Cocoa Fiber Market Report Scope & Overview:

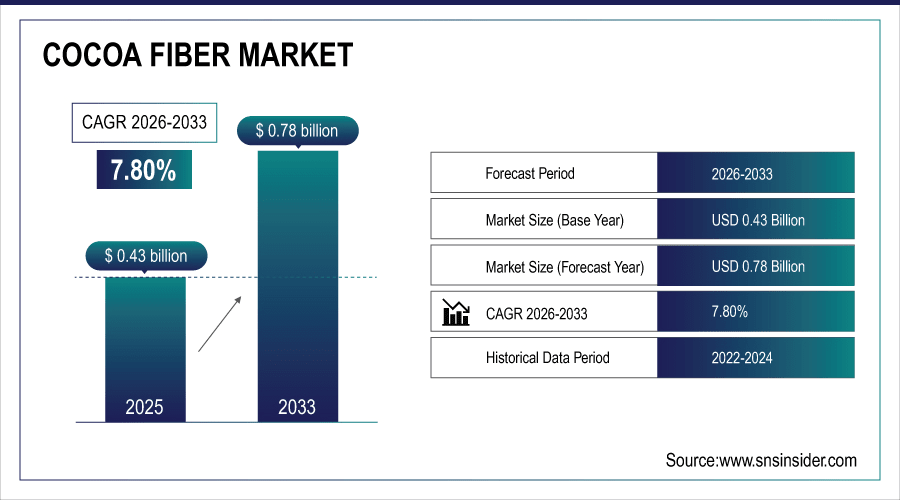

The Cocoa Fiber Market size was valued at USD 0.43 Billion in 2025E and is projected to reach USD 0.78 Billion by 2033, growing at a CAGR of 7.80% during 2026-2033.

The global market growth is attributed to increasing consumer demand for health-oriented, high-fiber foods as well as growing consumption of cocoa by-products in bakery, confectionery and functional food items. With a growing demand for more natural, sustainable, and nutrient-dense ingredients, manufacturers have been breaking the mold by innovating with cocoa fiber. Growing use in the fields of beverage, nutraceutical, or personal care applications further promotes market expansion as cocoa fiber continues to become an ever-important ingredient across the world food and wellness landscape.

More than 40% of new bakery and confectionery products are fortified with cocoa fiber to enhance nutritional value.

To Get More Information On Cocoa Fiber Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 0.43 Billion

-

Market Size by 2032: USD 0.78 Billion

-

CAGR: 7.80% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cocoa Fiber Market Trends

-

Increasing consumer focus on dietary fiber benefits like improved digestion, blood sugar control, cholesterol reduction, and lower heart disease risk is boosting market growth.

-

Cocoa fiber is widely used in bakery, confectionery, and snack products to enhance nutritional profiles.

-

Its prebiotic nature and antioxidant properties make it a preferred choice for novel food product formulations.

-

Consumers are increasingly seeking natural, clean-label, and plant-based ingredients in food and beverage products.

-

Cocoa fiber is being developed into high-fiber snacks, drinks, and supplements, expanding its applications in functional foods.

-

Rising vegan and vegetarian consumers preferring sustainable and nutrient-rich ingredients support cocoa fiber adoption and global market expansion.

-

Cross-border digital retail expansion and subscription models are boosting brand visibility, premium product penetration, and recurring sales globally.

U.S. Cocoa Fiber Market Insights

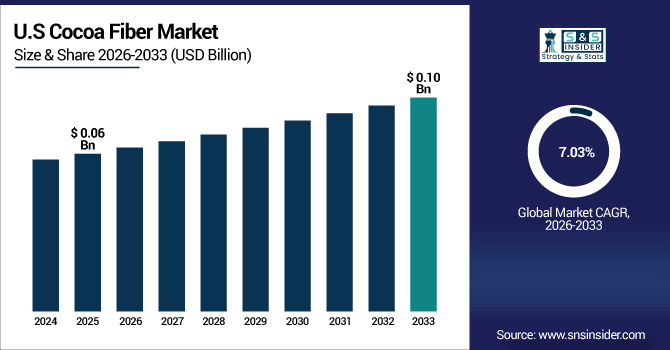

The U.S. Cocoa Fiber Market size was valued at USD 0.06 Billion in 2025E and is projected to reach USD 0.10 Billion by 2033, growing at a CAGR of 7.03% during 2026-2033. The U.S. market is growing on the back of increasing health awareness and rising demand for food & beverage products containing fiber-enriched products. The adoption is driven by the expansion of bakery, confectionery and nutraceuticals sectors, and rising trend of clean label and natural ingredients. E-commerce platforms have enabled manufacturers to expand and offer novel cocoa fiber-based products, which is likely to stimulate market growth as export of fiber-rich functional foods expand in the U.S. market.

Cocoa Fiber Market Growth Drivers:

-

Increasing Health-Consciousness and Demand for Functional Food Products Globally

Growing consumer awareness regarding dietary fiber consumption coupled with dietary fiber health benefits such as improved bowel regularity, stool frequency, stool form, lower gastrointestinal transit times, improved blood sugar levels, lower blood cholesterol, and reduced risk of coronary heart diseases is positively driving the market growth. Today, cocoa fiber can be found as a functional ingredient in bakery, confectionery and snack products because they may augment nutritional profiles. The prebiotic nature and antioxidant attributes of cocoa fiber have led manufacturers to use them when producing novel foods. The increasing demand for cocoa fiber in food and beverage sectors is being bolstered by this transition to healthy foods along with government regulations for healthier diets, ensuring the market growth during the coming years.

Over 25% of functional food products emphasize cocoa fiber for improving digestion and gut health.

Cocoa Fiber Market Restraints:

-

Limited Consumer Awareness About Cocoa Fiber Benefits Restricting Market Growth

While cocoa fiber is packed with helpful health benefits like a high level of dietary fiber and antioxidant properties and many other health advantages, the consumer is not aware of this and does not take the advantage of eating cocoa fiber. Low awareness of its uses in food, beverage and personal care products may limit uptake. It needs marketing and education campaigns to showcase its health and functional attributes. However, cocoa fiber-enriched products have low demand in regions where awareness about their health benefits is less, which can hamper the growth of cocoa fiber market. However, this lack of consumer education remains one of the biggest obstacles to growth across the globe.

Cocoa Fiber Market Opportunities:

-

Rising Demand for Plant-Based and Clean-Label Products Creating New Growth Avenues

Cocoa fiber leverages growing consumer demand for natural, clean-label and plant-based products. The incorporation of its use in bakery, confectionery and functional food products addresses the market seeking more healthy and plant-based ingredients. Cocoa fiber innovation Cocoa fiber can be made into high-fiber snacks, drinks, and food supplements that manufacturers can use. The increasing vegan and vegetarian population that prefers sustainable and rich nutrient ingredients also projects a positive outlook for this trend. Through the expansion of product portfolios to incorporate cocoa fiber, companies can penetrate new market segments and generate higher global revenue streams.

More than 35% of plant-based food launches now feature cocoa fiber as a natural, high-fiber ingredient.

Cocoa Fiber Market Segmentation Analysis

-

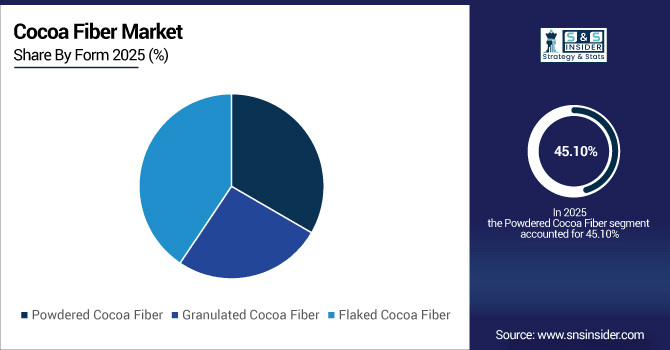

By Form, Powdered Cocoa Fiber led the market with 45.10% share in 2025E, while Granulated Cocoa Fiber is registering the fastest growth with a CAGR of 8.68%.

-

By Product Type, Cocoa Powder led the Cocoa Fiber Market with a 40.20% share in 2025E, while Cocoa Fiber is the fastest-growing segment with a CAGR of 9.56%.

-

By Application, the Food and Beverage Industry sector dominated the market with 40.50% share in 2025E, whereas the Cosmetics and Personal Care segment is expected to grow fastest with a CAGR of 8.85%.

-

By Distribution Channel, Supermarkets and Hypermarkets held 35.20% share in 2025E, whereas Online Retail sector is growing the fastest with a CAGR of 8.42%.

By Form, Powdered Cocoa Fiber Lead While Granulated Cocoa Fiber Registers Fastest Growth

Powdered Cocoa Fiber segment dominated Cocoa Fiber Market with the highest revenue share of about 45.10% in 2025E owing to its easy integration into various types of bakery, beverage, and functional food products Uniformity, extended shelf-life, and the ability to be incorporated into multiple formulations makes it a more favorable option for manufacturers. Olam International Powdered cocoa fiber is used in a variety of food and beverage applications worldwide. On the basis of form, Granulated Cocoa Fiber segment is expected to constitute maximum market share and grow at fastest CAGR of nearly 8.68% during 2026-2033, owing to its improved solubility, easy transportation and rising utilization in ready-to-eat foods, snacks, and dietary supplement.

By Product Type, Cocoa Powder Leads Market While Cocoa Fiber Registers Fastest Growth

The Cocoa Powder segment of the Cocoa Fiber Market accounted for the largest revenue share of about 40.20% in 2025E, owing to its extensive utilization in bakery, confectionery, and beverage products. All these reasons make it the ideal solution for manufacturers due to its flavor-enhancing nature, high consumer acceptance, versatility, and more. Cocoa powder is widely used in Barry Callebaut's unique and innovative product ranges as a leading global cocoa processor. The Cocoa Fiber segment is anticipated to realize the highest CAGR of approximately 9.56% during 2026-2033, owing to the rising understanding of dietary fiber advantages in sustenance and an increase in the capacity for functional foods containing cocoa.

By Application, Food and Beverage Industry Dominate While Cosmetics and Personal Care Shows Rapid Growth

The Food & Beverage Industry segment held the largest revenue share of 40.50% in the Cocoa Fiber Market in 2025E, with the immense application of cocoa fiber in bakery, confectionery and functional food. Its medicinal properties, enhancing consistency and palatability score this as an immediate darling. CocaFiber is one of the cocoa fibers that Cargill Inc., one of the leading ingredient suppliers, use in a variety of functional food formulations. During the forecast period of 2026-2033, it is anticipated that the Cosmetics and Personal Care segment will grow at the highest CAGR of around 8.85% due to the increasing popularity of natural or organic ingredients in skincare and personal care products.

By Distribution Channel, Supermarkets and Hypermarkets Leads While Online Retail Sector Grows Fastest

Supermarkets and Hypermarkets segment accounted for the highest revenue share of 35.20% in 2025E of the Cocoa Fiber Market due to wider product reach, brand visibility, and ease of bulk purchases. These channels are ideal for cocoa fiber products as they are a preferred choice for consumers due to high consumer trust and accessibility. Nestlé S.A. has utilized such channels for widespread distribution of cocoa fiber based products. With e-commerce becoming increasingly prevalent, and all purchases becoming much easier with doorstep delivery, the growth of Online Retail segment is expected to priceless over the next several years, growing at the fastest CAGR of around 8.42% during 2026-2033, as the variety of products available becomes the driving factor resulting in a wider range of food, nutraceuticals and health products or specialty ingredients available to the consumer.

Cocoa Fiber Market Regional Analysis:

North America Cocoa Fiber Market Insights

North America, followed by the U.S, accounts for a prominent share in the cocoa fiber market, owing to increasing consumer awareness for health and nutrition, will be positively influencing the cocoa fiber market in the near future. The other contributing drivers sustaining the growth of the market include well-established bakery and confectionery industries, food processing and distribution infrastructures, and the rising adoption rates of clean-label and functional ingredients preferred to innovatively develop food, beverage and nutraceutical products.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Cocoa Fiber Market Insights

U.S. leads the North America cocoa fiber market share, as a result of high consumer health awareness, high potential demand for fiber-enriched foods, high rate of food-processing infrastructure, well-established bakery and confectionery industries, and well-developed distribution network for product availability throughout the country.

Asia-Pacific Cocoa Fiber Market Insights

Asia Pacific is predicted to record the maximum growth during 2026 to 2033, progressing at a rate of approximately 8.47%, led by improvement in disposable income, urbanization, and thriving food and beverage industry. The region is also projected to be the biggest growth region in the global market due to the increased health-consciousness among consumers along with increased knowledge regarding the benefits of dietary fiber encouraging manufacturers to offer a wider range of cocoa fiber-based products.

China Cocoa Fiber Market Insights

China is the most active country in the Asia Pacific cocoa fiber industry and is expected to remain among the top consumers of cocoa fiber as rapid urbanization, rising disposable incomes, increasing food and beverage industry, growing health conscious population and adoption of functional and plant-based ingredients fuels the demand for cocoa fiber in the country.

Europe Cocoa Fiber Market Insights

Europe held a largest revenue share of approximately 32.90% in 2025E of the Cocoa Fiber Market owing to high health cognizance, well-established Bakery and Confectionery industries. Consumer preference towards functional foods, and presence of large manufacturers and effective distribution channels have made Europe the largest region for adoption of cocoa fiber in terms of both availability and production.

Germany Cocoa Fiber Market Insights

Germany occupies the largest share of the European market for cocoa fiber owing to the massive food processing industry, the largest population of health-conscious consumers, and the availability of the raw material for production coupled with higher production in close proximity to major cocoa growing regions. Its strong manufacturing capabilities along with consumption of numerous functional and fiber-enriched products bolster its leadership position.

Latin America (LATAM) and Middle East & Africa (MEA) Cocoa Fiber Market Insights

UAE dominates the Middle East & Africa, owing to health consciousness, demand for functional food & increasing growth of bakery sector however Saudi & Qatar contributes steady towards the coco fiber market in the region. Brazil is the leader in Latin America for that reason: Strong cocoa production and processing capacity and increasing consumption of fiber-enriched products.

Cocoa Fiber Market Competitive Landscape:

Barry Callebaut is the global largest manufacturer and supplier of chocolate and cocoa products to various manufacturers and craftsmen in the world. Focus on sustainability, innovation, and being a fully-fruit cacao practitioner, making high-quality, fiber-rich ingredients for multiple applications. The same holds firm for flavors like their Dark Chocolate with Chicory Root Fiber and Milk Chocolate with Chicory Root Fiber.

-

In November 2024, Barry Callebaut expanded its portfolio by adding upcycled cacaofruit ingredients, aiming to provide food manufacturers with sustainable options that utilize the entire cacao fruit, thereby reducing waste and enhancing the nutritional profile of products.

Cargill is a global corporation of food, agriculture and industrial products. In the cocoa sector, Cargill produces cocoa and chocolate products driven by sustainability and innovation with an emphasis on meeting the growing demands of the food industry. They offer Gerkens Cocoa Powder and Soluble Fiber Solutions utilized to improve flavor and function in many different food applications.

-

In December 2024, Cargill opened a new cocoa production line in East Java, Indonesia, to meet the rising demand for indulgent foods in the Asian market, enhancing its production capabilities.

Olam Food Ingredients is a leading global sustainable supply chain manager of natural food ingredients including cocoa, coffee, dairy, nuts, and spices. To provide customers with high-quality ingredients, the company emphasizes traceability, sustainability, and innovation. Their Cocoa Powder and Cocoa Liquor and Butter are chocolate manufacturing staples, providing flexibility and quality for diverse chocolate creation.

-

In December 2024, ofi launched its first cocoa biochar project in collaboration with LOTTE, Fuji Oil Co, and MC Agri Alliance in Ghana, aiming to implement the project in the 2024/25 crop season to enhance soil health and reduce the carbon footprint of cocoa farming.

Cocoa Fiber Market Key Players:

Some of the Cocoa Fiber Market Companies are:

-

Barry Callebaut

-

Cargill Inc.

-

Olam International

-

Touton S.A.

-

Blommer Chocolate Company

-

Interfiber Ltd.

-

GreenField Natural Ingredients

-

Custom Fiber

-

Olympos Cocoa

-

Nestlé S.A.

-

ADM (Archer Daniels Midland)

-

Meiji Holdings Co., Ltd.

-

Guan Chong Berhad

-

Mane Kancor Ingredients Pvt. Ltd.

-

Uncommon Cacao

-

Jindal Cocoa

-

Carlyle Cocoa

-

Niche Cocoa Industry

-

JB Cocoa

-

Intercontinental Distribution Company (IDC)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 0.43 Billion |

| Market Size by 2033 | USD 0.78 Billion |

| CAGR | CAGR of 7.80% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cocoa Powder, Cocoa Butter, Cocoa Cake and Cocoa Fiber) • By Application (Food and Beverage Industry, Cosmetics and Personal Care, Pharmaceuticals, Animal Feed and Others) • By Form (Powdered Cocoa Fiber, Granulated Cocoa Fiber and Flaked Cocoa Fiber) • By Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores and Direct Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Barry Callebaut, Cargill Inc., Olam International, Touton S.A., Blommer Chocolate Company, Interfiber Ltd., GreenField Natural Ingredients, Custom Fiber, Olympos Cocoa, Nestlé S.A., ADM (Archer Daniels Midland), Meiji Holdings Co., Ltd., Guan Chong Berhad, Mane Kancor Ingredients Pvt. Ltd., Uncommon Cacao, Jindal Cocoa, Carlyle Cocoa, Niche Cocoa Industry, JB Cocoa, and Intercontinental Distribution Company (IDC). |