Street Lighting Market Report Scope & Overview:

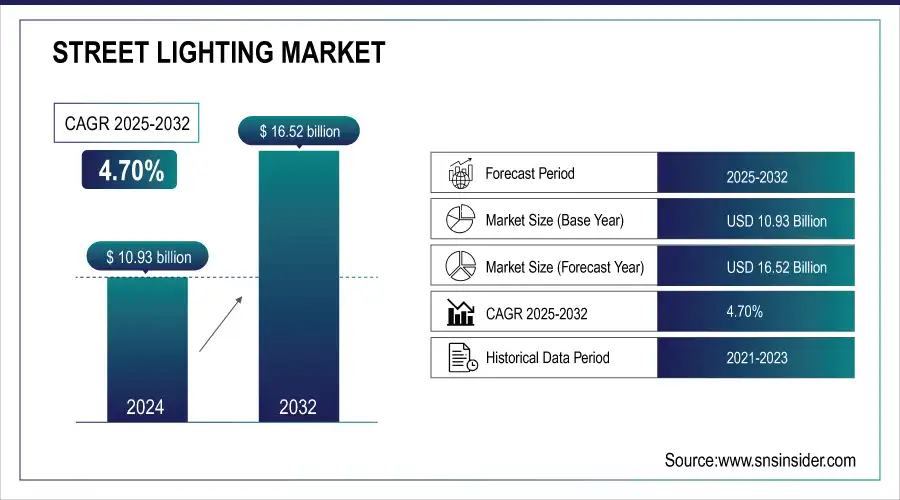

The Street Lighting Market Size was valued at USD 10.93 Billion in 2023 and is expected to reach USD 16.52 Billion by 2032, growing at a CAGR of 4.70% from 2024-2032. Major factors contributing to this growth are the increased uptake of energy conservation and efficiency lighting solutions, technical breakthroughs in the smart lighting segment and rising urbanization that requires the enhancement of the public infrastructure.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

Furthermore, government programs offering grants and subsidies to support sustainability and energy conservation contribute to the growth of the market. LED technology adoption rates are increasing due to anticipated installations at significant numbers across regions and energy consumption metrics that point to massive savings as municipalities replace conventional lighting systems with modern lighting systems. Together, these factors create a conducive environment for the street lighting market to flourish in the coming years.

Key Street Lighting Market Trends

-

Shift from conventional lighting to LED-based streetlights for higher efficiency and lower energy use.

-

Growing adoption of smart street lighting with IoT, sensors, and remote monitoring systems.

-

Expansion of solar-powered streetlights to support renewable energy goals and sustainability.

-

Strong push from government smart city initiatives driving large-scale installations.

-

Increasing integration with smart grids for optimized energy management.

-

Use of AI and data analytics to improve lighting schedules, predictive maintenance, and cost savings.

-

Rising demand for public safety features like CCTV, motion sensors, and emergency alerts within lighting systems.

-

Declining total cost of ownership (TCO) due to longer LED lifespan and reduced maintenance costs.

Street Lighting Market Growth Drivers

-

Revolutionizing urban lighting with energy-efficient solutions enhances safety, reduces energy consumption, and supports sustainability goals in cities worldwide.

Cities around the globe are increasingly embracing energy-efficient street lighting solutions that dramatically cut energy consumption and operational costs. he adoption of LED and smart lighting technologies enhances public safety and sustainability initiatives, making it a prudent investment for local governments. To give one example, the city of Los Angeles replaced more than 200,000 traditional streetlights with LED fixtures, cutting energy use by around 60% and CO2 emissions by more than 40,000 metric tons per year. In the Nordic region, Copenhagen implemented flexible street lighting, generating 50% in savings adjusted for real-time conditions, while Singapore developed intelligent street lighting that uses ambient light and motion sensors to optimize energy, yielding 40% savings. Barcelona’s solar streetlights rely on renewable energy, while Amsterdam’s smart city lighting leverages data analytics to save energy by as much as 70%. These innovations enhance public safety, lower maintenance costs, and contribute to environmental sustainability, highlighting the vital role of energy-efficient street lighting in modern urban planning.

Street Lighting Market Restraints

-

Regulatory and compliance issues significantly restrain the street lighting market, as strict regulations and standards can impede the adoption of new technologies.

Municipalities face with many complexities of local laws and safety standards, so new lighting solutions often need to pass specific safety certification standards which can cause long lead times for project completion and additional costs. Fortunately, contemporary LED design offers many benefits. It can cut street lighting electricity use by 50% and more, resulting in huge savings on municipal energy bills, which can represent up to 40% of total costs. Additionally, LEDs have longer lifespans, resulting in lower maintenance costs that can exceed savings from energy consumption alone. They also enhance streetlight tracking, allowing municipalities to identify and eliminate unnecessary or incorrectly billed streetlights, as seen in some Vermont towns that removed 30-40% of their streetlights during LED upgrades. Furthermore, advanced lighting controls compatible with LED technologies enable automated dimming, reducing energy use. The improved visibility from LEDs can enhance public safety while significantly decreasing nighttime light pollution. Ultimately, these technologies contribute to lower greenhouse gas emissions, helping municipalities achieve smart or green city status.

Street Lighting Market Opportunities

-

The street lighting market provides opportunities for customizable and scalable smart lighting solutions.

The street lighting market is larger and highly customizable and scalable, with manufacturers developing smart lighting solutions for various areas ranging from the street and public infrastructure to residential and commercial. Such flexibility improves user experience and caters to particular local requirements, providing an edge to the manufacturers. The use of IoT and wireless communication protocols (such as LoRa, Zigbee) is continuously opening new horizons in city applications, advancing the ability to manage lighting infrastructure more effectively and improve it as needed. Moreover, these systems are easily scalable, meaning it can be scaled up or down according to the needs of the people and the urban environment. Where environmentally sound practices and community-need centric projects are on the rise in several municipalities, such versatile street-lighting solutions will play a prominently visible role in achieving operational efficiency.

Street Lighting Market Challenges:

-

Infrastructure limitations in many cities hinder the street lighting market by necessitating costly upgrades to support modern lighting technologies.

Infrastructure limitations present a significant restraint in the street lighting market, as many cities rely on outdated electrical systems and poles that are incompatible with modern lighting technologies. These aging infrastructures often lack the capacity to support energy-efficient solutions like LED lights or smart lighting systems, necessitating costly upgrades or replacements. Additionally, the integration of new technologies may require extensive retrofitting of existing streetlight setups, further increasing financial burdens on municipalities. The challenge is compounded by the need for coordination with other urban infrastructure improvements, which can delay project timelines. As a result, cities face obstacles in achieving efficient and sustainable street lighting solutions, hindering overall progress toward modernizing their urban environments.

Street Lighting Market Segment Analysis

By Type

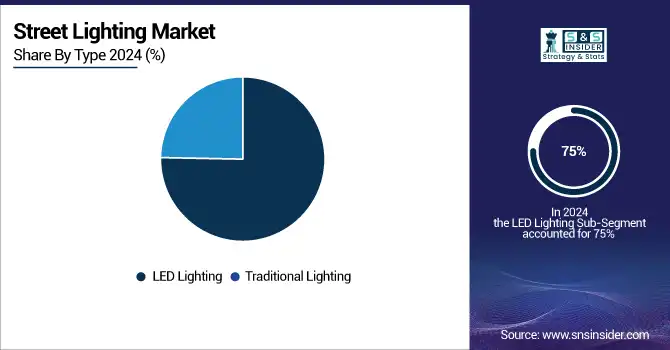

In 2024, the LED lighting segment emerged as the dominant force in the street lighting market, capturing around 75% of the total revenue. This remarkable market share highlights the growing trend toward energy-efficient and long-lasting lighting solutions, as municipalities and urban planners increasingly recognize the benefits of LED technology. LEDs not only provide superior illumination and visibility but also significantly reduce energy consumption and maintenance costs compared to traditional lighting options. Their extended lifespan further contributes to lower operational expenses, making them an attractive choice for cities aiming to enhance public safety and sustainability. As a result, the widespread adoption of LED street lighting is transforming urban environments, creating brighter and more cost-effective public spaces.

The traditional lighting segment is expected to witness rapid growth during the forecast period from 2025 to 2032. Energy-efficient LED bulbs have overtaken the market, yet there is still a significant need for more traditional lighting sources where infrastructure upgrades are not possible or where cost is crucial. As agencies begin to balance budget needs with lighting needs, full-size traditional lighting will likely increase in certain applications, including high-pressure sodium and metal halide lamps. This increase can also be explained by the gradual replacement cycles of existing installations as well as the continued maintenance of older systems. As a result, throughout these years, the conventional lighting segment will still account major share in overall street lighting market.

By Application

The roadway segment dominated the street lighting market in 2023, capturing approximately 69% of the total revenue. This significant share can be attributed to the increasing focus on enhancing road safety and visibility for drivers and pedestrians. Municipalities are investing heavily in modernizing roadway lighting to improve nighttime visibility, reduce accidents, and promote safer travel conditions. Additionally, the rise in vehicle traffic and the expansion of urban infrastructure have necessitated effective lighting solutions along major roads and highways. As cities continue to prioritize infrastructure improvements and embrace smart lighting technologies, the roadway segment is poised for sustained growth, driving innovations that further enhance safety and energy efficiency in street lighting systems.

The highways segment is forecasted to experience significant growth in the street lighting market from 2024 to 2032. With an increase in traffic congestion and the spread of urbanization, the need for improved lighting systems over highways will be essential for the safety and visibility needs of drivers. Investments would be made in advanced lighting technologies like LED and smart lighting systems, which would help drive energy savings and reduced maintenance costs. Governments are also likely to prioritize high-end infrastructure development in highways to meet both safety standards and environmental goals. This trend towards effective highway lighting solutions is expected to lead to innovations, thus making the highways segment a significant area of focus for the street lighting market in the forecast period.

Street Lighting Market Regional Analysis

Asia Pacific Street Lighting Market Insights

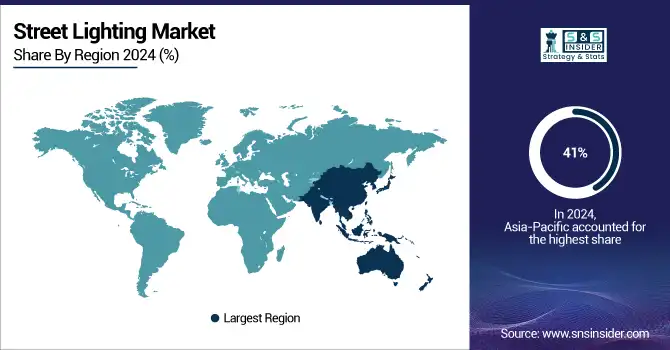

The Asia-Pacific region dominated the street lighting market with approximately 41% of the total revenue in 2023, largely due to rapid urbanization and ongoing infrastructure development across various countries. Nations like China and India are investing significantly in smart city initiatives, which include the integration of advanced technologies such as LED and IoT in street lighting systems. Additionally, the region's focus on sustainability and reducing carbon emissions drives the adoption of energy-efficient lighting solutions. Furthermore, the continuous development of urban environments enhances the demand for modern street lighting, positioning the Asia-Pacific region as a leading market in the global street lighting landscape. With these factors in play, the region is expected to maintain its dominance and experience continued growth in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Street Lighting Market Insights

The North America region is projected to be the fastest-growing market in the street lighting sector over the forecast period from 2024 to 2032, due to significant investments in upgrading infrastructure and a shift towards smart lighting solutions. With an increased focus on sustainability and energy efficiency, U.S. and Canadian cities are more and more replacing outdated street lighting with LED technology, as well as smart systems that incorporate IoT capabilities. Moreover, government initiatives and funding programs geared towards improving urban safety and energy consumption also drive growth. The increasing awareness towards environmental concerns and need for a greener city also drive municipalities to switch to advanced street lighting technology, making North America a significant player in the emerging street lighting market.

Europe Street Lighting Market Insights

In Europe, the street lighting market accounted for 27.4% of the global share in 2024, driven by widespread adoption of LED retrofitting projects, strong regulatory support for energy efficiency, and smart city initiatives across countries like France, the UK, and Italy. Within the region, Germany emerged as a leader, supported by its focus on sustainable infrastructure and the integration of smart lighting with urban mobility solutions.

U.S. Street Lighting Market Insights

The United States held the largest single-country share at 30.1%, fueled by federal and state-level investments in smart infrastructure, rapid deployment of connected streetlights, and growing use of lighting poles as multifunctional assets for 5G, EV charging, and surveillance.

Latin America (LATAM) & Middle East & Africa (MEA) Street Lighting Market Insights

Latin America (LATAM) captured 7.2% of the market in 2024, with Mexico and Brazil leading adoption through public-private partnerships to replace outdated sodium lamps with energy-efficient LED systems. The Middle East & Africa (MEA) accounted for 9.3%, supported by large-scale infrastructure projects in GCC countries, such as Saudi Arabia and the UAE, where smart streetlighting forms a key part of urban transformation plans. In Africa, countries like South Africa and Kenya are increasingly turning to solar-powered streetlights to improve rural electrification and reduce grid dependency, highlighting a growth trajectory for the region.

Street Lighting Market Competitive Landscape

Thorn Lighting

Thorn Lighting is a UK-based provider of professional and architectural lighting solutions, specializing in road, street, and urban applications.

-

In October 2024, Thorn Lighting launched City of Thorn, a unique digital resource designed to simplify the selection process for lighting designers, installers, and building managers. This interactive 3D city showcases a wide range of interior and exterior lighting applications across education, industry, retail, sports, urban, architectural, and street environments, offering users an engaging and comprehensive product exploration experience.

Cree Lighting LLC

Cree Lighting is a U.S.-based leader in LED lighting fixtures and solutions, focused on energy efficiency and sustainable illumination.

In October 2024, Cree LED, in partnership with IDC Componentes and Ilumiled, initiated a large-scale project in Santiago de Querétaro, Mexico, replacing 1,600 sodium-based lamps with high-efficiency LED fixtures. The initiative is expected to improve energy efficiency by over 50%, preserve the historic ambiance of the city center, and deliver annual savings of USD 80,000 for the next decade.

Street Lighting Market Key Players

Some of the Major key Players in Street Lighting Market along with their product:

-

Acuity Brands (USA) [Lighting Solutions]

-

ams-OSRAM AG (Germany) [Optoelectronic Products]

-

Signify Holding (Netherlands) [LED Lighting]

-

Cree Lighting LLC (USA) [LED Fixtures]

-

Zumtobel Group (Austria) [Professional Lighting]

-

Cooper Lighting LLC (USA) [Commercial Lighting]

-

Hubbell (USA) [Electrical and Lighting Products]

-

Schréder (Belgium) [Outdoor Lighting Solutions]

-

Thorn (UK) [Architectural Lighting]

-

Itron Inc. (USA) [Smart Metering and Lighting Solutions]

-

Philips Lighting N.V. (Netherlands) [Smart Lighting Systems]

-

K-LITE (India) [LED Lighting Solutions]

-

OSRAM GmbH (Germany) [Lighting Solutions and Components]

-

Panasonic (Japan) [LED Lighting]

-

Toshiba Lighting (Japan) [General Lighting Solutions]

List of Suppliers Who supply raw materials and components for the street lighting market:

-

Signify Holding

-

OSRAM GmbH

-

Cree, Inc.

-

Nichia Corporation

-

Samsung Electronics

-

Philips Lighting

-

Everlight Electronics

-

Luminus Devices

-

Lumileds

-

Mean Well Enterprises

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.44 Billion |

| Market Size by 2032 | USD 16.52 Billion |

| CAGR | CAGR of 4.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Traditional Lighting, LED Lighting) • By Application (Highways, Roadways) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | cuity Brands (USA), Cree Lighting USA LLC (USA), Zumtobel Group (Austria), Cooper Lighting LLC (USA), Hubbell (USA), Schréder (Belgium), Thorn (UK), Itron Inc. (USA), Philips Lighting N.V. (Netherlands), K-LITE (India), OSRAM GmbH (Germany), Panasonic (Japan), Toshiba Lighting (Japan). |