Smoke Evacuation System Market Size & Trends

Get More Information on Smoke Evacuation System Market - Request Sample Report

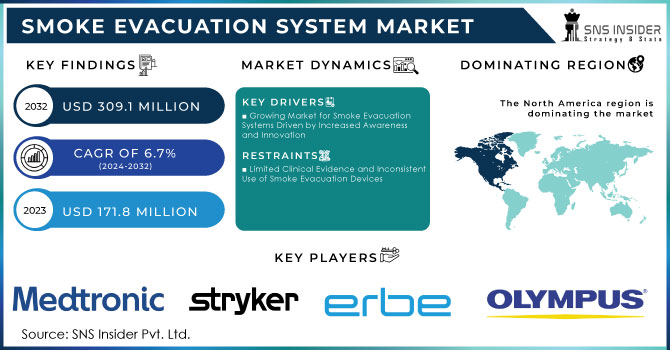

The Smoke Evacuation System Market was valued at USD 171.8 million in 2023 and is expected to grow to USD 309.1 million by 2032 and grow at a CAGR of 6.7% over the forecast period of 2024-2032.

Several factors are believed to converge and fuel significant growth in the smoke evacuation system market. Growth in the volume of electrosurgical procedures, which is further driven by growth in medical tourism for cosmetic surgeries as well as newer innovations with products, shall continue to drive this market. Interestingly, research in the JAMA Network Open journal concludes that from January 2019 to 2021, 13 million surgeries have been reported in the U.S.; the surgical activities significantly increased. The increased procedure volume is expected to increase the demand for effective solutions to smoke evacuation.

As of now, smoke evacuation and filtration devices are not mandatory during the laparoscopic procedure as per the National Institute for Occupational Safety and Health Administration, though they have gained much acceptance lately due to their effectiveness in improving surgical conditions. The acceptability of smoke evacuation solutions with electrosurgical generators, which produce significant smoke plumes, is on the rise. These solutions are highly essential for keeping the surgical area unobstructed so that the surgeon performs surgery with ease and increases the overall productivity of the process.

There is also the increasing health expenditure and improvement in the health care infrastructure market in the countries as these countries have the growing medical tourism business. The increased popularity of procedures such as breast augmentation, rhinoplasty, abdominoplasty, rhytidectomy, and liposuction further propels the demand for smoke evacuation systems.

New product launches are significant growth drivers. For example, Palliare recently obtained FDA 510(k) clearance for the EVA15 insufflator and smoke evacuation system, an occurrence that happened in July this year. The EVA15 was created to fulfill the demand for quicker and safer insufflation of patients concerning robotic and endoscopic surgical procedures. This is part of the shift toward more complex and effective smoke evacuation solutions.

Overall, the growth in the market of the Smoke Evacuation System is high surgical procedures and improvements in medical technology and also increased awareness in bettering surgical environments. This trend will continue going forward as the need for safer and more functionally efficient surgical operating room safety and efficiency rises.

Smoke Evacuation System Market Dynamics

Drivers

- Growing Market for Smoke Evacuation Systems Driven by Increased Awareness and Innovation

Rising demand for the product and increasing awareness of health dangers posed by surgical smoke force a market for the smoke evacuation system. A concerning trend in the healthcare provider's preference has been increasingly adopting evacuation and suction devices to efficiently remove smoke as well as surgical plumes from operating rooms as well as surgical theaters. Increasing chronic health risks posed by exposure to inhalation of surgical plumes remain a threat both to patients and surgeons, which brought forward the recognition of these hazards by various government agencies and industry associations.

To solve these problems, smoke evacuation manufacturers develop and sell new innovative products. Innovations are tailored to ensure improved safety and efficiency better than the current smoke evacuation products and thus minimize the risk involved with smoking during surgery. With all this in mind, a focus is being placed on developing advanced smoke evacuation systems showing the growing interest in improving the environment of the operating room and ensuring the health of surgical team members and patients. Eventually, as the industry is advanced, more of such high-end products will be available in the market which will also enhance the adoption of effective smoke evacuation technologies in the medical sector.

Restraints

- Limited Clinical Evidence and Inconsistent Use of Smoke Evacuation Devices

Even though surgical smoke evacuation devices minimize the exposure to foul odors effectively, their massive introduction has still been associated with various challenges. The existing clinical evidence remains limited and cannot prove their operational efficiency positively. In addition, although several standard organizations such as OSHA, NIOSH, and AORN have suggested that surgical smoke be removed from the surgical field with appropriate engineering controls and ventilation systems that include smoke evacuation devices, there are no strict legal or regulatory requirements to enforce its use. As a result, very few operating rooms use these devices regularly and in a routine fashion, which has slowed down their widespread use in the operating room.

Smoke Evacuation System Market Segmentation Overview

By Product

The Smoke Evacuation System market is segmented based on product types into several key areas: smoke evacuating systems, smoke evacuation pencils and wands, smoke evacuation filters, smoke evacuation tubing, smoke evacuation fusion products (shrouds), and accessories. In 2023, the smoke evacuating systems segment held the highest market share at 39.6%. The market is led by this segment because it can detect smoke and activate fans to escort it out of occupied spaces, making it more in demand in the market.

Under the smoke evacuating systems segment, there are two sub-segments. These consist of stationary systems and portable systems. The smoke evacuation filters segment is likely to earn the second-largest revenue share since they are used very crucially in the removal of byproducts of smoke emanating from laser and electrosurgical procedures. These filters help cauterize vessels and vaporize blood, tissues as well as fluids; hence, they enjoy a large demand in the market. It is further sub-classified into ULPA filters, Charcoal filters, in-line filters, and pre-filters. The prime business driver for this segment is that the high-efficiency ULPA filters capture almost all particles which are as small as 120 nanometers in size.

By Application

Applications in the smoke evacuation system market are segmented into laparoscopic surgeries, orthopedic surgeries, medical aesthetic surgeries, and others. In 2023, the largest application in terms of revenue share was laparoscopic surgeries, with 36.9%. This application segment grows with the increasing number of laparoscopic procedures. An article published in AHA Journals reveals that more than 2 million laparoscopic surgeries are performed annually in the U.S. This, therefore explains the large market appearance of this application segment.

The medical aesthetic surgeries segment is poised to register the maximum compound annual growth rate during the forecast period. This is because of the growing number of aesthetic procedures and rising patient awareness regarding cosmetic improvement. According to The American Society of Plastic Surgeons, approximately USD 16.7 billion was spent on cosmetic procedures in the U.S. in 2020, reflecting impressive demand and expansion in the aesthetic surgeries market.

By End-Use

The Smoke Evacuation System market is further segmented by end-users into hospitals, dental clinics, Ambulatory Surgical Centers (ASCs), veterinary healthcare providers, and cosmetic surgery centers. In the year 2023, hospitals held the highest share at 42.7%. Such dominance is assumed in the forecast period mainly due to an immense volume of surgeries, including complex heart and orthopedic procedures. The Occupational Health and Safety Administration cites that 500,000 workers are annually exposed to laser or electrosurgical smoke. This is the reason why the hospital decided to install smoke evacuation devices in its operating rooms in a bid to promote a safer environment.

Cosmetically, the cosmetic surgery centers segment is expected to grow at the fastest CAGR from 2024 to 2032. Some of the factors driving this growth come through increasing cosmetic laser surgeries that emit smoke. A growing propensity for non-surgical cosmetic procedures, medical aesthetic lasers, and medical tourism has been a major factor in the rapid expansion of this segment.

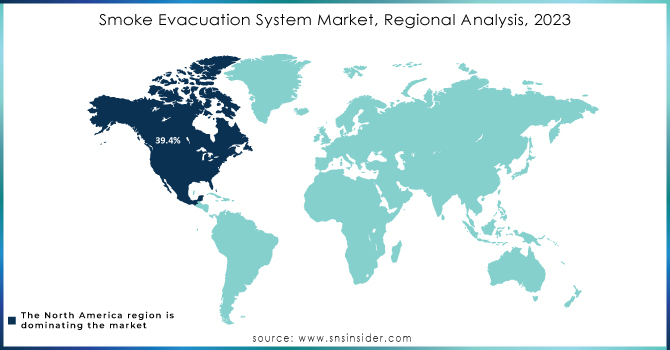

Regional Analysis

North America was the largest regional market for global smoke evacuation systems in 2023, accounting for 39.4% of the overall revenue share. This is largely due to a substantially large number of aesthetic surgeries, such as laser liposuction in which lasers create smoke plumes during treatments. The region has also built health facilities and continually rising demand for minimally invasive surgeries that support this market.

Europe follows next with a huge market share, its established healthcare base together with advanced smoke evacuation products and even a qualified workforce it has advanced to achieve such a rank. Focus on embracing the latest technologies to be used in medical practices may also support such a huge market share.

The Asia-Pacific region is expected to achieve the highest compound annual growth rate during the forecast period. Improving investments in R&D and efforts by major players in the process of commercializing their products at competitive prices are fueling market expansion. Improving healthcare infrastructure and rising surgical procedures in this region further propel this rapid growth.

Meanwhile, Latin America is to witness steady growth, driven by continued healthcare reforms and efforts towards quality healthcare. In the MEA, healthcare organizations are to improve the medical structures in the region, thus encouraging market growth in the relevant regions.

Need any customization research on Smoke Evacuation System Market - Enquiry Now

Key Players

-

Medtronic (PlumeSafe Smoke Evacuator)

-

Stryker (Neptune Smoke Evacuation System)

-

Erbe Elektromedizin GmbH (ERBE VIO Smoke Evacuation System)

-

Steris (STERIS SAFE-DROP Smoke Evacuation System)

-

Olympus Corporation (USG-400 Smoke Evacuation System)

-

Symmetry Surgical Inc. (Symmetry Surgical Smoke Evacuation Pencils)

-

CONMED Corporation (ClearView Smoke Evacuation System)

-

Medical Devices Business Services, Inc. (MegaVac Plus Smoke Evacuation Pencil)

-

Zimmer Biomet (Zimmer ATS Smoke Evacuation System)

-

KLS Martin Group (MarVac Smoke Evacuator)

-

I.C Medical (Crystal Vision Smoke Evacuation System)

-

Utah Medical Products Inc (Filtravac Smoke Evacuation System)

-

Pall Corporation (PlumeSafe Turbo Smoke Evacuation System)

-

Ecolab (ViroVac Surgical Smoke Evacuation System)

-

Deroyal (Deroyal ClearView Smoke Evacuation Tubing) and others.

Recent Developments

In June 2023, CONMED Corporation launched its new ClearView Ultra Smoke Evacuation System, designed to provide enhanced filtration and smoke removal capabilities during surgical procedures.

In April 2023, Stryker introduced its Neptune 3 Smoke Evacuator, further advancing its portfolio of integrated surgical solutions to improve safety in operating rooms.

In February 2023, Olympus Corp. secured a contract with Vizient Inc., granting Vizient members access to discounted pricing on Olympus smoke evacuation products as part of the agreement.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 171.8 million |

| Market Size by 2032 | US$ 309.1 million |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Bridge to Transplant, Destination Therapy, Others) • By Product (Left Ventricular Assist Device, Right Ventricular Assist Device, Bi-Ventricular Assist Device, Total Artificial Heart) • By Type of Flow (Pulsatile Flow, Continuous Flow) • By Design(Implantable Ventricular Assist Device, Transcutaneous Ventricular Assist Device) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Medtronic, Stryker, Erbe Elektromedizin GmbH, Steris, Olympus Corporation, Symmetry Surgical Inc., CONMED Corporation, Medical Devices Business Services, Inc., Zimmer Biomet, KLS Martin Group, I.C Medical, Utah Medical Products Inc, Pall Corporation, Ecolab, Deroyal and others |

| Key Drivers | • Growing Market for Smoke Evacuation Systems Driven by Increased Awareness and Innovation |

| Market Restraints | • Limited Clinical Evidence and Inconsistent Use of Smoke Evacuation Devices |