Wound Care Market Report Scope and Overview:

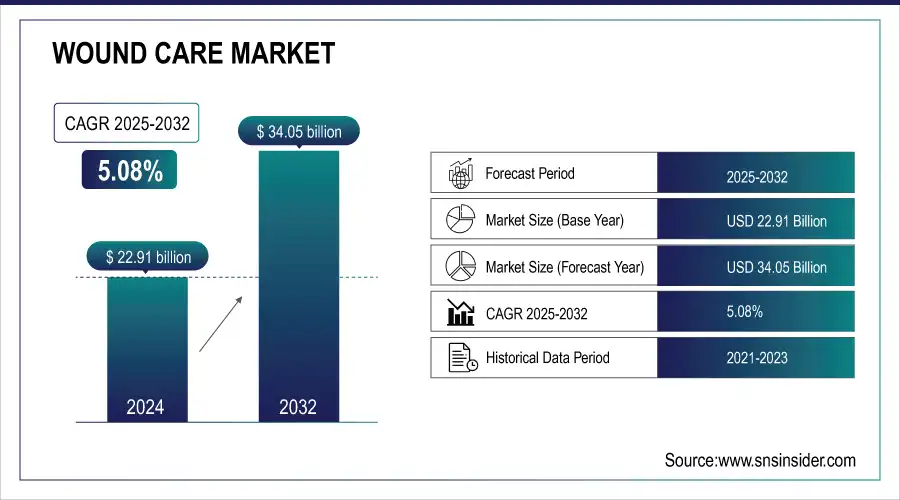

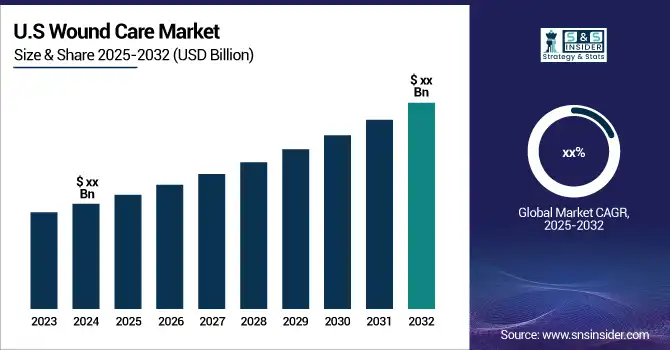

The Wound Care Market Size was valued at USD 22.91 billion in 2024 and is expected to reach USD 34.05 billion by 2032 and grow at a CAGR of 5.08% over the forecast period 2025-2032.

Get more information on Wound Care Market - Request Sample Report

The Wound Care Market is being propelled by various factors including advancements in wound treatment technologies, an aging population, and the increasing incidence of chronic conditions. According to research, chronic wounds, including diabetic foot ulcers and pressure ulcers, affect millions of individuals worldwide. In the U.S. alone, approximately 6.5 million people suffer from chronic wounds, with diabetes being a key contributor. A study from the National Institutes of Health (NIH) suggests that diabetic patients are at a heightened risk for developing these wounds, with about 15% of individuals with diabetes developing foot ulcers in their lifetime. As the global population ages, the prevalence of such chronic conditions is expected to grow, thereby increasing the demand for wound care treatments.

Wound Care Market Size and Forecast:

-

Market Size in 2024: USD 22.91 Billion

-

Market Size by 2032: USD 34.05 Billion

-

CAGR (2025–2032): 5.08%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Wound Care Market Highlights:

-

Innovations such as bioengineered skin, negative pressure wound therapy (NPWT), and antimicrobial dressings are transforming wound care, reducing healing time by 40–60% for chronic wounds.

-

Increasing cases of trauma-related injuries, burns, cuts, and surgical wounds (over 1 million surgical wounds annually in the U.S.) are fueling demand for effective wound management solutions.

-

Emerging markets, particularly in Asia-Pacific, are witnessing rapid adoption of wound care solutions due to urbanization, rising healthcare investments, and government initiatives.

-

Growing demand for bioactive dressings, smart bandages, and home care solutions is enhancing patient convenience, usability, and long-term treatment outcomes.

-

Rising healthcare-associated infections (HAIs) and multidrug-resistant infections (MRIs) are boosting the adoption of advanced antimicrobial wound care products.

-

High cost of advanced wound care products and a shortage of skilled professionals remain key barriers to wider adoption, especially in low- and middle-income regions.

Technological advancements are also central to market growth. The development of bioengineered skin and negative pressure wound therapy (NPWT) has revolutionized wound healing, offering more effective and faster solutions for chronic and complex wounds. Additionally, antimicrobial dressings, which have gained popularity due to their ability to reduce infection rates, are further driving the market. As noted by several studies, advanced wound care products are increasingly preferred by healthcare providers due to their superior performance in promoting healing and reducing complications. A report by the Wound Healing Society highlights the effectiveness of these products, demonstrating a 40-60% reduction in healing time for chronic wounds.

Moreover, with the rise in trauma-related injuries, such as burns, cuts, and surgical wounds, there is a growing need for specialized wound care treatments. Data from the Centers for Disease Control and Prevention (CDC) indicates that over 1 million surgical wounds occur annually in the U.S., further driving demand for effective wound management solutions.

Furthermore, improving healthcare infrastructure in emerging markets is enhancing access to wound care products and treatment options. This is particularly important as regions like Asia-Pacific experience rapid urbanization and rising healthcare investments. Government initiatives and funding aimed at improving chronic disease management and wound care have also contributed to market growth, with organizations like the National Wound Care Strategy Programme focusing on improving wound care outcomes.

Wound Care Market Drivers:

-

Advancing Patient-Centric Care with Innovative Wound Solutions

The focus on patient-centric care has significantly influenced the growth of the wound care market, with an increasing emphasis on advanced wound care technologies and home care solutions. Products such as bioactive dressings, smart bandages, and biological wound therapies have gained traction due to their ability to create optimal healing environments, accelerate recovery, and minimize the risk of complications, especially in cases of chronic wounds. These innovations cater to the evolving needs of patients and healthcare providers, ensuring better treatment outcomes. Additionally, the shift toward home care settings has further driven demand for wound care solutions that are convenient, cost-effective, and easy to use. Patients increasingly prefer self-administered products designed with comfort and usability in mind, encouraging the development of user-friendly wound care technologies. This dual focus on advanced solutions and accessibility underscores the market’s commitment to enhancing patient experiences and improving long-term healing outcomes.

-

Addressing the Rising Threat of Healthcare-Associated Infections in Wound Care

The growing concern over healthcare-associated infections (HAIs) is significantly influencing the wound care market. These infections, often occurring in hospital and clinical settings, pose a critical challenge, particularly in the management of surgical and chronic wounds. The prevalence of multidrug-resistant infections (MRIs) has escalated, making it increasingly essential to utilize advanced antimicrobial wound care products. These products help prevent infections, promote faster healing, and mitigate complications associated with resistant pathogens. Furthermore, the rise in antibiotic resistance is driving the development of specialized antimicrobial solutions, such as dressings infused with silver, iodine, or other antimicrobial agents. These innovative products are designed to reduce bacterial load, minimize the risk of infections, and improve overall treatment outcomes. By addressing the limitations of traditional wound care approaches, these solutions play a crucial role in enhancing patient care and reducing the burden of HAIs in healthcare systems worldwide.

Wound Care Market Restraints:

-

Premium Pricing of Advanced Wound Care Products

The premium pricing of advanced wound care solutions, such as bioengineered skin substitutes, negative pressure wound therapy (NPWT), and antimicrobial dressings, can limit their accessibility, particularly in low- and middle-income countries. This cost barrier often leads to reliance on traditional wound care methods, hindering market growth.

-

Lack of Skilled Professionals for Advanced Wound Management

The effective use of modern wound care technologies requires specialized knowledge and training. A shortage of skilled healthcare professionals in both developed and emerging markets poses a significant challenge to the adoption of advanced wound care solutions, impacting their widespread implementation.

Wound Care Market Segment Analysis:

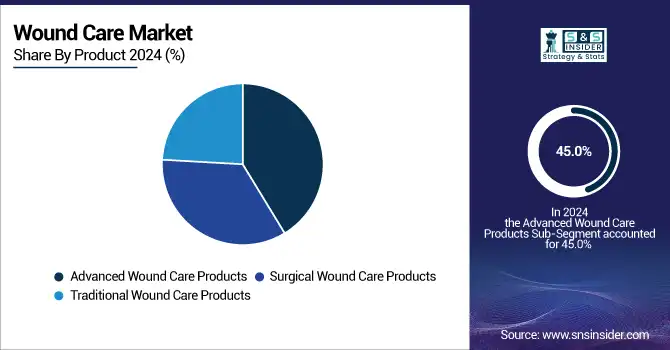

By Product

In 2024, advanced wound care products dominated the market, accounting for approximately 45.0% of the market share. This dominance is attributed to their superior efficacy in managing chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Products such as hydrocolloids, foam dressings, and bioengineered skin substitutes provide optimal moisture balance and reduce healing time, making them a preferred choice among healthcare providers. The rising prevalence of chronic conditions and increasing adoption of advanced therapies in developed regions further supported this segment's dominance.

The surgical wound care products segment is anticipated to exhibit the fastest growth during the forecast period. This growth is driven by the rising number of surgical procedures globally, along with heightened awareness of postoperative care. The increasing focus on reducing surgical site infections (SSIs) has led to a surge in the adoption of surgical tapes, sutures, and staples. Additionally, advancements in wound closure technologies are further propelling the growth of this segment.

By Wound Type

Chronic wounds held the largest market share in 2023, contributing to nearly 55.0% of the market revenue. This is due to the rising incidence of chronic conditions such as diabetes and obesity, which lead to long-term wound complications like diabetic foot ulcers and pressure sores. Chronic wounds require specialized and prolonged care, driving the demand for advanced wound care products, including bioengineered dressings and negative pressure wound therapy (NPWT).

The acute wound segment is poised to grow at the fastest rate, fueled by the increasing prevalence of trauma and burn injuries worldwide. Additionally, the rising number of surgical procedures, particularly in emerging economies, is boosting the demand for products aimed at managing acute wounds, such as surgical tapes, traditional dressings, and antimicrobial solutions.

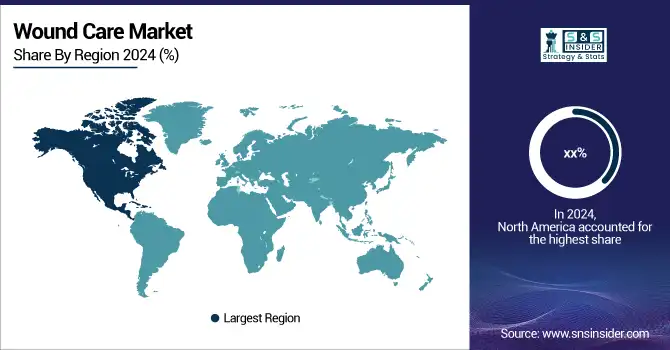

Wound Care Market Regional Analysis:

North America Wound Care Market Trends:

North America dominated the market in 2023, primarily due to its advanced healthcare system, high prevalence of chronic diseases such as diabetes and obesity, and a rising number of surgical procedures. The region’s focus on adopting advanced wound care solutions, coupled with substantial investments in healthcare technology, has bolstered its market position. The presence of major industry players and favorable reimbursement policies further support the market’s growth in the U.S. and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Wound Care Market Trends:

Europe held the second-largest market share, driven by the increasing geriatric population and a higher prevalence of chronic wounds. Countries like Germany, France, and the UK have witnessed rising adoption of advanced wound care products due to better healthcare accessibility and government support for chronic wound management.

Asia-Pacific Wound Care Market Trends:

In contrast, Asia-Pacific is the fastest-growing region in the wound care market, owing to its large patient population, rising healthcare expenditure, and growing awareness about advanced wound care solutions. Rapid urbanization, an increase in surgical procedures, and a surge in road accidents in countries like China, India, and Japan are key growth drivers.

Wound Care Market Key Players:

-

Smith+Nephew

-

Convatec Group PLC

-

Mölnlycke Health Care AB

-

Baxter

-

DeRoyal Industries, Inc.

-

Coloplast Corp

-

Medtronic

-

3M

-

Integra LifeSciences

-

Medline Industries, LP

-

Johnson & Johnson Services, Inc.

-

B. Braun SE

-

MiMedx Group, Inc.

-

Cardinal Health

-

Organogenesis Inc.

-

Derma Sciences (Integra LifeSciences)

-

Hollister Incorporated

-

KCI (Acelity, now part of 3M)

-

Urgo Medical

-

Paul Hartmann AG

Wound Care Market Competitive Landscape:

SolasCure Ltd., established in 2017, is a UK-based biotechnology company specializing in enzymatic debridement therapies. The company’s lead candidate, Aurase®, aims to transform chronic wound treatment by accelerating healing in hard-to-treat wounds through clinical innovation and cutting-edge biotech.

-

In Dec 2024, SolasCure Ltd. partnered with the U.S. Army Institute of Surgical Research (USAISR) to evaluate Aurase Wound Gel, a hydrogel containing the recombinant enzyme tarumase, derived from medical maggots, for managing and promoting healing in combat wounds.

Swift Medical, founded in 2015, is a Canada-based digital health company specializing in wound care technology. The company launched the Skin & Wound 2.0 platform, an AI-powered solution that enables accurate wound imaging, remote monitoring, and advanced analytics to support clinicians in delivering better patient outcomes. Swift Medical is recognized as a leader in digital wound care innovation.

-

In Oct 2024, Swift Medical launched the Skin & Wound 2 platform, an AI-powered solution aimed at accelerating wound healing. Recognized as the gold standard in digital wound care, the platform has supported over 50 million patient assessments across various healthcare settings and is backed by 22 peer-reviewed publications demonstrating its accuracy, equitable AI, and improved healing outcomes.

Human BioSciences Inc., established in 1990, is a U.S.-based biotechnology company specializing in advanced wound care and tissue regeneration solutions. The company develops and manufactures collagen-based products that promote effective healing of chronic and acute wounds. With a focus on innovation and biocompatible technologies, Human BioSciences aims to enhance patient recovery and improve global wound care standards.

-

In May 2024, Human BioSciences Inc., a US-based pharmaceutical company, partnered with Skintech Green Ltd in Kenya to launch advanced collagen products for wound care. The collaboration includes plans to build a multi-million-shilling production facility over the next two years, creating hundreds of direct and indirect job opportunities while improving healthcare in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.91 Billion |

| Market Size by 2032 | USD 34.05 Billion |

| CAGR | CAGR of 5.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Advanced Wound Care Products, Surgical Wound Care Products, Traditional Wound Care Products • By Wound Type [Acute Wound (Surgical & Traumatic Wounds, Burns), Chronic Wound (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds)] • By End User (Hospitals and Clinics, Long-term patient care, Home care settings, Other end users) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Smith+Nephew, Convatec Group PLC, Mölnlycke Health Care AB, Baxter, DeRoyal Industries, Inc., Coloplast Corp, Medtronic, 3M, Integra LifeSciences, Medline Industries, LP, Johnson & Johnson Services, Inc., B. Braun SE, MiMedx Group, Inc., Cardinal Health, Organogenesis Inc., Derma Sciences (Integra LifeSciences), Hollister Incorporated, KCI (Acelity, now part of 3M), Urgo Medical, Paul Hartmann AG. |