Medical Device Reprocessing Market Report Scope & Overview:

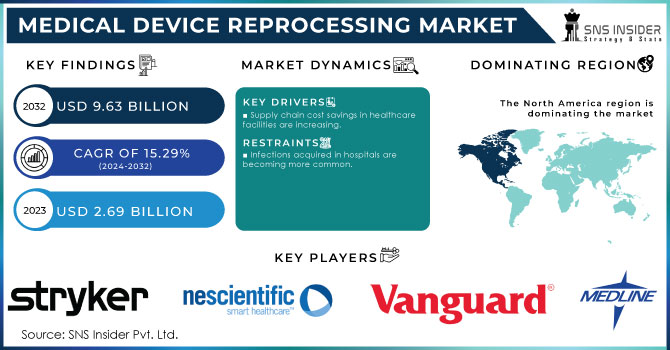

The Medical Device Reprocessing Market size was estimated at USD 3.10 billion in 2024 and is expected to reach USD 9.68 billion by 2032 at a CAGR of 15.29% during the forecast period of 2025-2032.

Reusable medical devices are essential tools in healthcare, offering cost-effective solutions for diagnosing and treating multiple patients. Examples include surgical forceps, endoscopes, and laryngoscopes. Respiratory diseases, such as asthma and COPD, affect millions worldwide. For instance, over 34 million Americans grapple with these conditions. Reprocessing surgical instruments, used in treating such diseases, offers a dual benefit. It significantly reduces the financial burden on healthcare systems, similar to the cost-saving measures employed by organizations supporting those with lung diseases. Additionally, it aligns with sustainability goals by minimizing waste, much like efforts to reduce the environmental impact of these chronic illnesses. However, their reuse necessitates rigorous reprocessing to eliminate contaminants and prevent infections. While the risk of infection from inadequately reprocessed devices is relatively low, the potential for outbreaks remains a significant public health concern. Proper disinfection and sterilization of medical devices are crucial for preventing the spread of infectious diseases to patients, as emphasized by the Centers for Disease Control and Prevention (CDC). Adherence to industry standards and best practices in medical device reprocessing significantly reduces infection risk and enhances patient outcomes within healthcare settings.

Get more information on Medical Device Reprocessing Market - Request Sample Report

Market demand for these devices is substantial, driven by increasing surgical procedures and the need for durable, high-quality equipment. The substantial volume of surgical procedures performed underscores the critical role of medical device reprocessing. Between 2019 and 2020, over 13 million surgical procedures were conducted, with women accounting for more than half of these. This massive number highlights the essential need for effective and efficient medical device reprocessing to ensure patient safety and prevent the spread of infections across procedures. Key segments include surgical instruments, endoscopy equipment, and respiratory care devices. Despite this demand, supply chain challenges, including material shortages and manufacturing complexities, can impact availability. Additionally, stringent sterilization requirements and the risk of contamination contribute to the overall cost of these devices, affecting affordability and accessibility in certain healthcare settings.

To ensure patient and staff safety as well as stay compliant, reprocessing medical devices is a necessary practice when the device or instrument is reusable. Reprocessing a device offer economic benefits for the healthcare facility, as the alternative is purchasing disposable instruments or devices for use during only a single patient procedure. While other costs are associated with medical device reprocessing (device repair and replacement, cleaning chemistries, capital purchases like sinks, washer/disinfectors, sterilizers, etc.), reprocessing through a third party or within the hospital has economic benefits for the facility.

Moreover, the disposal of medical waste is a complex process requiring strict adherence to OSHA guidelines for containment and treatment in US. This highlights the environmental and health risks associated with single-use medical devices. In contrast, medical reprocessing offers a sustainable alternative by extending the life of equipment, reducing waste, and conserving resources. This approach not only minimizes the environmental impact but also presents potential cost savings for healthcare facilities.

Medical Device Reprocessing Market Size and Forecast:

-

Market Size in 2024: USD 3.10 Billion

-

Market Size by 2032: USD 9.68 Billion

-

CAGR: 15.29% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Medical Device Reprocessing Market Highlights:

-

Reprocessing medical devices offers significant supply chain cost savings, being 30–50% cheaper than new devices, allowing hospitals to invest in staff, technology, and healthcare quality

-

Hospitals, surgical centers, and healthcare facilities widely adopt reprocessing as a cost-cutting strategy

-

Hospital-acquired infections (HAIs) remain a concern, with inadequate device reprocessing contributing to 22% of surgical site infections

-

Despite guidelines, insufficient reprocessing practices can increase morbidity and mortality risks in healthcare settings

-

Regulatory reforms by FDA and EU encourage safe, effective, and cost-efficient device reprocessing

-

Legal frameworks, standardized protocols, and sustainability incentives drive broader adoption while protecting patient health

Medical Device Reprocessing Market Drivers

-

Supply chain cost savings in healthcare facilities are increasing.

Reprocessing medical devices and equipment has received a lot of attention in recent years, not only in healthcare facilities for saving millions of dollars each year but also among manufacturers, who see it as a way to gain a significant competitive edge. According to the Association of Medical Device Reprocessors (AMDR, US), reprocessed medical devices are 30% to 50% less expensive than their new counterparts; as a result, medical device reprocessing has become one of the most widely used supply chain cost-cutting strategies among hospitals, surgical centers, and other healthcare facilities. This frees up funds for end users to recruit more people, modernize technology, and improve healthcare quality, among other things.

Medical Device Reprocessing Market Restraints:

-

Infections acquired in hospitals are becoming more common.

Hospital-acquired infections (HAls) are nosocomial infections that occur during a patient's stay in a hospital or other healthcare facility. HAIs are not detected at the time of admission and are a major cause of morbidity and mortality worldwide. Despite the existence of reprocessing guidelines and advances in device reprocessing methods, inadequate reprocessing of medical devices contributes to a significant proportion of hospital-acquired infection, with inadequate reprocessing of medical devices contributing to 22% of all surgical site infections (SSIs), one of the most common types of HAls cases.

Medical Device Reprocessing Market Opportunities:

-

Regulatory reforms that encourage the use of medical device reprocessing.

Regulatory reforms promoting medical device reprocessing focus on ensuring safety, efficacy, and cost-effectiveness while reducing environmental impact. Agencies like the U.S. FDA and EU authorities have established clear guidelines for validated cleaning, sterilization, and reuse of single-use devices. These reforms encourage hospitals and clinics to adopt reprocessing practices by providing legal frameworks, standardized protocols, and oversight mechanisms, minimizing liability concerns. Incentives include reduced procurement costs, waste management benefits, and alignment with sustainability goals. By setting rigorous quality and safety standards, regulatory reforms simultaneously protect patient health and promote broader adoption of environmentally responsible, cost-saving medical device reprocessing practices.

Medical Device Reprocessing Market Segment Analysis:

By Type

In 2024, the reprocessing support and services segment is expected to grow the fastest, at 56% during the forecast period. This surge is fueled by healthcare facilities increasingly outsourcing reprocessing operations to third-party providers, aiming to cut internal costs while ensuring efficient, compliant, and high-quality device management.

By Device Category

In 2024, critical devices accounted for the largest market segment at 44%. This growth is driven by the rising global prevalence of cardiac diseases and the growing adoption of reprocessed catheters, offering hospitals a cost-effective, safe alternative for cardiac procedures and other critical medical interventions.

By Application

In 2024, cardiology held the largest market share at 35%. The rising prevalence of heart diseases has increased diagnostic and cardiac procedures, prompting healthcare facilities to adopt reprocessed devices as a cost-effective solution, reducing expenses associated with purchasing new medical devices for each procedure.

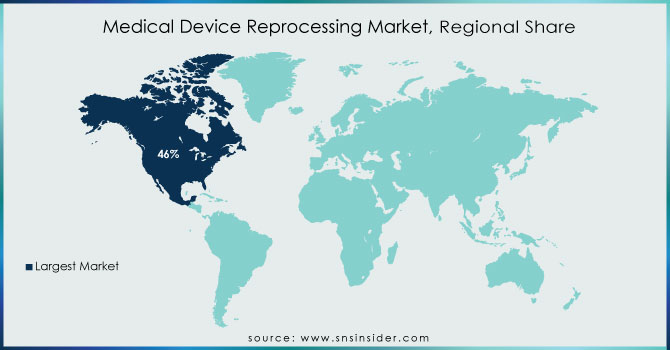

Medical Device Reprocessing Market Regional Analysis:

North America Medical Device Reprocessing Market Trends:

North America had the greatest revenue share, accounting for more than 46% of the global market. The growing need to decrease hospital waste and the potential environmental damage caused by the region's expanding waste landfills are major market drivers. Furthermore, favorable government measures and strategic actions conducted by healthcare institutions to raise awareness about equipment reprocessing are projected to generate considerable potential for this market.

Asia-Pacific Medical Device Reprocessing Market Trends:

Asia-Pacific is expected to increase at the fastest rate. The developing regional market for reprocessed medical equipment has been fueled by the growing economy, rising prevalence of chronic illnesses, and rising demand to reduce hospital expenses. Developing countries, such as China and India, have seen an increase in the occurrence of chronic diseases, as has the rest of the world. This has resulted in a greater emphasis on healthcare, with governments investing in healthcare infrastructure but limiting their spending.

Europe Medical Device Reprocessing Market Trends:

Europe is witnessing steady growth, driven by rising healthcare costs, stringent medical waste regulations, and increasing adoption of reprocessed devices. Countries like Germany are leading the market, supported by government initiatives and hospital strategies aimed at promoting cost-effective and sustainable medical device reprocessing.

Latin America Medical Device Reprocessing Market Trends:

Latin America is growing steadily, fueled by increasing chronic disease prevalence, rising healthcare expenditures, and the need to reduce hospital costs. Brazil leads the regional market, with healthcare facilities increasingly adopting reprocessed devices to ensure affordable and efficient patient care.

Middle East & Africa (MEA) Medical Device Reprocessing Market Trends:

MEA is expected to expand due to developing healthcare infrastructure, increasing medical waste, and rising demand for cost-effective medical solutions. Saudi Arabia is a key driver, supported by government investments and hospital initiatives promoting safe and efficient reprocessing of medical devices.

Need any customization research on Medical Device Reprocessing Market - Enquiry Now

Medical Device Reprocessing Market Key Players:

-

Stryker

-

Innovative Health

-

NEScientific, Inc.

-

Medline Industries, LP

-

Arjo

-

Vanguard AG

-

Cardinal Health

-

SureTek Medical

-

Soma Tech Intl

-

Johnson & Johnson MedTech

-

Steris Corporation

-

Getinge AB

-

3M Health Care

-

Olympus Corporation

-

Becton Dickinson (BD)

-

Cantel Medical

-

Mölnlycke Health Care

-

Advanced Sterilization Products (ASP)

-

SteriPack Group

-

Tuttnauer

Medical Device Reprocessing Market Competitive Landscape:

Stryker, established in 1941, is a leading global medical technology company specializing in surgical equipment, orthopedics, and medical device reprocessing. Its Sustainability Solutions (SSS) division focuses on reprocessing single-use devices, helping healthcare facilities reduce waste, lower costs, and achieve environmental goals while maintaining FDA-compliant, high-quality standards.

-

In June 2025, Stryker’s Sustainability Solutions reprocessed single-use devices across 3,773 healthcare facilities, diverting 5 million pounds of waste and saving hospitalsUSD 239M. The company highlights environmental impact through awards and Life Cycle Assessment tools, promoting high-quality, FDA-compliant, cost-effective medical device reprocessing.

Becton Dickinson (BD), founded in 1897, is a leading global medical technology company providing syringes, infusion systems, diagnostic equipment, and smart healthcare solutions. The company focuses on improving medical safety, infection prevention, and patient care across hospitals and laboratories worldwide, maintaining a strong presence in critical care and surgical markets.

-

In 2024, Becton Dickinson (BD) acquired Edwards Lifesciences’ Critical Care division for USD 4.2B, expanding its smart connected care portfolio with advanced monitoring technologies, AI-enabled tools, and minimally invasive sensors, expected to be immediately accretive and strengthen BD’s position in operating rooms and intensive care units.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.10 Billion |

| Market Size by 2032 | USD 9.68 Billion |

| CAGR | CAGR of 15.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Reprocessing Support & Services, Reprocessed medical devices) • By Device Category (Critical Devices, Semi- Critical Devices, Non- Critical Device) • By Application (Cardiology, Gastroenterology, Gynecology, Arthroscopy & Orthopedic Surgery, General Surgery and Anesthesia, Other Device Categorys (Urology, non-invasive surgeries, patient monitoring) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Key players in the medical device reprocessing market include Stryker, Innovative Health, NEScientific, Medline Industries, Arjo, Vanguard AG, Cardinal Health, SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech, Steris Corporation, Getinge AB, 3M Health Care, Olympus Corporation, Becton Dickinson, Cantel Medical, Mölnlycke Health Care, Advanced Sterilization Products, SteriPack Group, and Tuttnauer. |