Soy Protein Isolate Market Report Scope & Overview:

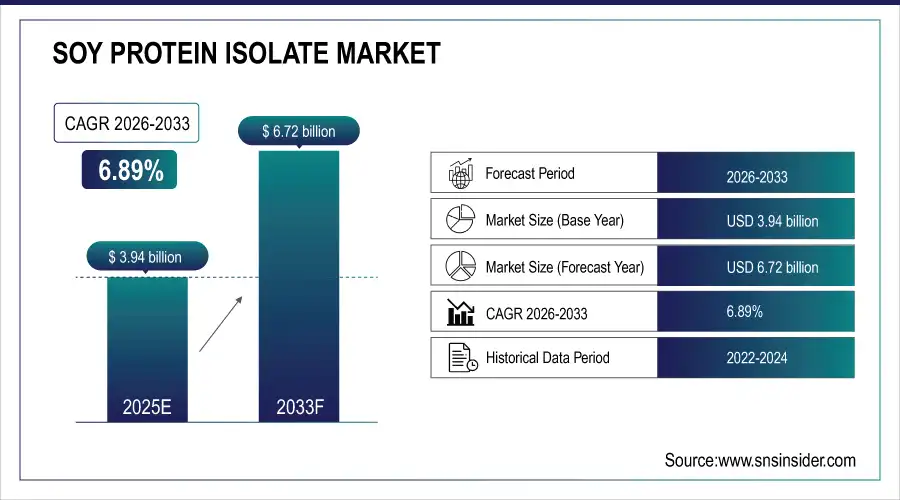

The Soy Protein Isolate Market size was valued at USD 3.94 Billion in 2025E and is projected to reach USD 6.72 Billion by 2033, growing at a CAGR of 6.89% during 2026–2033.

The Soy Protein Isolate Market is witnessing significant growth, driven by increasing consumer demand for plant-based proteins and health-focused diets. Rising preference for flexitarian eating, combined with a shift toward cleaner-label and minimally processed ingredients, is boosting adoption. Soy protein isolates are widely used across food, beverage, and nutritional applications due to their high protein content, functional properties, and versatility. Continuous innovation in formulations, including protein-fortified products and dairy alternatives, is expanding their application scope. Growing awareness of the health and environmental benefits of plant-based proteins is further propelling market expansion globally, making soy protein isolates a key ingredient for manufacturers.

To Get more information on Soy Protein Isolate Market - Request Free Sample Report

In Feb 2025, Glanbia Nutritionals highlights key plant-based protein trends shaping 2025, emphasizing nutrition, functionality, and product innovation. Flexitarian diets continue to drive demand, with 25% of U.S. consumers reducing meat while embracing plant-forward options. Cleaner-label, minimally processed proteins are gaining popularity, appealing to health-conscious and mainstream consumers alike, signaling strong market growth ahead.

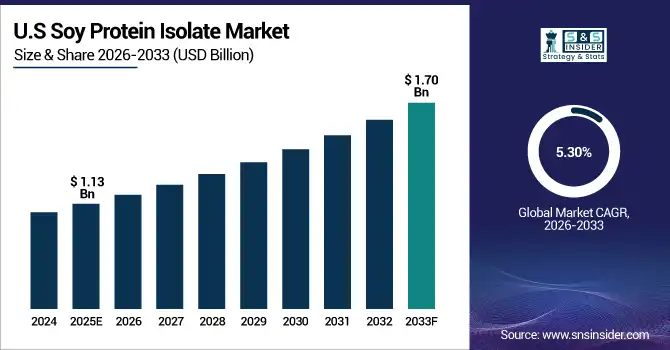

The U.S. Soy Protein Isolate Market size was valued at USD 1.13 Billion in 2025E and is projected to reach USD 1.70 Billion by 2033, growing at a CAGR of 5.30% during 2026–2033. Market growth is fueled by increasing consumer demand for plant-based proteins, health-conscious diets, and cleaner-label products, alongside expanding applications in food, beverages, and nutritional supplements, highlighting strong adoption across the U.S. market.

Soy Protein Isolate Market Size and Forecast:

-

Market Size in 2025: USD 3.94 Billion

-

Market Size by 2032: USD 6.72 Billion

-

CAGR: 6.89% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Soy Protein Isolate Market Highlights:

-

Enhanced quality and functionality driving growth with improved digestibility flavor and texture for health-conscious consumers and functional food applications

-

Enzyme technology adoption enhances amino acid bioavailability reduces bitterness and improves solubility and mouthfeel boosting product appeal

-

Processing complexity and allergen concerns with high-purity production techniques and soy allergens limiting use in certain consumer segments

-

Regulatory and cost challenges with compliance and higher production costs posing barriers to market expansion

-

Growing plant-based protein demand driven by consumer preference for non-GMO clean-label and sustainable proteins

-

Capacity expansion and innovation through large-scale production facilities and advanced processing technologies meeting increasing global demand

Soy Protein Isolate Market Drivers:

-

Enhanced Quality and Functionality of Soy Protein Isolates Driving Market Growth

The increasing use of enzyme technology in soy protein isolate production is a key driver of market growth. Enzymatic treatments improve digestibility, break down complex proteins into smaller peptides, and enhance amino acid bioavailability, making products more suitable for health-conscious consumers. They also refine flavor profiles by reducing bitterness and improving umami notes, while enhancing texture, solubility, and mouthfeel in food and beverage applications. These benefits enable manufacturers to develop high-quality, functional, and consumer-friendly protein products, fueling demand across sports nutrition, plant-based alternatives, bakery, and dairy sectors globally, thereby expanding the soy protein isolate market.

In June 2025, Enzyme technology enhances soy protein isolates by improving digestibility, flavor, and texture, enabling higher-quality, functional, and consumer-friendly protein products.

Soy Protein Isolate Market Restraints:

-

Processing Complexity and Allergen Concerns Limiting Soy Protein Isolate Growth

The growth of the soy protein isolate market is restrained by processing challenges and allergen-related concerns. Manufacturing high-purity soy protein isolates requires complex processing techniques, increasing production costs and limiting accessibility for smaller manufacturers. Additionally, soy is a common allergen, which restricts its use in certain consumer segments, particularly infants and individuals with soy sensitivities. Taste and texture issues in some formulations can also hinder consumer acceptance. Regulatory compliance for food safety and labeling further adds to operational challenges. These factors collectively slow adoption and pose barriers to broader market expansion despite growing demand for plant-based proteins.

Soy Protein Isolate Market Opportunities:

-

Expanding Production Capacity to Meet Growing Soy Protein Demand

The growing global demand for plant-based proteins creates significant opportunities for the soy protein isolate market. Increasing consumer preference for high-purity, non-GMO, clean-label, and sustainable protein ingredients across snacks, baked goods, beverages, and meat alternatives is driving the need for scalable production. Manufacturers that can deliver versatile, high-quality soy protein isolates with enhanced functionality, affordability, and nutritional benefits are well-positioned to capture market share. Continuous innovation in processing technologies and expanding production capacities further enable companies to meet evolving consumer expectations and support the rapid growth of the plant-based protein sector globally.

In May 2025 ,Bunge invests €484M in a new Indiana facility to produce high-purity, non-GMO soy protein concentrates, meeting growing plant-based protein demand.

Soy Protein Isolate Market Segment Highlights:

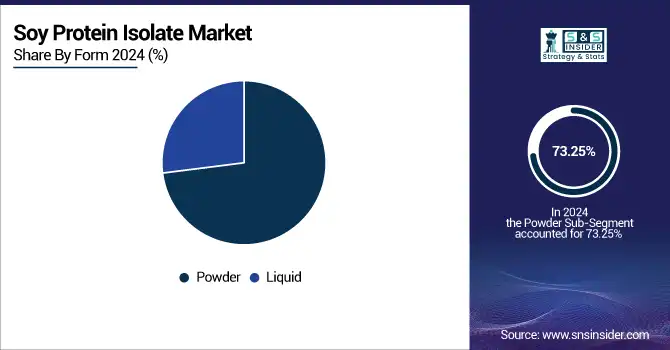

-

By Form: Dominant – Powder: 73.25% in 2025E, Fastest-growing – Liquid: 8.97% CAGR

-

By Product Type: Dominant – Regular Soy Protein Isolate: 54.38% in 2025E, Fastest-growing – Soy Protein Hydrolysate: 8.29% CAGR

-

By Application: Dominant – Food & Beverage: 49.00% in 2025E, Fastest-growing – Nutritional Supplements: 8.72% CAGR

-

By End User: Dominant – Commercial: 69.75% in 2025E, Fastest-growing – Residential: 7.54% CAGR

Soy Protein Isolate Market Segment Analysis:

By Form, Powder Dominates While Liquid Leads Growth in Soy Protein Isolate Market

Powder remains the dominant form of soy protein isolate due to its versatility and widespread use across food, beverage, and nutritional applications, while liquid formats are the fastest-growing segment, driven by rising demand for convenient, ready-to-drink protein products and innovations enhancing solubility, taste, and functionality.

By Product Type, Regular Soy Protein Isolate Dominates While Hydrolysate Drives Growth

Regular soy protein isolate remains the dominant segment due to its established use and versatility across various applications, while soy protein hydrolysate is the fastest-growing product type, driven by increasing demand for highly digestible, functional, and specialized protein formulations in food, beverages, and nutritional products.

By Application, Food & Beverage Dominates While Nutritional Supplements Lead Growth

Food & beverage remains the dominant application for soy protein isolates due to its widespread use in various products, while nutritional supplements are the fastest-growing segment, driven by increasing consumer focus on health, wellness, and protein-fortified functional foods and beverages.

By End User, Commercial Dominates While Residential Segment Grows Rapidly

Commercial users remain the dominant segment of the soy protein isolate market due to large-scale applications in food manufacturing, beverages, and nutritional products. Meanwhile, the residential segment is growing rapidly as more consumers adopt plant-based proteins at home, driven by increasing health awareness, convenience, and demand for high-quality protein in daily diets.

Soy Protein Isolate Market Regional Highlights:

-

By Region – Dominating: North America (44% in 2025E → 42% in 2033, CAGR 5.27%)

-

Fastest-Growing Region: Asia-Pacific (26% in 2025E → 28% in 2033, CAGR 7.12%)

-

Europe: 21% → 22% (CAGR 6.88%)

-

South America: 6.00% → 5.02% (CAGR 3.55%, declining)

-

Middle East & Africa: 5% → 4.02% (CAGR 3.32%, declining)

Soy Protein Isolate Market Regional Analysis:

North America Soy Protein Isolate Market Insights:

North America dominates the soy protein isolate market, driven by strong demand for plant-based proteins, clean-label options, and high-protein diets. Growing consumer focus on health, wellness, and sustainable food sources is supporting market growth, while innovations in functional formulations and convenient applications are enhancing adoption across food, beverages, and nutritional supplements.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Soy Protein Isolate Market Insights:

The United States is the dominant country in the North American Soy Protein Isolate market, driven by high consumer demand for plant-based proteins, clean-label products, and protein-fortified foods and beverages.

Asia-Pacific Soy Protein Isolate Market Insights:

Asia-Pacific Leads as the Fastest-Growing Region in the Soy Protein Isolate Market, driven by rising demand for plant-based proteins, health-conscious diets, and functional foods. Growing nutrition awareness, urbanization, and population growth are boosting adoption, with China, India, Japan, and Australia emerging as key regional markets.

-

China Soy Protein Isolate Market Insights:

China is the dominating country in the Asia-Pacific Soy Protein Isolate market, driven by high consumer demand for plant-based proteins, growing health awareness, and increasing use in food, beverages, and nutritional products.

Europe Soy Protein Isolate Market Insights:

The Europe Soy Protein Isolate Market is growing steadily, driven by rising demand for plant-based proteins, clean-label foods, and high-protein diets. Increasing health awareness, sustainability concerns, and innovation in functional foods are boosting adoption, with Germany, France, the UK, and Italy emerging as key and fastest-growing regional markets for soy protein isolates.

-

Germany Soy Protein Isolate Market Insights:

Germany is the dominating country in the Europe Soy Protein Isolate market, supported by strong demand for plant-based proteins, high-protein foods, and clean-label functional products.

Latin America Soy Protein Isolate Market Insights:

The Latin America Soy Protein Isolate market is witnessing steady growth, driven by increasing demand for plant-based proteins, health-focused diets, and functional food products. Rising consumer awareness, expanding food processing industries, and adoption in snacks, beverages, and nutritional products are boosting market growth, with Brazil and Mexico as key markets.

-

Brazil Soy Protein Isolate Market Insights:

Brazil is the dominating country in the Latin America Soy Protein Isolate market, driven by growing demand for plant-based proteins, expanding food processing industries, and increased adoption in snacks, beverages, and nutritional products.

Middle East & Africa Soy Protein Isolate Market Insights:

The Middle East and Africa market is growing steadily, driven by increasing demand for plant-based proteins, health-conscious diets, and functional foods. Rising awareness of nutrition, expanding food processing sectors, and adoption in snacks, beverages, and supplements are boosting market growth, with Saudi Arabia and South Africa as key markets.

-

Saudi Arabia Soy Protein Isolate Market Insights:

Saudi Arabia is the dominating country in the Middle East & Africa Soy Protein Isolate market, driven by growing demand for plant-based proteins, health-focused diets, and expanding food processing and nutritional product industries.

Soy Protein Isolate Market Competitive Landscape:

Fuji Oil Holdings Inc. , Established in 1950, Fuji Oil Holdings Inc. is a global leader in the food industry, specializing in sustainable, plant-based, and functional food products. The company focuses on soy protein peptides, chocolate alternatives, and vegetable oils, leveraging advanced technology, automation, and digital transformation to drive innovation, expand its global presence, and meet growing consumer demand for health-conscious and high-quality foods.

-

In Jan 2025, Fuji Oil is advancing sustainable, plant-based products and expanding globally while leveraging automation, digital transformation, and functional soy proteins to address demographic shifts and labor shortages.

Arla Foods Ingredients, established in 2000, is a leading Danish dairy company specializing in high-quality ingredients for food, beverages, and sports nutrition. The company generates annual revenues exceeding $2 billion, leveraging global operations and strategic acquisitions to expand its portfolio, enhance production capabilities, and meet growing consumer demand for protein-rich and functional products.

-

In Nov 2024, Arla Foods Ingredients acquires Volac’s whey nutrition business, expanding its global sports nutrition portfolio and production capabilities.

Soy Protein Isolate Market Key Players:

-

Archer Daniels Midland (ADM)

-

Cargill

-

Fuji Oil Holdings

-

Farbest Brands

-

Kerry Group

-

Batory Foods

-

CHS Inc.

-

Crown Soya Protein Group

-

The Scoular Company

-

Foodchem International Corporation

-

Nutra Food Ingredients

-

Osage Food Products

-

DuPont de Nemours

-

Taj Agro International

-

Titan Biotech Limited

-

Xi'an Healthful Biotechnology Co., Ltd

-

ET Chem’s

-

Wilmar International

-

Glanbia Nutritionals

-

Arla Foods Ingredients

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.94 Billion |

| Market Size by 2032 | USD 6.72 Billion |

| CAGR | CAGR of 6.89% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Powder, Liquid) • By Product Type (Regular Soy Protein Isolate, Organic Soy Protein Isolate, Textured Soy Protein Isolate, Soy Protein Hydrolysate) • By Application (Food & Beverage, Nutritional Supplements, Pharmaceuticals, Cosmetics & Personal Care Products, Animal Feed, Others) • By End User (Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland (ADM), Cargill, Fuji Oil Holdings, Farbest Brands, Kerry Group, Batory Foods, CHS Inc., Crown Soya Protein Group, The Scoular Company, Foodchem International Corporation, Nutra Food Ingredients, Osage Food Products, DuPont de Nemours, Taj Agro International, Titan Biotech Limited, Xi'an Healthful Biotechnology Co., Ltd, ET Chem’s, Wilmar International, Glanbia Nutritionals, Arla Foods Ingredients |