Wearable Technology Market Size & Overview:

Get More Information on Wearable Technology Market - Request Sample Report

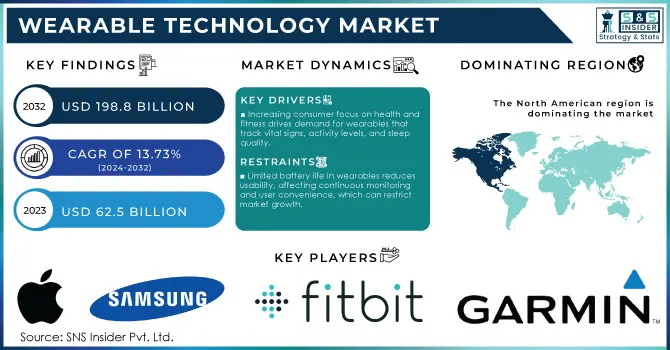

Wearable Technology Market was valued at USD 62.5 billion in 2023 and is expected to reach USD 198.8 Billion by 2032, growing at a CAGR of 13.73% from 2024-2032.

The wearable technology market is experiencing robust growth, driven by rising consumer demand for health and fitness tracking, connectivity, and hands-free communication. Wearables, including smartwatches, fitness trackers, smart clothing, and even medical devices, have become integral to personal and professional routines. One of the driving forces behind this market's expansion is the increased emphasis on health and wellness post-pandemic, with consumers more engaged than ever with tools that monitor physical activity, heart rate, sleep quality, and other health metrics. According to a recent report, as of 2023, more than 320 million wearable devices were sold worldwide, showing the growing penetration of wearables in daily life.

The adoption of wearable technology in healthcare settings is also advancing rapidly. Devices that track vitals and alert users of anomalies, such as irregular heartbeats or elevated blood pressure, are becoming commonplace and are being adopted by healthcare providers for remote monitoring. For example, the Apple Watch, equipped with advanced sensors, has received FDA approval for its ECG feature, which can detect atrial fibrillation and other heart issues. A recent study by Stanford University showed that wearables could detect COVID-19 even before symptoms appeared, highlighting their potential in early diagnosis. This practical utility is leading hospitals and care providers to adopt wearable devices as essential tools for patient monitoring, especially as telehealth services grow.

Another significant factor driving market growth is the expanding use of wearables in corporate wellness programs. Companies, particularly in North America and Europe, are providing employees with fitness wearables to promote healthier lifestyles and improve productivity. For instance, Salesforce partnered with Fitbit in 2022 to launch a wellness initiative, using data to offer employees personalized insights and challenges. Additionally, the growing integration of wearable devices with the Internet of Things (IoT) allows for seamless data transfer across devices, enabling more efficient and personalized experiences.

| Application Area | Example Use Case | Growth Insight |

|---|---|---|

| Health and Wellness | Smartwatches with ECG monitoring | Drives demand in healthcare and personal use |

| Corporate Wellness | Employee health tracking programs | Companies invest in productivity and wellness |

| Medical Diagnostics | Wearables for patient monitoring | Expanding remote patient care and telemedicine |

| Sports and Fitness | Trackers for physical performance | High adoption among athletes and enthusiasts |

Wearable Technology Market Dynamics

Drivers

-

Increasing consumer focus on health and fitness drives demand for wearables that track vital signs, activity levels, and sleep quality.

-

Improved sensors enable accurate, real-time health monitoring and data collection, enhancing the appeal of wearable devices.

-

Seamless connectivity with IoT ecosystems enables wearables to provide personalized insights, increasing user engagement and market demand.

In the wearable technology market, IoT ecosystem integration has significantly driven up demand and value. This connectivity enables wearables like fitness trackers and smartwatches to interact seamlessly with IoT-enabled devices, including smartphones, health monitoring systems, and smart home platforms. As a result, wearables can gather and transmit real-time data, offering users personalized insights into physical activity, health, and daily habits. For example, wearables such as the Apple Watch and Fitbit track health metrics like heart rate and sleep patterns, syncing with mobile health applications to help users monitor their well-being and make informed, data-based decisions. This interconnected approach extends beyond health, benefiting workplace settings where companies use wearables to enhance employee wellness and productivity. With IoT connectivity, wearables have evolved from standalone devices into essential tools that enrich both personal and professional lives with actionable insights.

Wearable technology’s integration with IoT is broadening beyond healthcare into the corporate sector, where businesses increasingly use wearables to monitor employee wellness and productivity. Connected to enterprise IoT systems, these devices collect data on metrics such as activity and stress levels, syncing with wellness applications to encourage healthier work habits. This synergy between IoT and wearables fuels demand by providing actionable, personalized insights, and positioning wearables as essential tools in personal and professional environments. With IoT connectivity as a backbone, wearables evolve from isolated gadgets into essential, data-driven solutions that foster connected and personalized lifestyles.

Restraints

-

Limited battery life in wearables reduces usability, affecting continuous monitoring and user convenience, which can restrict market growth.

-

The relatively high cost of advanced wearable devices may limit adoption, especially in emerging markets where affordability is a key factor.

-

Compatibility challenges with other devices and IoT systems can hinder the seamless functionality of wearables, reducing their appeal in interconnected environments.

Compatibility challenges with various devices and IoT systems significantly impact the functionality and attractiveness of wearable technology in the market. As wearables like smartwatches, fitness trackers, and health monitors become increasingly integrated into daily life, their ability to interact seamlessly with other devices and platforms becomes essential. When wearables struggle to connect efficiently with smartphones, smart home devices, or health applications, their usability and effectiveness suffer. For example, a fitness tracker that cannot sync data with a user’s smartphone app or a health monitoring device that fails to connect with a healthcare provider’s system can frustrate users and diminish their overall experience.

Moreover, the diversity of operating systems and communication protocols among devices can lead to interoperability issues. For instance, a wearable specifically designed for Android devices may not perform well with iOS systems, potentially alienating users who prefer different platforms. This lack of standardization can cause inconsistent performance and hinder crucial data sharing, which is vital for users seeking comprehensive health insights and effective lifestyle management.

As a result, the perceived value of wearables diminishes when users encounter these compatibility hurdles, leading to decreased market adoption rates. Companies in the wearable technology sector must prioritize interoperability to ensure their products can effectively communicate with a broad range of devices and systems. By addressing these compatibility issues, manufacturers can enhance user experience, increase customer satisfaction, and ultimately drive growth in the wearable technology market. Focusing on cross-platform functionality and establishing universal standards can significantly improve the appeal of wearables, allowing them to integrate effortlessly into users' lives and providing a more compelling value proposition.

Wearable Technology Market Segment Analysis

By Product

The wrist-wear product segment dominated the market in 2023, accounting for over 49.39% of total revenue. Most smartwatch and fitness tracker manufacturers aim at consumers including athletes, adventurers, and sports enthusiasts to boost their sales. The wearables provide fitness metrics and help to lead a healthier life by providing calorie intake tracking, hydration interval reminders, and step count reminders. In addition, headwear and eyewear are expected to be the second-largest as well as second-fastest-growing product segments during the forecast period.

By technology, the smart hat segment is anticipated to hold the largest share in the global market as a result of increasing adoption of Augmented and Virtual Reality (AR/VR) which are also one of new trends in multimedia and healthcare sectors with VR headsets and AR headsets gaining popularity. Additionally, the attractiveness of smart caps with their data-driven insights and tracking implementation technology is expected to support segment growth. Companies like Spree Wearables and Life BEAM are playing a key role in exploring the market potential for smart hats.

By Application

The consumer electronics application segment dominated the market and represented over 48.95% of total revenue in 2023. This leadership is largely due to the increasing adoption of wearable technology, such as fitness bands and AR/VR headsets. Several manufacturers, including Garmin Ltd., Omron, Apple Inc., and Nemaura, are dedicated to creating devices that deliver both clinical and non-clinical data. For instance, Nemaura's sugar BEAT Wearable Technology allows continuous blood glucose monitoring for diabetic patients, eliminating the need for daily finger-prick calibrations.

Meanwhile, the healthcare segment is projected to register the second-fastest growth rate during the forecast period. The growing applications of wearable devices in the pharmaceutical sector are expected to further boost this segment's development. Through digital health technology, physicians can engage with patients using telehealth solutions and mobile apps, facilitating virtual patient monitoring. Moreover, advancements in VR and AR are gaining considerable momentum in healthcare, with VR technology increasingly being used for medical training and surgical procedures.

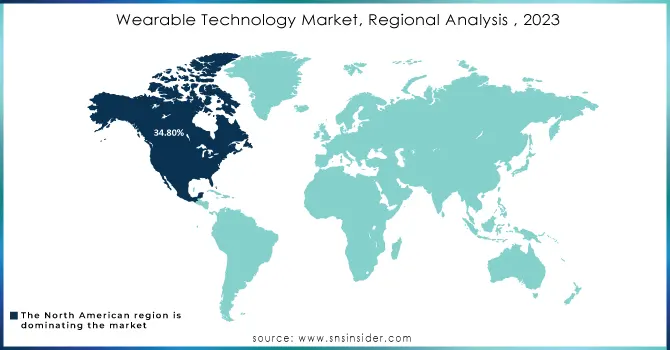

Wearable Technology Market Regional Analysis

In 2023, North America dominated the global market, securing the largest share of 34.80% of total revenue, followed by the Asia Pacific and Europe. This growth in North America has been driven by high levels of technology adoption and the swift introduction of new products. There is a rising demand for devices that support health, facilitate preventive care, and help manage chronic conditions. According to the National Library of Medicine, 30% of Americans use wearable medical technology.

Conversely, the Asia Pacific region is expected to register the fastest growth rate from 2024 to 2032. China is set to play a crucial role in this market, with a growing number of vendors providing competitive product features. Moreover, the demand for wearable technology in China is anticipated to increase as smartphone prices continue to decline, enhancing accessibility. This heightened demand from various target customer groups enables manufacturers to reduce product prices while increasing production volumes.

Do you need any custom research on Wearable Technology Market - Enquire Now

Key Players

The major key players with products are

-

Apple Inc. - Apple Watch Series 9

-

Samsung Electronics - Galaxy Watch 6

-

Fitbit, Inc. (part of Google LLC) - Fitbit Charge 5

-

Garmin Ltd. - Garmin Forerunner 955

-

Xiaomi Corporation - Mi Band 7

-

Huawei Technologies Co., Ltd. - Huawei Watch GT 3

-

Fossil Group, Inc. - Fossil Gen 6 Smartwatch

-

Polar Electro Oy - Polar Vantage V2

-

Withings S.A. - Withings Body Cardio Scale

-

Amazfit (Huami Corporation) - Amazfit Bip 3

-

Sony Corporation - Sony SmartBand 2

-

LG Electronics - LG Watch Sport

-

Microsoft Corporation - Microsoft Band

-

Oura Health Ltd. - Oura Ring Generation 3

-

Whoop, Inc. - Whoop Strap 4.0

-

Suunto (part of Amer Sports) - Suunto 9 Peak

-

Striiv, Inc. - Striiv Smart Pedometer

-

BioBeat Technologies Ltd. - BioBeat Smart Patch

-

Jabra (part of GN Group) - Jabra Elite 7 Active

-

Mio Global (part of the FitTec Group) - Mio Slice

Raw Material Suppliers

-

Apple Inc. - Nippon Seiko Co., Ltd.

-

Samsung Electronics - LG Chem Ltd.

-

Fitbit, Inc. (part of Google LLC) - Broadcom Inc.

-

Garmin Ltd. - Texas Instruments Incorporated

-

Xiaomi Corporation - Qualcomm Technologies, Inc.

-

Huawei Technologies Co., Ltd. - Taiwan Semiconductor Manufacturing Company (TSMC)

-

Fossil Group, Inc. - Midocean Partners, LLC

-

Polar Electro Oy - Vishay Intertechnology, Inc.

-

Withings S.A. - STMicroelectronics N.V.

-

Amazfit (Huami Corporation) - MediaTek Inc.

-

Sony Corporation - Murata Manufacturing Co., Ltd.

-

LG Electronics - Samsung SDI Co., Ltd.

-

Microsoft Corporation - Intel Corporation

-

Oura Health Ltd. - NXP Semiconductors N.V.

-

Whoop, Inc. - Avnet, Inc.

-

Suunto (part of Amer Sports) - BASF SE

-

Striiv, Inc. - Dialog Semiconductor plc

-

BioBeat Technologies Ltd. - Grove Sensors

-

Jabra (part of GN Group) - Knowles Corporation

-

Mio Global (part of the FitTec Group) - Dialog Semiconductor plc

Recent Developments

-

August 2024: Huawei unveiled the All-New HUAWEI TruSense system, set to enhance its upcoming wearables. This innovative system represents a significant advancement in fitness and health sensor technology.

-

July 2023: Samsung Electronics strengthened its partnership with the National Sleep Foundation to leverage new technologies in addressing the growing prevalence of sleep disorders. The tech company will incorporate NSF insights to enhance its wearable innovations.

|

Report Attributes

|

Details

|

|

Market Size in 2023

|

US$ 62.5 billion

|

|

Market Size by 2031

|

US$ 198.8 billion

|

|

CAGR

|

CAGR of 13.73% from 2024-2032

|

|

Base Year

|

2023

|

|

Forecast Period

|

2024-2032

|

|

Historical Data

|

2020-2022

|

|

Report Scope & Coverage

|

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

|

|

Key Segments

|

• By Product (Wrist-Wear, Eyewear & Headwear, Footwear, Neckwear, Body-Wear, Others)

• By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, Others) |

|

Regional Analysis/Coverage

|

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles

|

Apple Inc, Samsung Electronics, Fitbit, Garmin, Xiaomi Corporation, Huawei Technologies, Fossil Group, Polar Electro Oy, Withings S.A., Amazfit, Sony Corporation, LG Electronics, Microsoft Corporation, Oura Health, Whoop, Suunto, Striiv, BioBeat Technologies, Jabra, Mio Global |

|

Key Drivers

|

• Increasing consumer focus on health and fitness drives demand for wearables that track vital signs, activity levels, and sleep quality. • Improved sensors enable accurate, real-time health monitoring and data collection, enhancing the appeal of wearable devices. • Seamless connectivity with IoT ecosystems enables wearables to provide personalized insights, increasing user engagement and market demand. |

|

Market Restraints

|

• Limited battery life in wearables reduces usability, affecting continuous monitoring and user convenience, which can restrict market growth. • The relatively high cost of advanced wearable devices may limit adoption, especially in emerging markets where affordability is a key factor. • Compatibility challenges with other devices and IoT systems can hinder the seamless functionality of wearables, reducing their appeal in interconnected environments. |