Strobe Lighting Market Size & Trends:

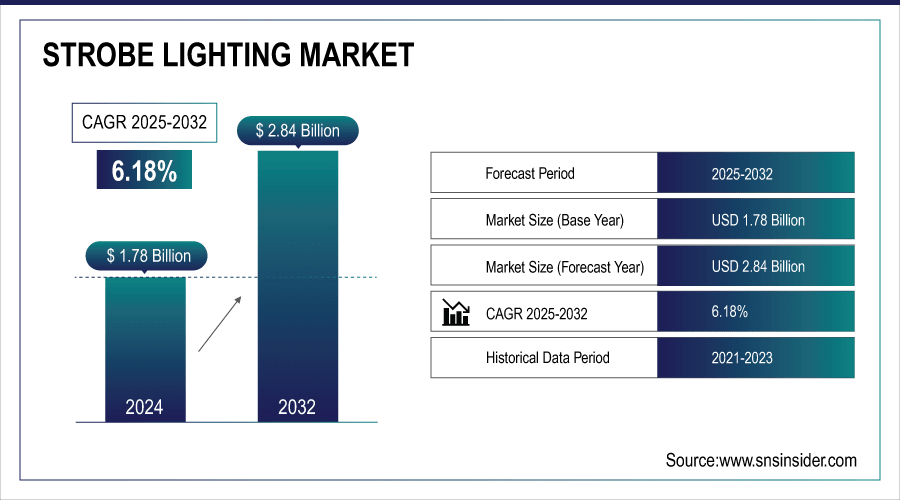

The Strobe Lighting Market Size was valued at USD 1.78 billion in 2024 and is expected to reach USD 2.84 billion by 2032 and grow at a CAGR of 6.18% over the forecast period 2025-2032.

To Get More Information On Strobe Lighting Market - Request Free Sample Report

The Global Strobe Lighting Market Size is on a remarkable rise as furthering lighting techniques especially in its industrial, residential and commercial lighting applications are fueling the demand for this market to a very good extent. Increased adoption of energy-efficient systems based on LEDs, increasing urban infrastructure and increased industrial application, also help to boost the market upward. Durable, maintenance-free, and smart device compatible strobes also are fueling wider adoption of strobe lighting solutions globally.

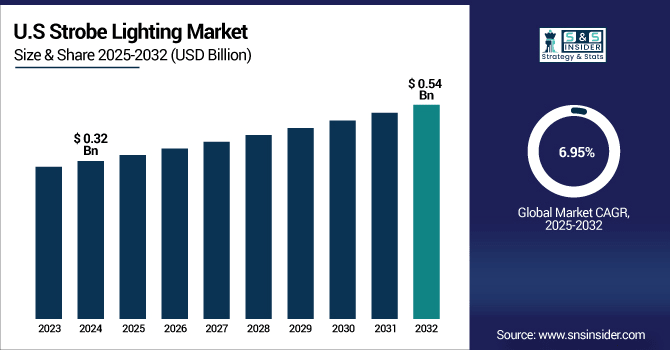

The U.S. Strobe Lighting Market size was USD 0.32 billion in 2024 and is expected to reach USD 0.54 billion by 2032, growing at a CAGR of 6.95% over the forecast period of 2025–2032.

Growth is primarily attributed to increased safety measures in sectors such as transportation and manufacturing that require use of strobe lights to indicate a hazard. Moreover, growing use of entertainment industry and rising application of smart lighting technologies drive the growth of the market in the region.

According to research, Over 60% of lighting purchases in the U.S. live event industry involve programmable or customizable features like adjustable strobe effects, color shifting, and sync with music/visuals.

Strobe Lighting Market Dynamics

Key Drivers:

-

Increasing adoption of smart and IoT-integrated strobe lighting systems accelerates market growth worldwide

Digital technologies and IOT function meets strobe lighting systems, this is what will transform the market. These sophisticated systems allow for remote control, user programmable flash patterns and environmental trigger programmed responses, bringing benefits to both operational efficiency and safety. The rising inclination toward smart infrastructure for commercial and industrial verticals pushes manufacturers to come up with cutting-edge solutions, subsequently triggering the growth of the market for intelligent strobe lighting. This change is a major driver of growth, particularly in advanced markets where automation is increasingly being adopted.

According to research, Smart lighting systems can reduce energy costs by up to 40%, while increasing operational safety through environmental response triggers and remote control features.

Restrain:

-

Stringent regulatory standards and certification requirements create entry barriers and slow product launches globally

Regional compliance with safety, environmental, and quality regulations is a time consuming process that requires testing and certification and can lead to lost opportunity to bring new strobe lighting products to market. Manufacturers having to devote additional time and resources to meet multiple standards in different countries means product cost and availability are affected. All this complexity can deter some companies, particularly small companies, from entering the marketplace to develop and innovate, which can seriously constrain strobe lighting market growth.

Opportunities:

-

Development of customizable and programmable strobe lighting systems opens new avenues for market differentiation

Technological developments also make possible the provision of a highly configurable strobe light product offering adjustable flash patterns, colours and intensities which produce a light that can be quite specifically tuned to meet the bespoke requirements of particular industries. This customization draws in sectors like entertainment, automotive and emergency where people need bespoke lighting. Bespoke products serve not only diverse customer needs but also help manufacturers foster brand loyalty and higher price premiums, making the competitive market landscape an attractively high-growth market segment.

According to research, Manufacturers offering customized lighting solutions are able to charge 15–30% price premiums, reflecting rising demand for personalization in both consumer and B2B markets.

Challenges:

-

Fluctuating raw material prices and supply chain disruptions affect manufacturing costs and product availability

The strobe lighting sector is subject to fluctuations in the basic components of strobe lights, such as semiconductors, LEDs, and electronic circuits. Global supply chain issues - aspects of which are driven by geopolitics and/or logistics - result in delays and higher production costs, which in turn shrink margins, leading to a drop in product availability, while compromising customer satisfaction and inhibiting the growth of the market. Manufacturers need to mobilize their sourcing and their inventory to lessen the impact of the issues besetting the sector.

Strobe Lighting Market Segment Analysis:

By Light Source

The LED-based strobe lights segment dominated the highest Strobe Lighting Market share of about 35.83% in 2024, owing to the increasing demand for the energy efficient strobe lights, and the LED lights are cost-effective, energy efficient, have longer operational life span, and offer high brightness as compared to other traditional incandescent and halogen lighting sources. Due to LED's low power consumption and minimal maintenance, it has become the most-chosen for the new generation strobe light systems in commercial and industrial applications everywhere.

The Xenon strobe lights segment is expected to grow at the fastest CAGR of about 7.52% from 2025 to 2032 due to high energy, powerful & intense flashes that they produce which are tailored for niche applications such as photography, emergency signalling and aviation. They can generate extremely bright flashes with virtually limitless life expectancy for high visibility needs.

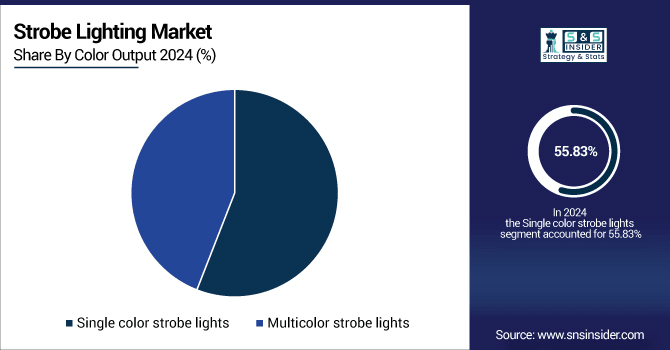

By Color Output

Single color strobe lights segment dominated the Strobe Lighting Market with the highest revenue share of about 55.83% in 2024, due to its cost benefit, simplicity and its reliance in critical industries. They are the perfect choice for repetitive signaling tasks. Adoption is also driven by the fact they are readily available and simple to install. Some strobe lighting market companies, such as Federal Signal Corporation and Whelen Engineering, and Pfannenberg, have robust offerings of single-color strob products for industrial and safety markets, worldwide.

Multicolor strobe lights segment is expected to grow at the fastest CAGR of about 6.95% from 2025 to 2032, due to their capacity to support dynamic, visually appealing effects for entertainment, architectural lighting, and retail displays. These are lighting systems that support programmable color patterns and intensity and are used for events, theme parks, and promotional installations. Growth is being driven by the need for enriching visual experience and decorative lighting. Key players such as Martin Professional, Chauvet DJ and ADJ Group are making significant strides in RGB and DMX multicolor strobe lighting technology to keep pace with growing creative and professional requirements.

By End Use

Commercial segment dominated the Strobe Lighting Market with the highest revenue share of about 39.13% in 2024, due to the high adoption of strobe lighting in event venues, nightclubs, concerts, and advertising environments that depend on lighting as the central aspect of the visual experience. They are beneficial in drawing attention to sites, creating atmosphere and ensuring crowd safety, which means continued use. Aggressive marketing and entertainment infrastructure development initiatives are the key drivers of growth. Some of the primary manufacturers of commercial strobe lighting, such as Altman Lighting, Elation Lighting, or GLP Lighting, offer computerized control and energy efficient products built for high output large commercial systems.

The industrial segment is expected to grow at the fastest CAGR of about 7.34% from 2025–2032, with the rising concerns associated with safety and the ongoing industrial automation across factories, refineries, warehouses, and transportation units. Flashing lights have become critical for indicating machine malfunctions, directing workflow, and enhancing safety for workers. Growing smart factory infrastructure and real-time alerting systems are also driving adoption. Companies like Pfannenberg Inc, Edwards Signaling, and Banner Engineering offer heavy-duty, ultra-bright strobe lights that have been ruggedized for use in the harshest of industrial environments as well as certified to meet demanding performance standards required for global applications.

Strobe Lighting Market Regional Analysis:

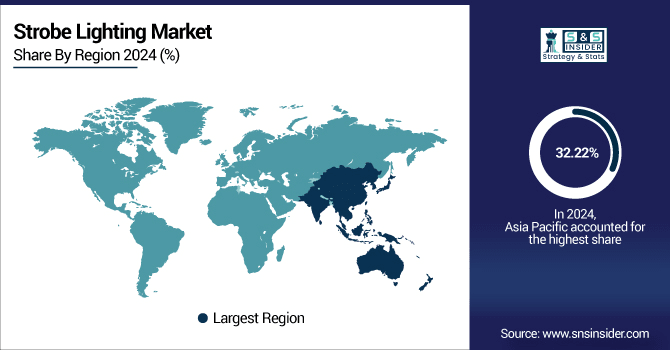

Asia Pacific dominated the Strobe Lighting Market with the highest revenue share of about 32.22% in 2024. This was due to rapid industrialization, infrastructure development and increasing use of strobe lights in commercial and manufacturing spaces. Rising investment in event and entertainment industries as well as expanding urban centers are driving demand. Moreover, strict implementation of working conditions and large population size in countries such as China, India has further resulted into the growth of visual alert systems especially in construction, transportation and public safety industries.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China is first in the Asia Pacific strobe lighting market, because of its manufacturing base, increased construction, and growing transportation network. Government promotion of industrial safety, and the increased use of strobe lighting in entertainment and public alert/rescue systems has created strong domestic market demand.

North America is expected to grow at the fastest CAGR of about 7.51% from 2025–2032, due to the rising adoption advanced safety technologies in commercial and industrial establishments. Strong gains in the smart building sector, increased safety requirements, and rising demand for energy-efficient lighting systems also boost the market. Also, these regions with a significant penetration of the lighting industry in applications such as Emergency Services, Automotive, and Entertainment industry, along with increased level of knowledge and fast adoption of lights in, also helps in making sure of lighting industry expansion in those regions.

The U.S. holds dominance in the North American strobe lighting market because of the substantial industrial framework, strong safety regulations, and greater use of emergency signaling systems. There is continued demand from the automotive, entertainment, and aerospace industries has allowed for a rapid deployment of strobe lighting solutions.

The stroke lighting market in Europe is easily fueled with growing investments in industrial automation and public safety systems. Increase in demand for energy-efficient and intelligent lighting systems, increasing demand for street lighting systems in transport and commercial sectors, and stringent government regulations drives the market growth. Moreover, with the flourishing hold of regular large festivals and cultural events, growth of strobe lighting in the region remains incremental.

Germany tops the European strobe lighting market with its strong industrial base, stringent safety regulations, and emphasis on smart automation and Industry 4.0. Extensive investments in smart infrastructure and rising demand in the manufacturing and transportation sectors propel its top market position.

The Middle East & Africa strobe lighting market is being led by the UAE owing to the rapid growth in infrastructure development and increasing implementation of smart city initiatives. In Latin America, Brazil dominates the market, as the region witnesses rising industrialization, urbanization, and the proliferation of the safety and commercial lighting sectors, thereby buttressing incremental growth across the region.

Strobe Lighting Companies are:

Major Key Players in Strobe Lighting Market are Acuity Brands, Claypaky, Chauvet Professional, ROBE Lighting, ADJ (American DJ), SGM Light, PR Lighting, Aputure, Eaton Corporation, Profoto AB and others.

Recent Development:

-

February 2025, ROBE Lighting Launched at ISE 2025, this dynamic moving multi-zoomed strobe offers extreme output, rapid motorized zooms, and continuous pan and tilt control, suitable for various production environments.

-

February 2025, Claypaky Introduced at ProLight+Sound 2025, this hybrid bar delivers powerful graphical strobe effects with pixel-perfect control, enhancing immersive lighting experiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.78 Billion |

| Market Size by 2032 | USD 2.84 Billion |

| CAGR | CAGR of 6.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Light Source (LED-based strobe lights, Xenon strobe lights, Halogen strobe lights, Other light sources) • By Color Output (Single color strobe lights, Multicolor strobe lights) • By End Use (Commercial, Industrial, Residential, Government & public sector) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Acuity Brands, Claypaky, Chauvet Professional, ROBE Lighting, ADJ (American DJ), SGM Light, PR Lighting, Aputure, Eaton Corporation, Profoto AB. |