Green Technology and Sustainability Market Report Scope & Overview:

Get more information on Green Technology and Sustainability Market - Request Sample Report

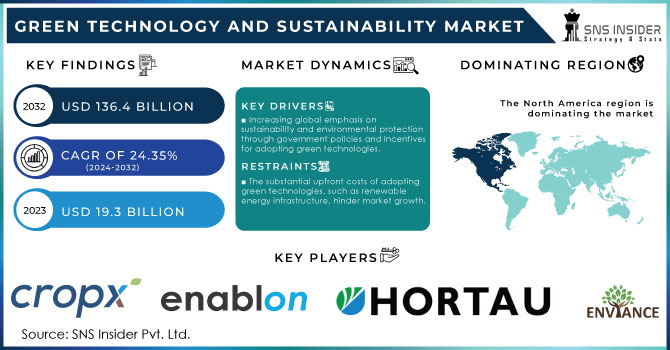

Green Technology and Sustainability Market Size was valued at USD 19.3 Billion in 2023 and is expected to reach USD 136.4 Billion by 2032, growing at a CAGR of 24.35 % over the forecast period 2024-2032.

Global green technology and sustainability market is principally driven by the stringent demands of governments all across to reduce Carbon emissions. The data published by U.S. Environmental Protection Agency disclosed that in 2023 the U.S. Federal Government spent $555 billion on clean energy and green technology, which is 20% up from the previous year. This funding supports renewable energy projects, carbon capture, energy-saving solutions, and equipment for environmental monitoring. Another important catalyst for green technology and sustainability market growth are the goals of the European Union. The European Union’s Green Deal is committed to achieving balance with the climate by 2050, and in 2023 the investments in sustainability technologies and infrastructure of the member countries comprised €700 billion. Moreover, the industry is also highly motivated by the influence suffered from a different government’s measures, which can be taken under the condition of the policies, such as a tax credit or renewable energy subsidies, or the carbon footprint charges. The increasing need for the strict climate regulations imposed by different countries and the motivation for decreasing the emissions contribute to the green technology and sustainability market growth. The policies implemented by the governments are shortening the time for the green technologies deployment. At the same time, the development of policies and projects expand the innovation opportunities for the companies, which start inventing new technologies, which are less harmful to the environment.

Generative AI had a significant impact on the market. The Gen AI Municipal Employee will provide tools and models for business and sustainability adjusters with Sustainability KPIs. Schneider Electric recently launched a Gen AI and end-user tool that will help their end-users revolutionize their operations and provide profound evidence of this process with their Gen SAI. Schneider Electric has found a perfect match for its Gen AI Sustainability and Productivity tools with the Microsoft Azure OpenAI combine for its operations revolutionization.

Market Dynamics

Drivers

-

Increasing global emphasis on sustainability and environmental protection through government policies and incentives for adopting green technologies.

-

A growing need for renewable energy sources such as solar, wind, and hydropower to reduce carbon footprints.

-

Increasing corporate social responsibility (CSR) efforts among companies to implement eco-friendly practices and reduce greenhouse gas emissions.

-

Rising awareness of climate change and environmental impacts is pushing consumers and businesses toward sustainable products and services.

-

Industries are shifting towards circular economy models that focus on reducing waste, reusing materials, and recycling to minimize environmental impact.

A major contributor to the green technology and sustainability market is corporate sustainability drives. In the past few years, environmental awareness has increased among businesses of all industries. Every company’s main ambition now focuses on reducing carbon footprints, waste production, and reliance on non-renewable energy sources. For example, in 2023, over 80% of the world’s largest companies reported sustainability as a key priority, with many aiming for carbon neutrality by 2050 or earlier.

Corporate social responsibility (CSR) programs also have become more widespread, with major brands companies establishing environmental goals. For example, various tech giants along with Apple and Google have already promised to reach 100% renewable energy in their global output. Moreover, the World Economic Forum reports that virtually 90% of businesses in developed countries integrate sustainability into their global supply chains. Additionally, approximately 67% of US businesses are now shifting production towards sustainable product offerings to benefit from the demand. Consequently, as businesses collectively invest in green technologies, this drive for sustainability promotes the market from a commercial standpoint, ensuring long-standing environmental benefits.

Restraints

-

The substantial upfront costs of adopting green technologies, such as renewable energy infrastructure, hinder market growth.

-

Lower awareness and technological infrastructure in developing regions slow the global adoption of green technologies.

-

Continued reliance on fossil fuels and resistance from industries that rely on traditional energy sources slow the transition to green technologies.

One factor that substantially restrains the development of the market is related to costs. Specifically, green technologies are often associated with high upfront expenses needed to adopt them. Many types of technology tailored to promoting sustainability involve renewable resources, such as solar-panels, wind turbines, and other forms of infrastructure and following-adjustments that are more energy-efficient. However, adopting these technologies is facilitate-related and may surpass the cost of traditional energy systems. Specific materials of technologies may be more advanced and require skills both in development and handling, as well as equipment which is difficult to obtain. As such, a class of problems arises can be attributed largely to initial costs and can frankly deter businesses and consumers.

For businesses and consumers alike, this cost factor can be a deterrent, especially in regions where short-term economic benefits take precedence over long-term environmental goals. Though the technology guarantees savings in the long-run, for it to even start generating return on investments prospective users must outlay certain capital. This is impeding the feed of small and medium enterprises to adopt green technologies and users with inferior financial capabilities. This issue is compounded by the absence of financing tools and incentives, is resulting in a slower transition to sustainable practices and the lasting of reliance on traditional sources of energy.

Segment analysis

By Technology

Internet of Things (IoT) accounted for the largest share in green technology and sustainability market with a 38% market share. IoT has become integral in optimizing energy usage, monitoring environmental changes, and improving waste management systems, leading to its dominance in the market. For example, smart grids based on IoT are gaining widespread adoption in areas such as north America and Europe. With more than 50 million smart meters in place across the U.S. by end-2023, energy will be distributed far more efficiently and wastage can be significantly reduced (based on US Department of Energy). In addition, the Renewable Energy Directive from the EU requires member states to introduce smart grids into their renewable energy shift and provides additional room for IoT in green tech growth. This technology allows the monitoring of emissions, energy consumption and other environmental variables in real-time so it becomes crucial for Governments/Enterprises planning to fulfil their sustainability goals.

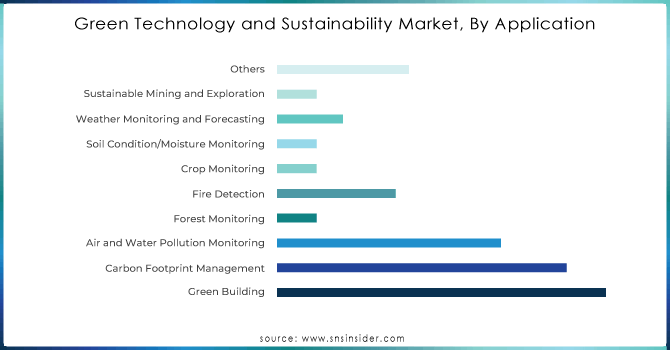

By Application

The Green Building segment became the dominant in the Green Technology and Sustainability Market in 2023 which held approximately 25% of the market share. Aided by governmental regulations and initiatives, the development of green building solutions is driven by the need for energy-efficient and sustainable construction practices. For example, as stated by the U.S. Green Building Council, over 68% of all new commercial buildings constructed in the U.S. in 2023 were certified under the LEED standard, indicating the prevalence of the trend to engage in sustainable architecture. This is largely done to promote lower energy consumption, improved indoor air quality, and decreased greenhouse gas emissions. In fact, green buildings serve as essential resources in the fight against climate change.

One of the major contributing factors is the activity of the governmental organizations that support the establishment of this trend. For example, the federal government of the U.S. initiated the use of tax schemes in the form of Energy Efficient Commercial Buildings Deduction as a method of incentivizing businesses of all sizes and types to engage in green building practices, which incited widespread adoption across economic sectors. In the European Union, the increase in the stringency of the Energy Performance of Buildings Directive fuelled the growth of the green building market by stipulating higher energy efficiency standards for new structures and building renovations. Combined with the advancements in sustainable construction materials and energy management systems such as building automation, these practices have made green building solutions the largest application segment in the industry.

Carbon Footprint Management grow with significant growth rate. This significant growth can be attributed to increasing regulatory pressure on industries to reduce their carbon emissions and meet international climate goals, such as those set by the Paris Agreement. The United Nations Environment Programme (UNEP) reported that global CO2 emissions reached 36.8 billion tons in 2023, making carbon footprint management a top priority for both governments and industries. Technologies such as carbon capture, emission tracking software, and energy efficiency solutions are increasingly being implemented by industries to monitor and reduce their carbon output.

Need any custom research on Green Technology and Sustainability Market - Enquiry Now

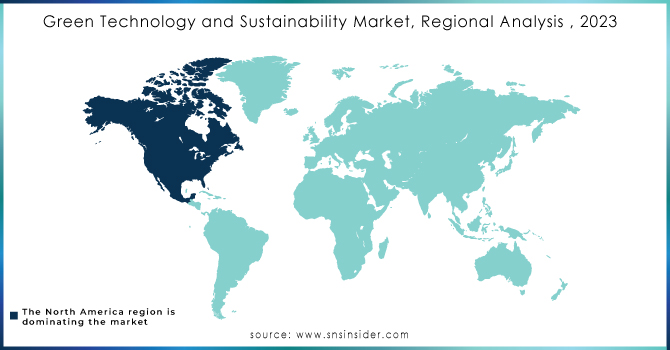

Regional Analysis

In 2023, green technology and sustainability market was led by North America and accounted more than 38% revenue share. This is sustained by robust commitment of government for green initiatives, technology development and environmentally sustainable regulatory environment. The U.S. Energy Information Administration (EIA) reported that in 2023, the U.S. produced 1,820 terawatt-hours of renewable energy, a 10% increase from the previous year, thanks to federal and state incentives for renewable energy sources like wind and solar. It's one of the reasons that investments in smart grids, carbon capture and green buildings have helped make it a leader in clean tech. Further market growth is expected, though this outlook assumes that the U.S. government's $369 billion allocation toward clean energy in 2023 as part of the Inflation Reduction Act takes place. In addition to the provinces and territories, North America demonstrates its climate commitment with Canada's Climate Action Incentive Fund for businesses that embrace clean technologies. This has made it a key global player in green technology given the advanced technological infrastructure present and continuous strive for environmental sustainability.

The APAC is expected to grow with significant growth rate during the forecast period. While in other places like India and China the highest growth is registered, where it highlights that while these countries grow at a vigorous rate, they are also integrating new technological developments to enhance their business operations.

Key Players

The major players in market are Cropx inc., Enablon, Enviance, General Electric company, Engie Impact, Hortau, Wolters Kluwer N.V., Salesforce, Inc., International business machines corporation, Lo3 energy, Microsoft, Oracle corporation, Trace genomics, inc., Tech Mahindra limited and others in final Report.

Recent Developments

-

February 2024, IBM upgrades its Envizi Scope three emissions accounting solution with related features. The Supply Chain Intelligence Module is a key part of the IBM Envizi ESG Suite and now incorporates gathering Product Carbon Footprint (PCF) data as well as supplier information and product-level transactional details to enable true Scope 3 reporting calculation.

-

February 2024, Microsoft released AI and data tools for to sustainable business goals. Updates to the Microsoft Sustainability Manager including Copilot and intelligent insights will also enable businesses to report in a more streamlined manner, providing easier tracking and reduction of emissions, waste and water use. It is one of the sustainability offers under Microsoft Cloud.

-

In November 2023, The U.S Department of Energy announced a $200 million research and development investment in carbon capture technologies to support the government's plan for net-zero emissions by 2050. The effort is designed to improve the efficiency of carbon capture and storage (CCS) systems in industrial settings like energy. The investment is designed to spur greater innovation in carbon management technologies.

| Report Attributes | Details |

| Market Size in 2023 | USD 19.3 Bn |

| Market Size by 2032 | USD 136.4 Bn |

| CAGR | CAGR of 24.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (solution and services) • by Technology (Internet of Things (IoT), Cloud Computing, Artificial Intelligence & Analytics, Digital Twin, Cybersecurity, Blockchain) • by Application (Green Building, Carbon Footprint Management, Weather Monitoring & Forecasting, Air and Water Pollution Monitoring, Forest Monitoring, Crop Monitoring, Soil Condition/Moisture Monitoring, Water Purification, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cropx inc., Enablon, Enviance, General Electric company, Engie Impact, Hortau, Wolters Kluwer N.V., Salesforce, Inc., International business machines corporation, Lo3 energy, Microsoft, Oracle corporation, Trace genomics, inc., Tech Mahindra limited |

| Key Drivers | • Increasing global emphasis on sustainability and environmental protection through government policies and incentives for adopting green technologies. • A growing need for renewable energy sources such as solar, wind, and hydropower to reduce carbon footprints. |

| Market Opportunities | • The substantial upfront costs of adopting green technologies, such as renewable energy infrastructure, hinder market growth. |