Spicy Dairy Products Market Report Scope & Overview:

Get More Information on Spicy Dairy Products Market - Request Sample Report

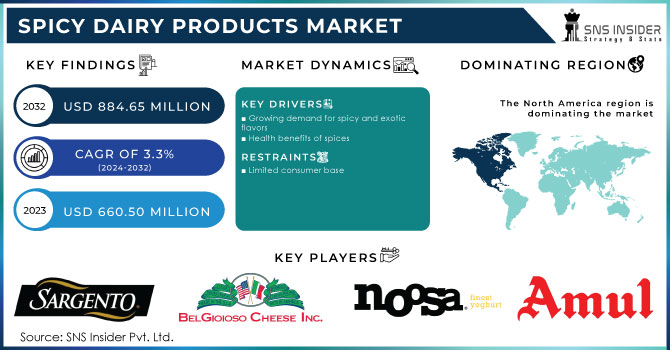

The Spicy Dairy Products Market size was USD 660.50 million in 2023 and is expected to Reach USD 884.65 million by 2032 and grow at a CAGR of 3.3 % over the forecast period of 2024-2032.

Dairy products that have been spiced up with flavors like cumin, chili powder, or black pepper are referred to as spicy dairy products. They include a variety of items such as buttermilk, cheese, ice cream, butter, yogurt, curd, cream cheese, paneer, and others. The dairy sector is placing a lot of emphasis on spicy dairy products. These products are available in Liquid, solid, and other form.

Based on spices, the market is categorized into Garlic, pepper jack, chilly, herbs, Habanero Jack, Spicy jalapeno, Jalapeno White Cheddar, Peppadew Pepper, and Cardamom.

Based on Product Type, spicy dairy products are available as Processed Milk Casein, Cheese, Yogurt, Buttermilk, Dessert, Butter, Milk Powder, Condensed milk, Cream, and Other products.

MARKET DYNAMICS

KEY DRIVERS

-

Growing demand for spicy and exotic flavors

Customers are increasingly looking for new and intriguing flavors, and spicy dairy products provide a tasty and novel way to enjoy conventional dairy products. Spicy dairy products are frequently used in ethnic cuisines such as Indian, Mexican, and Thai. This is contributing to the expanding global appeal of these items. Spicy dairy products are becoming increasingly accessible in supermarkets and restaurants, making them easier for customers to buy and enjoy. Many spices, including chili peppers and turmeric, have been demonstrated to offer a variety of health advantages, including inflammation reduction and immune system stimulation. Spicy cheese can be used to make quesadillas, nachos, and mac & cheese. Dips, dressings, and sauces can all be made with spicy yogurt. Spicy ice cream can also be made into milkshakes, floats, and desserts.

-

Health benefits of spices

RESTRAIN

-

Limited consumer base

Spicy dairy products are not as popular as typical dairy products everywhere. This is because some consumers are not used to hot flavors, or they have dietary restrictions that limit them from eating spicy dishes. Spicy foods are considered harmful or even banned in some cultures. Furthermore, some people may have sensitive stomachs or spice allergies, which may prevent them from enjoying spicy dairy products.

OPPORTUNITY

-

Expansion of spicy dairy products into new markets

There are a number of emerging markets where ethnic cuisines are popular, and where consumers are increasingly seeking out unique and exciting flavors. Spicy dairy products are becoming increasingly popular in countries including the U.S., Canada, Mexico, Brazil, and Argentina. The popularity of spicy flavors drives demand for spicy dairy products in the region, with supermarkets and hypermarkets serving as the primary distribution channels. Spicy cheese is a popular item in the area.

CHALLENGES

-

Availability of substitute products

Almond milk, soy milk, and coconut milk are just a few of the plant-based dairy substitutes available. These products are frequently considered as being healthier and more environmentally friendly than typical dairy products. There are also a variety of non-dairy spicy foods available, including as vegan cheese, vegan yogurt, and vegan ice cream. These products are gaining popularity among consumers looking for dairy-free options.

-

Price-sensitive consumers

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine are major producers of dairy products, including milk, cheese, and yogurt. The war has disrupted the supply of these products to other countries, including those that produce spicy dairy products. The war has also caused the prices of dairy products to rise. This is due to a number of factors, including the increased cost of feed and fuel, as well as the disruption of supply chains. The war has also led to a reduction in consumer demand for spicy dairy products. This is due to a number of factors, including the rising cost of living, the uncertainty caused by the war, and the reduced availability of disposable income. The price of milk has increased by 20% in the United States since the start of the war.

IMPACT OF ONGOING RECESSION

The recession has impacted the spicy dairy products market. In the most recent CPI report, the cost of ice cream, which is created with ingredients like milk and eggs, increased by 15% annually. India's spice exports appear to have been harmed by the world economic downturn. In dollar terms, the shipments between April and November of the current fiscal year decreased by 6.5% from the same time last year. The war has disrupted spicy dairy products so they may shift to dairy products as consumers prefer to prefer less cost items.

MARKET SEGMENTATION

By Spices

-

Garlic

-

pepper jack

-

chilly

-

herbs

-

Habanero Jack

-

Spicy jalapeno

-

Jalapeno White Cheddar

-

Peppadew Pepper

-

Cardamom

By Product Type

-

Liquid

-

Solid

-

Others

By Form

-

Processed Milk Casein

-

Cheese

-

Yogurt

-

Buttermilk

-

Dessert

-

Butter

-

Milk Powder

-

Condensed milk

-

Cream

-

Others

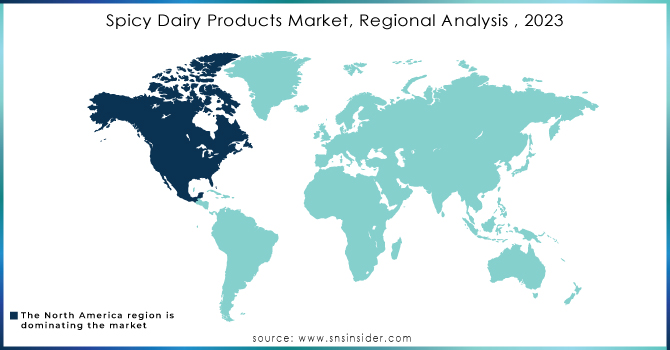

REGIONAL ANALYSIS

The North American market for Spicy Dairy Products is expected to grow at a rapid pace, with the United States being the leading consumer. Spicy dairy products like cheese, yogurt, and ice cream are in high demand in the region. In 2022, the United States accounted for 29.8% of the global market, with a value of USD 205.8 million.

Europe has a significant market in 2022 due to Spicy dairy products becoming increasingly popular in Europe, with key consumers including France, Germany, and the United Kingdom. The region's demand for spicy dairy products is being pushed by the growing trend of healthy snacking as well as an increased interest in spicy flavors. The food service industry consumes a substantial amount of hot dairy products, with increasing popularity on Internet channels.

The Asia Pacific region is witnessing rapid growth in the market for spicy dairy products, with countries like India, China, and Japan being major consumers. The China lemongrass oil market grew at a rate of 4 % CAGR in the forecast period. Spicy yogurt is a popular product in the region, and the increasing popularity of Western-style diets and fast food has also led to an increase in the consumption of spicy dairy products.

The Middle East and Africa are emerging markets for spicy dairy products, with countries such as Saudi Arabia, the United Arab Emirates, and South Africa being major consumers. The region's demand for spicy dairy products has been driven by a growing interest in spicy flavors and an increase in demand for healthy snack options. The food service sector is the region's largest consumer of spicy dairy products.

Need any customization research on Spicy Dairy Products Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Spicy Dairy Products Market are SARGENTO FOODS INC, BelGioioso Cheese, Inc., Organic Valley, Noosa Yoghurt, Amul, Cabot Creamery, Sangam Paneer, Kraft Heinz Company, Tillamook County Creamery Association, PIERRE'S ICE CREAM COMPANY, Chobani, LLC, Britannia Industries Limited, Schreiber Foods Inc., and other key players.

RECENT DEVELOPMENTS

In 2023 Lee Kum Kee U.S.A., a major manufacturer of authentic Asian sauces and condiments, launched Sriracha Milk, the trendiest new milk trend. This one-of-a-kind product will tantalize your palate with a sweet and scorching touch of spicy flavor, followed by a pleasantly relaxing aftertaste that you'll want to repeat.

In 2022, In honor of the Matariki public holiday, Lewis Road Creamery introduces Winter Spice Milk. The artisanal dairy business is currently introducing Winter Spice, a limited-edition flavor of milk flavored with horopito, often known as pepper tree and inspired by Matariki.

In 2022, Singaporeans were perplexed after FamilyMart Taiwan introduced "Singapore flavor" pepper milk tea. Singaporeans love their tea in a variety of ways, from a mug of traditional teh tarik to a cup of energizing bubble tea.

| Report Attributes | Details |

| Market Size in 2023 | US$ 639.4 Million |

| Market Size by 2032 | US$ 829 Million |

| CAGR | CAGR of 3.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Spices (Garlic, pepper jack, chilly, herbs, Habanero Jack, Spicy jalapeno, Jalapeno White Cheddar, Peppadew Pepper, Cardamom) • By Form (Liquid, solid, others) • By Product Type (Processed Milk Casein, Cheese, Yogurt, Buttermilk, Dessert, Butter, Milk Powder, Condensed milk, Cream, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SARGENTO FOODS INC, BelGioioso Cheese, Inc., Organic Valley, Noosa Yoghurt, Amul, Cabot Creamery, Sangam Paneer, Kraft Heinz Company, Tillamook County Creamery Association, PIERRE'S ICE CREAM COMPANY, Chobani, LLC, Britannia Industries Limited, Schreiber Foods Inc. |

| Key Drivers | • Growing demand for spicy and exotic flavors • Health benefits of spices |

| Market Restrain | • Limited consumer base |