Human Capital Management Market Size & Overview:

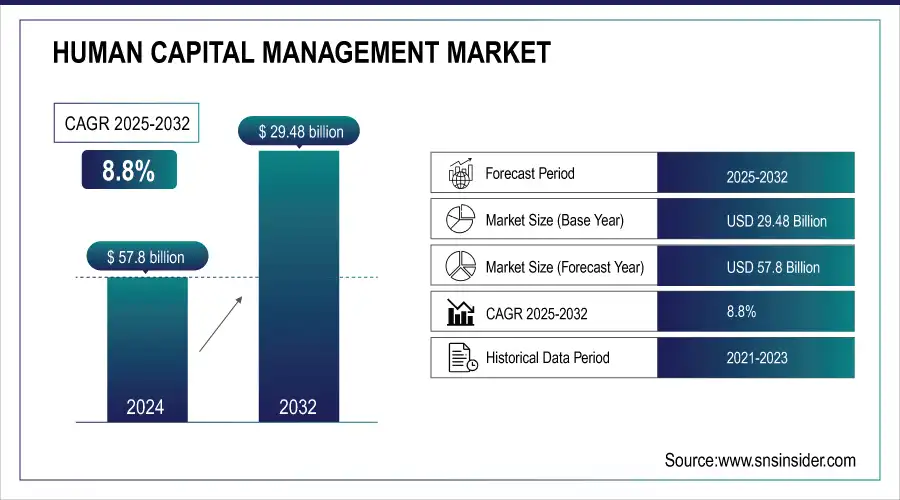

The Human Capital Management Market Size was valued at USD 29.48 Billion in 2024 and is expected to reach USD 57.8 Billion by 2032, growing at a CAGR of 8.8% over the forecast period 2025-2032.

Get more information on Human Capital Management Market - Request Free Sample Report

The Human Capital Management (HCM) Market has seen substantial growth in recent years, driven by the increasing emphasis on digital transformation and data-driven workforce management strategies. A key driver for this expansion is government policies promoting the adoption of digital solutions in human resource functions to enhance productivity and organizational efficiency. For instance, in 2023, the U.S. Bureau of Labor Statistics reported that digital roles within HR departments grew by approximately 5.2%, reflecting a shift toward tech-based workforce management. This governmental push for digitization, supported by statistics indicating rising workforce management complexities, is motivating businesses to adopt HCM solutions to streamline recruitment, payroll, and performance management processes. Tools like video assessments, social sourcing, chatbots, and predictive analytics also aid in selecting candidates suited to roles. Key players are adopting cloud-based and machine learning-integrated HCM solutions to drive efficiency and meet evolving business needs.

Key Human Capital Management Market Trends

-

Rising adoption of cloud-based HCM solutions is driving efficiency, scalability, and real-time workforce management across enterprises.

-

Integration of artificial intelligence (AI) and machine learning (ML) into HCM platforms is enhancing talent acquisition, predictive analytics, and employee engagement.

-

Growing focus on employee experience and retention is fueling the implementation of HCM systems with performance management, learning, and career development modules.

-

Expansion of remote work and hybrid workforce models is increasing demand for digital HCM tools that streamline payroll, benefits, and compliance management.

-

Use of advanced analytics and data-driven insights in HCM is improving decision-making related to workforce planning, succession, and skills gap analysis.

-

Regulatory compliance and global workforce management requirements are shaping HCM solution development, emphasizing automated reporting and legal adherence.

-

Employee wellness, diversity, equity, and inclusion (DEI) programs are being integrated into HCM platforms to support holistic human capital strategies.

For example, in October 2023, sa.global launched Evergreen HCM, a Microsoft-partnered HR tool designed to streamline processes for professional services. Additionally, RPA embedded with AI and ML is helping organizations reduce IT costs and boost operational efficiency, creating growth opportunities in the HCM Market.

Human Capital Management Market Drivers:

-

Increased demand for digital HCM solutions to manage remote workforce efficiently, along with adoption of cloud-based HCM platforms for real-time collaboration and employee engagement.

-

Companies are focusing on enhancing employee satisfaction and retention through personalized HCM solutions. Advanced analytics and AI tools are being integrated to monitor and improve employee experience.

-

Stricter labor laws and data privacy regulations drive demand for automated compliance tracking. HCM systems are essential for organizations to stay compliant and avoid legal risks.

-

Automation streamlines recruitment, payroll, and performance evaluation processes, enhancing efficiency.

The shift towards remote and hybrid work models has significantly transformed the Human Capital Management (HCM) landscape. The pandemic accelerated remote work adoption, with studies showing that around 74% of U.S. companies have either implemented or plan to adopt a permanent hybrid model. This trend has driven companies to seek advanced digital HCM solutions to manage their dispersed workforce effectively, improve collaboration, and sustain employee productivity. Cloud-based HCM platforms play an important role in facilitating seamless communication, task allocation, and performance monitoring, allowing organizations to adapt to the flexibility demanded by these work models.

An example of this shift is evident at companies like Microsoft, who have implemented a hybrid model supported by its own HCM solutions. Microsoft’s experience highlights the need for platforms that integrate communication, workflow management, and employee engagement, enabling HR teams to track productivity and support remote team members effectively. Similarly, Dropbox has adopted a “Virtual First” policy, leveraging cloud-based HCM to foster connectivity and inclusivity across global teams. Furthermore, a recent report highlights that nearly 75% of hybrid or remote employees feel more productive with flexible work arrangements, emphasizing the need for digital tools that can support this setup. These trends underscore how HCM platforms are becoming essential for organizations aiming to sustain productivity and engagement while managing the complexities of a hybrid workforce.

-

Using Cloud Computing for HR and Talent Management in Organizations to Accelerate Business Growth

Cloud computing has progressed from a radical IT approach to a key corporate technology. Cloud computing solutions in HR tools enable organizations to increase employee engagement and experience by enhancing performance and talent management capabilities. HR and management teams may quickly access and offer business and personal data on employees using sophisticated cloud-based solutions. Cloud-based solutions open up new potential for businesses by automating time-consuming and complex operations like performance evaluation, timesheet submission, and payroll administration. Furthermore, certain cloud HR management solutions may be customized by HR experts and company personnel without the assistance of IT professionals. HR managers may therefore enhance efficiency and make data-driven, informed choices using cloud computing.

Human Capital Management Market Restraints:

-

Handling sensitive employee data increases the risk of data breaches and privacy violations. Organizations hesitate to fully adopt cloud-based HCM solutions due to cybersecurity concerns.

-

The cost of implementing and maintaining HCM solutions can be high, particularly for SMEs.

-

Integrating HCM solutions with existing enterprise systems can be technically challenging.

A significant challenge faced by the Human Capital Management Market is related to data security and privacy issues. Although HCM solutions provide businesses with a means to collect and oversee huge volumes of sensitive employee information ranging from personal details and payroll data to performance records they can also be a risk factor for data breaches and unauthorized access. Despite the expected benefits of cloud-based HCM solutions, many organizations are still hesitant to switch due to the supposed risks of hacking that could cause data loss or data misuse. Moreover, the new wave of data protection regulations around the globe- from GDPR across Europe to CCPA in California makes compliance non-negotiable if businesses want to avoid major fines. This can become especially complicated for large global organizations that are required to store data in certain locations, access and manipulate it from other regions of the world, and protect sensitive or regulated information at all points of vulnerability. These concerns make it crucial for HCM providers to invest in robust cybersecurity measures, but the fear of data breaches continues to act as a deterrent for many companies considering HCM solutions.

Human Capital Management Market Segmentation Analysis

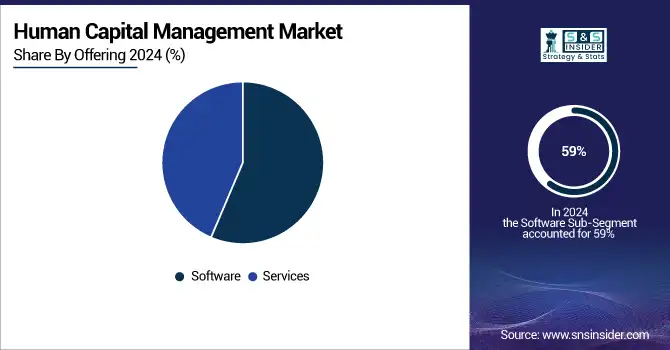

By Offering, the Software Segment Dominates the Human Capital Management Market in 2024

The Human Capital Management Market was dominated by the software segment in 2024, with a share of USD 59% of the entire market. It is this robust positioning that drives the growing demand for automation that allows HR functions to handle large-scale employee data more effectively. According to government reports, the use of cloud-based solutions in the HR sector has helped companies with more than 500 employees save costs by around 15% per year, and thus, organizations are encouraged to invest in HCM software. The U.S. Department of Commerce's 2024 survey on business technology adoption also found that 68% of large enterprises in the U.S. have implemented HR/ HCM software, an indication that companies are embracing the concept and its promise to improve efficiency & productivity across HR functions.

By Organization Size, Large Enterprises Lead HCM Market with 69% Share in 2024

Large enterprises dominated the market and accounted 69% of the overall HCM Market share in 2024. The primary reason for this is larger corporations have huge workforce management needs and require such advanced-level software solutions as they need to manage recruitment, performance management along with calculating compliance and payroll across various regions. According to the recent statistics of the government, 85% of organizations with over 1000+ employees are reliant on HCM solutions in order to comply with regional labour laws & regulations which is really important for enterprises having a complex approach to operational frameworks. As per a report by the European Union's Directorate-General for Employment 2024, more and more large enterprises, especially those with international activities are turning toward HCM solutions to manage the global workforce and cut down operational costs while improving productivity.

By End-Use Industry, IT & Telecommunication Sector Drives Significant HCM Market Adoption

The IT & telecommunication industry accounted for significant share of 24% of the HCM Market in 2024 due to the higher inclination of this sector towards advanced workforce management technologies. HCM systems optimize processes for recruitment, onboarding, and retention for this tech-savvy workforce-dependent industry. As per the U.S. Bureau of Labor Statistics in 2024, the technology sector had one of the highest turnover rates at 13.2%, emphasizing the need for robust HCM solutions to manage retention and employee satisfaction effectively. The shift towards remote and hybrid work modes in the IT sphere has also led to widespread usage of HCM solutions to enable seamless functioning and connectivity within distributed teams.

Human Capital Management Market Regional Analysis

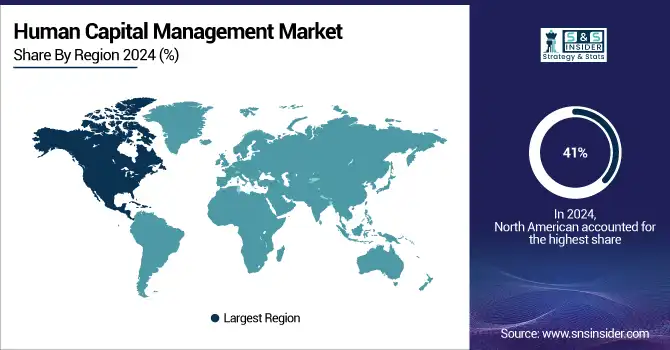

North America Dominates Human Capital Management Market in 2024

North America is the dominant region in the Human Capital Management Market, holding an estimated 41% market share in 2024. This leadership is driven by high adoption of cloud-based HCM solutions, widespread digital transformation, and significant investments in workforce automation, which enhance operational efficiency and employee management across enterprises.

Need any customization research on Human Capital Management Market - Enquiry Now

-

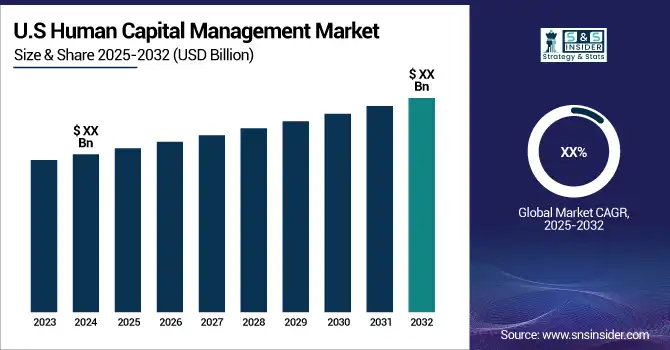

United States Leads North America’s HCM Market

The United States dominates due to its mature corporate ecosystem, advanced IT infrastructure, and high adoption of cloud-based HCM platforms. Large enterprises rely on these solutions for payroll automation, talent management, and compliance across multiple regions. Government initiatives supporting workforce digitalization, along with the presence of leading HCM software providers, further drive adoption. The U.S. also benefits from strong R&D capabilities, innovation hubs, and a growing emphasis on employee experience and engagement, making it the central hub for HCM adoption in North America.

Asia Pacific is the Fastest-Growing Region in Human Capital Management Market in 2024

Asia Pacific is the fastest-growing region in the Human Capital Management Market, with an estimated CAGR of 15.2% during 2024. Growth is fueled by rapid digital transformation, increasing workforce size, and rising adoption of cloud-based HR technologies, which drive demand for efficient workforce management.

-

China Leads HCM Market Growth in Asia Pacific

China dominates due to its large and expanding workforce, growing number of enterprises, and increasing investment in digital HR solutions. Companies in China are adopting HCM systems for recruitment, payroll, performance management, and compliance with local labor laws. The rise of tech-savvy organizations, government support for digitalization, and increasing focus on employee engagement accelerate the implementation of HCM platforms. Additionally, multinational corporations operating in China integrate advanced workforce management solutions to optimize productivity, talent retention, and operational efficiency, establishing China as the hub of HCM growth in Asia Pacific.

Europe Human Capital Management Market Insights, 2024

Europe holds a significant share of the Human Capital Management Market, driven by adoption in IT, manufacturing, and financial services. Germany’s high adoption of cloud-based HCM solutions accelerates workforce automation, improving productivity, compliance, and employee engagement. Germany dominates due to its strong industrial and corporate base, early adoption of digital HR systems, and emphasis on workforce efficiency. Companies in Germany implement HCM solutions for payroll, performance management, and compliance. Government policies promoting workforce digitalization and technological innovation further enhance adoption, making Germany the central hub for HCM in Europe.

Middle East & Africa and Latin America Human Capital Management Market Insights, 2024

The Human Capital Management Market in the Middle East & Africa and Latin America is emerging, driven by modernization of workforce management and increasing investments in cloud-based HR technologies. Countries like Brazil, Mexico, UAE, and Saudi Arabia are implementing HCM solutions to enhance employee engagement, streamline payroll, and comply with labor regulations. While adoption is slower than in North America, Europe, and Asia Pacific, gradual digital transformation, government support for workforce management, and growing multinational presence are expected to drive market growth in these regions.

Competitive Landscape of the Human Capital Management Market:

Workday, Inc.

Workday, Inc. is a U.S.-based leader in cloud-based human capital management (HCM) and financial management solutions. The company provides comprehensive HR, payroll, talent management, and workforce analytics platforms designed to streamline enterprise operations and improve employee experience. Workday serves a global customer base, including large enterprises and mid-sized companies, through direct sales and partner networks. Its role in the HCM market is vital, as it enables organizations to automate complex HR processes, ensure compliance, and make data-driven workforce decisions, supporting operational efficiency and organizational growth.

-

In 2024, Workday enhanced its HCM suite by integrating AI-driven workforce planning and predictive analytics tools, improving HR decision-making and employee engagement.

SAP SE

SAP SE is a Germany-based multinational software corporation specializing in enterprise resource planning (ERP) and human capital management solutions. SAP’s HCM offerings, including SAP SuccessFactors, provide cloud-based tools for talent management, payroll, learning, and workforce analytics. Serving businesses across industries worldwide, SAP enables companies to optimize HR processes, boost employee productivity, and align workforce strategies with organizational objectives. Its role in the HCM market is significant, offering scalable and customizable solutions for enterprises of all sizes.

-

In 2024, SAP SuccessFactors introduced advanced AI-driven recruiting and skills-matching modules, enhancing workforce acquisition and retention for global enterprises.

Oracle Corporation

Oracle Corporation, headquartered in the U.S., is a global provider of cloud-based HCM, ERP, and database solutions. Oracle HCM Cloud delivers talent management, payroll, workforce management, and HR analytics, supporting large enterprises in improving workforce efficiency and operational performance. Oracle’s comprehensive solutions integrate seamlessly with its broader cloud ecosystem, providing enterprises with unified data and insights. Its role in the HCM market is central, helping organizations manage complex HR operations across multiple geographies while driving digital transformation.

-

In 2024, Oracle HCM Cloud introduced AI-powered employee engagement and career development features, boosting retention and workforce productivity.

ADP, LLC

ADP, LLC is a U.S.-based global provider of human capital management, payroll, and workforce management solutions. ADP serves businesses of all sizes with cloud-based platforms that automate HR processes, payroll, benefits administration, and compliance management. Its role in the HCM market is critical, offering flexible, scalable solutions that reduce administrative burdens, ensure regulatory compliance, and enhance employee experience. ADP’s extensive global network and expertise position it as a trusted partner for organizations seeking to optimize workforce management.

-

In 2024, ADP launched intelligent payroll automation and analytics capabilities, helping enterprises streamline operations and gain actionable workforce insights.

Human Capital Management Market Key Players:

Human Capital Management Market Companies

-

Workday, Inc.

-

Oracle Corporation

-

ADP, LLC

-

Ultimate Software Group, Inc. (UKG)

-

Kronos Incorporated (now part of UKG)

-

IBM Corporation

-

Cornerstone OnDemand, Inc.

-

Paycom Software, Inc.

-

Infor, Inc.

-

BambooHR, LLC

-

Namely, Inc.

-

Gusto

-

Ramco Systems

-

Talentsoft

-

PeopleFluent

-

Saba Software, Inc. (part of Cornerstone)

-

Zoho Corporation (Zoho People)

-

TriNet Group, Inc.

| Report Attributes | Details |

| Market Size in 2024 | US$ 29.48 Bn |

| Market Size by 2032 | US$ 57.8 Bn |

| CAGR | CAGR of 8.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Services) • By Organization Size (Large Enterprises, Small and Medium-sized Enterprises) • By Deployment Mode (On-premise, Cloud) • By End-use Industry (IT & Telecommunication, BFSI, Government, Retail, Healthcare, Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SAP SE, Oracle Corporation, Workday, Inc., ADP, Inc., Ceridian HCM, Inc., Ultimate Software (UKG), Cornerstone OnDemand, Inc., Kronos Incorporated, Infor, Zoho Corporation |