Global Veterinary Services Market Overview:

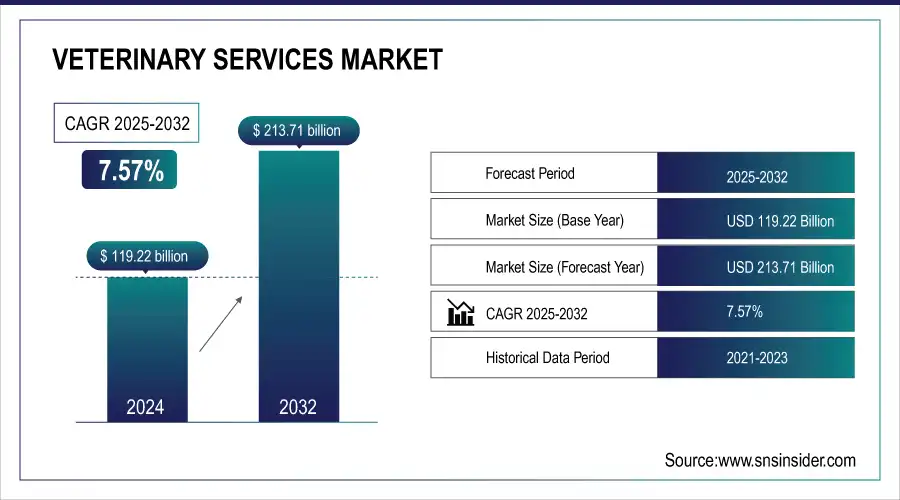

The Veterinary Services Market size was valued at USD 119.22 billion in 2025E, projected to reach USD 213.71 billion by 2033, growing at a CAGR of 7.57%. over the forecast period 2026-2033.

This report discusses key statistics and trends shaping the Veterinary Services Market. It looks at examples of animal diseases, emphasizing regional trends and new zoonotic threats. These include trends in the prescription of different kinds of veterinary drugs across different species and regions, as well as trends in drug production and usage trends, including antibiotics, vaccines, and specialty medications. It also examines spending on veterinary healthcare by source of government spending, insurers, and out-of-pocket expenses. The report also evaluates veterinary healthcare technology adoption, including telemedicine, artificial intelligence-based diagnostics, and EHRs. It also examines trends in market expansion carefully, measuring growth in veterinary clinics, diagnostic services and corporate investment. These insights provide a comprehensive understanding of the evolving veterinary services landscape.

Market Size and Forecast

-

Market Size in 2025E: USD 119.22 Billion

-

Market Size by 2033: USD 213.71 Billion

-

CAGR: 7.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Veterinary Services Market - Request Free Sample Report

The U.S. Veterinary Services market size was valued at an estimated USD 52.80 billion in 2025 and is projected to reach USD 95.60 billion by 2033, growing at a CAGR of 7.1% over the forecast period 2026–2033. Market growth is driven by rising pet ownership, increasing spending on animal healthcare, and growing awareness of preventive veterinary care. Expanding demand for companion animal services, advancements in diagnostic and treatment technologies, and the rising prevalence of chronic and age-related conditions in pets are supporting market expansion. Additionally, growth in livestock healthcare services, increasing availability of specialty veterinary clinics, and strong investments in veterinary infrastructure and digital health solutions further strengthen the growth outlook of the U.S. veterinary services market during the forecast period.

Veterinary Services Market Trends

-

Rising pet ownership and livestock production are driving demand for veterinary services.

-

Increasing focus on animal health, preventive care, and vaccination programs is boosting market growth.

-

Advancements in diagnostic tools, telemedicine, and mobile veterinary clinics are enhancing service accessibility.

-

Growing awareness of zoonotic diseases and food safety is shaping adoption trends.

-

Expansion of specialty care, surgical procedures, and wellness programs is widening service offerings.

-

Integration of digital recordkeeping and AI-driven analytics is improving treatment efficiency and outcomes.

-

Collaborations between veterinary hospitals, pharmaceutical companies, and research institutions are fostering innovation and market expansion

Veterinary Services Market Growth Drivers:

-

Advancements in veterinary medicine and technology have enhanced diagnostic capabilities, enabling early detection and accurate diagnosis of various health conditions, thereby improving treatment outcomes.

With the advancement of veterinary medicine and technology, diagnostic abilities have been greatly improved so that many health conditions can now be diagnosed much earlier and the accuracy of diagnosis has also improved, leading to better treatment options. In veterinary diagnostics, one of the noticeable trends is an increasing implementation of point-of-care testing (POCT). These portable devices enable veterinarians to carry out rapid and accurate tests in the clinic or out in the field, bypassing the need for an outside laboratory. Such a change in strategy is fueled by the need for rapid diagnostics and advancements in patient care. One of the big developments is the adoption of artificial intelligence (AI) in veterinary imaging. Also, AI-driven tools are capable of examining diagnostic images such as X-rays and ultrasounds to identify abnormalities, helping veterinarians make quicker and more informed decisions. By providing in-depth analysis, this integration helps veterinarians diagnose conditions more accurately and efficiently than ever before, effectively revolutionizing veterinary diagnostics.

Veterinary Services Market Restraints:

-

The high costs associated with veterinary services can deter pet owners from seeking timely and comprehensive treatment for their animals, impacting overall animal health and welfare.

The high cost of veterinary services has been a major challenge for pet owners worldwide. For example, in the United States, the price of veterinary services increased 7.5 percent year-on-year as of September 2023. That surge in pet ownership has resulted in fewer households with dogs or cats (71%) receiving veterinary service in 2023, compared with 85% during peak pandemic years and 77% in early 2019. The financial burden is hitting millennials and Gen Z-ers the hardest, with half of pet owners in those demographics worried about the cost of emergency pet care. In the UK, the price of veterinary care has increased by 50% from 2015, resulting in a 34% increase in cat abandonment cases in the first seven months of 2024. Animal rescue charities across the country are overwhelmed as the trend continues and are unable to deal with the volume of abandoned animals. However, the increased costs have been partially driven by the consolidation of veterinary practices by large corporations and private equity firms.

Veterinary Services Market Opportunities:

-

Expanding telemedicine and digital health solutions in veterinary care enhances accessibility, particularly in remote areas, allowing for virtual consultations and remote monitoring, thereby improving service delivery.

Telemedicine and digital health in veterinary care Telemedicine and digital health solutions in the field of veterinary care are transforming the industry by improving accessibility and efficiency, especially in rural areas. By enabling quick connections between veterinary services and potential patients without the necessity of office visits, this technological advancement provides timely medical action for pet owners, and livestock managers alike bringing medical attention into continual view and consideration. New data highlights the expansion of veterinary telehealth services and consumer adoption.

Telemedicine is especially relevant for the shortage of veterinary professionals in rural and underserved areas. In 2023 in the United States, 40% of the rural areas had a shortage of veterinary services available causing a gap in their access to timely animal health care. Telemedicine closes this gap by offering remote consultations, enhancing animal health, and alleviating pressure on stretched veterinary practices. In addition, technological developments like the use of Artificial Intelligence (AI) and Machine Learning (ML) are improving how veterinary telemedicine works.

-

By 2023, around 42% of vet telehealth applications were using AI-based diagnostic tools, up from just 15% in 2021. These tools help analyze medical information, predict healthcare problems, and deliver personalized treatment solutions, resulting in higher accuracy rates and efficiency in remote veterinary solutions.

-

There has also been a surge in mobile apps specifically focused on monitoring pet health. The pet health monitoring app adoption soared by 67% between 2021 and 2023. Telemedicine apps allow pet owners to monitor vital signs, activity levels, and symptoms in real time, helping them take charge of their pets' care, and achieve early disease detection via telemedicine platforms. The evolution of telemedicine regulation is increasingly conducive to its development in veterinary medicine.

-

In July 2024, for instance, Florida passed the “Providing Equity in Telehealth Services (PETS) Act,” which permits veterinarians to diagnose, treat and prescribe medicines remotely. Such legislative support is crucial in standardizing telehealth practices and encouraging wider adoption among veterinary professionals.

Veterinary Services Market Challenges:

-

Navigating complex regulatory frameworks presents challenges for veterinary service providers, as compliance with varying regulations and licensing requirements can hinder operations, especially for smaller establishments.

The complex, regulatory environment is a sizable obstacle for veterinary service providers to navigate. Veterinary practices need to have stringent compliance measures in place as telemedicine guidelines, controlled substance regulations, and data privacy laws evolve. For example, a newly proposed House Bill 4200 in Michigan would regulate the practice of veterinary telemedicine in the state, forbidding individuals who are neither licensed veterinarians nor licensed veterinary technicians from operating, but permitting telemedicine under certain conditions. Separately, the UK's Competition and Markets Authority (CMA) launched an investigation into the £5 billion veterinary services market over possible issues like overcharging for pet medicine. This triggers a lot of feedback from customers, explaining the difficulties veterinary practices encounter while meeting regulatory standards. Additionally, the environmental impacts of veterinary products, like the negative effects of some flea treatments on wildlife, are facing increased scrutiny and this makes the regulatory compliance part of running a practice even more daunting.

Veterinary Services Market Segmentation Analysis

By Animal Type, Companion Animal segment dominates the Veterinary Services Market.

The largest revenue share was held by the companion animal segment in 2025, due to effective rates of pet adoption and increasing expenditures on the healthcare of pets. This shift is backed by government stats showing an increase in pet ownership. As an example, The American Pet Products Association (APPA) stated that roughly 66% of U.S. households own a pet, leading to higher demand for companion animal veterinary services.

In addition, the rise of the companion animal segment can be attributed to the humanization of pets, as they are considered family members. This trend has resulted in higher investments in high-tech animal treatment and diagnostic services. The North American Pet Health Insurance Association (NAPHIA) reported another 25% growth in the number of pets insured, underscoring the need for high-quality veterinary services for pet companions.

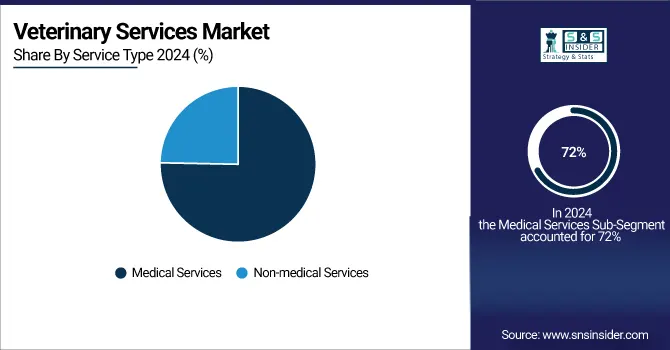

By Service Type, Medical segment dominates the Veterinary Services Market.

The medical segment dominated the veterinary services market with a revenue share of 72% in 2025. This dominance is mainly attributed to the rising incidents of complicated animal diseases necessitating the deployment of sophisticated diagnostic tools for proper identification along with treatment planning. Veterinary diagnostic services are recognized as essential components of animal health and zoonotic disease prevention according to government reports highlighting the need for accurate and rapid diagnostics in veterinary medicine.

This segment is also on the rise due to the increasing adoption of advanced diagnostic technologies, including imaging and molecular diagnostics. Moreover, government initiatives for enhancing animal health through better diagnostic facilities have also been responsible for the growth of this market. This has significantly increased access to veterinary medical services further enhanced by telemedicine and remote consultations leading to more efficient and timely care.

Veterinary Services Market Regional Analysis

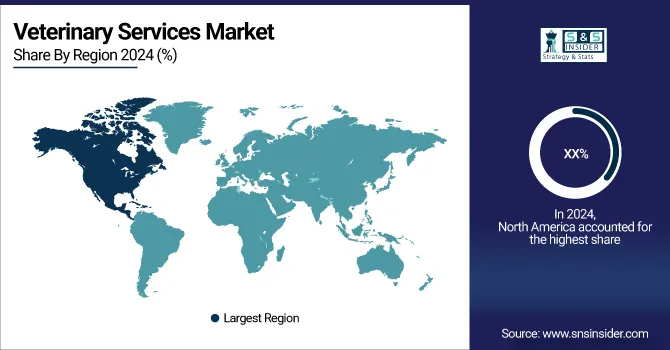

North America Veterinary Services Market Insights

North America accounted for the largest market share in the veterinary services market in 2025, owing to its strong pet culture and advanced veterinary infrastructure. For instance, the U.S. veterinary services market held a significant share in 2025. This large growth is primarily the result of concerted efforts by many government animal welfare organizations to improve veterinary services in the United States and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Veterinary Services Market Insights

The Asia Pacific region is projected to witness the highest growth rate, attributable to increasing urbanization, growing middle-class income, and changing perceptions of pet ownership. Additionally, modernization of the animal husbandry as well as the increase in veterinary services for companion as well as livestock animals are also contributing to the growth of the region. Government statistics show that countries like China and India are leading this growth, with significant investments in veterinary infrastructure and education. Asia Pacific's veterinary healthcare market is projected to expand at a significant CAGR during the forecast period, 2026 to 2033 owing to advancements in veterinary diagnostics, treatment, and immunization, and government initiatives aimed at promoting animal welfare and managing diseases.

Europe Veterinary Services Market Insights

In Europe, the veterinary services market is driven by rising pet ownership, increasing expenditures on companion animal healthcare, and growing awareness of animal welfare. Advanced veterinary infrastructure, including clinics offering medical, surgical, and diagnostic services, supports market growth. Countries like Germany, the UK, and France are witnessing higher adoption of pet insurance and sophisticated treatment options. Government initiatives and technological advancements in diagnostics and telemedicine further bolster market expansion across the region.

Middle East & Africa and Latin America Veterinary Services Market Insights

In the Middle East & Africa and Latin America, the veterinary services market is expanding due to increasing pet adoption, rising disposable incomes, and growing awareness of animal health and welfare. Investments in veterinary infrastructure, including modern clinics and diagnostic facilities, are driving service accessibility. Additionally, government initiatives promoting livestock health and pet care, along with the adoption of advanced diagnostic and telemedicine solutions, are supporting steady market growth across these regions.

Veterinary Services Market Competitive Landscape:

Zoetis

Zoetis is a global animal health company specializing in innovative medicines, vaccines, diagnostics, and genetic testing for pets and livestock. The company leverages advanced technologies, including AI and data analytics, to improve veterinary care, enhance animal health, and support veterinary professionals worldwide. Zoetis focuses on developing solutions that optimize diagnostics, treatment, and wellness programs, while promoting human-animal bonds and advancing scientific research to meet evolving needs in the animal health industry.

-

In 2025, Zoetis launched the AI Masses tool, enabling real-time identification and classification of skin and lymph node lesions through Vetscan Imagyst.

-

In 2025, Zoetis introduced the Vetscan OptiCell, a point-of-care hematology analyzer combining viscoelastic focusing and AI technology.

-

In 2025, Zoetis opened a state-of-the-art reference laboratory in Louisville, enhancing U.S. diagnostics.

-

In 2025, Zoetis partnered with HABRI and NAVC to provide free Human-Animal Bond Certification to veterinary students.

-

In 2025, Zoetis and partners launched a handbook to guide policymakers on pet-inclusive policies.

Royal Canin

Royal Canin is a leading pet nutrition company specializing in scientifically formulated diets for cats and dogs. The company develops tailored nutrition solutions addressing breed, size, age, and health-specific requirements. By combining research, veterinary expertise, and high-quality ingredients, Royal Canin supports pet wellness, longevity, and optimal performance. The company focuses on innovation and evidence-based nutrition to promote balanced diets and improve the health of companion animals worldwide.

-

In 2025, Royal Canin unveiled six new adult wet loaf canned diets in its Size Health Nutrition range.

Virbac

Virbac is a global animal health company providing vaccines, pharmaceuticals, and nutritional solutions for pets and livestock. The company focuses on innovation, research, and high-quality products to enhance animal welfare and veterinary care worldwide. Virbac emphasizes sustainable growth, strategic expansion, and strengthening veterinary partnerships to deliver advanced animal health solutions, addressing diverse clinical and preventive needs for companion animals and livestock.

-

In 2025, Virbac inaugurated its new global headquarters in Libourne, France.

Mars Petcare

Mars Petcare is a leading provider of pet food, veterinary services, and diagnostics, dedicated to improving pet health and well-being globally. The company leverages research, technology, and acquisitions to expand its product and service portfolio, supporting veterinarians and pet owners. Mars Petcare focuses on nutrition, diagnostics, and wellness solutions for pets, aiming to deliver innovative healthcare and enhanced quality of life across companion animal populations.

-

In 2025, Mars Petcare acquired Cerba HealthCare Group’s stake in Cerba Vet and ANTAGENE.

Nestlé Purina PetCare

Nestlé Purina PetCare is a global pet nutrition and wellness company producing scientifically formulated food and treats for cats and dogs. The company emphasizes research-based nutrition, sustainable practices, and partnerships with academic and nonprofit organizations to enhance pet health and community well-being. Nestlé Purina PetCare combines innovation, veterinary expertise, and high-quality ingredients to deliver optimal nutrition and support responsible pet ownership worldwide.

-

In 2025, Nestlé Purina PetCare announced charitable donations exceeding $37 million in 2024, supporting academic and nonprofit initiatives.

Boehringer Ingelheim Animal Health

Boehringer Ingelheim Animal Health is a global leader in veterinary pharmaceuticals and vaccines for livestock and companion animals. The company focuses on innovation, research, and sustainable solutions to improve animal health, welfare, and productivity. Boehringer Ingelheim supports veterinarians, farmers, and pet owners with advanced diagnostics, medicines, and wellness programs, aiming to enhance disease prevention, treatment, and overall animal care worldwide.

-

In 2025, Boehringer Ingelheim reported that 66 million animal patients were reached in 2024, up 8.0% from the previous year.

Key Players in the Veterinary Services Market

Key Service Providers/Manufacturers

-

Zoetis (Rimadyl, Revolution)

-

Royal Canin (Renal Feline Special, Dental Care kibbles)

-

Virbac (CaniLeish vaccine, Effipro spot-on)

-

Mars, Incorporated (Pedigree pet food, Whiskas cat food)

-

Nestlé Purina PetCare (Purina Pro Plan, Fancy Feast)

-

Boehringer Ingelheim Animal Health (NexGard, Heartgard)

-

Elanco Animal Health (Trifexis, Interceptor Plus)

-

Ceva Santé Animale (Vectra 3D, Adaptil)

-

Merck Animal Health (Bravecto, Nobivac vaccines)

-

Vetoquinol (Zylkene, Marbocyl)

-

IDEXX Laboratories (Catalyst One Chemistry Analyzer, SNAP 4Dx Plus Test)

-

Covetrus (Pulse Veterinary Software, Vetstreet)

-

Patterson Veterinary (Patterson Veterinary Catalog, NaVetor software)

-

National Veterinary Associates (NVA) (Companion Animal Hospitals, Ethos Veterinary Health)

-

Banfield Pet Hospital (Optimum Wellness Plans, Vet Chat)

-

VCA Animal Hospitals (CareClub Wellness Plans, myVCA app)

-

MedVet (Emergency and Specialty Care, MedVet Oncology)

-

BluePearl Specialty and Emergency Pet Hospital (24/7 Emergency Care, Specialty Veterinary Services)

-

PetVet Care Centers (General Practice Veterinary Services, Specialty Veterinary Services)

-

Mission Veterinary Partners (Preventive Care, Surgical Services)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 119.22 Billion |

| Market Size by 2033 | USD 213.71 Billion |

| CAGR | CAGR of 7.57% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal Type (Production Animals {Cattle, Swine, Poultry, Others}, Companion Animals {Dogs, Horses, Cats, Others}) • By Service Type (Medical Services {Diagnosis, Preventative Care, Treatment}, Non-medical Services {Livestock Services, Pet Services}) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoetis, Royal Canin, Virbac, Mars Incorporated, Nestlé Purina PetCare, Boehringer Ingelheim Animal Health, Elanco Animal Health, Ceva Santé Animale, Merck Animal Health, Vetoquinol, IDEXX Laboratories, Covetrus, Patterson Veterinary, National Veterinary Associates (NVA), Banfield Pet Hospital, VCA Animal Hospitals, MedVet, BluePearl Specialty and Emergency Pet Hospital, PetVet Care Centers, Mission Veterinary Partners |