Sustainable Manufacturing Market Size & Growth:

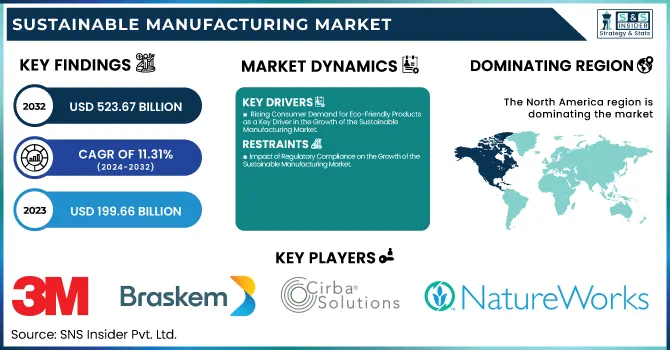

The Sustainable Manufacturing Market was valued at USD 199.66 billion in 2023 and is projected to reach USD 523.67 billion by 2032, growing at a CAGR of 11.31% from 2024 to 2032. Key drivers of this growth include increasing adoption of sustainable manufacturing technologies, such as renewable energy, AI integration, and resource-efficient machinery, which help reduce environmental impact.

To Get more information on Sustainable Manufacturing Market - Request Free Sample Report

In the US, the market was valued at USD 54.69 billion in 2023, with expectations to grow to USD 118.64 billion by 2032, driven by a CAGR of 8.98%. Moreover, innovations in material usage, including recycled and bio-based materials, are reshaping the sector. Consumer preferences, especially toward eco-friendly products, are also influencing this shift, with regions prioritizing green manufacturing. Transparency in supply chains is gaining prominence, with manufacturers adopting more sustainable practices to meet regulatory and consumer demands.

Sustainable Manufacturing Market Dynamics:

Drivers:

-

Rising Consumer Demand for Eco-Friendly Products as a Key Driver in the Growth of the Sustainable Manufacturing Market

As consumers become increasingly conscious of the environmental impact of their purchasing choices, demand for eco-friendly products made from sustainable materials and with minimal carbon footprints is on the rise. This shift in consumer preferences is driving manufacturers across industries, such as food packaging and electronics, to adopt more sustainable practices, including the use of plant-based packaging and eco-friendly cabinetry. Products like tree-free toilet paper and eco-friendly detergents are also gaining popularity as sustainability becomes a priority for consumers. This trend is further supported by the availability of eco-labels and scientific backing, providing consumers with transparency regarding the environmental impact of the products they purchase. Companies are responding by investing in compostable products and sustainable packaging solutions to meet the increasing demand for environmentally responsible goods. Where the wealthiest 10% contribute half of global emissions, while the poorest 50%—who contribute only 10%—bear the greatest impact of climate change, emphasizing the need for a just transition. Meanwhile, the growing use of wireless earbuds creates a sustainability challenge, as their finite battery lifespan contributes to rising e-waste, with only 22.3% of it being recycled, as reported by the World Health Organization. Moreover, the extraction of rare earth minerals for electronic products like earbuds is linked to environmental degradation and human rights concerns. In contrast, innovative products such as cellulose/zein detergents, which clean effectively without leaving residue on fabrics, highlight the potential for more sustainable solutions in everyday consumer goods.

Restraints:

-

Impact of Regulatory Compliance on the Growth of the Sustainable Manufacturing Market

Regulatory compliance is one of the key challenges hindering the rapid adoption of sustainable manufacturing practices. Manufacturers are increasingly pressured to embrace green technologies and practices as governments around the world tighten environmental regulations. Although these regulations can promote innovation by necessitating cleaner and more efficient manufacturing processes, they come with substantial costs. Businesses need to invest in new technologies and remake supply lines, and companies can be fined for bad practices — it is all extremely expensive and resource-intensive. These regulatory burdens have an influence on the market, too, as manufacturers must weigh the cost of compliance with the advantages of implementing more sustainable practices to promote innovation over compliance. Regulatory complexity can hold up market adoption, especially for smaller businesses that lack the resources to handle compliance.

Opportunities:

-

Capitalizing on Rising Consumer Demand for Eco-Friendly Products in Sustainable Manufacturing

As consumer preferences increasingly shift toward sustainable, eco-friendly, and ethically sourced products, manufacturers are presented with a significant opportunity to adapt and align their operations with these evolving demands. This trend is prompting companies to adopt sustainable practices, including the use of renewable energy, waste reduction, and responsible sourcing of materials. By providing eco-friendly products, manufacturers can meet the increasing demand whilst gaining a competitive advantage in a densely populated market. Moreover, adopting sustainability in their business operations allows the companies to gain higher brand loyalty, capture eco-friendly customers and stand out in the crowd of competitors. Sustainability is emerging as an important purchasing factor, and manufacturers that take eco-friendly approaches today are poised for long-term success in the global marketplace.

Challenges:

-

Navigating Regulatory and Compliance Challenges in Sustainable Manufacturing

Manufacturers in the sustainable manufacturing market face the complex challenge of adhering to a growing body of environmental regulations, which can vary greatly by region. Sustainability regulations by locality, country, and the world as a whole are constantly changing, meaning businesses need to keep themselves informed and adapt to keep compliant. These regulations can encompass numerous topics, such as emissions, waste handling, energy consumption, and raw material sourcing. Compliance must be ensured which is time-consuming and expensive, and often involves the implementation of new technologies, processes, and training. For the manufacturer, however, it is always the balance of compliance and cost-effectiveness that is important when assessing whether to gain certification for its products in line with increasing buyer demand for sustainable products that involve ethical sourcing of materials.

Sustainable Manufacturing Industry Segment Analysis:

By Offering

The Recycled Lithium-Ion Battery segment emerged as the dominant revenue-generating sector within the Sustainable Manufacturing Market, holding a substantial share of approximately 30% in 2023. The expansion of this segment is attributable to the increasing international demand for energy storage systems, notably in EVs and renewable energy systems. With the increasing adoption of electric mobility and clean energy technologies, lithium-ion batteries are experiencing a surge in demand, accentuating the need for effective recycling processes to mitigate their environmental impact. Recycling lithium-ion batteries can also reduce the need for new raw materials and services and thus the carbon emissions linked to mining and producing new batteries. In addition, recycling encourages a circular economy, which helps ensure that valuable resources are recycled for future use, thereby promoting the sustainability of manufacturing practices and the reduction of e-waste.

The Green Hydrogen segment is expected to be the fastest-growing sector in the Sustainable Manufacturing Market over the forecast period from 2024 to 2032. This increase is fueled by the worldwide interest in the decarbonization and shift to renewable energy resources. It is produced from solar, wind and potential geothermal powered water electrolysis —examples of carbon-free hydrogen, in contrast to classical hydrogen sources. As industries like transportation, heavy manufacturing, and energy storage search for ways to decrease their carbon footprints, green hydrogen appears to be an ideal replacement for fossil fuels. To top it off, governments and corporations around the world are pouring money into green hydrogen infrastructure, which will only accelerate its adoption. This transition not only enables the journey towards sustainable energy but also aligns with global emission reduction targets with green hydrogen emerging as a key driver for sustainable manufacturing.

By Vertical

In 2023, the Automotive segment dominated the Sustainable Manufacturing Market, accounting for around 30% of the total revenue Sustainable Materials Market Size Insights The rise of sustainability concerns in the automotive industry has been a pivotal factor contributing to this market share because manufacturers are focused on environmentally sustainable materials in automotive production when it comes to adopting eco-friendly materials, energy-efficient processing, and low-emission vehicles. The increasing shift from petrol cars (ICE vehicles) to more sustainable options (EVs) has of course played a huge role in the sector's revenue growth. Moreover, car manufacturers employ cutting-edge technologies like light-weight materials, recycled parts, and renewable energy sources in their manufacturing chain. These efforts align with global sustainability goals and are further supported by regulatory incentives and consumer demand for greener transportation solutions. As a result, the automotive sector continues to be a dominant player in the drive toward sustainable manufacturing.

The Packaging segment is poised to be the fastest-growing in the Sustainable Manufacturing Market over the forecast period from 2024 to 2032. As consumer preferences shift towards eco-conscious products, the demand for sustainable packaging solutions is accelerating. Companies are increasingly opting for recyclable, biodegradable, and reusable packaging materials to reduce environmental impact. Innovations in plant-based packaging, such as bioplastics, and the rise of circular economy models are also contributing to the segment's growth. Additionally, governments' increasing focus on reducing plastic waste and implementing stricter environmental regulations are pushing manufacturers to adopt more sustainable packaging practices. This trend is expected to continue as brands and consumers alike prioritize sustainability, making packaging a key growth driver in the market.

Sustainable Manufacturing Market Regional Outlook:

In 2023, North America dominated the Sustainable Manufacturing Market, accounting for approximately 40% of the global market share. This leadership can be attributed to the region's strong focus on environmental sustainability, supported by progressive government policies and regulations promoting green manufacturing practices. North American manufacturers are increasingly adopting renewable energy sources, eco-friendly materials, and advanced technologies to reduce their carbon footprint. Additionally, the growing consumer demand for eco-friendly products and the region's emphasis on corporate social responsibility further contribute to this dominance. Major industries, such as automotive, electronics, and packaging, are prioritizing sustainable manufacturing practices to meet regulatory requirements and consumer expectations. As a result, North America is expected to continue its leadership in the market throughout the forecast period.

Asia-Pacific is expected to be the fastest-growing region in the Sustainable Manufacturing Market over the forecast period from 2024 to 2032. Growing adoption of sustainability in traditional industries, including automotive, electronics, and packaging in the region, has been a key driver of this growth. Stringent environmental regulations in place in many Asia-Pacific nations and a push for energy efficient manufacturing processes is driving the shift towards greener manufacturing. Moreover, increasing consumer demand for environmentally friendly products and advancements in renewable energy and technology are further driving sustainable manufacturing initiatives in the region. Asia-Pacific is expected to exhibit substantial growth in the market due to the investments made by countries such as China, Japan, and India in terms of sustainable infrastructure and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Sustainable Manufacturing Market Key Players:

Some of the Major Key Players in Sustainable Manufacturing Market along with their Product:

-

3M (US): Adhesives, abrasives, filtration materials, nonwoven fabrics, sustainable packaging solutions.

-

Braskem (Brazil): Renewable polyethylene (green plastic), bioplastics, sustainable packaging solutions, eco-friendly chemicals.

-

Cirba Solutions (US): Lithium-ion battery recycling services, sustainable battery management solutions, resource recovery.

-

NatureWorks LLC (US): Ingeo biopolymer (PLA), renewable plastic alternatives, sustainable packaging, eco-friendly fibers.

-

Schneider Electric (France): Energy-efficient systems, smart grid solutions, sustainable building technologies, energy management software.

-

Siemens (Germany): Energy-efficient industrial automation, smart infrastructure, sustainable energy solutions, digital factory technologies.

-

Tesla (US): Electric vehicles, solar panels, energy storage systems, sustainable transport solutions.

-

Umicore (Belgium): Recycling solutions for precious metals, cathode materials for electric vehicle batteries, sustainable automotive materials.

-

Unilever (UK/Netherlands): Eco-friendly personal care, cleaning products, sustainable food and beverage solutions, biodegradable packaging.

-

Veolia (France): Waste management, water treatment solutions, renewable energy, sustainable resource recovery.

-

Indorama Ventures (Thailand): Recycled PET, sustainable polyester products, eco-friendly packaging solutions.

-

Unifi (US): Recycled polyester fibers, eco-friendly yarns, sustainable textile materials.

-

Dow (US): Biodegradable plastics, sustainable packaging materials, energy-efficient building solutions.

List of companies that provide raw materials and components for the Sustainable Manufacturing Market:

-

BASF (Germany)

-

Dow Chemical Company (US)

-

DuPont (US)

-

Covestro (Germany)

-

DSM (Netherlands)

-

Braskem (Brazil)

-

LG Chem (South Korea)

-

Sumitomo Chemical (Japan)

-

SABIC (Saudi Arabia)

-

U.S. Steel (US)

Recent Development:

-

On February 4, 2025, 3M's Chief Sustainability Officer, Gayle Schueller, underscored the company's dedication to sustainable practices, focusing on the challenge of cutting Scope 3 emissions and promoting carbon reduction throughout its operation.

-

On November 15, 2024, Schneider Electric and HP announced they will headline the inaugural Sustainable Manufacturing Expo in February 2025. Andre Marino from Schneider Electric will discuss automation’s role in enhancing sustainability, while François Minec from HP will highlight additive manufacturing's potential to reduce waste and optimize supply chains.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 199.66 Billion |

| Market Size by 2032 | USD 523.67 Billion |

| CAGR | CAGR of 11.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By offering (Recycled Lithium Ion Battery, Water Reuse and Recycling, Recycled Plastics , Green Hydrogen, Recycled Steel, Recycled Aluminium, Recycled Carbon Fibre, Bioplastics & Biopolymers, Natural Fibre Composites) • By Vertical(Automotive, Energy, Electrical & Electronics, Packaging, Building & Construction, Marine, Aerospace, Power, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Braskem, Cirba Solutions, NatureWorks LLC, Schneider Electric, Siemens, Tesla, Umicore, Unilever, Veolia, Indorama Ventures, Unifi, and Dow. |