Testing, Inspection, and Certification (TIC) Market Size Analysis:

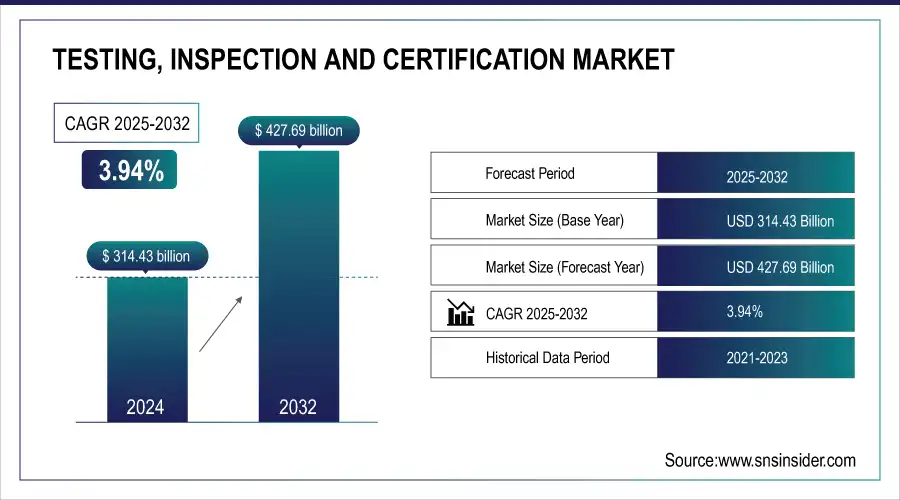

The Testing, Inspection, and Certification (TIC) Market Size was valued at USD 314.43 billion in 2024 and is expected to reach USD 427.69 billion by 2032 and grow at a CAGR of 3.94% over the forecast period 2025-2032. The Testing, Inspection, and Certification market plays a crucial role in ensuring the quality, safety, and compliance of products and services across various industries. The market encompasses a wide range of services, including testing of products for performance and safety, inspection of manufacturing processes and facilities, and certification that products or systems meet specific standards or regulatory requirements.

The TIC market has seen significant growth in recent years, driven by the increasing complexity of global supply chains, the rising demand for quality assurance, and the stringent regulatory requirements imposed by governments and industry bodies. In the U.S., the American National Standards Institute (ANSI) certifies organizations for certification services, with more than 800 accredited organizations across various sectors. Over 1.50 million entities worldwide, including numerous U.S. companies, have received the ISO 9001 certification, which is a global standard for quality management systems.

Get more information on Testing, Inspection, and Certification Market - Request Free Sample Report

Testing, Inspection and Certification (TIC) Market Size and Forecast:

-

Market Size in 2024: USD 314.43 Billion

-

Market Size by 2032: USD 427.69 Billion

-

CAGR (2025–2032): 3.94%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

The automotive sector is facing a complicated environment of rules, technological progress, customer demands, international market growth, and sustainability issues, which all require thorough Testing, Inspection, and Certification (TIC) services. Globally, the sector encounters more than 50,000 alterations in regulations annually, leading to a substantial increase in the need for compliance testing. Consumer expectations continue to impact the TIC industry, as 75% of consumers prioritize vehicle safety and reliability.

Key Testing, Inspection, and Certification (TIC) Market Trends:

-

Growth in international trade is driving demand for TIC services to ensure compliance with diverse country-specific regulations and standards.

-

Complex global supply chains require extensive testing and inspection at every stage to maintain quality and regulatory adherence.

-

Increasing consumer expectations for safe, reliable, and high-quality products are boosting investments in TIC services.

-

Online reviews and social media influence brand reputation, emphasizing the importance of product quality and safety certification.

-

Rising focus on food safety and contamination prevention is driving stricter testing and certification in the food and beverage sector.

Testing, Inspection, and Certification Market Growth Drivers:

-

Navigating intricate regulations and ensuring compliance in the TIC market influenced by global trade.

The growth of international trade is a major factor affecting the TIC market. As nations participate in global trade, products must meet various regulations and standards unique to each market. Extensive testing, inspection, and certification are required to ensure compliance with varying country-specific requirements. For instance, a product made in China and meant to be sold in the European Union must adhere to the strict regulations of the EU, which can vary from those in the United States or other areas. Globalization has created an intricate supply chain system, with parts of a solitary product possibly coming from various nations.

-

Increasing consumer safety demand is leading to higher investments in TIC services to ensure quality standards are met.

Consumers are increasingly expecting high-quality, safe, and reliable products due to the abundance of information available online. The change in consumer habits is causing businesses to increase their investments in TIC services to guarantee that their products adhere to the highest quality and safety standards. The growth of social media and internet review sites has increased the importance of product quality on brand image. Consumers are more worried about food safety in the food and beverage sector. This has pushed companies to put more money into stringent testing and certification procedures to guarantee their products are contaminant-free and comply with health and safety regulations.

Testing, Inspection, and Certification (TIC) Market Restraints:

-

Small and medium-sized testing, inspection, and certification firms embrace sophisticated technologies at a slower pace.

Smaller and medium-sized testing, inspection, and certification (TIC) companies frequently encounter difficulties in implementing advanced technologies because of various factors that affect their speed of integration. A major limitation that these companies face is the restricted financial resources at their disposal. Smaller companies may struggle to allocate the significant capital needed to invest in advanced technologies like automation tools, artificial intelligence, or state-of-the-art testing equipment. Smaller firms may find it difficult to invest financially in these high-risk opportunities that have uncertain returns.

Moreover, the challenge of incorporating new technologies into current systems is significantly difficult. Small and medium-sized TIC companies may not have the required technical knowledge or staff to effectively set up and upkeep complex systems. Providing training for employees on using new technologies and modifying current processes to incorporate these advancements can require a lot of resources and time, leading to increased reluctance.

TIC - Testing, Inspection, and Certification Market Segment Analysis:

By Service Type

Testing led the market in 2024 with a market share of more than 42%. It involves a wide range of activities such as product development and manufacturing that are demanded across different industries. Therefore, products and systems are under testing to ensure they meet safety, quality, and legal requirements. To comply with the demand and assure their customers of quality services, companies currently prefer using services of licensed test centers for the safety of their products. Their focus on material durability and strength, as well as functional and operational reliability, has resulted in their dominance in the market.

Inspection is considered to be the fastest-growing segment during 2025-2032 in the TIC market. It is defined by the growth of this segment because of the increased number of government regulations in such industries as construction, energy, and manufacturing. The demand is stated to grow as the risk associated with the in-house inspection of equipment with no standards and regulations for such inspections has also grown. The tendency is maintained because of the growing global trade, stricter government regulations surrounding the development and adoption of unified standards for world trade, and smart inspection technologies that also sustain demand for inspections.

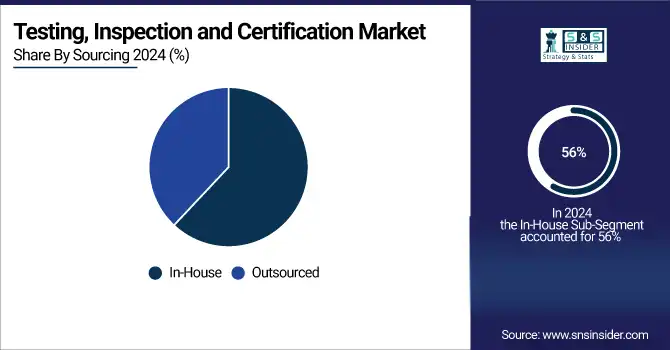

By Sourcing

The In-House segment held a market share of around 56% in 2024 and dominated the market. This approach enables companies to retain control over the quality, speed, and confidentiality of services, which is particularly important in precision and highly regulated industries. Companies utilize In-House TIC services in the pharmaceutical, aerospace, and automotive sectors, among others, because of the high standards and the need for protection of proprietary processes. Given that companies conduct the services in-house, they can appreciate risks effectively, comply with the requirements of complex regulations, and adapt the services to their specific conditions. At the same time, third-party access is limited, meaning that the majority of the risk is mitigated by the organization itself.

The outsourced is the most rapidly growing segment with a faster CAGR between 2025-2032. The situation is conditioned by the expansion of global supply chains and increasing demands, which make it difficult for companies to sustain versatile and specialized TIC services. Companies seek the services of third parties to benefit from providers’ advanced technology, knowledge, and worldwide coverage. The outsourced segment represents an appealing option for smaller entities because they have a varying degree of burden but may not require institutionalization of In-House TIC services.

By Application

The infrastructure segment led the market with a revenue share of more than 15% in 2024. Increased infrastructural activities in various countries, such as China, India, and some European countries, especially in the development of transportation systems, are expected to enhance the rate of adoption of TIC services and products in these regions, providing a boost to the market. The consumer goods and retail, as well as the agriculture and Medical & Life Science, chemicals, energy & power, education, and government, manufacturing, healthcare, and Chemicals, oil & gas, and petroleum, public sector, automotive, aerospace & defense, supply chain & logistics, and other applications segments also influence the market.

The consumer goods and retail segment are expected to grow at a faster rate during 2025-2032, due to the inspection activities that the companies in this sector carry out. To provide flawless products to its customers, consumer goods companies must comply with various quality regulations and standards. This is the deployment of highly efficient and comprehensive inspection systems and, consequently, the growth in the TIC market. Additionally, companies in the retail sector must provide customers with optimum products and the best possible customer shopping experience, which enhances the penetration of TIC services and technologies and, consequently, drives market growth.

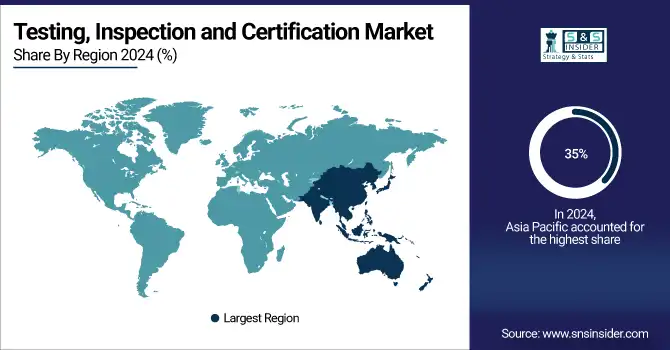

Asia Pacific Testing, Inspection, and Certification (TIC) Market Insights

Asia Pacific dominated the market in 2024 with a market share of over 35%. The prime driving factors that contribute to this growth include the expanding industrial base, growing manufacturing activities, and the increasing demand for improved quality and safety by consumers in the region. Additionally, the industrial growth experienced in China, India, and Southeast Asian countries requires these industries to increase their TIC services to ensure their products comply with international standards. The booming construction, electronics, and automotive industries in the region further stimulate the need and the demand for full-service TIC solutions.

Need any customization research on Testing, Inspection, And Certification Market - Enquiry Now

Europe Testing, Inspection, and Certification (TIC) Market Insights

Europe is projected to witness a massive growth rate during the forecast period. The presence of established and eminent automotive industries in countries such as Germany and France also makes the seamless deployment of the testing and inspection ecosystem enhance the operations of Europe-based automotive production companies. Similarly, with the presence of exceptional fashion brands and retail and consumer goods corporations based in countries like Italy, Portugal, and the U.K., they nurture and catalyze the growth, nurturing the growth of the local testing and certification market.

North America Testing, Inspection, and Certification (TIC) Market Insights

The North America Testing, Inspection, and Certification (TIC) market is driven by stringent regulatory standards, growing consumer demand for quality and safety, and expanding industrial and manufacturing activities. Key sectors include automotive, food & beverage, and electronics, with TIC services ensuring compliance, reliability, and competitive advantage across supply chains.

Latin America and Middle East & Africa TIC Market Insights

The LATAM and MEA Testing, Inspection, and Certification (TIC) markets are growing due to increasing industrialization, regulatory enforcement, and rising consumer awareness of product quality and safety. Key sectors include energy, construction, and food & beverage, with TIC services ensuring compliance, risk mitigation, and enhanced market credibility.

Testing, Inspection & Certification (TIC) Companies are:

-

SGS Group

-

Eurofins Scientific

-

Apave International

-

TIC Sera

-

Element Materials Technology

-

UL LLC

-

QR Testing

-

Hohenstein

-

Dekra Certification

-

ALS Limited

-

Intertek Group plc

-

SAI Global Limited

-

MISTRAS Group, Inc

-

TUV SUD

-

TUV Rheinland

-

DNV

-

Kiwa

-

CTC Group

Competitive Landscape for Testing, Inspection, and Certification (TIC) Market:

SGS Group, a global leader in testing, inspection, and certification (TIC) services, ensures product quality, safety, and regulatory compliance across industries. The company provides comprehensive solutions, including laboratory testing, audits, and certification, supporting global trade and consumer confidence.

-

In June 2024, a leading TIC company, SGS, introduced the SmartSense Environment Monitoring Solution used for real-time environmental monitoring. The advanced IoT sensors are used to provide accurate data of measurements of key environmental parameters and help to comply with environmental rules and norms.

TÜV SÜD is a global testing, inspection, and certification (TIC) company providing safety, quality, and sustainability solutions across industries. The company offers product testing, system certification, inspection, and training services, helping businesses comply with regulations and enhance operational efficiency.

-

In May 2024, TUV SUD launched AI-driven inspection technology used to increase the accuracy of industrial inspections. By using machine learning algorithms to detect defects and anomalies in the manufacturing processes, this new technology allows to reduce the time needed for inspections.

Bureau Veritas is a global leader in testing, inspection, and certification (TIC) services, offering expertise in quality, health, safety, and environmental compliance. The company supports industries with auditing, certification, laboratory testing, and consulting to ensure regulatory adherence and operational excellence.

-

In April 2024, Bureau Veritas introduced a new cybersecurity certification program developed specifically for the Internet of Things. This type of IoT certification is expected to prove that “connected devices are secured by design and by default”.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 314.43 Billion |

| Market Size by 2032 | USD 427.69 Billion |

| CAGR | CAGR of 3.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Testing, Inspection, Certification) • By Sourcing (In-House Sourcing, Outsourced) • By Application (Consumer Goods & Retail, Agriculture & Food, Chemicals, Infrastructure, Energy & Power, Education, Government, Manufacturing, Healthcare, Mining, Oil & Gas and Petroleum, Public Sector, Automotive, Aerospace & Defense, Supply Chain & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SGS Group, Bureau Veritas, Eurofins Scientific, Apave International, IRClass, TIC Sera, Element Materials Technology, UL LLC, QR Testing, Hohenstein, Dekra Certification, ALS Limited, Intertek Group plc, SAI Global Limited, MISTRAS Group, TUV SUD, TUV Rheinland, DNV, Kiwa, and CTC Group. |