Medical Aesthetics Market Report Scope and Overview:

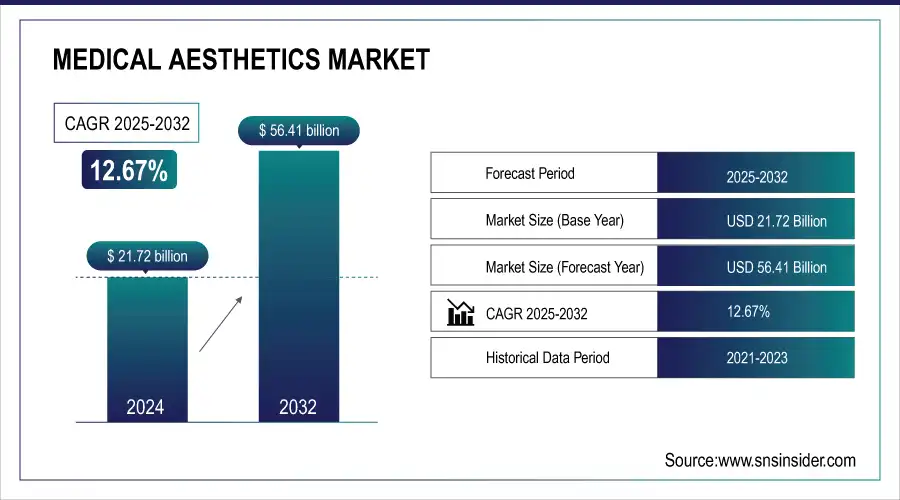

The Medical Aesthetics market size was USD 21.72 billion in 2024 and is expected to reach USD 56.41 billion by 2032 and grow at a CAGR of 12.67% over the forecast period of 2025-2032.

To Get more information on Medical Aesthetics Market - Request Free Sample Report

This report provides in-depth statistical insights into the medical aesthetics market, covering key trends and emerging innovations. It analyzes procedure volume statistics, highlighting the growth of non-invasive treatments and shifting patient demographics. The report explores pricing trends and cost analysis, examining fluctuations in treatment costs and consumer spending patterns. Technology adoption and innovations are assessed, including AI-driven aesthetic solutions and at-home treatment devices. Additionally, it presents regulatory and compliance statistics, tracking FDA approvals and safety incidents. The influence of social media and consumer awareness on treatment demand is also evaluated. Lastly, the report delves into sustainability and ethical practices, addressing eco-friendly product trends and ethical concerns shaping the market.

The U.S. dominated the North American medical aesthetics market in 2023, holding a market size of USD 6.10 billion with a 72% market share. This leadership is driven by a high demand for minimally invasive cosmetic procedures, supported by advanced healthcare infrastructure and the presence of leading aesthetic device manufacturers such as Allergan Aesthetics (AbbVie), Revance Therapeutics, and Cynosure. The growing preference for Botox, dermal fillers, and laser-based treatments, along with rising disposable incomes and increased consumer awareness, has further fueled market growth. Additionally, the strong regulatory framework and high adoption of AI-based aesthetic technologies contribute to the expansion. The U.S. also leads in R&D investments and FDA approvals for new aesthetic treatments, ensuring a continuous influx of innovative and safe procedures and reinforcing its dominant position in the region.

Medical Aesthetics Market Drivers:

- Rising demand for minimally invasive and non-surgical procedures drives the medical aesthetics market growth.

The growing preference for minimally invasive and non-surgical aesthetic procedures is a key driver of the Medical Aesthetics Market. Treatments such as Botox, dermal fillers, laser skin resurfacing, and non-invasive body contouring have gained popularity due to shorter recovery times, lower risks, and cost-effectiveness compared to surgical procedures. According to the American Society of Plastic Surgeons (ASPS), minimally invasive procedures have increased significantly in recent years, with Botox injections leading the market. Moreover, advancements in AI-driven aesthetic solutions, personalized skincare treatments, and robotic-assisted aesthetic procedures are further fueling market expansion. The increasing influence of social media and celebrity endorsements has also played a crucial role in boosting consumer awareness and demand. Additionally, the rise in male aesthetic procedures and younger patients opting for preventive treatments contribute to the market's robust growth.

Medical Aesthetics Market Restraints:

- Stringent regulatory approvals and compliance requirements restrain the medical aesthetics market growth.

The Medical Aesthetics Market faces challenges due to stringent regulatory approvals and compliance requirements imposed by authorities such as the U.S. FDA, European Medicines Agency (EMA), and other regional health agencies. Aesthetic medical devices and treatments must undergo rigorous clinical trials, safety assessments, and compliance checks before receiving approval, which leads to delays in product launches and increased costs for manufacturers. Regulations on advertising and patient safety protocols also add complexities, restricting marketing strategies for aesthetic companies. Moreover, frequent changes in regulatory guidelines create uncertainty for market players, impacting their investment decisions. In regions with less defined or evolving regulatory frameworks, manufacturers face additional hurdles in obtaining market entry. The need for continuous post-market surveillance, risk assessment, and compliance with updated standards further restrains industry expansion.

Medical Aesthetics Market Opportunities:

- Advancements in AI and personalized aesthetic treatments create lucrative opportunities in the medical aesthetics market.

Technological advancements in AI-based skin analysis, 3D imaging, and personalized treatment planning present significant opportunities in the Medical Aesthetics Market. AI-powered aesthetic solutions enable practitioners to analyze facial structures, predict treatment outcomes, and customize procedures based on individual patient needs. Leading companies such as Allergan Aesthetics, Cutera, and Merz Aesthetics are integrating AI-driven tools to enhance precision and patient satisfaction. The rise of personalized skincare products, regenerative aesthetics using stem cells, and non-invasive anti-aging treatments is further revolutionizing the industry. Additionally, virtual consultations and AI-powered recommendation platforms are streamlining patient engagement, improving treatment accessibility. The integration of big data and machine learning in aesthetic medicine also allows for enhanced research and innovation, paving the way for new product developments and market expansion in the coming years.

Medical Aesthetics Market Segment Analysis:

By Product Type

The medical aesthetics market was dominated by facial aesthetic products and held around 32% in 2024. It is attributed to the increasing number of procedures performed using Botox and dermal fillers along with laser treatment for skin. Allergan Aesthetics (AbbVie) introduced their Juvéderm VOLUX XC dermal filler to improve facial definition. In like manner, Revance Therapeutics launched Daxxify, a durable neuromodulator. Additionally, an increasing inclination towards minimally invasive anti-aging solutions, technological advancements, skin aging as a result of social media influencing a person's beauty, and others serve to bolster the growth of the market. As the AI-based skin analysis and personalized treatment plan gain popularity among patients and continuously boost their satisfaction, the market grows further

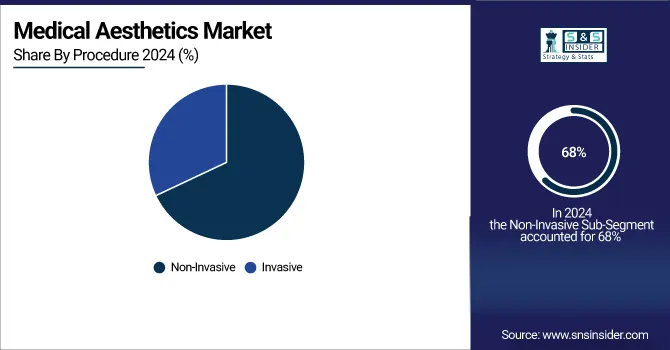

By Procedure

The non-invasive procedures segment is expected to hold the largest market share around 68%, in 2024. It is owing to the growing popularity of Botox, laser hair removal, and chemical peels. This October 2023, Cynosure launched the Potenza RF microneedling system for more personalized skin treatments. Moreover, CoolSculpting Elite by AbbVie added next-gen fat-reduction technology that allows for better patient results. This segment is growing due to the preference for non-invasive and no-downtime, quick procedures and rising disposable income and growing geriatric population. Rising use of energy-based instruments and AI-controlled treatment customization are anticipated to fuel Medical Aesthetics Market expansion.

By End-User Industry

Clinics and Medical Spas held the largest market share at around 34% in 2024. As clinics and medical spas are specialized, they offer the best available treatment and have more experience handling aesthetic equipment at a low cost. The increasing demand for preferred aesthetic treatment solutions by patients is expected to monetize, thus dominating the medical aesthetics market. In 2023, Ultherapy by Merz Aesthetics was rolled out to more clinics, and Lumenis launched Stellar M22 for multi-application skin rejuvenation. This segment is fueled by increasing demand towards non-surgical cosmetic treatment in recent years, the increasing accessibility of non-surgical procedures, and the formation of partnerships between aesthetic brands and medical spas. Clinics are now able to provide AI-assisted consultation and advanced laser technologies, both of which help various clinics retain patient satisfaction and rule the market for years to come.

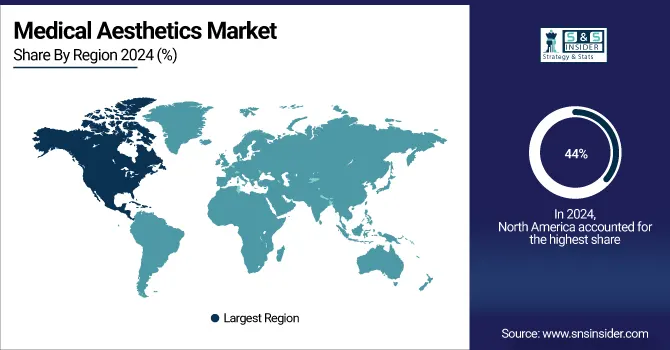

Medical Aesthetics Market Regional Analysis:

North America Medical Aesthetics Market Trends:

North America maintained its lead overall in 2024 with an estimated 44% of the Medical Aesthetics Market due to the higher disposable income to spend on the services and advanced healthcare sector and growing consumer demand for aesthetic surgery. The U.S. was also instrumental, driven by launches of Laura's Botox and Juvederm filler products by AbbVie (Allergan Aesthetics) and new laser-based aesthetic solutions by Cynosure. The development of non-invasive processes such as CoolSculpting and laser skin resurfacing, together with expanding market approval and AI-driven aesthetic treatments, signifies potential for sizeable market growth. Moreover, the presence of top dermatology clinics, medical spas, and cosmetic centers will further improve accessibility and drive North America to stay at the top of this range.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Medical Aesthetics Market Trends:

Asia Pacific held the significant market share. The increase in disposable income and the growing popularity of cosmetic procedures in China, Japan, and South Korea, particularly among the middle class, accounts for this increase. Merz Aesthetics, Allergan Aesthetics, and other key players are broadening their footprint by introducing highly advanced dermal fillers, botulinum toxins, and laser-based products based on the accelerating demand. Due to the regional cultural preference for youthful appearances, non-invasive procedures such as laser skin resurfacing, body contouring, and thread lifts are becoming increasingly popular. The Asia Pacific region is expected to grow as the fastest region in medical aesthetics due to government initiatives supporting medical tourism, especially in countries like Thailand, South Korea, and India.

Europe Medical Aesthetics Market Trends:

Europe accounted for a substantial market share in 2024, supported by advanced healthcare infrastructure, high awareness of cosmetic procedures, and strong demand for minimally invasive treatments. Countries such as Germany, France, and the United Kingdom are leading due to their established dermatology clinics and the growing acceptance of anti-aging solutions. The availability of advanced botulinum toxin injections, dermal fillers, and skin tightening procedures from companies like Ipsen, Evolus, and Allergan Aesthetics is fueling market expansion. Moreover, regulatory approvals for new aesthetic devices and the increasing popularity of medical spas in urban centers are accelerating growth. Rising emphasis on natural-looking results and personalized treatment plans will further reinforce Europe’s strong presence in the global market.

Latin America Medical Aesthetics Market Trends:

Latin America is witnessing steady growth in the medical aesthetics sector, driven by the rising beauty-conscious population and affordability of cosmetic procedures compared to North America and Europe. Brazil and Mexico are the major contributors, with Brazil recognized as one of the top global hubs for cosmetic surgery and minimally invasive treatments. Growing influence of social media, rising awareness of advanced aesthetic technologies, and increasing participation of international players like Allergan Aesthetics and Merz in the region are supporting this trend. Additionally, medical tourism is a key growth driver, with many patients from North America and Europe traveling to Latin America for cost-effective yet high-quality procedures. Non-invasive body contouring and facial rejuvenation solutions are among the most in-demand treatments in the region.

Middle East & Africa Medical Aesthetics Market Trends:

The Middle East & Africa region is emerging as a promising market, fueled by rising disposable incomes, urbanization, and a cultural shift toward aesthetic enhancement. Countries such as the UAE, Saudi Arabia, and South Africa are leading in adoption, supported by strong private healthcare investments and rapid expansion of medical spas and cosmetic centers. The demand is particularly high for botulinum toxins, dermal fillers, and laser-based skin rejuvenation, with global players like Allergan, Galderma, and Cynosure actively expanding their footprint. Medical tourism plays a crucial role, as countries like the UAE are positioning themselves as premium destinations for aesthetic treatments. Government regulations supporting advanced healthcare infrastructure and increasing consumer preference for minimally invasive procedures are expected to accelerate regional growth.

Medical Aesthetics Market Key Players:

-

AbbVie Inc. (Botox, Juvederm)

-

Allergan Aesthetics (CoolSculpting, Natrelle)

-

Galderma (Dysport, Restylane)

-

Cynosure (SculpSure, TempSure)

-

Johnson & Johnson (Neostrata, Mentor Breast Implants)

-

Revance Therapeutics, Inc. (RHA Collection, Daxxify)

-

Evolus Inc. (Jeuveau, Evolux)

-

Lumenis (Stellar M22, Legend Pro)

-

Alma Laser (Harmony XL Pro, Accent Prime)

-

Syneron Candela (PicoWay, GentleMax Pro)

-

Solta Medical (Thermage FLX, Fraxel)

-

Fotona (StarWalker, Dynamis Pro)

-

Medytox (Neuronox, Coretox)

-

Hugel, Inc. (The Chaeum, Dermalax)

-

Morpheus8 by InMode (Morpheus8, Evoke)

-

Venus Concept (Venus Legacy, Venus Versa)

-

Cutera (truSculpt iD, Secret RF)

-

Aerolase (Neo Elite, Era Elite)

-

Hologic Inc. (SculpSure, TempSure)

-

Silhouette Soft by Sinclair Pharma (Silhouette Soft Threads, Ellansé)

Medical Aesthetics Market Competitive Landscape:

Allergan Aesthetics, established in 2020 as a subsidiary of AbbVie, is a global leader in medical aesthetics offering a broad portfolio of innovative products including Botox, Juvederm dermal fillers, and CoolSculpting. With a strong focus on non-invasive and minimally invasive treatments, it drives advancements in facial injectables, body contouring, and regenerative aesthetics worldwide.

-

In 2023, Allergan Aesthetics (AbbVie Inc.) secured FDA approval for BOTOX Cosmetic to address moderate to severe platysma bands, strengthening its neuromodulator portfolio.

Galderma, established in 1981, is a leading global dermatology company specializing in medical aesthetics, therapeutic dermatology, and consumer care. Its portfolio includes popular brands such as Restylane dermal fillers, Dysport botulinum toxin, and Sculptra. Galderma focuses on science-driven, minimally invasive solutions to enhance skin health, aesthetics, and patient confidence worldwide.

-

In 2023, Galderma introduced FACE by Galderma, an augmented reality application designed to help practitioners and patients visualize treatment outcomes during the planning stages.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.72 Billion |

| Market Size by 2032 | USD 56.41 Billion |

| CAGR | CAGR of 12.67 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Facial Aesthetic Products, Body Contouring Devices, Cosmetic Implants, Hair Removal Devices, Skin Aesthetic Devices, Tattoo Removal Devices) • By Procedure (Invasive, Non-Invasive) • By End Users (Clinics and Medical Spas, Hospitals, Dermatology Clinics, Cosmetic Centers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AbbVie Inc., Allergan Aesthetics, Galderma, Cynosure, Johnson & Johnson, Revance Therapeutics, Inc., Evolus Inc., Lumenis, Alma Laser, Syneron Candela, Solta Medical, Fotona, Medytox, Hugel, Inc., InMode, Venus Concept, Cutera, Aerolase, Hologic Inc., Sinclair Pharma |