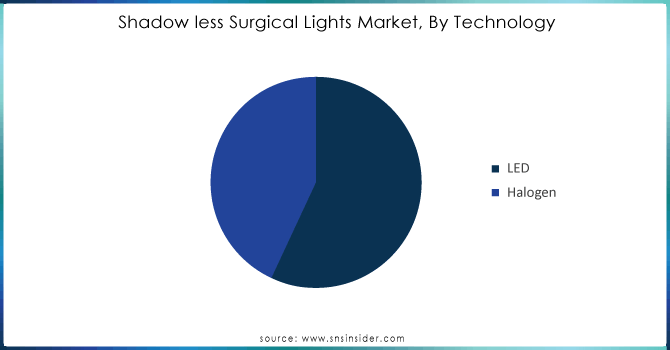

By Technology

Based on Technology, LED dominate the largest share revenue in shadow less surgical light market with 58% of share in 2023. This superiority is due to multiple key benefits that LEDs have compared to traditional lighting technologies like halogen or xenon. LEDs offer better lighting with a greater brightness, essential for accurate surgical procedures. They provide a steady brightness level of 40,000 to 100,000 Lux, which is crucial for precise and complex surgeries. Furthermore, LEDs are recognized for their excellent ability to render colors, boasting a Color Rendering Index (CRI) near 100, guaranteeing precise depiction of tissues and blood. This is crucial for reducing color distortion and improving surgical accuracy. LED's long lifespan and energy efficiency are notable factors contributing to their dominance. LED lights outlast traditional light sources by having a lifespan of up to 50,000 hours, leading to fewer bulb replacements and lower maintenance expenses. The lower operational costs and reduced environmental impact are also a result of their energy efficiency. Additionally, LEDs generate very little heat, which helps alleviate worries about the surgical setting being affected by temperature and ensuring patient comfort. This characteristic is important for keeping the operating room temperature stable during long surgical procedures. The superior performance, cost-effectiveness, and alignment with modern healthcare demands are the reasons for the widespread use of LED technology in shadow less surgical lights. With technology progressing, LEDs are projected to stay at the forefront in the market due to enhancements in light quality and energy efficiency.

Need any customization research on Shadow less Surgical Lights Market- Enquiry Now

By End User

Based On End-User, Hospital dominate the Shadow less Surgical Lights Market with 39% of share. Hospitals need surgical lights that offer maximum illumination, minimize shadows, and guarantee precise color rendering for various intricate surgical procedures. Top companies in the market, like Stryker and Hill-Rom, are leading the way in developing innovative solutions for hospital settings. Stryker's most recent products, such as the Stryker 1288 HD Surgical Imaging System, utilize advanced LED technology and high-definition imaging features to improve both visualization and procedural accuracy. Hill-Rom has unveiled the TruLight® 700 Series, which includes innovative light modulation and adjustable intensity options tailored to various surgical disciplines. Furthermore, KARL STORZ and Getinge are also pushing the market forward with products aimed at improving surgical accuracy and patient well-being. KARL STORZ's LED C-MAC® Surgical Lights use advanced optics and color temperature controls to provide excellent lighting and minimize eye fatigue in surgeons. Getinge's Surgical Light Systems utilize intelligent technology to automatically adjust brightness according to the surgical area, enhancing efficiency as a whole. These advancements demonstrate the increasing focus on improving surgical lighting technology to meet the demanding needs of hospitals.

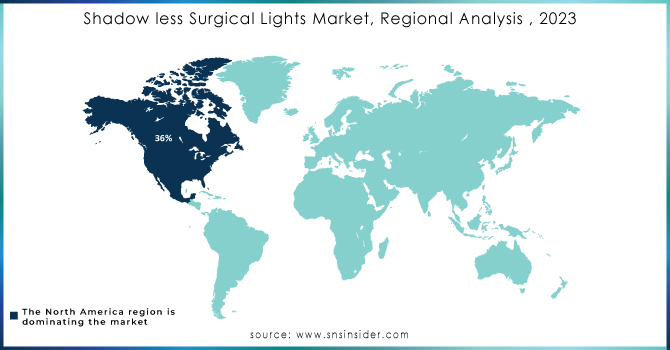

Shadow less Surgical Lights Market Regional Overview

The reason for this dominance is the high demand for advanced lighting solutions in hospital operating rooms, where accuracy and dependability are crucial. Hospitals need surgical lights that offer the best possible brightness, minimize shadows, and guarantee precise color representation for diverse and complicated surgical processes. Top companies in the industry, like Stryker and Hill-Rom, are leading the way in creating innovative solutions specifically designed for hospital settings. Stryker's newest products, such as the Stryker 1288 HD Surgical Imaging System, combine state-of-the-art LED technology with high-definition imaging features, improving both visualization and procedural precision. Hill-Rom has launched the TruLight® 700 Series, which offers advanced light modulation and adjustable intensity settings to address the unique requirements of various surgical specialties. Furthermore, KARL STORZ and Getinge are also pushing the market forward by creating products that improve surgical accuracy and protect patient well-being. KARL STORZ's LED C-MAC® Surgical Lights use advanced optics and color temperature controls to provide better lighting and lessen eye fatigue for surgeons. Getinge's Surgical Light Systems incorporate intelligent technology to automatically adjust brightness according to the surgical area, enhancing overall productivity. These advancements underscore the increasing focus on improving surgical lighting technology to meet the demanding requirements of hospital settings.

Europe is the second largest in shadow less surgical lights market in 2023. The significant market share is propelled by the area's robust healthcare system and increasing emphasis on cutting-edge surgical technologies. Germany, France, and the United Kingdom are leading the way in implementing and incorporating advanced surgical lighting solutions. The area's dedication to improving surgical accuracy and patient well-being is clear through various technological advancements and innovative products. For instance, Olympus has launched the VISERA ELITE II surgical light system in Europe, which includes powerful LED lighting capable of providing excellent color rendering for intricate surgical procedures. Karl Storz has enhanced its product line by introducing the Image 1 S surgical imaging system, which combines top-notch illumination and imaging features to improve surgical results. Furthermore, Medtronic has broadened its range of products by introducing the O-ARM® Imaging System, featuring innovative lighting technology aimed at improving visibility and efficiency in spinal and orthopedic surgeries. European companies are also putting money into research and development to enhance lighting technologies, with a focus on energy efficiency, durability, and customizable features to meet various surgical requirements. Stringent regulatory standards and a strong focus on quality and safety in medical devices continue to drive the market's growth. Europe's leading position in the shadow less surgical lights market highlights its crucial role in promoting surgical technology and enhancing patient care throughout the continent.

Key Players

The major Players are Stryker (US), TRUMPF, Karl Storz, Mizuho OSI, Skytron, Steris, Eschmann, Kenswick, Merivaara, Philips Healthcare, KLS Martin Group, Getinge, Drager, Mindray, Heal Force Bio-meditech Holdings, XYC Medical and others players.

Recent Development

-

In March of 2022, Viscor, a brand under Leviton Lighting, unveiled a new Certolux MSU-DFX light fixture featuring 365DisInFx UVA technology in order to promote sterilized operating rooms.

-

In January 2022, Merivaara expanded its Q-Flow surgical light line with the launch of Q-Flow Fluent. Clients who value simplicity, durability, and high hygiene standards in their operating rooms but also seek a top-quality surgical light will discover the Q-Flow Fluent to be the perfect choice.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.71 Billion |

| Market Size by 2032 | USD 2.46 Billion |

| CAGR | CAGR of 4.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Mobile Shadowless Lamp, Light Emitting Diode (LED) Shadowless lamp ,Holes Shadowless Lamp ,Integral Reflex Shadowless Lamp) • By Technology (LED, Halogen ) • By Application (Surgical Suites, Endoscopy Procedures, Dental Procedures) • By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stryker (US), TRUMPF, Karl Storz, Mizuho OSI, Skytron, Steris, Eschmann, Kenswick , Merivaara , Philips Healthcare ,KLS Martin Group ,Getinge ,Drager, Mindray ,Heal Force Bio-meditech Holdings ,XYC Medical and others players |

| Key Drivers | • The Effect of an Aging Population on Shadow less Surgical Lights. • Improved Functionality and Accreditation of LED Operating Room Lights |

| RESTRAINTS | • Expenses and Technological Complications in Shadow Free Surgical Lighting |