Medical Tourism Market Report Scope & Overview:

Get more information on Medical Tourism Market - Request Free Sample Report

The Medical Tourism Market Size was valued at USD 10.78 Billion in 2023, and is expected to reach USD 70.18 Billion by 2032, and grow at a CAGR of 24.52% over the forecast period 2024-2032.

The global medical tourism market is poised to expand in the next few years. The medical tourism market is expanding with an increase in healthcare technology, greater accessibility, and growing demand for desired treatment internationally. The advent of high health service costs in home countries is the major factor boosting market growth. Increasing emphasis on R&D for the development of innovative healthcare is anticipated to drive market growth over the forecast period. In the coming decade, it is estimated that developing countries will also cater to patients from outside their nation seeking for state of art treatments such as robotic surgery and oncology treatment, etc. In March 2023, the Medical Tourism Association along with Global Healthcare Resources and The International Healthcare Research Center launched its inaugural Medical Tourism Moonshot to help dismantle big obstacles standing in the way of greater expansion for medical tourism. These initiatives, to help in the advancement of medical devices are expected to further increase the tourist footfall for advanced healthcare services and thereby sustain the growth of the market.

MARKET DYNAMICS:

KEY DRIVERS:

-

Availability of Latest Medical Technologies and High Quality of Service Are Significant Drivers for The Medical Tourism Market.

-

Growing Compliance of International Quality Standards Drives the Medical Tourism Market.

RESTRAINTS:

-

Issues with Patient Follow-Up and Post-procedure Complications are a Significant Restraint Hampering the Growth of the Market

-

Medical Record Transfer Issues are Limiting the Growth of the Medical Tourism Market.

OPPORTUNITY:

-

Expanding International Healthcare Networks and Partnerships Create Opportunities for Hospitals and Clinics to Attract a Global Patient Base.

-

Countries With Favorable Regulatory Environments and Partnerships with International Insurance Companies Can Boost Medical Tourism by Providing Seamless Access and Financing Options for Foreign Patients.

KEY MARKET SEGMENTATION:

By Treatment Type

The growing self-awareness about aesthetic appearance and rising demand for cosmetic procedures are the major drivers for the cosmetic treatment type growth that hold 30% in 2023. Additionally, people are opting more for these procedures in some other countries primarily due to the high cost of cosmetic procedures in their country. For example, according to the data published by the International Society of Aesthetic Plastic Surgery, almost 14.98 million surgical and 18.86 million non-surgical cosmetic procedures were performed globally in 2022. The highest number of procedures was reported in the age group of 35 to 50 years which is approximately 4.4 million procedures, followed by 18 to 34 years which is around 2.2 million procedures. According to the same source, the top five countries with the highest numbers of cosmetic surgical procedures in 2022 were the United States, Brazil, Mexico, Turkey, and Colombia. The first country has the highest number of procedures due to the presence of a sophisticated healthcare system and the presence of a large number of plastic surgeons.

Additionally, governments and companies are spending heavily to develop the medical tourism industry and attract cosmetic medical tourism in the native country. This factor is also expected to drive the cosmetic medical tourism market growth because new investments and the introduction of more new companies to the market will have more investments and launch that will result in more improvement in the infrastructure that will lead to more inflow of medical tourists seeking cosmetic treatment. For example, in March 2023, in Indonesia, GC Bio group launched its medical aesthetic clinic NULOOK on Bali Island to provide all-encompassing K-beauty aesthetic procedures grounded on bio-medical technology and brand name the island as a prominent cosmetic medical tourism destination. Similarly, in July 2023, in India, India’s SPARSH Group of Hospitals launched its most recent high-tech medical department – The Institute of Cosmetic Surgery and Cosmetology to provide world-class all-inclusive medical care for aesthetic medicine and attract medical tourists seeking aesthetic medicine procedures in India.

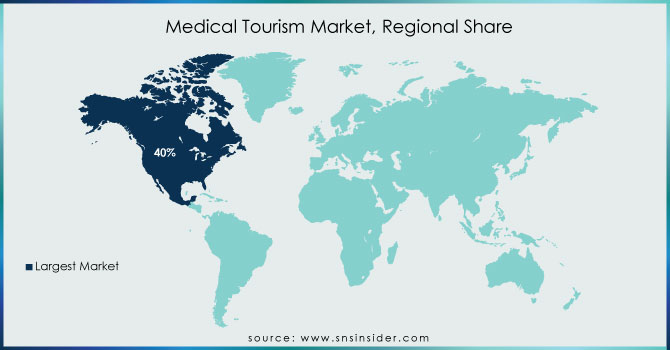

REGIONAL ANALYSIS:

In 2023, North American Medical Tourism market share is held by 40%. The presence of a large number of healthcare institutions that are well equipped is expected to drive the market in North America. It is more than 6,120 hospitals in the United States as of the American Hospital Association 2024. Likewise, the Canadian government site states that there were 779 medical and surgical hospitals across the nation in May of 2022. This extensive network of hospitals gave rise to medical tourism attracting patients for availing of advanced healthcare treatments thus propelling the market growth.

This is likely to accelerate the growth of the market over time for the assessment period with increasing efforts and investments from major industry participants as well as governments. Moreover, government funding to develop healthcare facilities in the region is anticipated as one of the factors that could fuel market growth during the forecast period. An additional USD 33.60 billion was spent to enhance healthcare services in February of 2023 by the Canadian government.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

The key market players are Raffles Medical Group, MOHW Hengchun Tourism Hospital, Fortis Healthcare, Bumrungrad International Hospital, Livonia Global, Asian Heart Institute, Apollo Hospitals Enterprise Ltd., Mount Elizabeth Hospitals, Gleneagles Hospitals, KPJ Healthcare Berhad & other players.

RECENT DEVELOPMENTS

-

Health Tourism Abroad - Health and Wellness Destination - A new platform compatible with top-of-the-line medical facilities, global healthcare services & luxury tourism experiences was launched as an official introduction in June 2024. It aims at becoming the top healthcare destination for patients in need of high quality& affordable treatment overseas.

-

The gifting brand Ferns N Petals announced the launch of its global medicinal tourism division 'MediJourney' in Jan 2024. MediJourney is changing the game in healthcare support to empower individual health and well-being on a global scale. MediJourney is an all-in-one platform to support any healthcare facility, including doctor consultation, medical visa assistance, or Telemedicine services followed by post-treatment follow-up.

-

In September 2023, Alibaba Japan began offering a medical tourism service for Chinese tourists in cooperation with the Japanese national hospital using 'Tmall Global,' an overseas EC platform opened by The Alibaba Group. It starts with a health checkup or medical screening program. Alibaba was the first one to build their official shop on Tmall Global and directly provide booking options to consumers.

-

DarwinAI was born on July 2023 by the Medical Tourism Association, as a new cutting-edge AI-based marketing technology for the medical travel and tourism industry. Innovatively, Darwin AI leverages advanced AI algorithms to enhance branding and move beyond the echo systemic effect of brand names.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.78 Billion |

| Market Size by 2032 | US$ 70.18 Billion |

| CAGR | CAGR of 24.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedics Treatment, Bariatric Treatment, Infertility Treatment, Ophthalmic Treatment, and Others) •By Service Provider (Public & Private) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Raffles Medical Group, MOHW Hengchun Tourism Hospital, Fortis Healthcare, Bumrungrad International Hospital, Livonia Global, Asian Heart Institute, Apollo Hospitals Enterprise Ltd., Mount Elizabeth Hospitals, Gleneagles hospitals, KPJ Healthcare Berhad & other players |

| Key Drivers | •Availability of Latest Medical Technologies and High Quality of Service Are Significant Drivers for The Medical Tourism Market. •Growing Compliance of International Quality Standards Drives the Medical Tourism Market. |

| RESTRAINTS | •Issues with Patient Follow-Up and Post-procedure Complications are a Significant Restraint Hampering the Growth of the Market •Medical Record Transfer Issues are Limiting the Growth of the Medical Tourism Market. |