Culinary Sauces Market Report Scope & Overview:

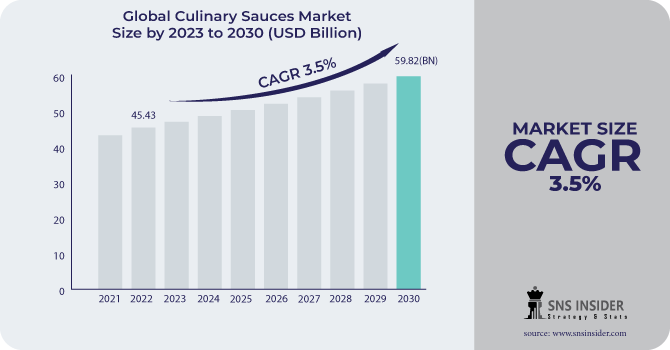

The Culinary Sauces Market size was USD 45.43 billion in 2022 and is expected to Reach USD 59.82 billion by 2030 and grow at a CAGR of 3.5 % over the forecast period of 2023-2030.

Culinary sauces are semi-solid ingredients that are used to enhance the flavor, wetness, and texture of meals. They can be produced with a wide range of components, such as vegetables, fruits, meats, seafood, dairy products, and spices.

Based on type they are segmented into wet sauces, Dry sauces. Wet culinary sauces, such as dressings, gravies, and marinades, are versatile and can be used in a variety of recipes. They can be used as cooking bases, coatings for grilling or roasting, salad dressings, or as accompaniments for diverse cuisines. Wet sauces' extensive application possibilities boost their market appeal and recognition.

Based on End Users they are categorized as Restaurants, Households, Food Processor, and others. Due to the rise in home cooking trends, the household application segment has become the dominating one. The performance of the market is boosted by the extensive accessibility and availability of a variety of sauces. Additionally, adding various non-native sauces to traditional dishes helps to improve their flavor and texture, complimenting the dish and making it more appetizing. It is anticipated that the aforementioned factors will increase product demand.

MARKET DYNAMICS

KEY DRIVERS

-

Growing trend of vegetarian and vegan people

The global population of vegetarians and vegans is growing due to a variety of issues, including worries about animal welfare, health, and the environment. This is increasing demand for vegetarian and vegan sauces. Plant-based components such as tomatoes, vegetables, fruits, and spices are used to make vegetarian and vegan sauces. They are high in nutrients and can be utilized to enhance the flavor and variety of vegetarian and vegan cuisine.

RESTRAIN

-

Fluctuation in raw material prices

Raw material prices, such as tomatoes, fruits, vegetables, spices, and herbs, can fluctuate due to a variety of factors such as weather, crop yields, and demand and supply. When the prices of raw materials rise, culinary sauce manufacturers may face higher costs. This can make it harder for companies to sustain profit margins, and it can also contribute to increased consumer pricing.

OPPORTUNITY

-

Demand for Exotic Sauce in Restaurants, Hotel, and Cafes

-

Investment in research and development for new flavors, texture

Consumers are continuously looking for new and intriguing flavors to add to their cuisine. Many customers are increasingly looking for healthier options when it comes to eating. Culinary sauce manufacturers can appeal to this rising market group by improving the nutritional profile of their sauces. They are also working on dry sauce concentrates with additions such as soy pepper, soy mushroom, and others.

CHALLENGES

-

Stringent government regulations

Government regulations that are too stringent can hinder innovation in the culinary sauces sector. Manufacturers may be cautious about producing new items if they are unsure whether they will be able to comply with all of the rules. They generally require the following information to be provided on the label including the name of the ingredients & preservatives and any potential negative effects. The rigorous requirements can make it impossible for culinary sauce manufacturers to export their products to select regions in some situations. This may limit their sales and growth prospects.

IMPACT OF RUSSIA UKRAINE WAR

The war has harmed the culinary sauces sector by disrupting supply lines for several commodities, including materials used in culinary sauces like oil, vegetables, fruits, and others. This has resulted in sauce shortages and expensive pricing. In addition to the growth in food prices, global oil and gas prices have risen due to high demand. Russia is a key supplier of oil and gas, and oil prices have risen beyond $100 per barrel since the start of the Russia-Ukraine conflict.

IMPACT OF ONGOING RECESSION

Food and vegetable costs have risen globally as a result of the recession. According to a study from the UN Food and Agriculture Organization, the worldwide Food Price Index (FPI) averaged 159.3 points in March 2022, an increase of 17.9 points (12.6%) from February. Several of these countries saw more food price inflation than the global average (12.6%) during this time period. Hence, the rise in food inflation has indirectly led to an increase in the prices of culinary sauces.

MARKET SEGMENTATION

by Product Type

-

Dry Sauces

-

Wet Sauces

by Distribution Channel

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

by End User

-

Restaurants

-

Households

-

Food Processor

-

Other

.png)

REGIONAL ANALYSIS

North America is the largest market for culinary sauces, accounting for a share of over 30% of the global market. The market is driven by the growing demand for convenience foods, as well as the increasing popularity of ethnic cuisines. The United States is the largest market in North America, followed by Canada.

Asia Pacific's culinary sauces market in 2022 stood at USD 17.3 billion and is anticipated to register the fastest growth rate during the forecasted period. Increased sales of culinary sauces in this region is driven by a changed lifestyle and willingness to experiment with various flavors and taste. Asian cuisines are known for their diverse, vibrant, and varied flavors imparted by using a wide range of condiments such as culinary sauces.

Europe’s culinary sauces market share is growing by the robust growth in the sauces and condiments industry across the region. The rising demand for spicy ethnic foods and their increasing popularity in European countries, such as Italy, Germany, France, and others, is encouraging key international market players such as McCormick and Hormel to invest in the European market.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Ken’s Foods, Hormel Foods Corporation, Yamasa Corporation, The Kraft Heinz Company, Conagra Brands, Del Monte Foods, Unilever PLC, McCormick & Company, McllhennyCompany, Hormel Foods Corporation, and other key players are mentioned in the final report.

Hormel Foods Corporation-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 Mother's Recipe, India's top food brand, recently announced the launch of a new category of "Exotic Global Sauces" under the brand 'Recipe' - available in Green Chili, Red Chili, Soya bean, Garlic Chilli, Sriracha Sauce, and Chilli Vinegar.

In 2023 Heinz is introducing "Culinary Tomatoes," a new line that includes only its "finest" tomatoes that are "sun-ripened and grown in Italy for incomparable flavor." The product line comprises chopped and peeled tomatoes, pizza sauce, tomato puree, and a variety of tomato bases for cooking sauces (passata, chilli, curry, and frito).

In 2022 Sonia Group Holding, a culinary and solutions producer, purchased the sauce experts Sauces etCreations and Atelier D2i in France to broaden its product offering range with sweet and savory made-to-measure sauces.

| Report Attributes | Details |

| Market Size in 2022 | US$ 45.43 Billion |

| Market Size by 2030 | US$ 59.82 Billion |

| CAGR | CAGR of 3.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Wet Sauces, Dry Sauces) • By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online) • By End User (Restaurants, Households, Food Processor, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ken’s Foods, Hormel Foods Corporation, Yamasa Corporation, The Kraft Heinz Company, Conagra Brands, Del Monte Foods, Unilever PLC, McCormick & Company, McllhennyCompany, Hormel Foods Corporation |

| Key Drivers | • Growing trend of vegetarian and vegan people |

| Market Challenges | • Stringent government regulations |