Specialty Malt Market Report Scope & Overview:

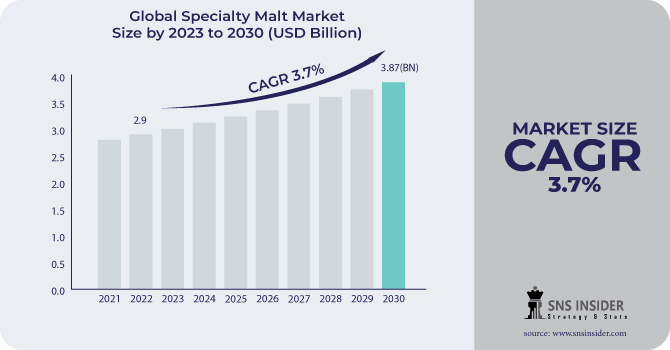

The Specialty Malt Market size was USD 2.9 billion in 2022 and is expected to Reach USD 3.87 billion by 2030 and grow at a CAGR of 3.7% over the forecast period of 2023-2030.

The malt that has been soaked in unconventional ways to bring out a specific desired flavor is known as a specialty malt. The expanding global demand for alcoholic and non-alcoholic beverages is expected to have a substantial impact on the specialty malt market in the upcoming years.

Based on the source, the barley segment held a 56.3% share of the market in 2022. Barley malt is a natural sweetener made from barley that has powerful and distinct flavors and fragrances, making it a great beverage industry option for highly refined sugar and non-nutritive syrups. The usage of specialty malt in beverages is also being driven by increasingly severe food additive regulation standards.

The fourth-largest global supplier of malt to the whisky and beer industries, United Malt, anticipates that underlying EBITDA of $140-160 million in 2022–2023 as a result of improved North American barley crops and its ability to successfully pass on rising costs through new contracts with its beer brewing and whisky distilling clients.

MARKET DYNAMICS

KEY DRIVERS

-

Rising demand for beer consumption and craft beer

Specialty malts are frequently used in the brewing process to add taste, fragrance, and color to wort and beer. It is essential to understand how specialty malts affect the characteristics of wort and beer because the use of malts contributes to the variety of beer products. Craft beers are frequently perceived as more premium than mass-produced beers, and customers are increasingly expecting high-quality products. According to the Brewers Association; the craft brewing business has grown significantly in recent years around the world. As consumption of Beer is rising among the young generation and other populations it is driving the market.

RESTRAIN

-

Rising prices of barley and other raw materials

Malting barley is more expensive than feed barley. Malting barley prices are primarily governed by malt availability in the global and domestic markets, as well as demand for malt-related products. However, spring wheat and corn prices, which serve as viable production substitutes, are progressively influencing malting barley prices. This indirectly increases the prices of beer which impedes sales of beer.

OPPORTUNITY

-

Demand for malt-based RTDs/high-strength premixes

Malt-based RTDs/high-strength premixes are alcoholic beverages that contain malt as well as other ingredients such as fruit juice, sugar, and water. They are usually sold in cans or bottles, and they are the best option as ready-to-drink beverages. These are gaining popularity, particularly among millennials and young adults. This is because they are convenient, inexpensive, and come in a variety of tastes. Specialty malts are frequently utilized to provide richness and depth of flavor to malt-based RTDs/high-strength premixes. Crystal malts, for example, can be used to give sweetness and caramel notes, and roasted malts can offer coffee and chocolate aromas.

-

Emerging markets offer potential for specialty malts

CHALLENGES

-

Disruption in the supply chain for specialty malt

The specialty malt market is a global market with a complicated supply chain that includes many different stakeholders such as farmers, maltsters, brewers, and suppliers. Disruptions in the supply chain at any point might have a detrimental influence on the entire market. The COVID-19 epidemic, as well as geopolitical concerns such as the crisis in Ukraine, can interrupt the specialty malt supply chain, stifling industry growth.

IMPACT OF RUSSIA UKRAINE WAR

The Russia and Ukraine wars are having a big influence on the worldwide specialty malt market. Russia and Ukraine are important users, exporters, and manufacturers of specialty malt, and the conflict has hampered the supply chain. This has resulted in a scarcity of specialty malt and a price rise. The war has reduced the global supply of specialty malt by 20%. In addition, the scarcity of malt processing facilities has hampered the process.

IMPACT OF ONGOING RECESSION

The Recession has impacted the specialty malt market in 2022. In comparison to previous years, the UK's annual inflation rate grew to 9.3% in June 2022. The UK's purchasing patterns are known to change when prices rise. For instance, despite the current recession, a recent report by the Brewers Association indicated that craft beer sales in the United States increased by 8.3% in 2022. This implies that there is still a high demand for specialty malt, which is used to make craft beer. Additionally, the specialty malt market in those locations may be more significantly impacted if the recession is concentrated in certain areas, such as Europe or North America.

MARKET SEGMENTATION

By Product Type

-

Caramelized Malt

-

Roasted Malt

By Source

-

Barley

-

Wheat

-

Rye

-

Other

By Application

-

Distilling

-

Non-Alcoholic Malt Beverages

-

Brewing

-

Baking

-

Others

.png)

REGIONAL ANALYSIS

Asia Pacific region dominates the specialty market which is expanding at a CAGR of 7.96% between 2023 and 2030. The considerable amount of raw material production in the Asia Pacific area is anticipated to boost the specialty malt market in India, Australia, China, and other Asian nations. China's market is expected to be worth USD 305 million in 2022 and increase at a 7% CAGR. Specialty malt is mostly produced in China. Additionally, as people become more aware of the advantages of eating healthy foods, there may be a rise in the market for non-alcoholic malt beverages. To meet the rising demand for non-alcoholic beverages, Anheuser-Busch InBev, for instance, introduced its non-alcoholic beers in India.

Europe's regional specialty malt market is estimated to be USD 189 million covering a market share of 21%. The growth of the specialty malt market in Europe is being driven by the increasing popularity of craft beer and non-alcoholic malt beverages in the UK is driving the rise of specialty malt production.

North American regional market for specialty malt is growing significantly. This is attributed to the popularity of beer and the wide consumption of beer. Due to a significant market share of 60%, the United States is the world's largest market for malt beverages, with a total market value of USD 659.9 million.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Specialty Malt Market are GrainCorp Ltd., Barmalt India Pvt Ltd., Viking Malt, IREKS GmbH, Weyermann, Bar Malt India Pvt. Ltd., Axereal Group, Soufflet Group, Simpsons, Cargill, Inc., Malteurop Groupe, Briess Malt & Ingredients Company, and other key players.

GrainCorp Ltd-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Ian Macleod Distillers (IMD) released a pair of single malts into UK travel retail: The White Cask First-Fill Edition and Shieldaig American Oak Reserve.

In 2023, The New Viking Malt Production Plant in Lahti, Finland, was inaugurated. The new malting factory, which replaces the old plant in Lahti, has a capacity of around 85,000 t/y. The new mill will produce base malts, a variety of specialty malts, and Sprau, Viking Malt's malted faba bean invention.

In 2023, Hi-Wire Brewing, a craft beer company announced that Ohio would be the site of its first brewery. The brewery was expected to have a rooftop bar, patio, taproom, and a selection of brews.

| Report Attributes | Details |

| Market Size in 2022 | USD 2.9 Billion |

| Market Size by 2030 | USD 3.87 Billion |

| CAGR | CAGR of 3.7 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Caramelized Malt, Roasted Malt) • By Source (Barley, Wheat, Rye, Other) • By Application (Brewing, Distilling, Non-Alcoholic Malt Beverages, Baking, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GrainCorp Ltd., Barmalt India Pvt Ltd., Viking Malt, IREKS GmbH, Weyermann, Bar Malt India Pvt. Ltd., Axereal Group, Soufflet Group, Simpsons, Cargill, Inc., Malteurop Groupe, Briess Malt & Ingredients Company |

| Key Drivers | • Rising demand for beer consumption and craft beer |

| Market Restrain | • Rising prices of barley and other raw materials |