Sports Nutrition Market Report Scope & Overview:

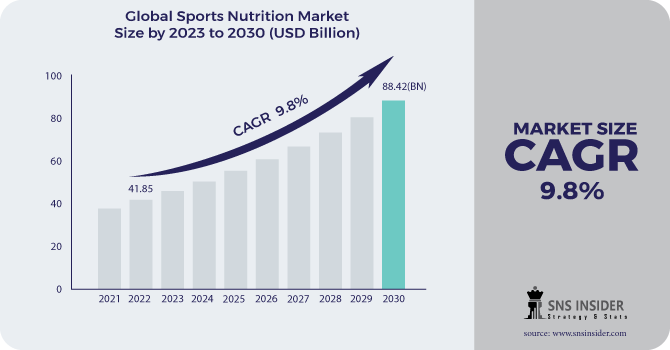

Sports Nutrition Market size was esteemed at USD 41.85 billion of 2022 and is supposed to arrive at USD 88.42 billion by 2030 at a build yearly development rate (CAGR) of 9.8% from 2023 to 2030.

The idea of sports nutrition rotates around the utilization of explicit supplements including minerals, nutrients, supplements, and certain natural mixtures involving proteins, fats, and sugars. Development in the market will be driven by expanding interest in nutrition bars, prepared-to-drink items, and energy bars; and developing the noticeable quality of protein as the most omnipresent and significant fixing.

Proteins are supposed to acquire ubiquity as a viable wellspring of a fair and healthful eating routine because of their useful advantages like an unrivaled healthy benefit, backing to the invulnerable framework, and weight the executives. Extra development drivers incorporate dramatic development of gyms, wellness focuses, and sporting outfits; gigantic capability of non-protein items; expanding utilization of sports refreshments as reward drinks; rise of the Internet, especially online entertainment, as the new advertising stage; consistent send-off of items with normal fixings that offer dependable and economical energy benefits; and always changing flavor patterns.

Nutrition and diet are fundamental for the greatest execution. Sports nutrition items offer advantages, for example, ideal additions from preparing, expanded recuperation among exercises and occasions, upkeep and accomplishment of ideal body weight, diminished injury hazard, and execution consistency. Reception of sports nutrition items by competitors inferable from their benefits is a significant boundary driving the market.

Market Dynamics:

Driving Factors:

-

Expanding mindfulness among shoppers connected with individual prosperity and wellbeing is expected.

-

Significant medical advantages.

Restraining Factors:

-

Sports drinks were ordinarily utilized by competitors to recharge the water level in the body.

Opportunity:

-

Makers and retailers working in the market are engaged with new item advancement, joint efforts, and associations to increment item reception and in this way drive deals.

Challenges:

-

Meeting the genuine requirements of a different and growing shopper base.

-

To give a satisfactory item to wellness devotees.

Impact of Covid-19:

The COVID-19 pandemic has brought about a decrease in the deals on sports supplements as customers were centered around buying fundamental merchandise. In addition, the transitory conclusion of rec centers, wellness focuses, gyms, and sports foundations harmed the ideals of sports nutrition items. Notwithstanding, online deals expanded quickly in 2020 as purchasers moved to internet business to stay away from swarmed puts and keep up with cleanliness because of COVID-19. Expanding mindfulness concerning well-being and a sound way of life is assessed to drive the interest in sports nutrition sooner rather than later.

Key Market Segmentation:

By Function:

-

Energizing Products

-

Rehydration

-

Pre-workout

-

Recovery

-

Weight Management

Sports Nutrition Market by Product Form:

-

Ready-to-Drink Sports Supplements

-

Energy & Protein Bars

-

Powder Sports Supplements

-

Sports Supplement Tablets/Capsules

Sports Nutrition Market by Flavor:

-

Regular Sports Nutrition Supplements

-

Flavoured Sports Nutrition Supplements

-

Fruit Punch

-

Berries

-

Citrus

-

Chocolate

-

Vanilla

-

Other Flavours

Sports Nutrition Market by Sales Channel:

-

Modern Trade

-

Convenience Stores

-

Specialty Stores

-

Pharmacy Stores

-

Online Retail

-

Other Sales Channels

Sports Nutrition Market by Nature:

-

Organic Sports Nutrition Supplements

-

Conventional Sports Nutrition Supplements

Sports Nutrition Market by Price Range:

-

Economic Sports Nutrition Products

-

Premium Sports Nutrition Products

.png)

Sports supplements represented the biggest income portion of more than 50.0% in 2021 inferable from the developing utilization of protein enhancements, for example, whey protein and the accessibility of different plant proteins like soy, spirulina, pumpkin seed, hemp, rice, and pea. Besides, expanding utilization of proteins for muscle reinforcing by competitors and rec center attendees is assessed to fuel the market development. Besides, the accessibility of a huge assortment of protein supplements in retailers including Walmart, Amazon, and Vitamin Shoppe will uphold the section development.

The post-exercise portion held the biggest income portion of more than 35.0% in 2021. Post-exercise supplements offer advantages, for example, fixing harmed muscles, improved muscle gain, recuperation, and support of bulk. Various advantages of post-exercise supplements and expanding mindfulness in regards to post-exercise supplements are assessed to fuel the portion development. Post-exercise enhancements like extended chain amino acids, glutamine, and casein are building up some decent momentum worldwide attributable to the developing mindfulness in regards to their advantages.

The physical portion held the biggest income portion of more than 75.0% in 2021. There is the simple accessibility of an enormous number of items in physical stores, for example, specialty stores, little retail locations, wellness foundations, supermarkets, and general bargain shops. In addition, physical stores offer client dedication projects and enrollment benefits. This multitude of boundaries is liable for the huge income share.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players:

Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo, Cliff Bar, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, BA Sports Nutrition, Cardiff Sports Nutrition

Quest Nutrition-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 41.85 Billion |

| Market Size by 2030 | US$ 88.42 Billion |

| CAGR | CAGR 9.8% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Function (Energizing Products, Rehydration, Pre-workout, Recovery, Weight Management) • by Flavor (Regular Sports Nutrition Supplements, Flavoured Sports Nutrition Supplements, Fruit Punch, Berries, Citrus, Chocolate, Vanilla, Other Flavours) • by Product Form • by Sales Channel, by Nature |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo, Cliff Bar, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, BA Sports Nutrition, Cardiff Sports Nutrition |

| Key Drivers | •Significant medical advantages. |

| Restraints | •Sports drinks were ordinarily utilized by competitors to recharge the water level in the body. |