Sparkling Wine Market Report Scope & Overview:

The Sparkling Wine Market was valued at USD 42.47 billion in 2025E and is expected to reach USD 68.93 billion by 2033, growing at a CAGR of 6.24% from 2026-2033.

The Sparkling Wine Market is growing due to increasing consumer preference for premium and celebratory beverages, along with rising disposable income and evolving lifestyle trends. Expanding popularity of wine-based cocktails, festive occasions, and social gatherings is boosting demand. Additionally, innovations in flavors, packaging, and marketing, coupled with growth in e-commerce and on-trade sales channels, are further driving market expansion globally. Rising awareness of wine quality and origin is also supporting increased consumption.

Global sparkling wine consumption rose by 6.8% in 2023, fueled by premiumization and festive demand (IWSR, 2024). Online sales of sparkling wine grew by over 25% year-over-year, highlighting the surge in e-commerce and on-trade channels.

Sparkling Wine Market Size and Forecast

-

Market Size in 2025E: USD 42.47 Billion

-

Market Size by 2033: USD 68.93 Billion

-

CAGR: 6.24% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Sparkling Wine Market - Request Free Sample Report

Sparkling Wine Market Trends

-

Rising consumer preference for premium and luxury sparkling wines driven by gifting, celebrations, and lifestyle purchasing.

-

Growing popularity of low-alcohol, organic, and vegan sparkling wine among health-conscious and mindful drinkers worldwide.

-

Rapid expansion of online alcohol delivery platforms boosting accessibility, brand discovery, and subscription-based sparkling wine sales.

-

Increasing traction of flavored sparkling wines appealing to younger consumers seeking novelty and experimental taste profiles.

-

Rising demand for affordable sparkling wine options in emerging markets supporting mass-market consumption growth.

-

Strong adoption of canned and single-serve sparkling wine formats enhancing portability and on-the-go consumption occasions.

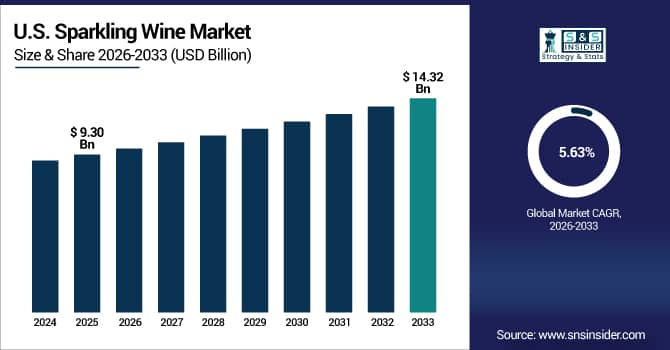

The U.S. Sparkling Wine Market was valued at USD 9.30 billion in 2025E and is expected to reach USD 14.32 billion by 2033, growing at a CAGR of 5.63% from 2026-2033.

Growth in the U.S. Sparkling Wine Market is driven by rising consumer preference for premium and celebratory beverages, increased disposable income, and the popularity of wine-based cocktails. Innovations in flavors, packaging, and e-commerce availability are further boosting market demand across on-trade and off-trade channels.

Sparkling Wine Market Growth Drivers:

-

Rising global preference for premium alcoholic beverages is boosting demand for sparkling wine across celebrations, social gatherings, and luxury consumption

Growing consumer inclination toward high-quality and premium alcoholic beverages has significantly increased the appeal of sparkling wine. It is increasingly associated with celebrations, weddings, corporate events, and special occasions, reinforcing its perception as a symbol of sophistication and luxury. Rising disposable incomes, particularly in emerging markets, are encouraging consumers to spend more on premium lifestyle products, including sparkling wine. Additionally, the growing presence of sparkling wine brands in retail, travel retail, and fine-dining spaces is further supporting steady market growth.

Global consumption of premium sparkling wine rose by nearly 20% between 2020 and 2023, with over 70% of purchasers citing special occasions as the primary reason for buying.

-

Increasing popularity of social dining, nightlife culture, and cocktail trends is driving consumption of sparkling wine among young urban consumers

Growing participation in social dining experiences, party culture, and nightlife activities has fueled higher consumption of sparkling wine. Younger demographics prefer sparkling wine for its refreshing taste and suitability for cocktails, brunches, and casual celebrations. The rise of premium bars, clubs, and rooftop lounges has also contributed to higher visibility of sparkling wine on menus. Social media influence and lifestyle-oriented beverage preferences are strengthening its adoption. As young urban consumers increasingly seek trendy, experiential drinking options, sparkling wine continues to gain momentum across global markets.

Sparkling wine consumption among consumers aged 21–35 rose by approximately 15% between 2021 and 2023, driven by its presence in bars, restaurants, and social media–influenced cocktail culture. Over 60% of urban millennials and Gen Z drinkers report having consumed sparkling wine in social dining or nightlife settings in the past year.

Sparkling Wine Market Restraints:

-

High product pricing and premium taxation on alcoholic beverages limit affordability, restricting sparkling wine consumption among price-sensitive consumer groups

Sparkling wine is generally positioned as a premium beverage, resulting in higher retail prices compared to other alcoholic drinks. Additionally, heavy excise duties, import tariffs, and luxury taxes imposed on alcoholic beverages in many countries further elevate final consumer prices. This makes sparkling wine unaffordable for a large segment of the population, especially in emerging markets. Economic fluctuations and inflation also influence consumer willingness to spend on non-essential premium products, ultimately restricting market penetration and lowering consumption among cost-conscious buyers.

Premium pricing and elevated alcohol taxes make sparkling wine significantly less accessible, with retail prices often 30–50% higher than still wines. This cost barrier reduces regular consumption among budget-conscious and younger demographics, particularly in regions with stringent excise duties.

-

Strict government regulations and alcohol consumption restrictions across many regions reduce market accessibility and limit sales growth opportunities

Alcoholic beverages face stringent regulatory frameworks in several countries, including licensing requirements, sales hour limitations, age restrictions, and advertising bans. These rules directly impact the distribution, marketing, and visibility of sparkling wine. In some regions, cultural or religious norms further discourage alcohol consumption, shrinking the potential consumer base. High compliance costs and restrictions on online alcohol sales also hinder market expansion. As governments continue to tighten alcohol safety policies, sparkling wine producers and retailers face significant barriers in scaling distribution and boosting sales.

Over 40 countries impose partial or full bans on alcohol advertising, while more than 30 enforce strict licensing laws that restrict retail and on-premise sales of alcoholic beverages. In regions like the Middle East and parts of South Asia, alcohol prohibition or heavy regulatory controls limit sparkling wine availability to a few duty-free or high-end channels.

Sparkling Wine Market Opportunities:

-

Growing demand for low-alcohol, organic, and vegan wine varieties creates opportunities for product innovation targeting health-conscious consumers globally

The shift toward healthier lifestyles has increased consumer interest in beverages with lower alcohol content, natural ingredients, and sustainable production methods. Sparkling wine brands can leverage this trend by introducing organic, biodynamic, sulfite-free, and vegan formulations. Health-focused consumers, especially millennials, increasingly value transparency, clean labels, and eco-friendly sourcing. Producers investing in environmentally responsible winemaking, ethical certifications, and reduced additive content can attract new customer segments. This growing preference for wellness-oriented alcoholic beverages opens a strong pathway for market diversification and premium pricing.

Global sales of low-alcohol and non-alcoholic wines grew by over 20% between 2022 and 2024, with organic and vegan-certified wines accounting for nearly 15% of new sparkling wine launches in 2023.

-

Expansion of e-commerce alcohol delivery platforms enables sparkling wine brands to reach broader audiences with personalized promotions and subscription models

The surge in online alcohol purchasing has transformed distribution channels for sparkling wine. E-commerce platforms, digital marketplaces, and direct-to-consumer services allow brands to bypass retail limitations and target global shoppers. Personalized recommendations, discount programs, and seasonal subscription boxes enhance consumer engagement and boost repeat purchases. Convenience-driven buying behavior, especially among young adults, supports strong online demand. With improved age-verification systems and home delivery logistics, sparkling wine producers can expand visibility, extend their geographic reach, and strengthen brand loyalty through data-driven marketing strategies.

Online alcohol sales grew by over 25% globally between 2021 and 2023, with sparkling wine among the fastest-growing categories on e-commerce platforms. Many brands now leverage direct-to-consumer channels, offering tailored subscriptions and targeted promotions that boost repeat purchases among urban and younger consumers.

Sparkling Wine Market Segment Highlights

-

By Type: In 2025, White led the market with 78% share, while Rosé is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Product: In 2025, Prosecco led the market with 29% share, while it is also the fastest-growing segment with the highest CAGR (2026–2033)

-

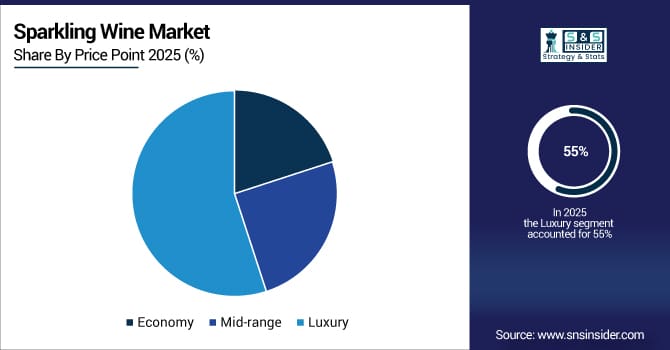

By Price Point: In 2025, Luxury / Premium led the market with 55% share, while it is also the fastest-growing segment with the highest CAGR (2026–2033)

-

By Sales Channel: In 2025, Supermarket & Hypermarket led the market with 50% share, while On-trade is the fastest-growing segment with the highest CAGR (2026–2033)

Sparkling Wine Market Segment Analysis

By Type: White segment led in 2025; Rose segment expected fastest growth 2026–2033

White segment dominated the Sparkling Wine Market with the highest revenue share of about 78% in 2025 due to its universal appeal and versatility in food pairings. Its crisp, light flavor profile makes it ideal for both casual and formal occasions. Strong consumer preference, established brand presence, and frequent use in celebrations contribute to its dominant market position.

Rose segment is expected to grow at the fastest CAGR from 2026-2033, driven by rising popularity among millennials and younger consumers. Its visually attractive pink hue, refreshing taste, and association with lifestyle trends have boosted demand. Increasing availability of premium rose offerings and growing interest in social media-driven consumption patterns are also accelerating growth in this segment.

By Product: Prosecco segment led in 2025; same segment expected fastest growth 2026–2033

Prosecco segment dominated the Sparkling Wine Market with the highest revenue share of about 29% in 2025 due to its affordable pricing, light and fruity flavor profile, and increasing global popularity as an everyday celebratory beverage. The segment is expected to grow at the fastest CAGR from 2026-2033, fueled by rising exports, expanding distribution channels, and growing consumer preference for approachable, low-alcohol sparkling wines that cater to casual and premium occasions alike.

By Price Point: Luxury/Premium segment led in 2025; same segment expected fastest growth 2026–2033

Luxury / Premium segment dominated the Sparkling Wine Market with the highest revenue share of about 55% in 2025 due to growing consumer inclination toward high-quality, prestige brands and unique tasting experiences. It is expected to grow at the fastest CAGR from 2026-2033, driven by rising disposable incomes, increasing demand for exclusive wines, and expansion of luxury wine tourism and personalized wine experiences worldwide.

By Sales Channel: Supermarket & Hypermarket segment led in 2025; On-trade segment expected fastest growth 2026–2033

Supermarket & Hypermarket segment dominated the Sparkling Wine Market with the highest revenue share of about 50% in 2025 due to its widespread availability, convenience, and competitive pricing. These channels attract bulk buyers and everyday consumers, making them a primary distribution avenue. Promotions, seasonal offers, and retail loyalty programs further strengthen their dominance.

On-trade segment is expected to grow at the fastest CAGR from 2026-2033, driven by rising consumption in bars, hotels, and restaurants. Increasing popularity of pairing wines with meals, the trend of social drinking experiences, and growing demand for premium offerings in dining and entertainment venues are key factors contributing to rapid expansion of this segment globally.

Sparkling Wine Market Regional Analysis

North America Sparkling Wine Market Insights

North America held a significant share in the Sparkling Wine Market in 2025, driven by rising consumer preference for premium and low-alcohol beverages, strong presence of established wine brands, and growing wine tourism. Expanding retail channels, increasing adoption of e-commerce platforms, and promotional campaigns further strengthened the region’s position in the market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Sparkling Wine Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 8.58% from 2026–2033 due to rising disposable incomes, accelerated Western lifestyle influence, and increasing preference for premium alcoholic beverages among younger consumers. Growing urbanization, expanding e-commerce alcohol delivery platforms, and aggressive brand promotions by global sparkling wine producers are boosting market penetration across the region.

Europe Sparkling Wine Market Insights

Europe dominated the Sparkling Wine Market with the highest revenue share of about 45% in 2025 owing to its long-established wine heritage, strong production infrastructure, and high consumption culture across countries like Italy, France, and Spain. Premiumization trends, robust tourism, and extensive distribution networks across supermarkets, restaurants, and wineries further reinforced its leadership position.

Middle East & Africa and Latin America Sparkling Wine Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Sparkling Wine Market in 2025, driven by increasing disposable incomes, growing urban populations, and rising consumer awareness of premium alcoholic beverages. Expanding retail and e-commerce channels, along with changing lifestyle preferences, further supported the regions’ emerging demand for sparkling wines.

Sparkling Wine Market Competitive Landscape:

Accolade Wines

Accolade Wines recently merged with Pernod Ricard Winemakers in 2025 to form Vinarchy, a global wine leader focused on redefining wine for celebration and connection. This merger united top brands like Hardys, Grant Burge, and Petaluma, delivering over 27 million cases annually to 132 countries. The New entity emphasizes sustainable growth through innovation and award-winning quality, supported by more than 1,000 employees worldwide, making it a dominant force in competitive markets like the UK and Australia.

-

2024, Accolade Wines also launched Cupiolo Prosecco Rosé — a light, berry‑toned sparkling wine crafted for summer enjoyment and appealing to modern‑palate wine drinkers.

Bacardi & Company

I could not find reliable, recent (2023–2025) public announcements of new sparkling‑wine product launches from Bacardi & Company. Most recent filings and press coverage focus on its spirits and ready-to-drink portfolio, not on sparkling or wine launches. If you like, I can look deeper for regional / smaller‑scale sparkling releases globally by Bacardi.

-

2025; Bacardi & Company partners with Coca-Cola to launch BACARDÍ Rum and Coca-Cola ready-to-drink pre-mixed cocktails in European and Mexican markets.

Bronco Wine Company

Bronco Wine Company introduced Red Truck wines with Helix total packaging, featuring innovative glass bottles with cork stoppers and twist-to-open, reclose functionality. This packaging solution, designed for 2025, aims to enhance user convenience and sustainability by reducing bottle waste and improving wine freshness after opening. The launch represents Bronco's commitment to combining tradition with modern packaging technology to meet evolving consumer preferences.

-

2024, Bronco Wine Co., Bronco Wine Company introduced Red Truck wines in innovative Helix packaging, featuring cork stoppers and twist-to-open, reclose glass bottles for sustainability and convenience, aimed at boosting availability of its wine portfolio across 20 U.S. states, helping expand reach for its wines

Sparkling Wine Market Key Players

Some of the Sparkling Wine Market Companies are:

-

Accolade Wines

-

Bacardi & Company

-

Casella Family Brands

-

Moët & Chandon

-

Caviro Extra S.p.A.

-

E. & J. Gallo Winery

-

Concha y Toro

-

The Sparkling Wine Co.

-

Illinois Sparkling Co.

-

Henkell Freixenet

-

Pernod Ricard Winemakers

-

Schramsberg Vineyards

-

Treasury Wine Estates

-

Giulio Cocchi Spumanti Srl

-

Codorníu S.A.

-

Bottega S.p.A.

-

Campari Group

-

Peter Mertes KG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 42.47 Billion |

| Market Size by 2033 | USD 68.93 Billion |

| CAGR | CAGR of 6.24% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Red, Rose, White) • By Product (Cava, Champagne, Cremant, Prosecco, Others) • By Price Point (Economy, Mid-range, Luxury) • By Sales Channel (Supermarket and Hypermarket, Specialty Stores, On Trade, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accolade Wines, Bacardi & Company, Bronco Wine Company, Casella Family Brands, Moët & Chandon, Caviro Extra S.p.A., Constellation Brands Inc., E. & J. Gallo Winery, Concha y Toro, The Sparkling Wine Co., Illinois Sparkling Co., Henkell Freixenet, Pernod Ricard Winemakers, Schramsberg Vineyards, Treasury Wine Estates, Giulio Cocchi Spumanti Srl, Codorníu S.A., Bottega S.p.A., Campari Group, Peter Mertes KG |