Textile Enzymes Market Report Scope & Overview:

Get More Information on Textile Enzymes Market - Request Sample Report

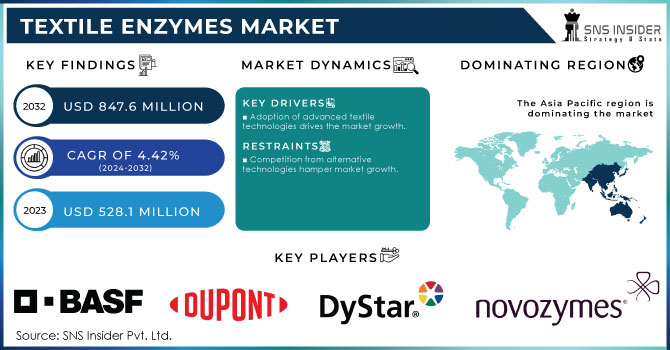

The Textile Enzymes Market Size was valued at USD 528.1 Million in 2023. It is expected to grow to USD 847.6 Million by 2032 and grow at a CAGR of 4.42% over the forecast period of 2024-2032.

The rise of demand for eco-friendly processing methods in the textile industry is one of the major trends promoting the growth of the textile enzymes market. As people and governments all over the world become more environmentally conscious and attempt to adhere to ecological standards and requirements, the necessity to minimize the ecological impact of the textile industry becomes more urgent. In this way, replacing ammonia, caustic, acids, and other harsh chemicals used at various processing stages with textile enzymes allows for supporting the changing needs of society and the world.

According to the United Nations Environment Programme (UNEP), the global textile industry is responsible for about 20% of industrial water pollution, driven largely by the use of chemicals in dyeing and finishing processes. In response, many governments are tightening regulations on textile production. For example, the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) legislation restricts the use of hazardous chemicals, pushing manufacturers to adopt safer alternatives, such as enzyme-based processes.

The demand for functional textiles is increasing, as customers tend to buy fabrics that ensure additional characteristics. However, textile enzymes help manufacturers reach specific and improved functionalities that meet the changing demands of the customers. For example, wrinkle-resistant textiles are produced with the help of enzymes, which effectively change the structure of fibers to make them more wrinkled. In addition, with the help of enzymes textiles can be made softer and more breathable to increase the level of comfort and make it easier to wear. Finally, enzymes contribute significantly to the longer lifespan of the textile and make it more durable.

The U.S. Environmental Protection Agency (EPA) reports that the textile industry is working towards sustainability goals, and innovations such as enzyme treatments are key to meeting these goals while addressing consumer demand for durable and functional textiles.

Textile Enzymes Market Dynamics

Drivers

-

Adoption of advanced textile technologies drives the market growth.

The main driver of growth in the textile enzymes market is consumer behavior, which pushes manufacturers to adopt increasingly advanced textile technologies. They aim to produce high-quality and functional textiles that use the most innovative solutions to improve characteristics crucial to the industry. For example, “smart textiles” or so-called wearable technology require a special enzymatic treatment, as their purpose is to have such innovative characteristics as efficient moisture management, good stretch ability, CO2 and perspiration control, improved comfort, and at the same time more environmentally friendly.

The U.S. Department of Energy has also noted the benefits of such advances, believing that it is possible to save up to 40% of the energy used by these businesses. The companies are integrating more advanced and eco-friendly processes”. Notably, many major businesses in the industry have already implemented advanced technology trends. All in all, such trends show that by applying modern advances in textile technology, the companies are also simultaneously contributing to an increased demand for textile enzymes supporting these developments.

Restraint

-

Competition from alternative technologies hamper market growth.

The major restraint faced by the textile enzymes markets is the competition offered by alternative technologies. Although enzymatic processes are more beneficial in terms of environment and fabric over traditional chemical processes, the latter is still considered the more established and cost-effective solution available. The widespread use of chemicals makes it easier for manufacturers to use synthetic chemical products due to their familiarity and the immediate effect they provide. The recently introduced methods to traditional processes are improving with time whose benefits translate to efficiency and performance and give the established technology of dyeing and coloring preference. For example, digital printing and high-temperature dyeing do not require enzymatic treatments and have a significantly quicker turnaround time.

Textile Enzymes Market Segmentation Overview

By Source

Microorganisms held the largest market share around 68% in 2023. The growth is due to the rising demand for enzymes and benefits such as less toxicity. Furthermore, there is more commercial production of enzymes which is more than other sources. Microorganisms-based enzymes are cut-down into three namely bacterial, fungal, and yeast. Fungi-based products entail amylases, lipases, and proteases. The rise in demand for fungi-based products is a result of their increased use in numerous end-use industries. Their significance in the preparation and production of several textile products.

The plant-based enzymes are sourced from plants, for instance, papain from papaya. The popular enzymes obtained from the plant include lipase, cellulase, protease, and amylase. Amylase is responsible for the consequent absorption and breakdown of starch and carbohydrates. The enzymes are then used to eliminate the starch and reduce the effectiveness of lignin, bleaching, and hydrogen peroxide on the textiles. Moreover, it also has such qualities and hence it is projected to trigger market growth in the forthcoming years.

By Type

The cellulose segment was the market leader and, accordingly, accounted for more than 48% of the total revenue in 2023. This is explained by the fact that this type of enzyme accelerates the process of abrasion of jeans during the finishing process. It is also worth noting that cellulase is the most commonly used type of enzyme for finishing clothing and textiles, which can also increase the demand for textile types during the reporting period.

In addition, the amylase group will show an increase in demand due to the specifics of the impact on the product and a greater degree of efficiency without any harm or damage to the fabric. Currently, amylases are mainly used at the preparatory stage of finishing for de-sizing, while cellulases are used for the softening of textiles, reducing pilling of cotton textiles, and bio-stoneware. In addition, the market uses other types of enzymes from this group, in particular, protease and pectinase.

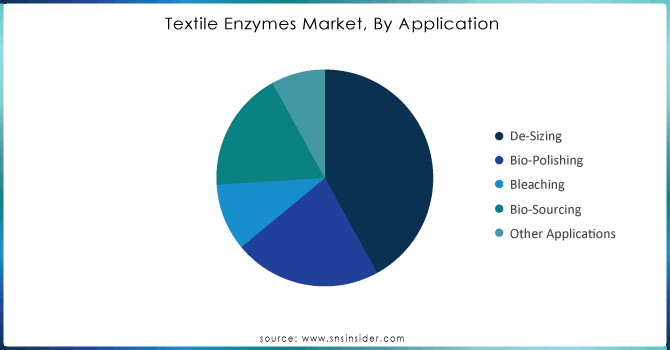

By Application

The de-sizing segment was the most dominant and accounted for a revenue share of 42% in 2023. The segment is dominant due to the recent advancements in the technologies of the desizing processes of jeans and the finishing of synthetic fabrics, which is the trending technology among the youth population across the world. Further, an increase in the popularity, and consumption of soft fabric products, and the lightweight of denim are expected to drive the market.

Bleaching is one of the prime applications of textile enzymes. In this process, enzymes like xylanase and laccases are used in the bleaching of indigo in the denim fabrics and the lignin-contained fibers. In addition, the bleaching of many textiles particularly cotton using enzymes is also being performed with the main objectives of decoloring natural pigments and giving a pure, clear white look. Earlier, hydrogen peroxide was the most-used bleaching agent. However, the application of hydrogen peroxide has to be replaced by applying the enzymatic bleaching technique to produce higher-quality products by damaging the fiber to a lesser extent.

Need Any Customization Research On Textile Enzymes Market - Inquiry Now

Textile Enzymes Market Regional Analysis

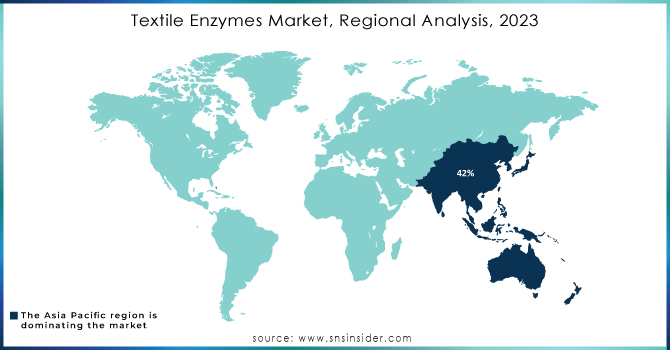

Asia Pacific held the largest market share around 42% in 2023 as it is driven by several aspects of the area’s dominance in the global textile industry. First of all, as the largest producer of textiles, this area of the globe generates the highest demand for textile enzymes. Thus, countries such as China, India, and Bangladesh, which produce the highest number of textiles and have the largest factories, are interested in the use of these substances. According to a report from the Textile Industry Development Centre (TIDC), China accounted for approximately 30% of global textile production in 2022, reinforcing its status as a major player in the market. Additionally, the region is developing due to ongoing urbanization, and despite increasing disposable incomes, the more demanding population requires advanced textiles with new features. To obtain these characteristics and incorporate synthetic parts into clothes, textile makers are more interested in such technologies as enzyme treatment or adding synthetic fiber. One more driving force is the vast investment in the textile industry made by regional governments. These investments come with prescriptions, and as the world is becoming more environmentally aware, governments focus on the use of environmentally friendly chemicals, such as enzymes in textiles. As a result, this region has the largest share in the textile enzymes sector, as it not only has the highest production facilities but also efficiently implements environmentally friendly innovations.

Key Players in Textile Enzymes Market

Key Manufacturers

-

Novozymes A/S (BioPrep)

-

BASF SE (Lavergy)

-

DuPont (PrimaGreen)

-

AB Enzymes GmbH (Biotouch)

-

DyStar Group (Sera)

-

Advanced Enzyme Technologies Ltd. (Savitase)

-

Amano Enzyme Inc. (Amyleaf)

-

Genencor (Puradax)

-

Sunson Industry Group Co., Ltd. (Sunsoft)

-

Maps Enzymes Limited (Mapstex)

-

Hayashibara Co., Ltd. (Amylase TX)

-

Enzyme Development Corporation (Pectinex)

-

Tex Biosciences Pvt. Ltd. (Texazym)

-

Biocatalysts Ltd. (Promod)

-

Chemtex Speciality Limited (Texaclean)

-

Roebic Laboratories, Inc. (Roebic Textile Enzyme)

-

ABF Ingredients (Abolin)

-

Reina Industries Pvt. Ltd. (Reinase)

-

Creative Enzymes (DePolyzyme)

-

Megazyme Inc. (Viscozyme)

Key Users

-

Hanesbrands Inc.

-

Levi Strauss & Co.

-

Nike, Inc.

-

H&M Group

-

Aditya Birla Group (Grasim Industries)

-

Arvind Limited

-

PVH Corp.

-

Kering SA (Gucci)

-

Inditex (Zara)

-

Lenzing AG

Recent Development:

-

In 2023, Novozymes introduced a new enzyme solution for the textile industry aimed at reducing water and energy consumption, aligning with their commitment to sustainable textile processing.

-

In 2022, BASF expanded its Lavergy enzyme range to include a new formulation designed for high-efficiency textile processing, enhancing bio-polishing and desizing capabilities.

-

In 2023, DuPont announced advancements in its PrimaGreen enzyme technology, which allows for cold-water processing, reducing energy usage significantly in textile treatments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 528.1 Million |

| Market Size by 2032 | US$ 847.6 Million |

| CAGR | CAGR of 4.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Plants, Animal Tissue, Microorganisms) • By Type (Amylases, Cellulase, Lipases, Proteases, Pectinases, Laccases, Others) • By Application (De-Sizing, Bio-Polishing, Bleaching, Bio-Sourcing, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novozymes A/S, BASF SE, DuPont, AB Enzymes GmbH, DyStar Group, Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., Genencor, Sunson Industry Group Co., Ltd., Maps Enzymes Limited, Hayashibara Co., Ltd., Enzyme Development Corporation, Tex Biosciences Pvt. Ltd., Biocatalysts Ltd., Chemtex Speciality Limited, Roebic Laboratories, Inc., ABF Ingredients, Reina Industries Pvt. Ltd., Creative Enzymes, Megazyme Inc. and Others |

| Key Drivers | • Adoption of advanced textile technologies drives the market growth. |

| Restraints | • Competition from alternative technologies hamper market growth. |