Specialty Tapes Market Analysis & Overview:

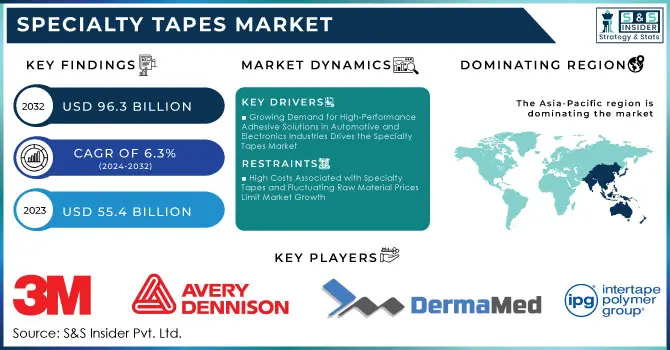

The Specialty Tapes Market Size was valued at USD 55.4 billion in 2023 and is expected to reach USD 96.3 billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

Get More Information on Specialty Tapes Market - Request Sample Report

The specialty tapes market is witnessing substantial growth driven by increasing demand across diverse industries, including automotive, electronics, healthcare, and construction. As industries push for innovation and advanced materials, specialty tapes are becoming essential in applications such as bonding, sealing, insulation, and packaging. In automotive manufacturing, for example, these tapes are utilized for lightweight and enhancing efficiency, aligning with the automotive industry's drive for sustainability and fuel efficiency. Specialty tapes are favored due to their durability, flexibility, and adaptability to various surfaces, enabling seamless integration into diverse applications, particularly in intricate and high-stress environments.

Technological advancements are a central factor in the market's growth, with ongoing R&D to develop specialty tapes with improved adhesive properties, thermal resistance, and chemical stability. In recent developments, companies are creating tapes with high bonding strength that can replace mechanical fasteners, providing a cleaner aesthetic and reducing the weight of electronic devices. This trend is particularly noticeable in the consumer electronics sector, where tapes are now replacing screws and bolts to achieve sleek, lightweight designs. In healthcare, tapes with advanced biocompatibility are gaining traction, enabling comfortable, long-lasting wear in medical devices and wound care applications. The demand for high-quality, high-performance adhesive tapes is leading to the introduction of products with specific properties tailored to application needs.

Environmental sustainability is increasingly influencing market dynamics as regulations push for eco-friendly and recyclable materials. To address this, some companies have recently launched tapes based on bio-based and water-based adhesives that meet industry standards for reduced environmental impact. Developments in biodegradable tapes, for example, are gaining attention as they reduce the environmental footprint, especially in disposable applications. Additionally, certain manufacturers are shifting towards solvent-free production processes, which align with environmental goals and provide safer work environments. This trend is particularly evident in packaging and logistics, where recyclable tapes are not only functional but also play a role in improving a company's sustainability profile.

The specialty tapes market is also becoming more competitive due to increased focus on custom solutions and specialty applications. In recent months, manufacturers have been emphasizing customization to cater to the specific demands of high-growth regions. For instance, the demand for specialty tapes with anti-bacterial and anti-static properties is rising in the Asia-Pacific region due to its strong healthcare and electronics manufacturing sectors. To meet these regional demands, companies are investing in localized production facilities, allowing them to provide region-specific products with shorter lead times. The market's expansion is closely tied to these region-specific requirements, which are driving companies to adopt agile strategies and focus on providing innovative, high-performance tape solutions tailored to industry needs.

Specialty Tapes Market Dynamics:

Drivers:

-

Growing Demand for High-Performance Adhesive Solutions in Automotive and Electronics Industries Drives the Specialty Tapes Market

The increasing need for high-performance adhesive solutions in sectors like automotive and electronics is significantly propelling the specialty tapes market. In automotive manufacturing, specialty tapes are being widely adopted to replace conventional bonding techniques, offering benefits such as weight reduction and enhanced durability. This shift aligns with the industry's focus on lightweight and fuel-efficient designs, reducing the carbon footprint while maintaining structural integrity. Similarly, the electronics sector is leveraging specialty tapes for precise bonding applications, particularly in compact devices where traditional fasteners are impractical. With rising consumer demand for smaller, more efficient devices, specialty tapes are becoming essential to create sleek, lightweight designs that are durable and resistant to various environmental factors. As both industries continue to grow, the role of specialty tapes is anticipated to become even more crucial, fueling market growth.

-

Rising Adoption of Specialty Tapes in Healthcare for Advanced Medical Applications Fuels Market Expansion

The healthcare sector’s increasing adoption of specialty tapes for various applications, including wound care and medical device assembly, is significantly driving the market. Specialty tapes in healthcare provide critical features such as biocompatibility, breathability, and hypoallergenic properties, making them suitable for sensitive medical applications. With an expanding elderly population and growing awareness of medical hygiene, there is a rising demand for advanced wound care products that can maintain a secure seal while being gentle on the skin. Specialty tapes are also being used in wearable medical devices for continuous monitoring, offering secure adhesion while providing patient comfort during prolonged use. As healthcare providers seek reliable, skin-friendly solutions to improve patient outcomes and comfort, the role of specialty tapes is expected to strengthen, contributing to market growth.

Restraint:

-

High Costs Associated with Specialty Tapes and Fluctuating Raw Material Prices Limit Market Growth

While specialty tapes offer significant benefits across industries, their high costs and the fluctuating prices of raw materials are considerable restraints to market growth. Specialty tapes often incorporate advanced materials and adhesives, leading to higher production costs compared to standard tapes. Industries with tight budget constraints, particularly small and medium-sized enterprises (SMEs), may find it challenging to adopt these high-cost solutions despite their benefits. Additionally, the cost of raw materials used in specialty tapes, such as acrylics, silicones, and foams, is subject to market fluctuations influenced by global supply chains and regulatory changes. These price instabilities impact manufacturers’ profit margins and limit the ability to produce affordable specialty tape solutions, potentially discouraging widespread adoption, especially in price-sensitive markets.

Opportunity:

-

Increasing Focus on Sustainable and Eco-Friendly Adhesive Technologies Creates Growth Opportunities in the Specialty Tapes Market

The growing emphasis on environmental sustainability is opening opportunities for the development of eco-friendly specialty tapes. With industries increasingly under pressure to reduce their carbon footprint and comply with environmental regulations, manufacturers are innovating with biodegradable and recyclable tape options. Bio-based adhesives, derived from renewable sources, are gaining popularity as they minimize environmental impact while meeting industry standards for performance. Additionally, companies are investing in water-based and solvent-free adhesive technologies, which reduce the release of harmful chemicals during production and use, aligning with the global trend towards greener manufacturing processes. These eco-friendly specialty tapes are particularly appealing in sectors like packaging and healthcare, where environmental considerations are paramount, paving the way for new growth avenues in the specialty tapes market.

Challenge:

-

Ensuring Adhesive Durability and Strength in Extreme Environmental Conditions Poses a Major Challenge for Specialty Tapes Market

A significant challenge in the specialty tapes market lies in developing products that maintain adhesive strength and durability under extreme environmental conditions. Industries such as automotive, aerospace, and electronics often require tapes that can withstand high temperatures, UV exposure, and moisture, which can degrade adhesive performance over time. Specialty tapes are expected to provide consistent adhesion even in challenging environments to ensure product reliability and longevity. For example, automotive and aerospace tapes need to endure prolonged exposure to harsh weather and temperature fluctuations without compromising their bonding strength. Achieving this balance of performance and durability while keeping costs manageable is challenging for manufacturers, as it requires specialized materials and testing processes, thereby impacting the pace of innovation in the specialty tapes market.

Specialty Tapes Market Segments

By Resin Type

The acrylic segment dominated the specialty tapes market in 2023, capturing a 40% market share. Acrylic-based tapes are widely preferred across various industries due to their strong adhesive properties, durability, and high resistance to UV radiation and environmental changes. These tapes are highly effective for outdoor applications, making them popular in industries like construction and automotive, where exposure to harsh conditions is common. Additionally, acrylic tapes offer a balance of strength and flexibility, making them versatile for bonding uneven surfaces, and contributing to their widespread use in packaging and signage applications.

By Backing Material

Polyvinyl Chloride (PVC) dominated the specialty tapes market by backing material in 2023, accounting for around 35% of the market share. PVC tapes are known for their exceptional flexibility, durability, and resistance to moisture and chemicals, which makes them highly suited for electrical insulation and protective sealing applications. The electrical and automotive industries extensively utilize PVC-backed tapes for wire harnessing, insulation, and protective coverings, where durability and insulation strength are crucial. PVC’s unique properties, including strong adhesion and adaptability to different surfaces, have reinforced its demand in various industrial settings, ensuring its dominant position in the market.

By End-use Industry

The electrical & electronics segment dominated the specialty tapes market in 2023 with a 30% market share. Specialty tapes play a critical role in electronic applications, where they are used for insulation, bonding, and thermal management in devices like smartphones, tablets, and computers. With the rising consumer demand for compact and advanced electronic devices, specialty tapes that offer precision and reliability have become essential. Electronics manufacturers, for instance, use these tapes to assemble and protect delicate components, reinforcing their position as a preferred adhesive solution within the sector.

Specialty Tapes Market Regional Analysis

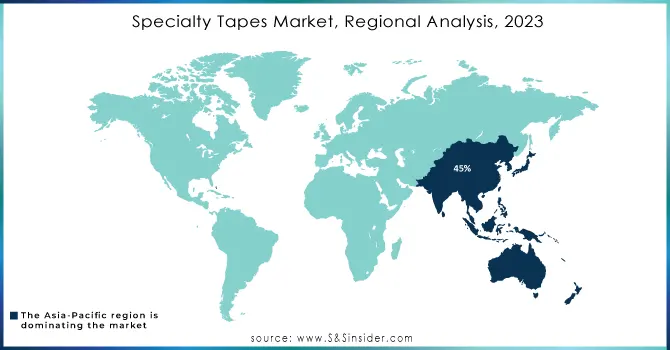

In 2023, Asia-Pacific dominated the specialty tapes market, accounting for a 45% market share. This dominance is driven by the region’s robust manufacturing base and expanding industries such as electronics, automotive, and healthcare in countries like China, Japan, and South Korea. Specialty tapes are essential in the electronics sector for assembly and thermal management, supporting the high demand from electronics manufacturers across Asia. The automotive industry's growth in China and India has also increased the need for specialty tapes in applications like bonding, sealing, and insulation, as these tapes offer efficient solutions for lightweight and enhancing durability. With its strong industrial growth and rising investments in advanced manufacturing, Asia-Pacific holds a significant position in the specialty tapes market.

Moreover, North America emerged as the fastest-growing region in the specialty tapes market in 2023, with a CAGR of around 7.5%. The region's rapid growth is driven by a surge in demand from sectors like healthcare, automotive, and construction, particularly in the United States. Specialty tapes are increasingly used in medical devices for wearable applications, supporting the growing healthcare sector's need for biocompatible and durable materials. Additionally, as construction activities and infrastructure projects rise, particularly in the U.S., the demand for high-performance adhesive solutions has grown, making specialty tapes crucial in insulation and protective applications. With ongoing advancements in adhesive technologies and a focus on sustainable products, North America is expected to continue as a fast-growing market for specialty tapes.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

3M (VHB Tape, Double-Sided Tape, Electrical Insulation Tape)

-

Avery Dennison Corporation (EcoFriendly Adhesive Tapes, Reflective Tapes, Labeling Tapes)

-

Berry Global Inc. (Polypropylene Tapes, Double-Sided Tapes, Packaging Tapes)

-

DermaMed Coatings Company, LLC (Medical Adhesive Tapes, Silicone Foam Tapes, Hypoallergenic Tapes)

-

ECHOtape (Masking Tapes, Double-Sided Tapes, HVAC Tapes)

-

Intertape Polymer Group (Paper Masking Tape, Duct Tape, Filament Tape)

-

LINTEC Corporation (Label Stock, Protective Films, Specialty Adhesive Tapes)

-

Lohmann GmbH & Co. (Bonding Tapes, Medical Tapes, Automotive Tapes)

-

NICHIBAN Co., Ltd (Medical Tape, General-Purpose Tape, Masking Tape)

-

NITTO DENKO CORPORATION (Electrical Insulation Tape, Double-Sided Tape, Protective Film)

-

Saint-Gobain (High-Performance Tapes, Duct Tapes, Protective Tapes)

-

Scapa Group Plc (Medical Adhesive Tapes, Industrial Tapes, Specialty Masking Tapes)

-

Specialty Tapes Manufacturing (STM) (Foam Tapes, Custom Adhesive Tapes, Surface Protection Tapes)

-

Tesa Tapes Private Limited (Double-Sided Tapes, Packaging Tapes, Specialty Adhesive Tapes)

-

Adchem Corporation (Double-Sided Foam Tapes, Transfer Tapes, Adhesive Tapes)

-

Essentra plc (Filament Tapes, Label Tapes, Packing Tapes)

-

Rogers Corporation (High-Performance Foam Tapes, Specialty Adhesive Tapes, Thermal Management Tapes)

-

Shurtape Technologies, LLC (Duct Tape, Painter's Tape, Gaffer Tape)

-

Sika AG (Construction Tapes, Adhesive Tapes, Sealing Tapes)

-

Toyochem Co., Ltd (Pressure-Sensitive Adhesive Tapes, Electrical Tapes, Specialty Tapes)

Users of Specialty Tapes Market

-

Electrical & Electronics

-

Automotive

-

Healthcare & Hygiene

-

Building & Construction

-

Aerospace

-

Packaging

-

Retail & Graphics

-

Paper & Printing

-

White Goods

-

Industrial Manufacturing

Recent Developments

- August 2023: Avery Dennison Performance Tapes launched an advanced line of pressure-sensitive adhesive tapes designed for the building and construction industry.

- January 2023: LINTEC introduced a new permanent hot-melt adhesive in its HVT label stock series. In February 2023, the company expanded the range with three products: a water-resistant paper-based label stock and two synthetic paper-based label stocks, tailored for versatile display label applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 55.4 Billion |

| Market Size by 2032 | US$ 96.3 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Acrylic, Silicone, Rubber, Others) •By Backing Material (Polyvinyl Chloride (PVC), Polypropylene, Woven/ Non- woven, PET, Paper, Foam, Others) •By End-Use Industry (Electrical & Electronics, Automotive, Healthcare & Hygiene, Building & Construction, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Tesa Tapes Private Limited, Avery Dennison Corporation, Scapa Group Plc, Berry Global Inc., Lohmann GmbH & Co., DermaMed Coatings Company, LLC, ECHOtape, LINTEC Corporation, Intertape Polymer Group, Saint-Gobain, NICHIBAN Co., Ltd, Specialty Tapes Manufacturing (STM), NITTO DENKO CORPORATION and other key players |

| Drivers | •Growing Demand for High-Performance Adhesive Solutions in Automotive and Electronics Industries Drives the Specialty Tapes Market •Rising Adoption of Specialty Tapes in Healthcare for Advanced Medical Applications Fuels Market Expansion |

| Restraints | •High Costs Associated with Specialty Tapes and Fluctuating Raw Material Prices Limit Market Growth |