Space Cybersecurity Market Report Scope & Overview:

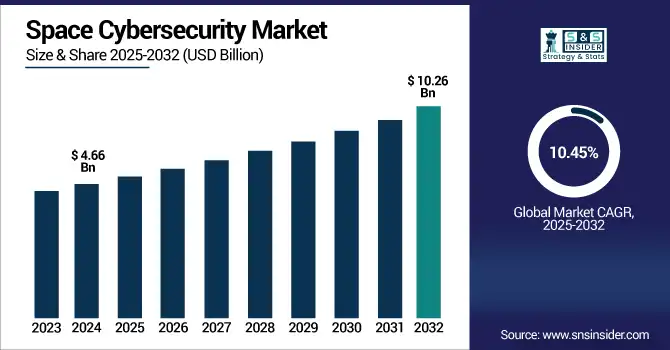

Space Cybersecurity Market size was valued at USD 4.66 billion in 2024 and is expected to reach USD 10.26 billion by 2032, growing at a CAGR of 10.45% from 2025-2032.

To Get more information on Space Cybersecurity Market - Request Free Sample Report

The Space Cybersecurity Market growth is driven by the rapid expansion of satellite constellations, increasing reliance on space-based assets for communication, navigation, and Earth observation, and the rising frequency of cyber threats targeting these critical systems.

-

As of 2025, over 12,000 active satellites are orbiting Earth, making space infrastructure as complex as any terrestrial datacenter.

The U.S. White House has emphasized the adoption of “zero trust” cyber architectures for space systems, urging agencies to implement AI-driven cybersecurity solutions.

-

According to CSIS's 2025 Space Threat Assessment, cyber incidents targeting space assets have surged by 192% between 2019 and 2025, with five major cyberattacks recorded in 2024 alone.

-

Additionally, the 2025 solar maximum disabled over 60 satellites due to geomagnetic storms, reducing their lifespans by 25–40%, further exposing vulnerabilities in space-based systems.

Governments and commercial players are heavily investing in securing their space infrastructure against espionage, signal jamming, and data breaches. Growing defense modernization programs, global space exploration initiatives, and the integration of AI and IoT technologies continue to amplify cybersecurity risks, prompting the need for robust, real-time threat detection and protection solutions across all space platforms.

U.S. Space Cybersecurity Market size was valued at USD 1.31 billion in 2024 and is expected to reach USD 2.85 billion by 2032, growing at a CAGR of 10.24% from 2025-2032.

The U.S. Space Cybersecurity Market is expanding due to rising cyber threats, increased satellite deployments, and growing investments in defense and national space programs. Public-private collaborations and the use of commercial satellites for communication, surveillance, and navigation are further driving the demand for advanced cybersecurity solutions.

Market Dynamics

Drivers

-

Rising Deployment Of Satellite Constellations Demands Enhanced Cybersecurity Frameworks To Protect Critical Space-Based Communication Infrastructure.

Investments in satellite constellations for communication, navigation, and Earth observation are rising and increasing the cyber-attack surface. A breach would be potentially calamitous, cautioning as these satellites are managing sensitive defence, weather and commercial data. This has compelled governments and private players to focus on cybersecurity frameworks specifically for satellite systems. Low-Earth orbit assets move fast and attack vectors change quickly, so they require constant surveillance and long-range infiltration detection. Increased vulnerabilities are putting cybersecurity front-and-center in mission planning, leading to rapid growth in the global space cybersecurity market.

-

Supporting this shift, the U.S. Space Systems Command (SSC) is actively deploying Zero Trust cybersecurity architecture across both ground and orbital systems. As part of its 2024 initiative, SSC awarded a USD 17 million contract to Xage Security to implement a “Never Trust, Always Verify” model for protecting satellite and ground station networks.

-

Reflecting the urgency, early 2025 alone saw around 145 new satellite launches, bringing the total number of orbiting objects to over 12,950 as of June 29, 2025, significantly expanding the cybersecurity attack surface in space.

Restraints

-

Lack Of Standardized International Space Cybersecurity Frameworks Creates Inconsistencies In Protection And Compliance Protocols.

The lack of globally accepted regulations on how to secure space assets creates gaps on national and commercial programs. However, without broad global coordination, cybersecurity efforts are built in silos, which results in inconsistent responses to threats and weaknesses in joint operations. It hampers data sharing, slows down incident response and limits scalable security frameworks. Overlapping jurisdictions further complicate enforcement. This fragmented governance causes inefficiencies, undermines stakeholder confidence, and ultimately restricts coherent expansion for the worldwide space cyber security market.

Opportunities

-

Rising Commercial Space Activity Opens Demand For Tailored Cybersecurity Solutions For Private Satellite Networks And Launch Systems.

The increasing number of private companies engaging in space endeavours like satellite-lifting rockets, data relay, and microgravity research, the need for bespoke cyber protection is growing. Secure Communications, Threat Monitoring, and Access Control for Proprietary Satellite Networks and Space-as-a-Service Platforms It opens up new markets for vendors providing more scalable, cloud-based and AI-enabled protection. With mission continuity, data confidentiality, and regulatory compliance as a primary goals for commercial space operators, this evolving market vertical, is rapidly increasing demand for multiple mission profiles of special purpose Cybersecurity architectures.

-

On April 10, 2025, NASA’s Space Communications & Navigation (SCaN) Program signed an agreement with the Space Information Sharing and Analysis Center (Space ISAC) to exchange cyber threat intelligence for protecting commercial space systems, including private satellite networks.

-

Additionally, NASA is funding research into zero-trust and blockchain-based cybersecurity aimed at securing inter-satellite and ground link communications for constellations of up to 2,080 nanosatellites by 2027.

-

Further reinforcing this initiative, NASA released its first Space Security Best Practices Guide in December 2023, covering communication protocols, access control, and mission assurance for both public and private missions.

Challenges

-

Sophisticated And Evolving Cyber Threats Targeting Satellite Systems Demand Continuous Innovation In Threat Detection And Mitigation Techniques.

As AI-driven malware, zero-day exploits and supply chain attacks erupt in number and sophistication, space-based systems experience rising cyber vulnerability. Their strategic importance makes them prime targets, especially satellites, ground stations, and data links. However, these increasing threats require response agility and near real-time response mechanisms that are expensive and technically complicated. Old fashioned legacy systems making vulnerabilities worse. Thus, this continuous demand for evolution and adaptation of cybersecurity protocols constitutes a formidable obstacle for all parties responsible for ensuring that space infrastructure is resilient and secure against a growing cyber threat landscape.

-

In February 2025, cybersecurity analyses highlighted that APT41 (Winnti) exploited a VPN vulnerability in Check Point devices to infiltrate aerospace and aviation operational technology supply chains, jeopardizing commercial space systems.

Segment Analysis

By Offering

The Solution segment dominated the Space Cybersecurity Market share of about 64% in 2024 due to the increasing need for hardware and software protection across satellites, networks, and ground systems. Integrated security platforms, including firewalls, encryption, and access control systems, which are capital-intensive, take precedence for governments and private players alike. They provide end-to-end, scalable protection, which is crucial to ensuring complex and expanding space infrastructure can be well-protected.

The Services segment is expected to grow at the fastest CAGR of about 11.64% from 2025–2032, as continuous monitoring, threat intelligence, incident response, and managed security services gain traction. Handling such rapidly evolving cyber threats has turned the need for an expert partner to provide adaptive, real-time cybersecurity support essential to organization. The ability to outsource these security operations to third-party service providers provides a level of cost efficiency and flexibility that will be very attractive to commercial operators and new space programs around the globe.

By End Use

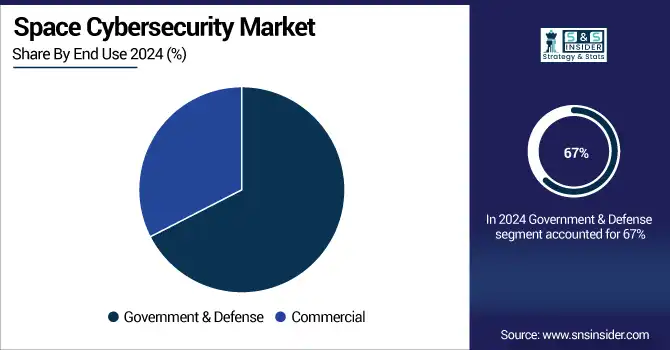

The Government & Defense segment dominated the Space Cybersecurity Market with the highest revenue share of about 67% in 2024, due to the need to secure national security resources, military communications, and surveillance satellites. Such stakeholders spend heavily on high-end cyber capabilities for the purposes of protecting space infrastructure from espionage, sabotage, and cyber warfare. They are still held firmly in their dominant market positions due to higher cybersecurity budgets and the sheer attention to the idea of sovereign control.

The Commercial segment is expected to grow at the fastest CAGR of about 12.04% from 2025–2032, fueled by the rapid expansion of private satellite operators, launch providers, and space-tech startups. Such enterprises that need to protect intellectual property, ensure the continuity of their mission and fulfil compliance are highly reliant on strong cyber security solutions. Global need for scalable, cloud-based security services is accelerating with the further commercialization of satellite internet, earth imaging, and launch services.

By Platform

The Satellites segment dominated the Space Cybersecurity Market with the highest revenue share of about 36% in 2024, owing to the high value and vulnerability of satellite systems to cyber threats. Satellites serve as critical nodes for communication, navigation, defense, and data transmission, making them prime targets for hackers. Organizations allocate substantial resources to secure satellite software, firmware, telemetry, and communication links, reinforcing the segment’s dominant position.

The Spaceports & Launch Facilities segment is expected to grow at the fastest CAGR of about 13.80% from 2025–2032 due to rising global launch activity and increasing concerns over physical-cyber convergence risks. As launch facilities become high-value infrastructure, protecting networks, telemetry systems, and access control against cyber intrusions becomes essential. The growth in commercial launch operators and multi-user spaceports is further accelerating demand for dedicated cybersecurity frameworks.

By Application

The Satellite Communications segment dominated the Space Cybersecurity Market with the highest revenue share of about 38% in 2024 owing to its critical significance in a lot of applications in the areas of aviation, maritime, broadband, and defense. Communication systems are often for signal interception, jamming, and spoofing. The segment continued to retain its largest share by ensuring critical data is transmitted over encrypted links and alongside resilient network architectures, making it as a strategic priority.

The Space Exploration segment is expected to grow at the fastest CAGR of about 14.78% from 2025–2032 due to the increased missions to the Moon, Mars, and beyond undertaken by space agencies as well as private enterprises. Such missions consist of complex networks, autonomous systems, interplanetary communication links, all of which need to be protected against cyber threats. Increasing investments in deep space programs and collaborative efforts are driving demand for new mission-critical cybersecurity architectures.

Regional Analysis

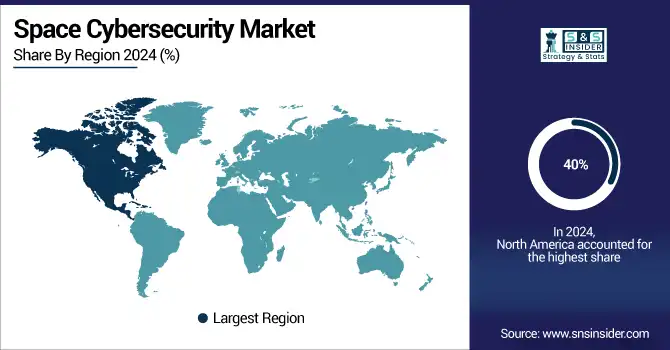

North America

North America led the Space Cybersecurity Market with around 40% revenue share in 2024, owing to high government funding, mature defence space programs, and a maturing domestic commercial space sector. The established ecosystem of top aerospace and cybersecurity companies as well as emerging satellite constellations and military programs is driving demand for integrated, end-to-end cybersecurity services and solutions across the public and private space landscape.

-

The U.S. Space Force’s 2024 budget request totaled USD 30 billion, with approximately USD 700 million specifically allocated to enhancing the cyber defense of critical networks associated with space operations.

-

Additionally, partnerships like General Dynamics IT and AWS, announced in March 2025, are focused on delivering secure cloud and AI-driven cybersecurity solutions to support government space missions.

The United States is dominating the Space Cybersecurity Market due to its advanced space programs, strong defense investments, and leading cybersecurity technology infrastructure.

Asia Pacific

Asia Pacific is projected to grow at the fastest CAGR of approximately 12.42% from 2025 to 2032, owing to growing investments in national space programs as well as commercial satellite activities by countries including China, India, Japan, and South Korea. Fast expanding satellite constellations and launch infrastructures make these countries more vulnerable to cyber insecurities.

China is leading the regional space cybersecurity market due to strong government support and advanced defense capabilities. Under its “Science and Technology Innovation 2030” plan, China is building a space–ground integrated information network (SGIIN) incorporating satellites, 5G, IoT, and secure communications under a PNTRC framework.

Europe

Europe is a significant player in the Space Cybersecurity Market, due to more collaborative style of space missions and growing national policies for attractive development of space cybersecurity solutions to secure satellite communications. The response includes advancing space security technologies, innovation ecosystems, and harmonized regulatory frameworks as mechanisms for responding to evolving threats in the region.

-

The IRIS² program, Europe's flagship secure communications constellation, will deploy 264 LEO and 18 MEO satellites by 2027 under a USD 12.31 billion, reinforcing continental cyber defense capabilities.

Germany is dominating the Space Cybersecurity Market in Europe owing to its robust aerospace industry, strong defense focus, and advanced cybersecurity research capabilities.

-

The country has invested USD 58.64 million in secure satellite communications and USD 45.80 million in quantum key distribution R&D, while also supporting ESA-led missions like Hera, Clearspace‑1, and Vigil with funding between USD 28.15–USD 84.41 million focused on space security and debris monitoring.

Middle East & Africa and Latin America

The Space Cybersecurity Market trends in the Middle East & Africa and Latin America show gradual growth, driven by increasing satellite adoption, defense modernization, and digital transformation efforts. However, limited infrastructure and investment continue to constrain rapid expansion in these emerging regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Space Cybersecurity Market companies are Lockheed Martin Corporation, Northrop Grumman, Thales, Airbus, Booz Allen Hamilton, BAE Systems, CHI Group, Checkpoint Software Technologies, SpiderOak Mission Systems, Xage Security, Inc., Anduril Industries, Inc., Cisco, CrowdStrike, Fortinet, Sophos

Recent Developments:

-

2025: Lockheed Martin launched a new Cyber Resiliency Level (CRL) framework to measure and enhance spacecraft and defense system cybersecurity resilience per NIST SP 800‑171(r2) guidelines through industry-standard assessments.

-

2024: Lockheed Martin announced CMMC 2.0 revisions published by DoD (Aug 15, 2024) to enforce stricter cybersecurity controls, impacting space-tech contractors handling Controlled Unclassified Information.

-

2024: Northrop Grumman unveiled next‑generation Cross‑Domain Solutions enabling secure transfer between different security classification levels for space and mission networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.66 Billion |

| Market Size by 2032 | USD 10.26 Billion |

| CAGR | CAGR of 10.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Services) • By Platform (Satellites, Launch Vehicles, Ground Stations, Spaceports & Launch Facilities, Command & Control Centers, Others) • By End Use (Government & Defense, Commercial) • By Application (Satellite Communications, Earth Observation, Navigation, Space Exploration, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, Northrop Grumman, Thales, Airbus, Booz Allen Hamilton, BAE Systems, CHI Group, Checkpoint Software Technologies, SpiderOak Mission Systems, Xage Security, Inc., Anduril Industries, Inc., Cisco, CrowdStrike, Fortinet, Sophos |