Acrylic Adhesives Market Analysis & Overview:

The Acrylic Adhesives Market Size was valued at USD 14.4 billion in 2023 and is expected to reach USD 24.1 billion by 2032 and grow at a CAGR of 6.0% over the forecast period 2024-2032.

Get More Information on Acrylic Adhesives Market - Request Sample Report

The acrylic adhesives market is growing rapidly with increasing demands from the construction, automotive, electronics, and packaging industries. Acrylic adhesives possess excellent bonding strength, flexibility, and durability, making it indispensable for long-lasting adhesion in applications. The market dynamics are driven by development in product formulation, such as pressure-sensitive adhesives, and integration of eco-friendly components. Companies are focusing on developing products that can exhibit enhanced performance to meet the increasing demands of industries and consumers. Some recent innovations include flame-resistant adhesives capable of offering thermal stability and bonding to various substrates under stringent requirements. In May 2024, Dow sold its flexible packaging laminating adhesives business to Arkema. Underlining its strategy for expanding the portfolio of high-performance material, particularly in adhesives, said Arkema. The integration of Dow's already well-established technology continues to support Arkema's ability to continue to provide high-end adhesion solutions for flexible packaging that serves the food and beverages and pharmaceutical markets. It reflects more attention to a much more sustainable, higher-performance adhesives market, as companies like Arkema are strategically stepping up to meet changing customer needs and regulatory expectations in the adhesives markets.

Additionally, another milestone event occurred during December 2023 with the introduction of new flame-retardant pressure-sensitive adhesives developed by a European lab. These adhesives are developed, keeping in view the need for safety in critical industries such as electronics and transportation. Flame-retardant adhesives are growing important as they offer safety compliance along with good adhesive performance. This is reflective of the emerging trend within the acrylic adhesives market: precision products addressing both performance demands as well as environmental concerns.

These latest developments underscore that innovation, sustainability, and safety are the foci of the acrylic adhesives market. Companies such as Arkema and Dow are driving that future into reality through acquisitions and product development. The focus here is on providing bonding agents with improved efficiency in performance, lower adverse effects to the environment, and aggressive, long-term bonds that can be attained in diversified industrial applications. Responding to this trend are advanced solutions coupled with more stringent regulatory standards and consumer preferences on sustainability, particularly in markets representing diversified industries-notably packaging and electronics.

Acrylic Adhesives Market Dynamics:

Drivers:

-

Growing Demand for Lightweight and Durable Bonding Solutions Driving Acrylic Adhesives Market Growth

The growing need for lightweight, flexible, and strong bonding solutions in every industry is the key driving factor behind the acrylic adhesives market. Acrylic adhesives find applications in sector-specific markets like automotive, electronics, and construction, solely because of their superior strength of bonding, flexibility, and resistance to heat and chemicals. For instance, acrylic adhesives find an important use in the automotive world, as they replace traditional mechanical fasteners to improve fuel efficiency. Similarly, in electronics, high precision and reliability in bonding of the most delicate pieces of equipment require acrylic adhesives. In building construction, acrylic adhesives are also largely used because they bond materials like glass, metal, and concrete in low-energy buildings. With further emphasis on durability and weight reduction in industries, advanced acrylic adhesives will increase demand and continue to drive market growth.

-

Rising Adoption of Acrylic Adhesives in the Growing Electronics Industry Stimulates Market Expansion

The growth in the electronics industry, especially consumer electronics and telecommunications, is accelerating the expansion of the market. In recent times, the electronics industry has faced an increasing demand for smaller size, efficiency, and durability, leading the use of acrylic adhesives because of their excellent bonding performance and stress endurance. High reliability adhesives are critical in assembling parts such as circuit boards, sensors, and screens with high bonding precision, protecting them from environmental factors such as moisture and heat. Increased demand for smartphones, tablets, wearable devices, and other electronic gadgetry boosts the demand for reliable adhesives that can ensure long-term product performance. In addition, the elevated use of 5G technology and advancements in IoT further increase the usage of acrylic adhesives within electronic assemblies. Hence, this will lead to constant growth during the next few years.

Restraint:

-

Volatile Raw Material Prices Restrain Acrylic Adhesives Market Growth

The fluctuation in the price of raw materials, especially the usage of petroleum-based components in the production of acrylic adhesives, is a major hindrance for the market. Acrylic adhesives are dependent on petrochemical derivatives. Therefore, any sudden change in the price of crude oil directly influences the cost of production. Variability in crude oil markets over the years has been dominated by frequent booms and busts triggered by geopolitical tensions, trade restrictions, and shifting demand patterns. This makes the pricing of acrylates and resins key raw materials really unpredictable, posing serious challenges for manufacturers to deliver a fixed pricing level for their products, especially when they are simultaneously pursuing cost competitiveness and profitability. Small and medium-sized companies operating in the adhesive industry also face such price fluctuations that these fluctuations hamper production and recover lower profit margins. The growing demand for alternative raw materials or investment in cost-saving technologies also increases costs to operations, thereby further limiting the growth of the market.

Opportunity:

-

Increasing Focus on Sustainable and Bio-Based Acrylic Adhesives Presents New Market Opportunities

The growing concern about sustainability in industries unlocks enormous growth opportunities for bio-based acrylic adhesives. It is because manufacturers are now focusing on an adhesive with lesser environmental harm as consumers look for greener alternatives, while their stringent rules are under development. Nonetheless, the most significant benefit of bio-based acrylic adhesives is that they are formulated from renewable resources, making it more sustainable than traditional petroleum-based adhesives. This trend towards 'green products' is also highly reflected in the packaging, construction, and automobile sectors where companies are aggressively working to reduce their carbon footprint. Innovations in green chemistry and adhesives with low VOC emissions are gaining momentum and thus ready to provide fertile grounds for market growth. Because sustainability will be the major concern for firms across the world, demands for acacia-based adhesives in eco-friendly solutions are expected to rise in the acrylic adhesives market.

Challenge:

-

Technical Challenges in Achieving Optimal Performance in Extreme Conditions Pose Market Hurdles

The most commonly overcome performance of acrylic adhesives in their market is the inconsistency that they tend to undergo under extreme environmental conditions. Although acrylic adhesives are strong and versatile, they tend to become unresponsive when put under unfavourable high temperature conditions, extreme conditions of humidity, or when exposed to chemicals. Adhesives in aerospace, automotive, and electronics require industrial applications where parts are under extreme stress or temperature conditions, so they cannot degrade or lose their bonding integrity while maintaining the needed performance. This is a technical challenge to the manufacturer since all demands should be appropriately addressed considering environmental and safety standards. The formulation has to continue to innovate for improvement in heat resistance, UV stability, and chemical durability, which are all complicating factors in production, hence more costly from R&D to actual production. It is a challenge that manufacturers need to overcome if they are going to stretch the applicability of acrylic adhesives in demanding industrial applications.

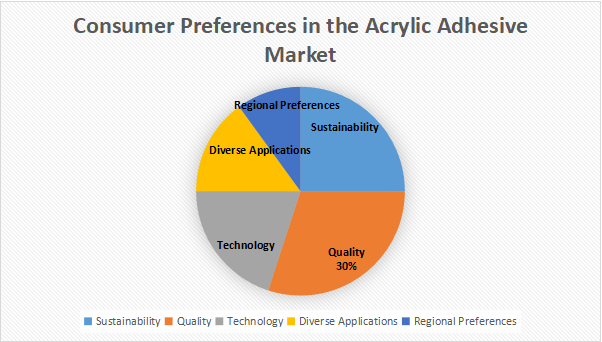

Key Insights on Consumer Behavior and Preferences in the Acrylic Adhesive Market

|

Aspect |

Description |

Key Insights |

|---|---|---|

|

Sustainability |

A growing preference for eco-friendly products, especially water-based adhesives with low VOCs. |

Reflects consumer awareness of environmental impacts. |

|

Quality Over Cost |

Increasing willingness to invest in high-performance adhesives that ensure durability and reliability. |

Consumers favor long-lasting solutions, reducing replacements. |

|

Technological Innovations |

Interest in new technologies like UV-curable adhesives and specialized formulations that cater to specific needs. |

Consumers are becoming more informed and seek innovative products. |

|

Application Diversity |

Acrylic adhesives are used across various industries such as automotive, construction, and medical, each with unique requirements. |

Understanding industry-specific needs is crucial for product development. |

|

Regional Variations |

Preferences differ by region, with Asia-Pacific emphasizing cost-effective solutions, while mature markets focus on sustainability and performance. |

Tailored marketing strategies are necessary to address regional demands. |

Acrylic Adhesives Market Segments

By Type

In 2023, the Acrylic Polymer Emulsion segment dominated the global acrylic adhesives market with around 45% market share. The dominance is because the acrylic polymer emulsions have high adhesive strength and flexibility along with environmentally friendly composition based on water. The vast variety of their application in such industries as packaging, construction, and woodworking made them successful. For instance, the acrylic polymer emulsions are used more in the packaging industry for bonding paper and plastic, considering such emulsions can have excellent durability and moisture resistance. With its eco-friendly nature and vast range of applications, this segment enjoys immense preference across a wide variety of sectors that seek environmentally friendly bonding solutions.

By Technology

In 2023, the Water-Based technology segment dominated and had the highest estimated market share of about 50%. That is because the water-based acrylic adhesives are highly demanded since they have low emissions of volatile organic compounds and environmental advantages. They are used majorly in the construction and packaging industries, in which it is beneficial to the environment and adheres to strict regulations concerning minimal chemical emissions from adhesives. For example, in construction, water-based adhesives fit well with the adhesion of materials like wood and textiles without any harmful solvent provide by other adhesives. The increasing demand for eco-friendly and sustainable adhesive solutions worldwide has remarkably spurred adoption of water-based technologies.

By Application

The Paper & Packaging industry dominated and had about 35% market share in the acrylic adhesives market in 2023. This is contributed by the extensive usage of acrylic adhesives in packaging solutions such as food and beverage, consumer goods, and e-commerce. It provides excellent bonding for a myriad of packaging materials such as paper, plastic, or cardboard, ensuring strong seals and durability. Acrylic adhesives are widely used in the bonding of corrugated boxes and flexible packaging, examples include e-commerce with its growing requirement for safe packaging that ensures product integrity when transporting.

Acrylic Adhesives Market Regional Analysis

The Asia-Pacific region dominated the acrylic adhesives market in 2023, accounting for an approximate 40% market share. The dominance of the region is primarily due to the rising industrialization and growth in major end-use industries like construction, automotive, and electronics in China, India, and Japan. China, among other countries, is one of the world's manufacturing hubs that contributes to a significant demand in the area of packaging and electronics, among others, for acrylic adhesives. The construction boom in India continues to drive demand for acrylic adhesives in infrastructure projects where bonding materials such as glass, metal, and wood will be extensively used. The growth of the automotive sector across Asia-Pacific has expanded applications of acrylic adhesives in lightweight bonding further strengthening leadership in the region.

Moreover, the North American region emerged as the fastest growing region in the acrylic adhesives market, with a CAGR of approximately 6% during 2023. This region undergoes a fast-changing requirement for environmentally friendly and high-performance adhesives in various packaging, medical, and construction markets. Strong regulatory requirements addressing environmental issues create the urgent need for low VOC water-based acrylic adhesives in the U.S. and Canada, leading to rapid adoption. North America has greatly depended on acrylic adhesives for medical device assembly, as well as different wound care applications. The growth in healthcare technologies mainly drives the demand in North America, hence moving the region's growth in this market forward.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

3M (Scotch Weld Acrylic Adhesive DP810, Scotch Weld Structural Adhesive DP420)

-

Avery Dennison Corporation (Avery Dennison V-5720, Avery Dennison V-5200)

-

B. Fuller Company (Flextra, Latticed)

-

Bostik (Bostik 785, Bostik GreenStreak)

-

Eastman Chemical Company (Eastman Tenacam 710, Eastman Acrylate Adhesives)

-

Henkel AG & Co. KGaA (Loctite EA 3478, Loctite 326)

-

Huntsman International LLC (Araldite 2011, Araldite 2020)

-

Permabond LLC (Permabond 105, Permabond 205)

-

Pidilite Industries Limited (Fevicol MR, Fevicol SE)

-

Royal Adhesives & Sealants (Royal 575, Royal 665)

-

Sika AG (SikaFast 5215, Sikaflex 221)

-

Tonsan Adhesive Inc (Tonsan 955, Tonsan 3210)

-

TOAGOSEI CO., LTD (TOAGOSEI ACRYLOID, TOAGOSEI ACRY-FLEX)

-

Adhesive Technologies (Hotmelt Adhesives, Water-based Adhesives)

-

AkzoNobel N.V. (AkzoNobel Acrylic Adhesive, AkzoNobel Duramune)

-

LORD Corporation (LORD 406, LORD 756)

-

Momentive Performance Materials Inc. (Momentive SilGrip, Momentive UV-Curable Adhesives)

-

Parson Adhesives, Inc. (Parson 1500, Parson 5000)

-

Scott Bader Company Limited (Crystic Adhesive, Scott Bader Acrybond)

-

Wacker Chemie AG (Wacker 2K Silicones, Wacker Silpaste)

Recent Developments

-

July 2024: Trinseo launched a new adhesive for dry lamination in flexible packaging, focusing on performance and sustainability.

-

May 2024: Dow sold its laminating adhesives business for flexible packaging to Arkema for about $150 million, allowing Dow to stay put within core areas while broadening flexible packaging market penetration for Arkema. The transaction is expected to be completed by the end of 2024, subject to regulatory clearances

-

November 2023: Henkel introduced the first and only medical-grade light-cure adhesive that's specifically designed for use in body-worn devices. IBOA and other skin-sensitizing monomers-free, the product conforms to the EU MDR 2017 requirements on the use of CMR substances in the production of medical devices.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 14.4 Billion |

|

Market Size by 2032 |

USD 24.1 Billion |

|

CAGR |

CAGR of 6.0% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Acrylic Polymer Emulsion, Methacrylic, Cyanoacrylic, UV Curable Acrylic) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

3M, Avery Dennison Corporation, Henkel AG & Co. KGaA, Sika AG, Eastman Chemical Company, Royal Adhesives & Sealants, TOAGOSEI CO., LTD, Permabond LLC, B. Fuller Company, Pidilite Industries Limited, Bostik, Huntsman International LLC, Tonsan Adhesive Inc and other key players |

|

Drivers |

•Growing Demand for Lightweight and Durable Bonding Solutions Driving Acrylic Adhesives Market Growth |

|

Restraints |

•Volatile Raw Material Prices Restrain Acrylic Adhesives Market Growth |