Pet Insurance Market Report Size & Forecast:

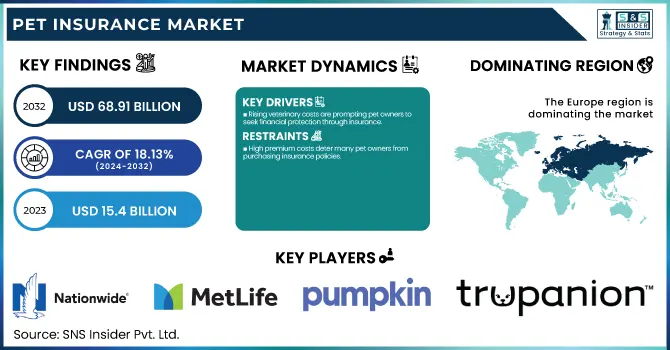

The Pet Insurance Market Size was valued at USD 15.4 Billion in 2023 and is expected to reach USD 68.91 billion by 2032, growing at a CAGR of 18.13% over the forecast period 2024-2032.

To Get more information on Pet Insurance Market - Request Free Sample Report

This report provides key statistical insights and trends in the Pet Insurance Market, highlighting critical industry dynamics. It includes incidence and prevalence rates of pet illness and accidents. It also explores premium pricing trends. It also looks at growth rates by the policyholder, charting both adoption trends and renewal rates. Insights into claims data and reimbursement trends reveal the frequency of claims and the most covered treatments. A market share analysis identifies leading insurance providers. It highlights pet healthcare spending, including a comparison of insurance-covered costs versus out-of-pocket veterinary expenses. These insights offer a comprehensive market overview for stakeholders.

Other growth factors for the pet insurance market include a rise in veterinary costs and government initiatives for better pet care. The U.S. market share revenue in 2023 amounted to 32%. Regulatory factors like SB 1217 in California which improve the insurance regulation framework will create a favorable environment for the pet insurance market growth in USA. According to the U.S. government, there has been a rapid increase in pet ownership, with more than 67% of households owning pets. This trend, along with growing veterinary costs, has translated into a booming appetite for pet insurance.

Key Drivers Fueling Pet Insurance Growth:

-

Rising veterinary costs are prompting pet owners to seek financial protection through insurance.

Rising veterinary costs are one of the significant drivers for the growing adoption of pet insurance among pet owners. In the past 10 years, U.S. veterinary expenses in the U.S. have surged by 60%, a development attributed to rising pet ownership and buyouts of local vets by big corporations and private equity firms. The rise in costs has created sticker shocks for many pet owners, with 23% going into debt for emergency vets in 2024, down from 42% in 2022. To combat these economic strains, more and more pet owners are seeking insurance to put a stop to surprise veterinary costs.

In North America, the pet insurance industry surpassed the $4 billion mark for the first time in 2023, with total premiums reaching $4.27 billion a 21.9% increase from the previous year. The number of insured pets also grew by 20.9%, totaling over 6.25 million. This trend is bolstered by survey data that shows that 50.8% of pet owners got insurance to provide the best care without financial concerns, and 40.4% wanted to prevent high vet bills. The toll of veterinary care costs is also apparent in individual cases. Just look at the UK woman who received a £13,000 vet bill for her cat's emergency surgery, of which insurance only paid half. Such cases are exacerbated by the wider problem of spiraling veterinary fees that have risen by between 70 and 105 percent in the past four years, which has forced many pet owners to go into debt or opt against having much-needed treatment.

Restraints:

-

High premium costs deter many pet owners from purchasing insurance policies.

High premium costs remain a significant restraint in the pet insurance market as many pet owners refrain from buying policies. In 2023, the average annual premium for accident and illness coverage in the U.S. is about $676 for dogs and $383 for cats. In California, premiums are even higher, averaging $1,264 for dogs and $626 for cats a year. These hefty costs can be a major burden, particularly for families handling tight household budgets. Such a rise in veterinary costs only adds to this problem. Veterinary costs rose by 60% between 2014 and 2024, prompting some pet owners to turn to insurance to avoid unexpected expenses. Most people actually don’t get comprehensive coverage because the high premiums far exceed the expected benefits. Currently, only around 2% of pets in the U.S. are insured, showing a significant opportunity for coverage. The high cost of pet insurance not only stifles the growth of the pet insurance market but also puts many pets at risk of receiving no medical attention whatsoever simply because their owners cannot pay for basic medical care. Reducing the cost of member premiums is key to make pet insurance available and attractive to more pet owners.

Opportunity:

-

Integrating wellness programs into insurance plans can attract customers by offering preventive care coverage.

Incorporating wellness programs into pet insurance plans is a big opportunity to improve pet health and drive customer growth. This is why such plans often provide preventative care like shots, teeth cleaning, and annual physicals, all of which are critical for identifying diseases early and remaining healthy. Providing this type of broad coverage not only encourages medical care before health issues arise but allows insurers to stand apart from each other in a competitive landscape. According to recent trends, pet owners are giving more importance to preventative care. For example, dental care claims rose 12% in 2023, as consumers realized oral health contributes to their overall wellness. Behavioural therapy claims, such as for anxiety, also increased by 10%, highlighting the growing focus on mental health in pets, the group said. This rise in preventative healthcare speaks to the desire for insurance policies that enable a wellness-first approach to care.

In addition, from the insurance perspective, wellness programs can reduce expenses for both insurers and policyholders. Preventive care can save you from paying for expensive treatments that arise from untreated health issues. Emergency care claims, for instance, paid the most in 2023, with an average cost of $2,500 per incident. Insurers want to avoid costly emergency treatment that preventive measures would have helped, helping them build a more sustainable premium structure that will also help to improve customer satisfaction in the process. Insurers are recognizing this opportunity and adapting their offerings accordingly. For example, Chewy's CarePlus is highlighted as a top newcomer, providing excellent customer service and wellness plans. These changes go in line with an industry-wide shift toward comprehensive offerings that address the changing tastes of pet owners. By integrating wellness programs into their pet insurance offerings, providers can meet the demand for preventive care among pet owners while positioning themselves to compete in a growing market. Pet healthcare can be broadened by addressing their holistic health needs, providing greater customer satisfaction, and improving the health of our furry friends, while also keeping emergency procedures to a minimum and avoiding high costs for their owners.

Challenges Impacting the Pet Insurance Industry:

-

Complex claims processes lead to customer dissatisfaction and hinder market growth.

In the pet insurance industry, complex claims processes lead to customer dissatisfaction and significantly impact market growth. In 2023, the average claim processing time was five days; however, digital claims platforms have reduced this time by 40%. Despite these advancements, 5% of claims were denied, usually because they were excluded from coverage due to a pre-existing condition or lapsed policy. Such denials can be particularly frustrating for policyholders who may not feel sufficiently educated about the exclusions of their policy. Furthermore, the intricacies involved in deciphering policy clauses and comprehending coverage specifics may discourage potential buyers from investing in pet insurance. Insurers have also started exploring using blockchain technology for greater transparency and to speed up those claims. Unless the claims process can be simplified policy language can be made clear, and customers can be better educated, while also ensuring that technology is being deployed to ensure that such claims are processed quicker customer satisfaction from General Insurance can hardly be increased, and hence support market growth.

Pet Insurance Market Segmentation Analysis

By Coverage

Accident & illness segment dominated the pet insurance market in 2023, accounting for an 84% share. This is due to the frequency of accidents and illnesses in pets, which place considerable financial strain on their owners. Government statistics indicate that veterinary costs are rising, making comprehensive coverage essential for pet owners. One might wonder why the accident & illness cover, which protects against unexpected conditions like surgery or chronic illnesses, continues to be popular. In addition, the growing support of regulatory bodies and awareness campaigns have led to more and more adoption of such policies, providing pet owners with financial security if an unexpected pet health issue arises.

The prevalence of accidents and illnesses among pets necessitates comprehensive insurance coverage. For example, data from veterinary clinics shows that common conditions like cancer and arthritis require costly treatments, making accident & illness coverage crucial. The growth of this segment is also bolstered by government initiatives that encourage transparency and fairness in insurance policies, which help ensure that pet owners are adequately protected against financial shocks.

By Animal

In 2023, the dogs segment accounted for the highest market share 61%. This happens because dogs are so widely kept as companions and veterinary bills are so expensive to run. The government statistics demonstrate that there is a growing tendency to humanize pets, especially dogs, which ultimately results in spending more on their medical care. The downside is that dogs are more prone to genetic conditions and chronic diseases, which can make pet insurance essential for many owners. Moreover, rise in pet insurance for dogs segment can also be attributed to regulatory support and increase in awareness regarding the significance of pet insurance. Many dog owners consider their dogs to be family members and they tend to invest more time and money into their health and well-being. Government data that indicates an increase in spending on pets supports this trend. The high cost of veterinary care for dogs, along with increasing awareness of the advantages of pet insurance, has made the demand for comprehensive dog insurance coverage in this segment.

By Sales Channel

The direct sales channel segment accounted for the largest market share of about 33% in 2023. This is due to the convenience and efficiency of direct sales platforms that enable pet owners to buy insurance policies directly from providers without intermediaries. According to government statistics, insurance purchased directly through digital platforms has been the faster and more popular method. Ease of information access and policy management online has further expanded this segment. These technological developments also help the direct sales channel, facilitating policy management and claims processing. As per government reports, digital literacy helps consumers adopt the direct sales channels offered by manufacturers. This trend is likely to persist, as pet owners increasingly seek out quick and cheap methods of purchasing insurance.

Pet Insurance Market Regional Outlook

In 2023, Europe was the largest shareholder 41% of the global pet insurance market with countries including Germany and the UK contributing most towards market share and growth. Germany holds a large share of the European market due to its high rate of pet ownership as well as extensive insurance coverage options. UK is anticipated to grow at a high growth rate, owing to innovative insurance products coupled with high consumer awareness. Powering this trend is the supportive regulatory framework surrounding pet insurance in various European countries, which has largely contributed to the region's dominance.

The second dominating region of pet insurance with a prominent market share is North America; the United States especially accounts for a significant market share of the global pet insurance market. The largest North American market is the United States, which represents about 75% of the North American market due to the high levels of pet ownership and the quality of veterinary infrastructure. Increasing pet adoption and growing awareness about pet healthcare costs in the region are benefitting the market. The U.S. pet population is massive, with more than 83.7 million dogs and government statistics that support it, which can be a good opportunity for insurance providers.

However, the Asia-Pacific region is growing with the fastest CAGR, driven by rising pet adoption and economic development. Asia-Pacific region growth is driven by pet adoption and economic growth. Rising middle-class incomes and the utilization of digital platforms to purchase insurance drive growth in the region, particularly the Asia-Pacific. Government initiatives in nations such as China and India are also playing a role in the growth of the pet insurance market by increasing awareness and accessibility of insurance products.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Pet Insurance Market

Key Service Providers/Manufacturers

-

Nationwide Mutual Insurance Company (Whole Pet with Wellness, Major Medical)

-

MetLife Services and Solutions, LLC (MetLife Pet Insurance, PetFirst Pet Insurance)

-

UK Insurance Limited (Direct Line Pet Insurance, Churchill Pet Insurance)

-

Pumpkin Insurance Services Inc. (Pumpkin Pet Insurance Plans, Preventive Essentials)

-

Anicom Holdings, Inc. (Anicom Pet Insurance, Wellness Plans)

-

Trupanion (Trupanion Pet Insurance, PHI Direct)

-

American Modern Insurance Group, Inc. (American Modern Pet Insurance, Specialty Coverages)

-

DFV Deutsche Familienversicherung AG (DFV Pet Protection, Digital Pet Insurance)

-

Allianz p.l.c. (Allianz Pet Insurance, Petplan)

-

Figo Pet Insurance LLC (Figo Pet Insurance Plans, Wellness Powerup)

-

Fetch Pet Insurance (Fetch by The Dodo, Comprehensive Coverage)

-

Cardif Pinnacle (Everypaw Pet Insurance, Helpucover Pet Insurance)

-

Future Generali India Insurance (FG Dog Health Cover, FG Health Absolute)

-

Tractive (Tractive GPS Tracker, Tractive Pet Cover)

-

Healthy Paws Pet Insurance (Unlimited Lifetime Coverage, No Caps on Claims)

-

Embrace Pet Insurance (Accident & Illness Coverage, Wellness Rewards)

-

ASPCA Pet Health Insurance (Complete Coverage, Accident-Only Coverage)

-

Petplan Pet Insurance (Comprehensive Coverage, Customizable Plans)

-

Pet Assure (Veterinary Discount Plan, Wellness Coverage)

-

Lemonade Pet Insurance (Preventive Care Package, Extended Accident and Illness Coverage)

Recent Developments

-

In September 2024, California passed legislation (SB 1217) requiring pet insurance providers to disclose policy terms, enhancing transparency and consumer protection.

-

In March 2024, The U.S. pet insurance market saw significant growth, driven by increasing veterinary costs and regulatory improvements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.4 Billion |

| Market Size by 2032 | USD 68.91 Billion |

| CAGR | CAGR of 18.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal (Dogs, Cats, Others) • By Coverage (Accident only, Accident & Illness, Others) • By Sales Channel (Agency, Bancassurance, Broker, Direct, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nationwide Mutual Insurance Company, MetLife Services and Solutions LLC, UK Insurance Limited, Pumpkin Insurance Services Inc., Anicom Holdings Inc., Trupanion, American Modern Insurance Group Inc., DFV Deutsche Familienversicherung AG, Allianz p.l.c., Figo Pet Insurance LLC, Fetch Pet Insurance, Cardif Pinnacle, Future Generali India Insurance, Tractive, Healthy Paws Pet Insurance, Embrace Pet Insurance, ASPCA Pet Health Insurance, Petplan Pet Insurance, Pet Assure, Lemonade Pet Insurance |