Specialty Lighting Market Report Scope & Overview:

Get More Information on Specialty Lighting Market - Request Sample Report

The Specialty Lighting Market Size was valued at USD 6.5 Billion in 2023 and is expected to reach USD 11.73 Billion by 2032 and grow at a CAGR of 6.82% over the forecast period 2024-2032.

The Specialty Lighting market comprises all the lighting solutions other than the regular residential and commercial ones. This encompasses, among others, architectural lighting, theatrical lighting, retail display lighting, as well as medical or horticultural lighting. The growing concern towards energy efficiency and sustainability led innovations in Specialty Lighting technologies into preferring LEDs due to low consumption as well as long lifespan.

In 2023, sales of Specialty Lighting in the USA reached approximately 12 Billion units, driven by increasing adoption in sectors like healthcare, entertainment, and architectural lighting. For 2024, projections suggest a rise to over 13.5 Billion units as demand continues to grow in these industries. The energy-efficient lighting market stood at a global value of USD 92.4 billion, which is expected to see 70% of all lighting installations embrace energy-efficient solutions by 2024. This is projected to have the energy-efficient LED lighting markets take about 80% of all the energy-efficient lighting markets by 2024. The savings arising from this shift towards energy efficiency are said to translate into some 800 TWh of power energy saved annually worldwide.

With Specialty Lighting being implemented to augment ambiance in art galleries, museums, and theaters, it will provide practical solutions in such sectors as the healthcare industry, where it may create the proper lighting that is required during procedures and diagnostics. Concerning that, demand is growing for advanced lighting, such that some industries pay attention to aesthetic appeal, safety, and functionality. Another new development is smart lighting technologies with new opportunities for smart control and customization into Specialty Lighting.

Specialty Lighting Market Dynamics

Key Drivers:

-

Energy Efficiency Revolution Drives Innovation in Specialty Lighting, Paving the Way for Smarter Solutions

Increased demand for energy-efficient solutions has been one of the major drivers for the Specialty Lighting market. As far as the industry and consumers are concerned, sustainability is now in the focus. The concept has significantly led to increased momentum towards energy-efficient lighting technologies. Amongst all solutions, LED is the most energy-efficient light solution as it has major energy savings over traditional lighting solutions. In addition to the above attributes, LEDs have a long working life, which reduces the cost of maintenance and replacement. Organizations are therefore utilizing energy-effective lighting not only to reduce their running expenses but also to comply with regulations and corporate targets on the environment. This increasing relevance of energy efficiency will be driving innovation in Specialty Lighting products to create even smarter and more effective solutions

-

Technological Advancements in Specialty Lighting Drive Customization and Dynamic Solutions for Diverse Industries

Technological advancements are also a relevant driver in this Specialty Lighting market. Improvements in lighting design and control systems allow users to respond with customized lighting according to need and preference; therefore, they improve the experience as a whole. This applies particularly in sectors such as retail, hospitality, and entertainment, which highly depend on the ambiance created through lighting to determine customer behavior. Moreover, increased wireless technologies allow greater integration and automation, making it easier for companies to accept dynamic lighting solutions. The possibility of tailoring lighting to individual Medical Types draws an increasingly diverse customer base, further fueling market expansion and prompting manufacturers to look to opportunities in new specialties in lighting design.

Restrain:

-

Manufacturers in Specialty Lighting Face Intense Competition and Struggle to Balance Innovation with Affordability

Retaining a market position in Specialty Lighting appears to be one of the biggest challenges for such manufacturers in the face of growing competition. Under these circumstances, differentiation is a big challenge since now more manufacturers are entering the space. In other words, companies must innovate constantly to remain relevant and focus, for instance, on features or Medical Types that are unique enough to attract customers. Other factors, such as quality control and managing production costs, could pressure resources, thereby implying difficult decisions about whether products can be made affordable or perform well.

Another challenge is the pace of technological innovations. High-paced innovation requires companies to put funds into developing new technologies to ensure that they are at the forefront of the trend of smart lighting and energy efficiency. This creates a need for constant adaptation, which may strain financial resources and even workforce capability, especially for the smaller players in the market.

Specialty Lighting Market Segmentation Overview

By Light Type

The LED lighting segment holds the largest market share of over 67% in 2023. Market growth witnessed due to the introduction of LED over incandescent and halogen bulbs is on account of longer life, less heating, and cost-saving features of LED lights. LED lights have overtaken every section of lighting, which includes smart, decorative, specialty, and architectural lighting.

The LED lighting segment is expected to grow at the highest CAGR of 67% during the forecast period. They are more versatile and convenient for varied fixture designs producing color and pattern. This is mainly because it can create lightweight fixtures, thus growing in demand for LED in Specialty Lighting. The other important reason for its adoption of LED specialty lights is its longer shelf life. In contrast, the halogen and incandescent lights are prone to breaking and fusing once the usage lasts long. However, LED lights cannot break since they have a smaller glass frame that is fitted inside the fixture. Besides, they consume less electricity compared to traditional lights.

By Application

The entertainment segment had a market share of more than 43% in 2023. It will continue its position for the forecast years because it is a strict cinema and photography lighting-based industry requiring fill lighting, backlighting, practical light, hard & soft lighting, bounce lighting, and ambient light to achieve the desired effects. Further, growth in the segment can be seen with the increase in the film industry through Hollywood and Bollywood.

The purification segment is expected to grow at the highest CAGR of 7.59% during the forecast period. The growth in the market is due to specialty UV lights employed for the purification of water, air, and surfaces. Globally, the demand for water purification has increased because of dwindling water sources and the growing practices of reusing treated wastewater. Air purification is also critical in the pharma and testing labs to prevent foreign particles in drugs or samples.

By Medical Type

In 2023, the Surgical lighting segment contributed the largest revenue share of 54% for the market. The high-quality healthcare infrastructure and advanced medical procedures contribute to a higher demand for surgical lighting. In addition to this, the increased demand for high-quality, adjustable, and energy-efficient surgical lighting is because of improvements in healthcare infrastructure and state-of-the-art technologies at hospitals and surgical centers, which assure proper visibility with minimal formation of shadows during surgical operations. The growing number of minimally invasive surgeries and other outpatient treatments further fuels the growing demand for innovative surgical lighting solutions adapted to the increasingly diversified surgical environment.

The examination lighting is likely to gain the highest CAGR of 7.08% from 2023 to 2032 due to growing product demand. Dedicated examination lighting assures that the examiner or doctor does not suffer any mishap while using the tool; hence, it forms an important part of the medical checkup process, which is likely to drive the market

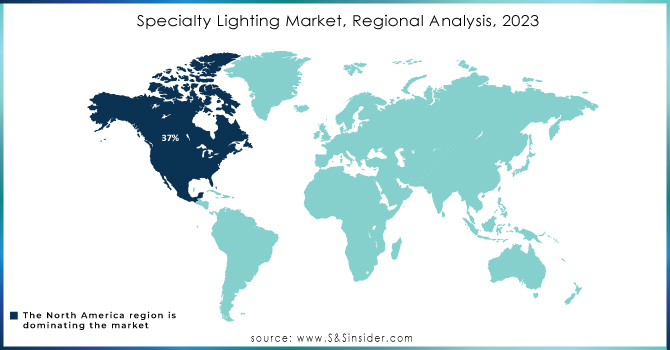

Specialty Lighting Market Regional Analysis

North America accounted for the highest share of over 37% in 2023 and is likely to dominate the market during the forecast period. This can be attributed to the fact that there are prominent lighting companies offering services for various Medical Types, such as horticulture, entertainment, water treatment, medical, seaports, and aquariums. Besides, the rapidly growing end-use sectors, especially entertainment in the region, are also driving the product demand. Another reason is that there's a strong healthcare system in the U.S. and Canada.

Asia Pacific is likely to gain the highest CAGR of 7.80% over the forecast period because Specialty Lighting is increasingly being utilized in multiple industries. The entertainment industry in India is one of the notable and most in-demand sectors among the market vendors, as the demand is always constant. In addition, the healthcare industry in China and Japan complements the regional market growth. Besides, the high utilization rate at the port to light up space and more secure and efficient nighttime operation will also support the growth of the market.

Need Any Customization Research On Specialty Lighting Market - Inquiry Now

Key Players in Specialty Lighting Market

Some of the major players in the Specialty Lighting Market are:

-

Osram Licht AG (LED modules, HMI lamps)

-

Philips Lighting (Signify) (Hue smart bulbs, LED downlights)

-

Cree, Inc. (Cree LED bulbs, COVR LED fixtures)

-

General Electric (GE) Lighting (Reveal LED bulbs, LED ceiling fixtures)

-

Acuity Brands, Inc. (Lithonia Lighting, Gotham Lighting)

-

Eaton Corporation (Metalux LED luminaires, Halo recessed lighting)

-

Luminaire (T5 and T8 fluorescent fixtures, LED decorative fixtures)

-

Nichia Corporation (High-power LEDs, specialty white LEDs)

-

Sylvania (LED lamps, halogen bulbs)

-

LEDVANCE (LED tubes, outdoor LED lighting)

-

Fulham Co., Inc. (LED drivers, emergency lighting solutions)

-

Lutron Electronics (Casetron dimmers, Sivoia QED shades)

-

RAB Lighting (LED floodlights, wall packs)

-

Kichler Lighting (Landscape lighting, ceiling fans)

-

WAC Lighting (LED track lights, recessed lighting)

-

Belkin International, Inc. (WeMo smart plugs, LED light strips)

-

Toshiba Lighting (LED bulbs, high-intensity discharge lamps)

-

Zhejiang Yongming (LED street lights, industrial lighting)

-

Lifx (Smart LED bulbs, Light strips)

-

Bega (Architectural lighting, exterior lighting solutions)

Recent Trends

-

In January 2024, Ledure Lightings Limited, a dedicated lighting Light Type brand, providing a range of Specialty Lighting, luminaires, and lighting solutions announced its media partnership with the much-acclaimed and awaited Bollywood movie FIGHTER.

-

In 2024, Cree Lighting expanded its Specialty Lighting portfolio by releasing high-output LED solutions for horticultural Medical Types. These new lights are designed to optimize plant growth and productivity in controlled agricultural environments, catering to the growing indoor farming industry

-

In 2024, Hubbell Lighting introduced a new range of explosion-proof LED fixtures for industrial and hazardous locations. These fixtures, launched in mid-2024, target sectors such as oil & gas, chemical processing, and mining, where safety and durability are paramount

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.5 Billion |

| Market Size by 2032 | USD 11.73 Billion |

| CAGR | CAGR of 6.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Light Type (LED, Others), • by Application (Entertainment, Medical, Purification, Others) • by Medical Type (Surgical Lighting, Examination Lighting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Osram Licht AG, Philips Lighting (Signify), Cree, Inc., General Electric (GE) Lighting, Acuity Brands, Inc., Eaton Corporation, Luminaire, Nichia Corporation, Sylvania, LEDVANCE, Fulham Co., Inc., Lutron Electronics, RAB Lighting, Kichler Lighting, WAC Lighting, Belkin International, Inc., Toshiba Lighting, Zhejiang Yongming, Lifx, Bega. |

| Key Drivers | • Energy Efficiency Revolution Drives Innovation in Specialty Lighting, Paving the Way for Smarter Solutions • Technological Advancements in Specialty Lighting Drive Customization and Dynamic Solutions for Diverse Industries |

| RESTRAINTS | • Manufacturers in Specialty Lighting Face Intense Competition and Struggle to Balance Innovation with Affordability |