Horticulture Lighting Market Size:

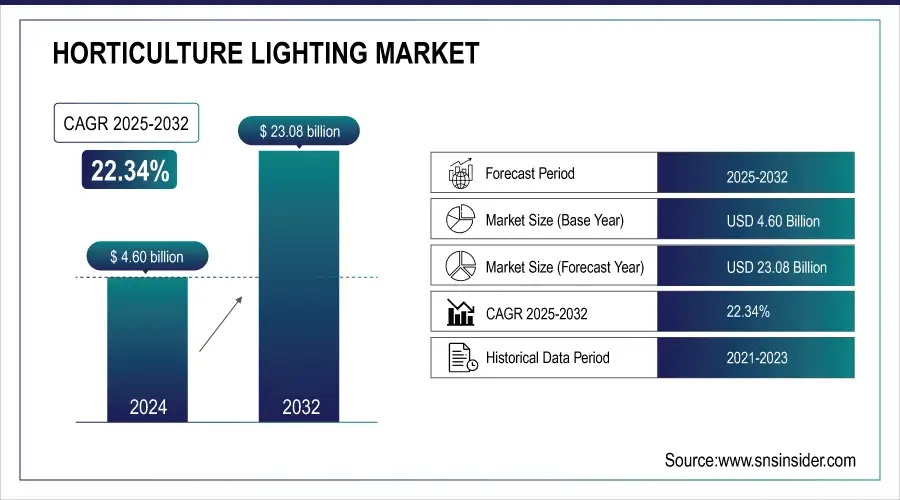

The Horticulture Lighting Market was valued at USD 4.60 billion in 2024 and is expected to reach USD 23.08 billion by 2032, growing at a CAGR of 22.34% from 2025-2032.

The growth of the Horticulture Lighting Market is driven by the increasing adoption of controlled-environment agriculture, including vertical and indoor farming, to ensure year-round crop production. Rising global food demand, urbanization, and limited arable land are accelerating the use of energy-efficient LED lighting systems. Technological advancements in spectrum control, automation, and smart farming solutions further enhance crop yield and quality. Additionally, government incentives supporting sustainable agriculture and energy-efficient technologies are fueling rapid market expansion worldwide.

Horticulture Lighting Market Size and Forecast

-

Market Size in 2024: USD 4.60 Billion

-

Market Size by 2032: USD 23.08 Billion

-

CAGR: 22.34% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on Horticulture Lighting Market - Request Sample Report

Horticulture Lighting Market Trends

-

Increasing adoption of controlled-environment agriculture (CEA), such as vertical farms and greenhouses, is propelling the horticulture lighting market.

-

Rising demand for high-efficiency LED grow lights is driven by their superior energy savings and longer lifespan compared to traditional lighting.

-

Expansion of commercial indoor farming to ensure year-round crop production is boosting light system installations.

-

Growing cultivation of high-value crops, including cannabis and specialty produce, is driving technological innovation.

-

Integration of smart lighting systems with IoT and AI is enhancing real-time monitoring and spectral optimization.

-

Government initiatives promoting sustainable agricultural practices are supporting market expansion.

-

Leading companies are focusing on spectrum tuning and light uniformity to improve plant growth and yield outcomes.

Horticulture Lighting Market Growth Drivers:

-

Surging demand for year-round crop production and controlled environment farming is propelling the adoption of horticulture lighting systems.

Rising global food demand and limited arable land are encouraging indoor and vertical farming adoption, where horticulture lighting plays a vital role in optimizing plant growth cycles. Controlled environment agriculture (CEA) allows consistent crop yields regardless of weather or season. LED-based horticulture lights enhance photosynthesis efficiency while reducing power costs. The growing emphasis on food security and sustainability further accelerates investments in advanced lighting technologies that enable high-quality, year-round crop production with improved control over growth parameters.

Horticulture Lighting Market Restraints:

-

Energy consumption concerns and heat management challenges are reducing large-scale adoption in certain crop segments.

Although LEDs are more energy-efficient than conventional systems, horticultural operations still require continuous lighting, leading to high electricity usage. Inefficient heat dissipation can affect plant health and increase the need for additional cooling systems. This energy and thermal management issue raises operational costs, especially in regions with expensive power tariffs. The resulting environmental impact also counters sustainability objectives, limiting scalability and adoption among environmentally conscious growers or those facing stringent energy regulations.

Horticulture Lighting Market Opportunities:

-

Growing legalization of cannabis cultivation and medicinal plant production is creating lucrative opportunities for horticulture lighting expansion.

The increasing global acceptance of cannabis for medical and recreational use has amplified the need for specialized lighting environments. Cannabis cultivation requires precise spectral control and intensity management to optimize cannabinoid content. Horticulture lighting manufacturers are developing tailored LED solutions for these controlled environments, offering tunable light spectra and energy-efficient systems. This niche yet rapidly expanding segment presents strong growth prospects, driving innovation and partnerships between lighting technology providers and licensed cultivators worldwide.

Horticulture Lighting Market Segment Analysis

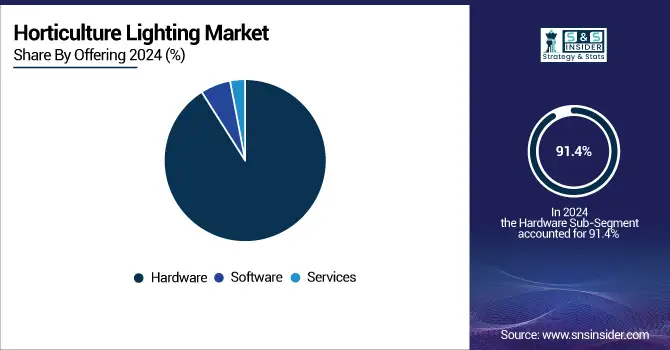

By Offering, Hardware segment dominated the Horticulture Lighting Market in 2024

Hardware dominates the horticulture lighting market, accounting for 91.4% share in 2024, driven by the rising installation of LED fixtures, ballasts, and control units. The increasing adoption of energy-efficient and high-output lighting hardware in greenhouses and vertical farms enhances plant productivity. Continuous innovation in LED design, heat management, and modular setups further strengthens hardware’s dominance as growers prioritize long-lasting, cost-effective, and easily scalable lighting infrastructure.

By Technology, LED segment led the Horticulture Lighting Market in 2024

LED technology leads the horticulture lighting market with an 80.3% share in 2024, owing to its superior energy efficiency, spectral flexibility, and extended lifespan compared to fluorescent and HID lamps. LEDs allow precise light spectrum tuning to support specific crop growth stages. Their lower operational costs and integration with smart controls make them the preferred technology for both new installations and retrofits in modern controlled-environment farming systems.

By Application, Greenhouses segment dominated the Horticulture Lighting Market in 2024

Greenhouses dominate the horticulture lighting market with a 43.2% share in 2024, driven by the increasing need for consistent crop production in all seasons. Greenhouses allow optimal integration of artificial and natural light, making them ideal for energy-efficient crop cultivation. The growing trend of large-scale greenhouse facilities for fruits, vegetables, and flowers especially in regions with limited sunlight further reinforces their leading position in the global horticulture lighting landscape.

By Cultivation, Fruits & Vegetables segment led the Horticulture Lighting Market in 2024

Fruits and vegetables remain the leading cultivation category, holding a 46.9% share in 2024, due to the rising global demand for high-yield, pesticide-free, and nutrient-rich produce. Controlled-environment farms increasingly adopt LED-based horticulture lighting to enhance photosynthesis and accelerate growth cycles. The ability to tailor light intensity and spectra for specific crops boosts productivity, making horticulture lighting indispensable for sustainable, year-round fruit and vegetable production worldwide.

Horticulture Lighting Market Regional Analysis

North America Horticulture Lighting Market Insights

North America dominated the Horticulture Lighting Market in 2024, accounting for 39% of the global share. The region’s leadership is driven by strong adoption of advanced indoor and vertical farming practices and the growing legalization of cannabis cultivation. Increasing focus on sustainable agriculture, technological innovations in LED lighting, and government support for energy-efficient greenhouse infrastructure further reinforce North America’s dominant position in modern horticulture lighting applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Horticulture Lighting Market Insights

Asia Pacific accounted for 29.4% of the global Horticulture Lighting Market in 2024, emerging as one of the fastest-growing regions. The rapid expansion of urban farming, increasing food demand, and government initiatives promoting sustainable agriculture are driving market growth. Rising adoption of LED-based horticulture lighting in countries like China, Japan, and India, coupled with technological advancements and affordable product availability, is strengthening the region’s position in controlled-environment agriculture.

Europe Horticulture Lighting Market Insights

Europe dominated a substantial 27.8% share of the global Horticulture Lighting Market in 2024, driven by widespread adoption of greenhouse and vertical farming technologies. The region’s strong emphasis on sustainable agriculture, energy efficiency, and reduced import dependency supports consistent growth. Leading countries such as the Netherlands, Germany, and France are pioneering advancements in LED-based horticulture lighting, supported by government incentives and research initiatives focused on improving crop productivity and optimizing energy utilization.

Middle East & Africa and Latin America Horticulture Lighting Market Insights

The Middle East & Africa and Latin America regions are witnessing steady growth in the Horticulture Lighting Market, driven by the increasing adoption of greenhouse and indoor farming to combat challenging climatic conditions and limited arable land. In Latin America, expanding cultivation of high-value crops such as fruits, vegetables, and flowers, along with supportive government initiatives promoting sustainable agriculture, is accelerating the shift toward energy-efficient LED horticulture lighting technologies across both regions.

Horticulture Lighting Market Competitive Landscape:

Signify Holding (formerly Philips Lighting)

Signify Holding is a global leader in lighting technology, driving innovation in sustainable and connected lighting solutions across residential, commercial, and agricultural sectors. Through its Philips brand, the company pioneers horticulture lighting systems that enhance plant growth efficiency while reducing energy consumption, helping growers optimize crop yield and quality.

-

In 2024, Signify published a Climate Transition Plan to cut greenhouse-gas emissions by 90% across its value chain and reach net-zero by 2040, strengthening sustainability credentials in horticulture lighting operations and global supply chains.

Heliospectra AB

Heliospectra AB is a Swedish horticultural lighting specialist known for its intelligent LED systems and control platforms designed to maximize crop growth and energy efficiency. The company integrates research-based lighting strategies with digital spectrum control for greenhouse and vertical farming applications worldwide.

-

In 2024, Heliospectra launched the Dynamic MITRA X multi-channel LED C3 and C4 fixtures along with a Spectrum Design Tool, enabling growers to customize lighting zones and spectra for higher yields and operational efficiency.

Valoya Oy

Valoya Oy is a Finnish LED lighting company that develops science-based spectral solutions for horticulture. Its products are widely used in research institutes, greenhouses, and vertical farms to improve plant growth rates and optimize nutritional content. Valoya’s mission centers on combining photobiological knowledge with energy-efficient technologies for sustainable cultivation.

-

In 2024, Valoya published horticultural lighting trends for Europe, emphasizing dynamic lighting and spectral customization as major growth drivers and providing insights for global adoption of precision lighting.

ams OSRAM International GmbH

ams OSRAM is a global leader in optoelectronic semiconductors, offering high-performance LEDs, sensors, and photonics solutions for various industries, including horticulture. The company’s technologies enable precise light spectra control for plant growth optimization while reducing energy usage and environmental impact.

-

In 2024, ams OSRAM introduced new IR:6-based IR LED products and released GreenTech participation reports, showcasing advancements in LED and sensor technologies that support horticultural applications and smart farming innovation.

Acuity Brands, Inc.

Acuity Brands delivers comprehensive lighting and building automation solutions designed for sustainability, efficiency, and performance. With a growing footprint in horticulture lighting, the company combines energy-efficient technology with modern controls to meet the evolving needs of controlled-environment agriculture.

-

Between 2023 and 2025, Acuity Brands agreed to acquire the Arize horticulture lighting product family from Current, retaining Hort Americas as exclusive North American distributor, strengthening its position in the horticulture lighting sector.

Lumileds Holding B.V.

Lumileds Holding B.V. is a global innovator in LED lighting solutions that power applications across automotive, mobile, and illumination markets. Its horticultural LEDs are engineered for high efficiency, long lifespan, and precise spectral output to improve crop productivity and sustainability.

-

In 2024, Lumileds announced new high-power LUXEON LED products and technical updates, enhancing performance for horticultural lighting system designers through better thermal stability and luminous efficacy.

Top 20 Horticulture Lighting Companies are

-

Signify Holding (N.V.) (formerly Philips Lighting)

-

ams OSRAM International GmbH

-

Gavita International B.V.

-

Heliospectra AB

-

Valoya Oy

-

Hortilux Schréder B.V.

-

ILUMINAR Lighting

-

Current Lighting Solutions, LLC

-

GE Lighting (Savant Technologies LLC)

-

ACUITY Brands, Inc.

-

Lumileds Holding B.V.

-

Cree, Inc. (LED business)

-

TCP Lighting

-

PARsource

-

EconoLux Industries Ltd.

-

Agnetix

-

Everlight Electronics Co., Ltd.

-

Samsung Electronics Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 4.60 Billion |

| Market Size by 2032 | US$ 23.08 Billion |

| CAGR | CAGR of 22.34% From 2025 to 2032 |

| Base Year |

2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Technology (Fluorescent, Led Strip Lighting, High-Intensity Discharge) • By Application (Greenhouses, Vertical Farms, Indoor Farms) • By Lighting Type (Toplighting, Interlighting) • By Cultivation (Fruits And Vegetables, Floriculture, Cannabis) • By Installation (New Installations, Retrofit Installations) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Signify Holding (N.V.) (formerly Philips Lighting), ams OSRAM International GmbH, Gavita International B.V., Heliospectra AB, Valoya Oy, California LightWorks, Inc., Hortilux Schréder B.V., ILUMINAR Lighting (U.S.), Current Lighting Solutions, LLC, GE Lighting (Savant Technologies LLC), ACUITY Brands, Inc., Lumileds Holding B.V., Cree, Inc. (LED business), TCP Lighting (U.S.), PARsource (U.S.), EconoLux Industries Ltd. (China), Bridgelux, Inc., Agnetix (U.S.), Everlight Electronics Co., Ltd., Samsung Electronics Co., Ltd. |