Spay And Neuter Market Size Analysis:

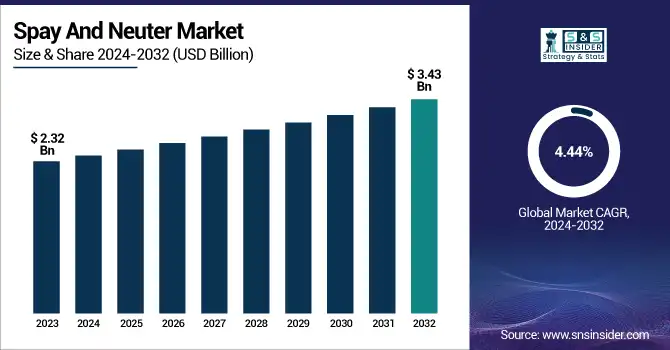

The Spay And Neuter Market Size was valued at USD 2.32 billion in 2023 and is expected to reach USD 3.43 billion by 2032, growing at a CAGR of 4.44% over the forecast period 2024-2032.

To Get more information on Spay And Neuter Market - Request Free Sample Report

This report provides comprehensive key statistical insights and emerging trends in the Spay and Neuter Market, covering key industry dynamics and valuable guidance and direction for companies and individuals interested in the industry. It signifies rates of spay/neuter procedures globally and provides data on the participation of veterinary clinics and shelters in offering these services. The report looks at cost trends and affordability, when some initiatives are considered private, others subsidized, and still others non-profit. It also analyzes the contributions and investments of governments and NGOs into pet sterilization programs, revealing where the funding is being allocated. Changing attitudes have motivated some of the trends in pet owner adoption and awareness that are discussed. Finally, this paper explores the expansion of the veterinary pharmaceutical and equipment market, including anesthesia, surgical tools and post-operative care, which will influence the future state of the spay and neuter field. awareness about animal population control and animal rights has influenced the spay and neuter market. Recent government figures suggest pet adoption has soared, with some 70% of American homes having a pet. Animal welfare organizations and local authorities are helping drive this trend. The spay and neuter market in the United States is expected to maintain growth, with a market size was USD 0.74 billion to USD 1.07 billion over the forecast period. This is a continuing upward trend fueled by growing pet adoption rates, awareness of the benefits of sterilization, and a growing scope of veterinary and shelter services.

Spay And Neuter Market Dynamics

Trends

-

Governments and non-profit organizations are actively promoting spaying and neutering through various campaigns to control stray animal populations and improve public health.

The medical regulations and government public health initiatives concerning sterilization are the main drivers for the spay and neuter market to control the sea of homeless pets and maintain animal welfare. Across the U.S., the launch of several programs worldwide were aimed at accessible, affordable spay/neuter services. As an example, in February 2024, the Massachusetts Department of Agricultural Resources announced that it had exceeded 20,000 animals assisted through its Spay/Neuter Voucher Program since 2012. More than 13,300 cats and dogs owned by low-income residents, among others, have benefited from the program. Through its mentorship program, the ASPCA Spay/Neuter Alliance has helped train clinics across the country, resulting in the sterilization of more than 10 million cats and dogs. This initiative highlights the commitment across the nation to lower shelter intake and euthanasia through spay/neuter services.

Proactive measures are also being taken at the local government level. San Antonio’s Animal Care Services in December 2024 also passed rules mandating the sterilization of loose pets and raised fines on owners of dogs that roam repeatedly to tackle an age-old problem in the city of stray and roaming animals. Nongovernmental entities are significant contributors, too. The 2024 Feral Fix Challenge, an initiative by Alley Cat Rescue, led to the spay and neutering of over 150,000 community cats across U.S. states and several clinics in South Africa, a record number of participating locations since the onset of the program. Such initiatives to promote spaying and neutering can be seen among government institutions and organizations alike, showcasing a step in the right direction toward better accountability, population control, and responsible pet ownership.

Restraint

-

Despite efforts to raise awareness, many pet owners remain uninformed about the benefits of spaying and neutering, posing a challenge to market growth.

One of the most significant restraints in the spay and neuter market is a lack of awareness about the benefits and importance of spay and neuter procedures. This knowledge gap contributes to higher rates of pet overpopulation and increased shelter intakes. According to the 2024 Mars State of Pet Homelessness Report for the United States, only 74% of the 94.7 million owned dogs and 77% of the 91.8 million owned cats are spayed or neutered. This leaves about 25 million dogs and 21 million cats intact and able to breed, aggravating overpopulation problems. Yet a study from the University of Florida’s College of Veterinary Medicine showed more than 2.7 million spay/neuter surgeries alone went unperformed in the U.S. during the pandemic when many veterinary clinics put non-essential services on hold. This backlog has resulted in higher birth rates, which are flooding shelters and rescue groups. Overcoming this barrier involves specific awareness campaigns to educate owners about the health and behavioural advantages of sterilization and its significance in mitigating pet overpopulation. Improved access to low-cost spay/neuter services is also essential to addressing this ongoing challenge.

Opportunity

-

The growing expenditure on pet healthcare and wellness is driving the demand for spay and neuter procedures, as pet owners invest in preventive measures for their pets' long-term health.

The rising demand and spending on pet healthcare services in the US correlates with a lucrative potential in the Spay and Neuter market. Americans spent about $147 billion on their pets in 2023, including $38.3 billion on sales of veterinary care and products. A growing trend, the projection for U.S. pet industry spending is set to hit $150.6 billion in 2024. Of this, veterinary care and veterinary products are expected to make up $39.1 billion. Pet insurance has also experienced phenomenal growth, making access to veterinary services easier. As of 2023, the North American pet health insurance industry exceeded $4 billion in total premiums with more than 6.25 million pets insured a 20.9% increase from the prior year. This increase reflects the growing willingness of pet owners to spend money on their pets’ health, including preventive procedures such as spaying and neutering.

The increase in spending on pet healthcare reflects a stronger recognition of responsible pet ownership. For instance, in Laredo, Texas, officials declared February Spay and Neuter Awareness Month, emphasizing the importance of spaying and neutering in curbing the overpopulation of strays and minimizing euthanizations. With a progressive atmosphere at play, as owners seek to improve their furry friends' health through preventative medicine, it's likely a breeding ground for spay and neuter services.

Challenge

-

A shortage of skilled veterinarians and veterinary clinics capable of performing spay and neuter procedures limits market growth, especially in certain regions.

One of the limitations of the spay and neuter market is the lack of veterinarians especially in the US. According to a 2024 projection by the American Association of Veterinary Medical Colleges (AAVMC), there will be a shortage of nearly 17,106 veterinarians by 2032. This is particularly acute in rural areas, with the USDA identifying critical deficits in 500 counties across 46 states as of 2023. This gap is due in part to high educational debt where graduates have debt-to-income ratios as high as 4:1 to declining interest in food animal veterinary practice which has dropped from 40% to approximately 5% in four decades. Michigan introduced House Bill 4200 to allow for the practice of telemedicine in veterinary medicine, one of the many legislative efforts underway to address the veterinarian shortage. Some animal services are also hiring full-time veterinarians to keep up with the demand for spay/neuter surgeries. These efforts, however, have not yet reversed the ongoing shortage of veterinary professionals that plagues the growth and efficacy of spay and neuter services nationwide.

Spay And Neuter Market Segmentation Analysis

By Animal Type

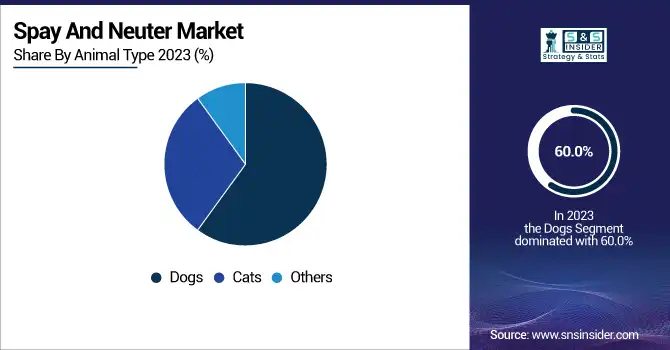

In 2023, the dogs segment accounted for the largest revenue share of about 60.0% of the total spay and neuter market. The dominance can be attributed to the higher population of these pets when compared to cats and also rising awareness among pet owners regarding vaccination, neutering, and spaying of the pets among others, along with the rising health risks associated with pets, is expected to drive the segment growth. As government figures indicate a large number of households own dogs, driving demand for such services. For example, in 2022, 48% of Australian households had dogs. This trend is also supported by a growing emphasis from governments and NGOs on animal welfare and population control. Another factor contributing to the growth of the dog segment is the active promotion of spaying and neutering by veterinary clinics and animal welfare organizations. Overpopulation is the star of these campaigns, along with health, as these procedures are essential to achieve both. As a result, businesses focusing on providing spay and neuter services for dogs have flourished, contributing to the segment's high revenue share.

By Provider

In 2023, veterinary clinics & hospitals accounted for the largest share of the spay and neuter market. Because of their focused expertise, advanced technology, and affordable prices. Thanks to government programs promoting animal welfare and public health, these services are now more accessible and affordable, and veterinary clinics have become the preferred option for many pet owners. Moreover, these clinics provide thorough pre-operative evaluations, secure surgical operations, as well as post-surgery treatment, enhancing users' confidence and aiding their market supremacy. Even veterinary clinics are on the move with active marketing campaigns and offering services, and regular packages that are more affordable options. This has allowed the clinics to be more accessible and less expensive for a wider range of pet owners, entrenching their position in the market even further. These clinics have significant market share because of the trust they built together with their ability to offer top-quality care.

By End-use

In 2023, the animal welfare groups segment accounted for the majority of the market. This is a large part of the reason why they are focused on pet population control and advancing animal well-being. According to government statistics, a large percentage of pet owners spay or neuter their pets to help regulate the pet population. Animal welfare groups play a crucial role in advocating for these procedures, which not only prevent unwanted litters but also improve animal health by reducing the risk of certain diseases.

Animal welfare organizations have historically been key in promoting awareness of the benefits of spaying and neutering. The segment's massive growth can be attributed to an increased adoption of these procedures. In addition, such groups often partner with veterinary clinics to offer affordable and nearby services, which greatly supplement their existing impact within the market.

Spay And Neuter Market Regional Insights

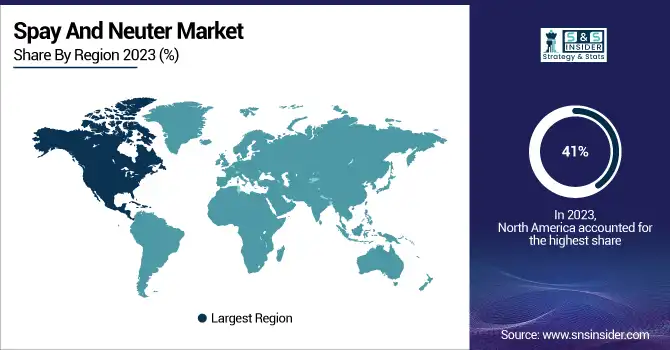

North America held the largest market share in 2023 accounting for 41% of revenue, owing to high rates of pet ownership and a focus on animal welfare. The increasing awareness of spay and neuter techniques has resulted in a growing number of surgeries in this region, establishing it as a leader in this field. For example, a report from 2023 noted that 54% of millennials in Canada considered themselves to be pet parents, which contributed to increases in pet populations and spay/neuter surgeries. Additionally, initiatives like those by the Ontario SPCA, which spayed/neutered over 7,500 animals in 2023, further underscore the region's commitment to animal welfare.

The Asia-Pacific will present the highest CAGR growth due to increasing pet ownership and awareness about animal health benefits. Countries like China and India are witnessing increased adoption of companion animals, creating lucrative opportunities for the spay and neuter market. These services are often promoted with government initiatives and partnerships with non-profit organizations, particularly in underserved communities. Initiatives such as mobile clinics for spay and neuter services are also increasing access to these services and propelling market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Spay And Neuter Market Key Players

Key Service Providers/Manufacturers

-

Dispomed

-

Patterson Veterinary

-

SouthPointe Surgical Supply

-

Avante Animal Health

-

Jorgensen Laboratories (JorVet)

-

Universal Surgical Instruments

-

Cardinal Health

-

gSource

-

GerVetUSA Inc

-

La Boit Specialty Vehicles

-

Whittemore Enterprises

-

Kane Veterinary Supply

-

Animal Care Equipment & Services (ACES)

-

Campbell Pet Company

-

Ethicon (Johnson & Johnson)

-

B. Braun Vet Care

-

Midmark Corporatio

-

Henry Schein Animal Health

-

Burtons Medical Equipment Ltd

Recent Developments in the Spay And Neuter Market

-

In January 2024, Shelter Animals Count reported a 10% increase in dog intakes from 2021, highlighting the growing need for spay and neuter services to manage pet populations effectively.

-

Animal Medicines Australia reported in November 2022 that 48% of households owned dogs, which means that the demand for spaying and neutering services in areas with high pets per capita is likely to be significant.

Spay and Neuter Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.32 Billion |

| Market Size by 2032 | USD 3.43 Billion |

| CAGR | CAGR of 4.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Provider (Veterinary Clinics & Hospitals, Others) • By Animal Type (Dogs {Neutering, Spaying}, Cats {Spaying, Neutering}, Others) • By End-use (Animal Welfare Groups, Pet Owners) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dispomed, Patterson Veterinary, SouthPointe Surgical Supply, Avante Animal Health, Jorgensen Laboratories (JorVet), Universal Surgical Instruments, Cardinal Health, gSource, GerVetUSA Inc, La Boit Specialty Vehicles, Whittemore Enterprises, Kane Veterinary Supply, Animal Care Equipment & Services (ACES), Campbell Pet Company, Medtronic, Ethicon (Johnson & Johnson), B. Braun Vet Care, Midmark Corporation, Henry Schein Animal Health, Burtons Medical Equipment Ltd. |