Supply Chain Management Market Size & Overview:

Get more information on Supply Chain Management Market - Request Sample Report

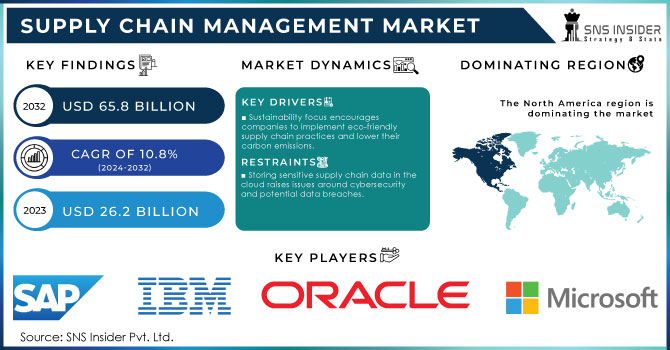

The Supply Chain Management Market Size was valued at USD 26.2 billion in 2023 and is expected to reach USD 65.8 billion by 2032, growing at a CAGR of 10.8% from 2024-2032.

The supply chain management (SCM) market is undergoing rapid transformation, driven by technological advancements and the increasing complexity of global supply chains. A recent study found that the average supply chain has a digitization level of 43%. SCM solutions encompass a wide range of services, including procurement, inventory management, logistics, and demand planning, all of which are crucial for optimizing the movement of goods and resources from suppliers to end consumers. A key driver of growth in the SCM market is the adoption of cloud-based platforms, which provide real-time visibility, scalability, and cost-effectiveness. These platforms allow businesses to streamline operations, respond to disruptions more quickly, and integrate data from various sources to improve decision-making. The rise of e-commerce is another major growth factor, as it has created the need for more sophisticated and responsive supply chain networks. Companies are investing in last-mile delivery solutions and reverse logistics to meet customer expectations for fast and reliable delivery. Moreover, the focus on sustainability and reducing carbon footprints is pushing organizations to adopt green supply chain practices, such as optimizing transportation routes, using eco-friendly packaging, and implementing circular supply chains.

Additionally, the increasing adoption of artificial intelligence (AI) and machine learning (ML) is transforming supply chain operations. AI-powered predictive analytics is playing a major role in helping companies anticipate demand fluctuations, reduce costs, and strengthen supply chain resilience. In 2023, AI-driven demand forecasting led to a 10% reduction in overstocking for companies like Nestlé by providing more accurate predictions based on historical data and demand variability. Automation and robotics are also becoming integral in warehouses and distribution centers, improving efficiency and reducing human errors.

Globalization and the increasing complexity of multi-tiered supply chains are prompting businesses to invest in advanced SCM solutions that offer end-to-end visibility, traceability, and collaboration across supply chain partners. This ongoing trend, coupled with rising consumer expectations for transparency and sustainability, will continue to drive innovation and adoption in the SCM market.

Supply Chain Management Market Dynamics

Drivers

- Sustainability focus encourages companies to implement eco-friendly supply chain practices and lower their carbon emissions.

- Cloud-based platforms enable real-time visibility, scalability, and cost-effective operations.

- E-commerce growth drives demand for advanced logistics, last-mile delivery, and reverse logistics solutions.

E-commerce growth is a key driver for the supply chain management (SCM) market, as the rise of online shopping demands faster and more efficient logistics solutions. Consumers now expect rapid deliveries and seamless returns, pushing businesses to invest in advanced supply chain technologies. Last-mile delivery, which refers to the final stage of product delivery from the warehouse to the customer's doorstep, is becoming increasingly critical. To meet customer expectations, companies are adopting technologies such as route optimization software, drones, and autonomous vehicles to speed up deliveries while reducing costs. Reverse logistics, or the process of managing product returns is also gaining importance as e-commerce expands. Efficient returns handling is essential for customer satisfaction and cost management, driving investment in specialized reverse logistics solutions.

Looking ahead, the continued growth of e-commerce will accelerate the adoption of innovative supply chain strategies. The future of SCM will likely see greater integration of automation, artificial intelligence, and data analytics to handle the increasing volume of orders and returns. Additionally, sustainability in logistics, such as using electric vehicles for deliveries and optimizing packaging, will play a crucial role as businesses respond to both regulatory pressures and consumer demand for eco-friendly practices.

Restraints

- Storing sensitive supply chain data in the cloud raises issues around cybersecurity and potential data breaches.

- Implementing and managing complex SCM systems require specialized knowledge, which is in short supply.

- Integrating new SCM technologies with legacy systems can be difficult and time-consuming.

Integrating new supply chain management (SCM) technologies with legacy systems can be challenging because older systems may not be compatible with modern software. Many businesses still rely on outdated, siloed systems that are not designed to communicate with advanced cloud-based or AI-driven SCM platforms. This lack of interoperability can lead to inefficiencies, data silos, and the need for extensive custom integration work. The process of integrating new technologies is often time-consuming, requiring careful planning, testing, and sometimes re-engineering existing processes. It may also involve training employees to use the new systems, adding to the complexity. Additionally, businesses may face operational disruptions during the integration phase.

Supply Chain Management Market Segment Analysis

By Component

In 2023, the solution segment dominated the market and captured the largest share of 54.8%. Supply chain management (SCM) solutions are utilized for various functions, including quality assurance, inventory management, vendor management, supplier management, and logistics management. These solutions offer numerous advantages, such as enhanced visibility, improved efficiency, advanced analytics, reduced costs, greater agility, and increased compliance within complex supply chains. They help automate key processes like order processing, billing, and order tracking, which ultimately reduces time and administrative expenses. In 2023, the transportation management system (TMS) segment accounted for the largest share of the market. A TMS is designed to plan freight movement and help clients efficiently manage transportation activities throughout the supply chain. The demand for TMS has been growing rapidly, as these systems are crucial to supply chains, influencing every stage of the process—from planning and procurement to logistics and lifecycle management.

The service segment is projected to witness the highest CAGR during the forecast period. Supply chain management (SCM) services deliver data-driven insights that enhance supply chain operations for businesses. These services provide real-time predictive assessments of production costs, helping to identify inefficiencies and opportunities for improvement. Additionally, they facilitate data-driven sales and operations planning as well as inventory management, contributing to cost reduction.

By Deployment

The on-premise segment dominated the market and accounted for the largest market share of 49.9% in 2023. This segment has traditionally been favored by many organizations due to its perceived advantages in control, security, and compliance. Businesses using on-premise SCM systems maintain direct oversight of their data and systems, allowing for customized configurations tailored to specific operational needs.

The cloud-based segment is projected to witness substantial growth at a significant CAGR during the forecast period. Organizations are increasingly adopting cloud-based solutions due to their enhanced adaptability and flexibility in supply chain processes. This approach provides numerous advantages, including improved processing capabilities, expanded storage options, cost-effective pricing models, and reduced operational overhead. These advantages are driving the growth of the market.

By Enterprise Size

In 2023, the large enterprise segment dominated the market and held the largest market share of 47.9%. This growth is driven by the rising demand for continuous monitoring systems and automation features, including advanced shipment notification management, customizable alerts, in-transit status updates, user-configurable dashboards, and visual supply chain maps across various large-scale industries. Supply chain management (SCM) solutions also provide access to accurate real-time freight analytics and the ability to generate reports, enabling large enterprises to make informed business decisions related to supply planning, inventory management, and distribution planning. Additionally, the market is expanding due to a significant increase in the need for software that helps large organizations gather critical business data, such as inventory levels, projected sales figures, and supplier information.

The small and medium-sized enterprise (SME) segment is anticipated to grow at the highest CAGR of 12.1% during the forecast period. Supply chain management (SCM) provides flexibility, scalability, and cost savings for supply chain operations. By implementing SCM solutions and services, SMEs can enhance profitability and achieve desired outcomes while improving operational efficiencies. Startups and SMEs often find themselves in a challenging position, grappling with the management of fluctuating demand and optimizing resource efficiency.

By Vertical

The manufacturing segment held a 20.9% market share in 2023 and is anticipated to remain a dominant force during the forecast period, driven by the growing demand for automation in supply chain processes within the manufacturing sector. By adopting a reliable supply chain management (SCM) system, manufacturers can enhance their production processes and reduce operating costs. For example, in March 2022, American Software, Inc. announced software enhancements aimed at improving planning capabilities throughout the product lifecycle. Clients in the manufacturing sector utilizing the company’s digital platform can leverage supply chain network maps to analyze the global relationships within their integrated supply chains.

The retail and e-commerce segment is projected to achieve the highest CAGR of 14.2% during the forecast period. E-commerce supply chain management (SCM) focuses on the timely procurement of raw materials, production, and distribution of products. It includes the management of supply and demand, warehousing, inventory tracking, order processing, and customer delivery. SCM enhances network transparency and facilitates the monitoring of performance across all activities in production, warehousing, and distribution. This allows for more comprehensive control and tracking of operations from procurement to the final shipment of goods to the end user. Moreover, effective SCM ensures on-time deliveries, which directly influences customer satisfaction and interactions.

Supply Chain Management Market Regional Analysis

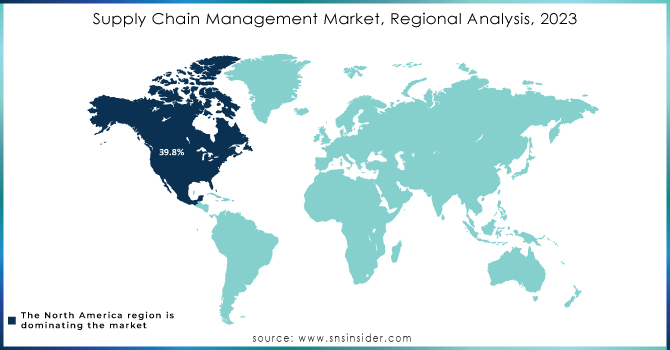

North America captured a significant market revenue share of 39.8% in 2023 and is projected to maintain its dominance during the forecast period. The growth in this region is driven by a large number of software adopters and its rapid technological advancements. Additionally, the presence of major players such as IBM, Microsoft, Telus International, and Infor further supports market expansion in the area.

The Asia Pacific region is expected to achieve the highest growth rate of about 11.9% during the forecast period. This market growth is driven by increasing opportunities in the area, as well as significant investments in supply chain management (SCM). The supply chain management industry in India has been experiencing significant growth, driven by the country's expanding manufacturing sector, increasing consumer base, and rapid e-commerce development. This growth has led to a rising demand for advanced solutions that optimize logistics operations, improve warehouse management functions, and integrate technologies like cloud computing, AI, and IoT for real-time visibility and data-driven decision-making. Leading firms such as Flipkart and Amazon.com, Inc. are utilizing these solutions to manage the surge in online orders and ensure efficient supply chain processes.

North America is the technologically most advanced region of the world in terms of SCM vendor presence. In North America, SCM services and products are widely used. In North America, the United States dominates its SCM market. Several sectors in the area, including BFSI, healthcare, retail, manufacturing, and retail, have embraced SCM services. The growing IoT trend and focus on increasing the effectiveness of supply chain activities such as logistics, warehousing, fulfillment, production, and transportation management have increased the need for SCM in the region.

The need for SCM in the Asia-Pacific area is anticipated to increase as a result of significant infrastructure investments made by governments and private businesses, particularly in India and Indonesia. The size of shipments and deliveries of raw materials, work-in-progress (WIP), and finished items are expanding globally thanks to the newest developments in trucking, containerization, and computerization, which are successfully regulating supply chain cost, quality, and delivery. Improving. SCM services and software. In the regional analysis study of the regions of North America, Europe, Asia Pacific middle east, and Africa.

Need any customization research on Supply Chain Management Market - Enquiry Now

Key Players

The major key players are

- Oracle - (Oracle E-Business Suite, Oracle Supply Chain Management Cloud)

- SAP - (SAP ERP, SAP S/4HANA)

- IBM - (IBM Watson Supply Chain, IBM Sterling Supply Chain Solutions)

- Microsoft - (Microsoft Dynamics 365 Supply Chain, Microsoft Azure IoT)

- Infor - (Infor CloudSuite Supply Chain, Infor Nexus)

- JDA Software - (JDA Demand Planning, JDA Warehouse Management)

- Manhattan Associates - (Manhattan Warehouse Management, Manhattan Transportation Management)

- Kinaxis - (Kinaxis RapidResponse, Kinaxis Demand Planning)

- Logility - (Logility Demand Planning, Logility Inventory Optimization)

- E2open - (E2open On-Demand Network, E2open Collaboration Cloud)

- BluJay Solutions - (BluJay Global Trade Network, BluJay Warehouse Management)

- C.H. Robinson - (C.H. Robinson 3PL, C.H. Robinson TMS)

- FedEx - (FedEx Ground, FedEx Express)

- UPS - (UPS Ground, UPS Air)

- DHL - (DHL Express, DHL Supply Chain)

- Kuehne + Nagel - (K+N Contract Logistics, K+N Seafreight)

- DB Schenker - (DB Schenker Logistics, DB Schenker Rail)

- Ryder - (Ryder Dedicated Transportation, Ryder Supply Chain Solutions)

- XPO Logistics - (XPO LTL, XPO Intermodal)

- Schneider National - (Schneider Truckload, Schneider Dedicated)

Recent Developments

- In May 2023, Accenture and Blue Yonder, Inc. announced an expansion of their strategic partnership to enhance supply chains by leveraging Accenture's technology and industry expertise. They will collaborate to develop new solutions on the Blue Yonder Luminate Platform, focusing on creating a more modular, digitized, and agile supply chain by utilizing emerging technologies like generative artificial intelligence and robotic process automation.

- In April 2023, Oracle launched enhanced artificial intelligence (AI) and automation features aimed at helping customers optimize their supply chain management processes.

The professional information, software, and services company Wolters Kluwer attended the North American Supply Chain Executive Summit (NASCES) in Chicago, Illinois, in August 2022. In order to benchmark, network, learn, and exchange solutions to global issues facing every supply chain worker in their everyday work, this event brings together service and solution suppliers and industry experts.

NTT Data and SAP Japan and Asia Pacific have jointly developed a supply chain insurance management system, which was launched in July 2022. The "Connected Product" solution was created in collaboration with SAP SE and NTT Data, two IT services leaders and digital enterprises.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 26.2 billion |

| Market Size by 2032 | USD 65.8 billion |

| CAGR | CAGR of 10.8% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (On-premise, Cloud) • By Enterprise Size (Large Enterprises, SMEs) • By Vertical (Retail & e-Commerce, Healthcare, Automotive, Transportation & Logistics, Food & Beverages, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle, SAP, IBM, Microsoft , Infor, JDA Software, Manhattan Associates, Kinaxis, Logility, E2open, BluJay Solutions, Others |

| Key Drivers | •Sustainability focus encourages companies to implement eco-friendly supply chain practices and lower their carbon emissions. •Cloud-based platforms enable real-time visibility, scalability, and cost-effective operations. |

| Market Restraints | •Storing sensitive supply chain data in the cloud raises issues around cybersecurity and potential data breaches. |