Biodegradable Packaging Market Report Scope & Overview:

Get More Information on Biodegradable Packaging Market - Request Sample Report

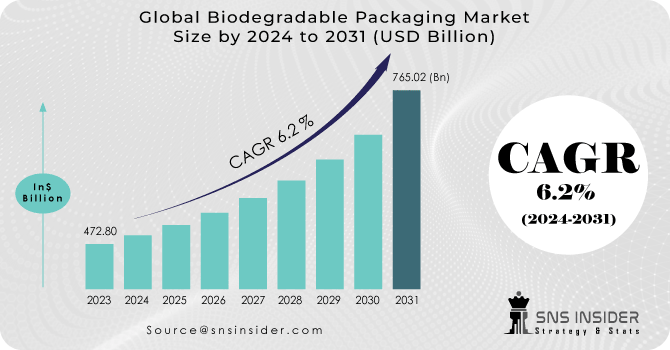

The Biodegradable Packaging Market Size was valued at USD 454.68 billion in 2023 and is expected to reach USD 780.73 billion by 2032 and grow at a CAGR of 6.19% over the forecast period 2024-2032.

The biodegradable packaging market is on the rise, owing to increasing awareness among consumers, stringent government regulations, and increasing focus on sustainability. Businesses in food & beverage, personal care, healthcare, and a number of other verticals are switching to sustainable packaging to reduce plastic waste and remain compliant with environmental regulations. Global industry front-runners are embedding biodegradable components such as paper, cornstarch, polylactic acid (PLA) and polyhydroxyalkanoates (PHA) into their plastic materials.

This eco-friendly consumer behavior trend is just one of the factors that molds the market. Under sustained packaging demand from consumers, companies are developing unique biodegradable-framed solutions that help in keeping durability without compromising with environment safety. Focus on bio-based polymers and compostable materials in the last two decades of material science, which enhanced the functional properties of biodegradable packaging. Government agencies around the world are developing rigorous standards aimed at decreasing plastic pollution, which is likely to further propel the adoption of biodegradable options. With governments across the European Union and North America putting into place bans on single use plastics, companies have begun working on sustainable alternatives. On the other side of the globe, the biodegradable packaging trend is growing in emerging economies as environmental concerns rise with urbanization.

Biodegradable Food Packaging Market Introduction The biodegradable food packaging market is witnessing a surge in demand owing to the launch of compostable packaging solutions for food service and retail by key market players. Biodegradable options are also taking over the personal care sector, with brands providing plant-based packaging. Furthermore, water-soluble and edible packaging are also emerging as exciting new alternatives to help eliminate plastic waste even more. According to research a significant rise in the distribution of biodegradable packaging such that more than 60% of international customers are looking for ecofriendly packaging options. The market is anticipated to grow further in the upcoming years owing to continuous technological advancements and product developments, as well as support from government and regulatory agencies, leading to a greener and more sustainable packaging environment.

MARKET DYNAMICS

DRIVERS

-

The biodegradable packaging market continues to grow as environmental issues, legislative directives, and consumer demand incentives propel it forward.

Increasing plastic pollution awareness and the impact of plastic waste on ecosystems is compelling consumers, businesses, and governments alike to move towards sustainable packaging options. The market adoption is further propelled by stringent regulations regarding the ban on single-use plastics coupled with the sustainability practices adopted by corporates. With buyers eyeing green options, brands are investing in biodegradable options like PLA, PHA and starch-based polymers. But they face major hurdles in the form of costs of production, lack of industrial composting facilities, and shelf life. While these limiters are present, the overall market has been seeing tremendous growth thanks to new material technology and the growing need for sustainable packaging in the e-commerce arena. Circular economy-oriented practices, R&D investments, and partnerships between packaging companies and environmental organizations are some of the things influencing the future of this space.

RESTRAINT

-

Adoption of biodegradable packaging is hampered by high production costs, but investments in R&D, regulatory support, and shifting trends towards sustainability will continue to spur market growth.

High production costs with biodegradable packaging is a major obstacle to be overcome for the growth of the market. Biodegradable materials like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are relatively high in raw material costs and require complex manufacture compared with conventional plastics. That makes them relatively expensive for SMEs and cost-sensitive businesses, which limits widespread adoption. Nonetheless, costs are likely to decline over time as investments in research and development scale up, alongside economies of scale. Rising consumer preferences for sustainable packaging coupled with a stringent regulatory environment is driving the demand in the market. These trends embrace the evolution of superior biopolymers, better composting facilities, and the mixing of biodegradable supplies in meal packaging and e-commerce. The biodegradable packaging market is expected to grow moderately across the world in the near future, as globally the trend to obtain sustainability has increased the corporate commitments to bring down plastic waste, whereas the current limitation with the market is due to the cost.

MARKET SEGMENTATION

By Material Type

The plastic segment dominated with a market share over 42% in 2023, owing to its versatility, durability and cost-effectiveness. Due to its strength in protecting products, its versatility in molding into different shapes, it has been widely adopted in diverse industries such as food and beverages, consumer goods and pharmaceuticals. But increasing environmental awareness about plastic waste is driving interest in sustainable alternatives. It is completely changing consumer and business mindsets and forcing stringent moves from a regulatory standpoint in several countries as governments around the world are banning the use of plastics. It is this trend that is driving the use of biodegradable materials such as paper, bagasse and bioplastics.

By Packaging Format

The Boxes & Cartons segment dominated with a market share over 24% in 2023. This continues due to their high application range in industries such as food packaging, retail, and shipping. This is yet another reason why many manufacturers or retailer manufacturers prefer to use boxes and cartons as they are best at protecting the products for long distance transportation and storage. Their low price and adaptability also played a part in the transition to biodegradable substitutes. With the growing consumer preference towards sustainable solutions, packaging solutions having lesser wastes like biodegradable boxes and cartons are growing in popularity.

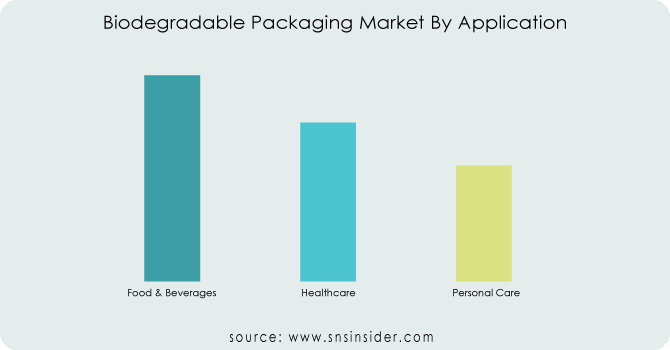

By Application

The Food & Beverages segment dominated with the market share over 34% in 2023. Consumers are increasingly aware of environmental issues and the negative effects of plastic waste, leading to high demand for eco-friendly substitutes. As a reaction to this, the food industry started to look into using biodegradable packaging materials instead of the plastics we are used to. The most visible change is in terms of packaging, mainly in beverages, snacks and ready-to-eat food products. With the introduction of stringent environmental regulation by governments and regulatory authorities, companies have been shifting their focus toward compostable alternatives to comply with sustainability goals and reduce their carbon footprint.

KEY REGIONAL ANALYSIS

North America region dominated with a market share over 34% in 2023. Increasing awareness regarding environment among the consumers as well as businesses drives this dominance reflecting a strong demand for sustainable products. Stringent regulations and policies in this regard are in favour of the adoption of eco-friendly packaging alternatives in the U.S. and Canada. Another contributing factor is the increasing awareness regarding plastic waste and its effect on environment, which has led to imperative increase in demand for biodegradable solutions. The influence of corporate social responsibility and consumer green preference also attracts this shift to market.

Asia-Pacific is showing the rapid growth in biodegradable packaging market. Growth of packaged goods demand due to rapid urbanization in Beijing, India and Japan is propelling the environmentally sustainable packaging market. Increased consumer awareness of environmental sustainability has increased the demand for green alternatives to traditional plastic packaging materials. Moreover, stricter regulations by governments in the region as well as incentives for the use of biodegradable materials are also projected to drive the market growth. The Asia-Pacific market is poised to dominate the biodegradable packaging market in the coming years, given the expanding middle class in the region and rising concerns over plastic pollution.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Some of the major key players of the Biodegradable Packaging Market

-

Amcor (Flexible packaging, Trays, Pouches, and Lidding)

-

Mondi Group (Paper-based packaging, Biodegradable films, and Coatings)

-

WestRock Company (Paperboard, Corrugated packaging, and Molded fiber packaging)

-

Smurfit Kappa Group (Paper-based packaging, Sustainable corrugated products)

-

International Paper Company (Recycled paperboard, Paper packaging)

-

DS Smith Plc (Corrugated cardboard packaging, Sustainable packaging solutions)

-

Sealed Air Corporation (Bubble wraps, Flexible packaging)

-

Stora Enso (Paperboard, Biodegradable and recyclable packaging materials)

-

Georgia-Pacific LLC (Paper packaging, Pulp-based products)

-

Evergreen Packaging (Paper-based packaging solutions, Beverage cartons)

-

Tetra Pak (Cartons, Paper-based beverage packaging, Barrier coatings)

-

Ball Corporation (Aluminum cans, Sustainable packaging)

-

Be Green Packaging (Compostable packaging, Plant-based materials)

-

Nampak (Recyclable packaging, Sustainable plastic and paper products)

-

UFP Technologies (Biodegradable foam packaging, Cushioning materials)

-

Sappi Group (Paper-based packaging, Biodegradable paper products)

-

Huhtamaki (Compostable food packaging, Paperboard, Flexible packaging)

-

Novamont (Biodegradable plastic products, Mater-Bi biodegradable resin)

-

Plantic Technologies (Biodegradable food packaging, Plant-based packaging)

-

Packsize (On-demand packaging, Eco-friendly packaging systems)

Suppliers for (Producing flexible and rigid packaging with a focus on sustainability, offering products made from recycled materials and promoting recyclable packaging solutions) on Biodegradable Packaging Market

-

Amcor

-

Mondi Group

-

WestRock Company

-

Smurfit Kappa Group

-

International Paper Company

-

DS Smith Plc

-

Sealed Air Corporation

-

Stora Enso

-

Georgia-Pacific LLC

-

Evergreen Packaging

RECENT DEVELOPMENT

In 2023: Pakka launched India’s first compostable flexible packaging, setting a new benchmark in sustainable packaging solutions. This groundbreaking product reflects the increasing global shift towards environmentally friendly alternatives to conventional packaging materials. Unlike traditional plastics, compostable flexible packaging decomposes into natural elements when composted, minimizing its environmental footprint.

In February 2024: TIPA unveiled compostable packaging as a sustainable alternative to plastic. Certified for biodegradation in both home and industrial compost bins, these products leave no environmental trace while offering enhanced convenience for consumers.

In September 2023: Mondi, in collaboration with the rice supplier Veetee, launched innovative recyclable paper-based packaging for dry rice. This packaging is designed to offer moisture protection and ensure product stability on retail shelves.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 454.68 billion |

|

Market Size by 2032 |

USD 780.73 billion |

|

CAGR |

CAGR of 6.19% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Recycled Content Packaging, Reusable Packaging, Degradable Packaging) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Amcor, Mondi Group, WestRock Company, Smurfit Kappa Group, International Paper Company, DS Smith Plc, Sealed Air Corporation, Stora Enso, Georgia-Pacific LLC, Evergreen Packaging, Tetra Pak, Ball Corporation, Be Green Packaging, Nampak, UFP Technologies, Sappi Group, Huhtamaki, Novamont, Plantic Technologies, Packsize. |

|

Key Drivers |

• The biodegradable packaging market continues to grow as environmental issues, legislative directives, and consumer demand incentives propel it forward, though problems, such as high cost and limited infrastructure, can impede this growth. |

|

RESTRAINTS |

• Adoption of biodegradable packaging is hampered by high production costs, but investments in R&D, regulatory support, and shifting trends towards sustainability will continue to spur market growth. |