Smart Pet Feeder Market Report Scope & Overview:

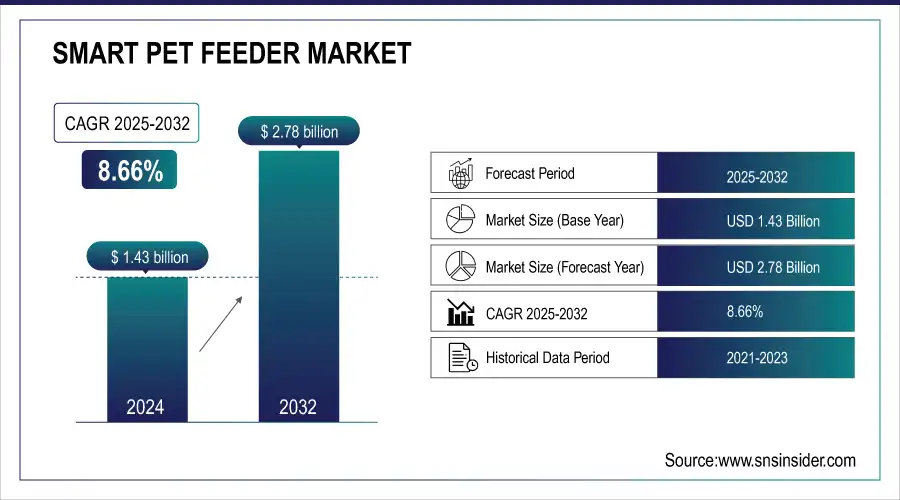

The Smart Pet Feeder Market size was valued at USD 1.43 billion in 2024 and is expected to reach USD 2.78 billion by 2032, growing at a CAGR of 8.66% over the forecast period of 2025-2032.

The global smart pet feeder market is being propelled by the increasing adoption of pets, which is likely to emerge as an ongoing smart pet feeder market trend, as dogs and cats are taken in by more and more city homes. Growing humanization of pets and nuclear families leads to the demand for automatic feeders with regular nutrition. Moreover, busy lifestyles are a smart pet feeder market trend that also helps in market growth, as working professionals and nuclear families prefer smart feeders for regular feeding, controlled feeding, and remote monitoring.

To Get more information on Smart Pet Feeder Market - Request Free Sample Report

For instance, in June 2024, urban pet owners accounted for 60% of global smart feeder purchases, reflecting convenience-driven adoption in cities.

Key Smart Pet Feeder Market Trends

-

Increasing adoption of smart feeders with Wi-Fi/Bluetooth connectivity, enabling remote feeding, portion control, and notifications.

-

Advanced AI-based feeders are providing precise portion control and personalized feeding schedules for pets.

-

Smart feeders with built-in cameras and sensors track pet nutrition, weight, and feeding habits.

-

Rising demand for high-end, feature-rich feeders with durable materials and multi-pet functionality.

-

Growth of online sales and subscription-based models delivering food and feeder services.

-

Increasing launch of feeders using sustainable, recyclable materials catering to environmentally conscious pet owners.

Smart Pet Feeder Market Report Highlights

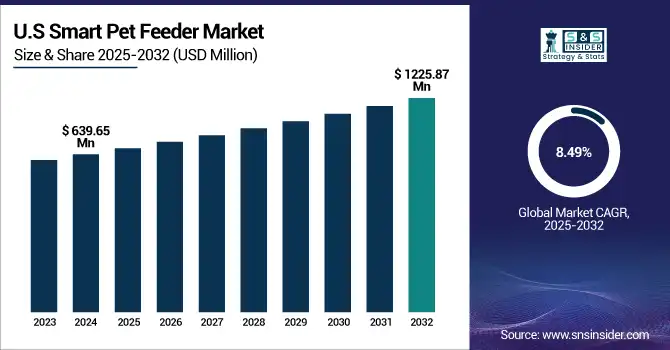

The U.S. smart pet feeder market was valued at USD 639.65 million in 2024 and is expected to reach USD 1225.87 million by 2032, growing at a CAGR of 8.49% over 2025-2032. The smart pet feeder market in the us is leading the industry on account of a high pet population, increasing disposable income, and tech-savvy people in the country. As per the Smart Pet Feeder Market analysis report, the incorporation of automated and app-connected feeders is gaining more and more demand from consumers, due to their convenient nature and use in pet health management.

Smart Pet Feeder Market trends are expected to witness significant growth during the forecast period, due to growth in the pet population, subsequent rise in adoption of IoT and AI-based feeders, and development in smart feeder design supported by the advancement in technology.

Key Smart Pet Feeder Market Segment Analysis

-

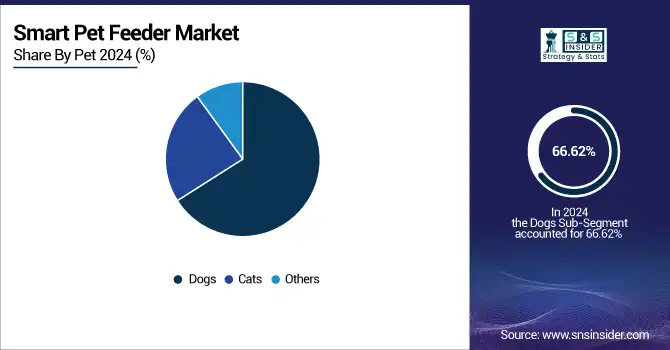

By Pet, dogs held the largest share of around 66.62% in 2024, and the cat segment is expected to register the highest growth with a CAGR of 9.25%.

-

By Connectivity, the Wi-Fi segment dominated the market with approximately 65.88% share in 2024, whereas the others segment is expected to register the highest growth with a CAGR of 9.00%.

-

By capacity, 3L to 5L accounted for the leading share of nearly 58.28% in 2024, and is expected to register the highest growth with a CAGR of 8.92%.

-

By Sales Channel, the offline segment led the market with about 72.88% share in 2024, while the online segment is forecasted to grow the fastest at a CAGR of 9.08%.

By Pet, Dogs Lead Market and Cats Register Fastest Growth

In 2024, the dog segment held a demanding revenue of around 66.62% in the smart pet feeder market share and is expected to continue its dominance, supported by increased global dog ownership, rising need for automatic feeding technology, and owners’ emphasis on volatility management and health surveillance. Ease and busy lives and pet humanization continue to drive adoption in this sector. The cat segment is projected to experience the fastest CAGR growth of around 9.25%, on account of a high level of indoor cat ownership, preference for automatic portion control, need for app-linked feeders that provide convenience and optimal nutrition.

By Capacity, 3L To 5L Dominate and Show Rapid Growth Over the Forecast Period

The smart pet feeder industry was dominated by the 3L to 5L segment with a revenue share of over 58.28% in 2024, owing to the perfect capacity for small to average sized pets, easy to use for multi pet homes, and you won’t have to refill it too many times unlike smaller feeders and it’s great at portioning out meals and setting them to be given regularly. On the other hand, it is anticipated to record the fastest CAGR of 8.92% during the forecast period (2024-2032), due to its perfect small to medium capacity, compatibility with multi-pet homes, and its reliable automatic portion control.

By Connectivity, Wi-Fi Lead, Whereas Others Register the Fastest Growth

The Wi-Fi segment led the smart pet feeder industry with the highest revenue market share of about 65.88% in 2024, owing to the ease of controlling remotely through mobile apps, real-time notifications for feeding, enabled smart home systems, better portion control ability, and the rising inclination of consumers towards connected devices. The Others segment is likely to register the fastest CAGR of approximately 9.00% over the forecast years 2024-2032, driven by the increasing acceptance of Bluetooth, cellular, and hybrid connection solutions, providing flexible control, improved monitoring, and compatibility with a range of smart home platforms.

By Sales Channel, Offline Lead, While Online Grows the Fastest

The offline segment of the smart pet feeder market was estimated as the highest earning segment with a revenue share of around 72.88% in 2024, due to large availability in retail stores, instantaneous product access, simpler returns and demos, strong brand representation, and customer preference in hands-on purchase experiences as opposed to online websites. The online segment is projected to attain the highest CAGR of approximately 9.08% throughout the forecast period (2024-2032), driven by increasing e-commerce penetration, availability of greater product options, competitive prices, more convenient home delivery, and lifting consumer preference for digital shopping channels.

North America Gaming Accessories Market Insights

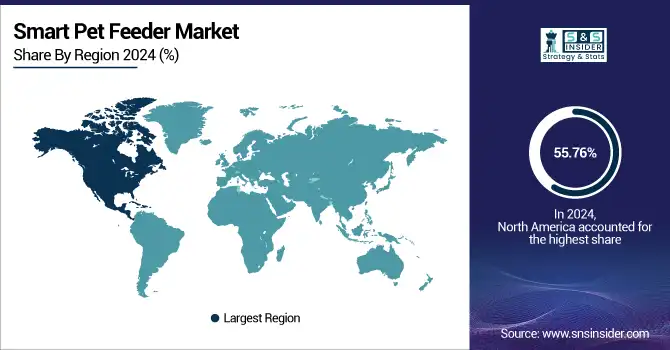

North America accounted for the highest revenue share of approximately 55.76% in 2024 of the smart pet feeder market, on account of rising pet owners, growing disposable income, and tech-savvy residents. Market leadership is driven by strong pet health awareness, high penetration of IoT- and AI-powered feeders, and mature e-commerce and retail channels. Increasingly hectic lifestyles and demand for automated, convenient feeding solutions also support North America’s lead.

Asia Pacific Gaming Accessories Market Insights

The Asia Pacific segment is projected to witness the fastest CAGR of 9.66% during the forecast period of 2024–2032, driven by a growing number of pets, urbanization, and disposable incomes. Increasing focus towards pet health and convenience-based applications will drive the IoT- and AI-based feeders. Increase in e-commerce, technological advancements, and the emergence of domestic and international smart feeder brands drive the growth of the market. Moreover, hectic work schedules and increasing adoption of nuclear families in countries including China, India, and Japan are further boosting the demand for automated feeding solutions.

Europe Smart Pet Feeder Market Insights

The Europe smart pet feeder market is growing steadily due to increasing pet ownership, awareness about the pet’s health and nutrition, and the need for automatic feeding solutions. Further, advancements in feeders, robust retail and e-commerce distribution channels, and increased implementation in countries including Germany, the UK, and France, among others, foster steady market growth in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Pet Feeder Market Insights

The Middle East & Africa and Latin America markets are also increasing, driven by a rising pet population, rapid urbanization and rising disposable incomes. Demand for IoT and app-controlled feeders is increasing, driven by growing online channels, an increase in knowledge about pet health, and global and regional smart feeder brands.

Smart Pet Feeder Market Growth Drivers:

-

Pet Health Awareness is Driving the Smart Pet Feeder Market Growth

Rise in awareness of animal health is also one of the key factors for the growth of the smart pet feeder market. Growth in pet owners’ concern regarding healthy nutrition, weight monitoring, and pets' well-being is driving the demand for automated feeders. With accurate portion control, purring schedules, and any monitoring, they are designed to allow owners to take care of their pets' health and obesity while also sharing their diets.

For instance, in June 2024, 68% of U.S. and 55% of European pet owners prioritized automated feeders for nutrition and portion control.

Smart Pet Feeder Market Restraints:

-

Dependency on Electricity & Connectivity is Hampering the Smart Pet Feeder Market Growth

Dependence on electricity and connection are significant limitations in the smart pet feeder market. Smart feeders need consistent power and internet or Wi-Fi connectivity to enable features including remote feeding, portion control, and app notifications. In areas with frequent power cuts or bad signals, these feeders may not work, and it may not be as easy for pet owners to use them.

Smart Pet Feeder Market Opportunities:

-

Integration with Health & Wellness Apps, Significant Growth Opportunities in Smart Pet Feeder Market

The opportunity in the Smart Pet Feeder Market is seen in its combination with health and wellness apps. Not to mention, packing feeders with a mobile app allows pet owners to be on the ball of their furry friend's diet, weight, and portion schedules. This simplifies pet health care, promotes personalized nutrition, and amplifies the usefulness and desirability of smart feeders in connected and health-focused homes.

For instance, in June 2024, urban pet owners accounted for 60% of global smart feeder purchases, reflecting convenience-driven adoption.

Competitive Landscape for Smart Pet Feeder Market:

PetSafe is a USA-based pet product expert and top supplier of pet products globally, including smart feeders, training equipment, containment systems, lifestyle products, waste management solutions, and treats. PetSafe operates globally with a US-based headquarters and offers a radio control lifestyle for pets and their owners with affordable, high-quality products providing convenience and comfort to pet owners.

-

In March 2025, PetSafe launched an updated Smart Feed Automatic Feeder featuring enhanced Wi-Fi connectivity, mobile app integration, and customizable portion control, enabling pet owners to manage feeding schedules and monitor their pets' health remotely.

Petnet is a U.S.-based smart pet feeding company. Its IoT-connected feeders offer automated portion control, scheduling, and mobile app integration. Petnet is committed to improving the lives of pets and pet owners by using smart technology to deliver nutritional solutions, health and wellness support, from the pet store to the pet bowl.

-

In January 2025, Petnet expanded its SmartFeeder platform globally, adding AI-based portion recommendations and enhanced mobile app features, allowing pet owners to remotely manage feeding schedules and monitor pets’ nutrition and health.

Cat Mate is a UK-based company that focuses on automatic pet feeders for cats. With a reputation for microchip-recognizing technology and programmable feeding schedules, Cat Mate is all about making life easier, portion control applications, and multiple pet management, dealing with tech-savvy cat owners, and enriching pet nutrition and health.

-

In June 2024, Cat Mate introduced the updated C500 microchip feeder with improved portion accuracy, faster programming, and greater durability, providing multi-cat households with precise feeding schedules and enhanced convenience.

Smart Pet Feeder Market Key Players:

Some of the Smart Pet Feeder Market Companies

-

PetSafe

-

Petnet

-

Cat Mate

-

SureFeed

-

WOpet

-

Petkit

-

Xiaomi

-

Pawbo

-

Petlibro

-

Dogness

-

ChowMate

-

Feed and Go

-

Paby

-

Arf Pets

-

PetWant

-

PetDine

-

Pioneer Pet

-

Moewy

-

iPet Smart Feeder

-

PETKIT Eversweet

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.43 billion |

| Market Size by 2032 | USD 2.78 billion |

| CAGR | CAGR of 8.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Pet (Dogs, Cats, Others) • By Capacity (Upto 3L, 3L to 5L, More than 5L) • By Connectivity (Wi-Fi, Others) • By Sales Channel(Offline, Online) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | PetSafe, Petnet, Cat Mate, SureFeed, Wopet, Petkit, Xiaomi, Pawbo, Petlibro, Dogness, ChowMate, Feed and Go, Paby, Arf, Pets, PetWant, PetDine, Pioneer Pet, Moewy, iPet Smart Feeder, PETKIT Eversweet and other players. |