Specialty Oleochemicals Market Report Scope & Overview

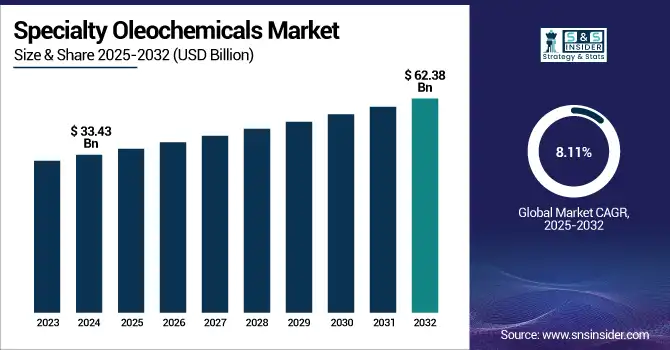

The Specialty Oleochemicals Market size was USD 33.43 billion in 2024 and is expected to reach USD 62.38 billion by 2032, growing at a CAGR of 8.11% over the forecast period of 2025-2032.

To Get more information on Specialty Oleochemicals Market - Request Free Sample Report

Specialty Oleochemicals Market Analysis indicates that the rising demand for polymers and plastics is propelling market growth. It is fatty acid derivatives & glycerides as oleochemicals widely used in polymer and plastics as plasticizers, lubricants, stabilizers, and anti-static agents. With the growth of industries, such as packaging, automotive, construction, and consumer goods, the demand for high-performance and sustainable plastic materials has skyrocketed. Eco-Friendly Substitutes for Petrochemical Additives Specialty oleochemicals are biodegradable, and biodegradable oleochemicals makes them an eco-friendly alternative to petrochemical-based additives. Growing sustainable materials, along with strict environmental regulations, this transition to oleochemical-based products can be a significant factor driving the specialty oleochemicals market growth.

The Index of Industrial Production (IIP) of the manufacturing sector in India recorded an IIP of 140.6 in September 2023, up 4.5% from 140.3 in September 2022, according to the Ministry of Statistics and Programme Implementation (MoSPI). This growth is in line with the increasing industrial activities, including the polymer and plastics industry, which account for a large share consumption of specialty oleochemicals.

Specialty Oleochemicals Market Dynamics:

Drivers:

-

Rising Use in Personal Care and Cosmetic Applications Drives the market Growth

The specialty oleochemicals market is increasing in the use of various personal care and cosmetics applications. Specialty oleochemicals including fatty acids, esters, alcohols, and glycerol are commonly utilized as emollients, surfactants, emulsifiers, and conditioning agents in a range of personal care products, such as lotions, shampoos, creams, soaps, and cosmetics. The growing consumer preference for natural, organic, and skin-friendly ingredients is forcing manufacturers to substitute synthetic chemicals with bio-based oleochemicals. Such a trend is especially pronounced in developed markets, wherein regulators and consumers are increasingly demanding sustainable and non-toxic formulas. Moreover, the demand for high-end personal care products and various cosmetics higher disposable income in emerging economies, is proliferating the growth for specialty oleochemicals, which in turn is increasing global demand for specialty oleochemicals. This, in turn, makes personal care & cosmetics the most popular application segment for market growth.

According to the Personal Care Products Council (PCPC) Economic Contribution Report, the U.S. cosmetics and personal care products industry is a key driver of the country's economy through jobs, science, and sustainability. It illustrates the task of the organization in raising social competency and emphasizes its contribution to financial development

Restraints:

-

Competition from Petrochemical Substitutes May Hamper Market Growth

Competition from petrochemical substitutes is expected to be a major restraint for the growth of the specialty oleochemicals market. While oleochemicals have environmental and sustainability benefits, cost-competitiveness, consistent supply, and existing industrial infrastructure for the production and conversion of petrochemical-based alternatives are often an advantage. The production of synthetic chemicals based on renewable resources has remained limited, as many industries prefer synthetic chemicals derived from petroleum as they are cheaper and more compatible with current processes. Petrochemical derivatives also have uniformity in performance and availability, making them the go-to polymer for manufacturers dealing with tight production deadlines or confined budgets.

Opportunities:

-

Increasing Use of Specialty Oleochemicals in Green and Biodegradable Packaging

The growing applications of these green and biodegradable packaging products, especially for the use of specialty oleochemicals in packaging, are expected to offer significant growth opportunities in the target markets over the near future. Specialty oleochemicals based on renewable natural oils & fats are highly biodegradable and compatible with biodegradable polymers. These additives based on oleochemicals enhance the flexibility, durability, and barrier properties of biodegradable packaging, which are available as a basic requirement of the biodegradable packaging solution for a wide range of applications, including the food packaging market, personal care, and consumer goods which drive the specialty oleochemicals market trends.

In June 2023, Oleon inaugurated a new enzymatic esterification plant in Oelegem, Belgium, employing nature-derived proteins for the sustainable production of oleochemicals that substantially lower CO₂ emissions in the manufacturing of food, feed, and advanced personal care products.

Specialty Oleochemicals Market Segmentation Analysis:

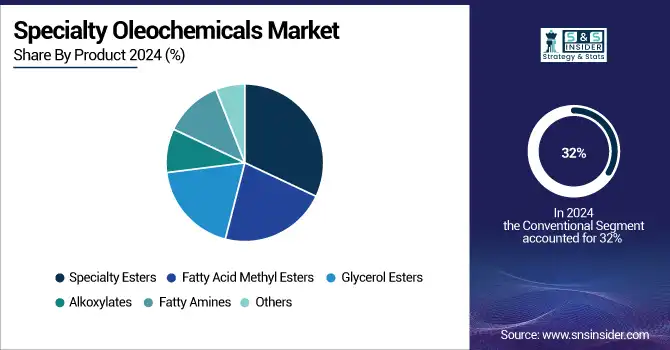

By Product

Specialty Esters held the largest specialty oleochemicals market share, around 32%, in 2024 due to their excellent emollient and lubricating, and solubilizing properties, as these esters are used widely in personal care products, cosmetics, pharmaceuticals, and industrial formulations. They are also highly prized in skincare and haircare products for their ability to improve texture, create stability in products, and offer moisturizing benefits. Secondly, the use of specialty esters in lubricants, plasticizers, and solvents can replace synthetic chemicals and is environmentally benign, with an increasing number of consumers opting for sustainable and biodegradable materials.

Fatty Acid Methyl Esters held a significant specialty oleochemicals market share, due to their extensive applications and eco-friendly nature fatty acid methyl esters (FAME) contribute to the market. FAMEs are mainly used as biodiesel feedstocks that provide renewable and sustainable substitutes to traditional fossil fuels, which in turn has resulted in higher demand due to the increasing global focus on reducing carbon footprints. More than the energy, these esters have been widely used by the cosmetic, detergent, and lubricant industries for their amazing biodegradability, low toxicity, and high lubricating properties.

By Application

Personal Care & Cosmetics held the largest market share of around 26%, in 2024. It is due to the unique moisturizing, emollient, and conditioning properties of fatty acids, esters, and glycerides. They are commonly used as principal ingredients in skin-care, hair-care, and cosmetic formulations, which is one of the major applications driving the demand for specialty oleochemicals. The hazards of synthetic chemicals have led both manufacturers and consumers to opt for bio-based and/or biodegradable ingredients, which specialty oleochemicals can offer. Furthermore, increasing speed of urbanization, rising per capita income, and changing perspectives regarding beauty in the emerging markets are boosting the growth of the personal care sector, which in turn is supporting the growth of specialty oleochemicals.

Consumer Goods hold a significant market share in the Specialty Oleochemicals market owing to the extensive use of oleochemical-based ingredients in a variety of everyday household products. Products of specialty oleochemicals (fatty acids, esters, and glycerol) are important ingredients in the production of soaps, detergents, cleaners, and personal care products about which belong to consumer goods. Consumers are becoming increasingly aware of sustainability and health, with a desire to increase renewable and non-toxic ingredients in household products.

Specialty Oleochemicals Market Regional Outlook:

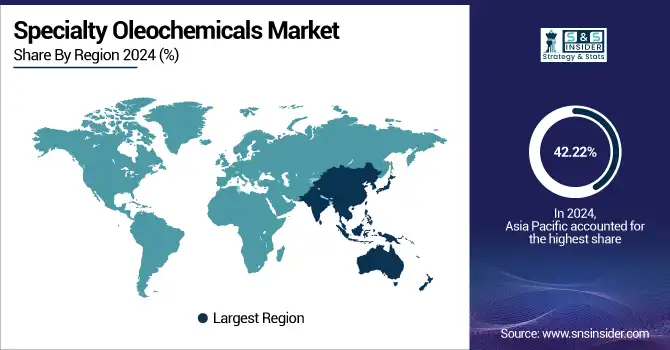

Asia Pacific held the largest market share, around 42.22%, in 2024. It is owing to the development of the industrial base, availability of a variety of raw material, and demand growth in the region due to the key end-use industries. High domestic demand for non-edible products across the region, availability of feedstock with countries, such as Indonesia, Malaysia, Philippines being dominant manufacturers of palm oil and coconut oil, which are major raw materials for oleochemicals, also assures and ensures the manufacturers of low-cost availability of feedstock and a steady supply chain. Moreover, the increasing demand for specialty oleochemicals, particularly from applications, such as personal care, food processing, and consumer goods, augmented by rapid urbanization, increasing disposable incomes, and significantly increasing consumer awareness regarding green products are significant factors expected to fuel the growth of the global specialty oleochemicals market during the forecast period.

For instance, in May 2024, Corbion partnered with IMCD and will distribute its bio-based products for Thailand's food and beverage market to strengthen its footprint in the Asian market.

North America Specialty Oleochemicals market held a significant market share and is the fastest-growing segment in the forecast period. The growth is driven by its established industrial infrastructure, important end-use sectors, and increasing focus on sustainability and biodegradable products. The region has a strong personal care, food processing, and pharmaceutical industry, so they are the largest end-use industry of specialty oleochemicals, particularly fatty acids, esters, and alcohols. Furthermore, the U.S. and Canada are the early adopters of green and bio-based chemicals, backed by strong environmental regulations and increased awareness related to environmentally friendly products. Flourishing presence of key market players, coupled with continuous investment in R&D for high-performing self-sustaining oleochemical formulations, has also bolstered growth in the oleochemical market.

The U.S Specialty Oleochemicals market size was USD 5.91 billion in 2024 and is expected to reach USD 11.86 billion by 2032 and grow at a CAGR of 9.08% over the forecast period of 2025-2032. It is owing to advanced manufacturing capabilities, higher demand from various end-use industries, and proactive sustainability initiatives in the region. Although specialty oleochemicals are primarily produced and consumed in the Far East, there are a number of other countries that are leading producers and consumers of specialty oleochemicals including the U.S. which has some of the leaders in the production of specialty oleochemicals and the production of specialty oleochemicals. market size in the personal care, pharmaceutical, and food processing markets. Extensive infrastructure development and a high rate of investment in R&D in the country have boosted bio-based and biodegradable chemical formulations.

In April 2024, Vantage Specialty Chemicals expanded its N-Methyl Taurine (NMT) production capacity at its world-class N-Methyl Taurine plant in Leuna to meet the increasing demand of personal care, industrial, and household applications. This is a strategic initiative and is intended to fortify its position in the specialty oleochemicals market.

Europe held a significant market share over the forecast period owing to its strong regulatory norms, focus towards sustainability, and growth of end-use industries including cosmetics, pharmaceuticals, and food processing, which are the major consumers of oleochemicals. Under strict environmental policies, such as REACH regulations and the EU Green Deal, the European Union has forced manufacturers to gradually replace petrochemical-based agents with bio-based alternatives, such as specialty oleochemical-based ingredients. Moreover, there are some of specialty oleochemicals companies in the region that invest significantly in R&D to initiate new technology to fulfill burgeoning demand for high-quality biodegradable and non-toxic chemical ingredients.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The leading players in the market are Croda International, BASF SE, Evonik Industries, Emery Oleochemicals, Oleon NV, AAK AB, KLK Oleo, Vantage Specialty Chemicals, Wilmar International, and Godrej Industries.

Recent Development:

-

In January 2024, Godrej Industries entered a four-year USD 71.8 million MoU with the state government to boost production of oleochemicals to meet growing demand from the personal care, pharmaceuticals, and food industry.

-

In October 2024, Oleon NV completed the purchase of Azevedo Óleos, a Brazilian manufacturer of natural base specialty oils, increasing its position in the specialty oils market and adding the ability to produce high-quality natural-based products.

| Report Attributes | Details |

| Market Size in 2024 | USD 33.43 Billion |

| Market Size by 2032 | USD 62.38 Billion |

| CAGR | CAGR of 8.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Specialty Esters, Fatty Acid Methyl Esters, Glycerol Esters, Alkoxylates, Fatty Amines, Others) •By Application (Personal Care & Cosmetics, Consumer Goods, Food Processing, Textiles, Paints & Inks, Industrial, Healthcare & Pharmaceuticals, Polymer & Plastics Additives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Croda International, BASF SE, Evonik Industries, Emery Oleochemicals, Oleon NV, AAK AB, KLK Oleo, Vantage Specialty Chemicals, Wilmar International, Godrej Industries. |