Third-Party Logistics (3PL) Market Report Scope & Overview:

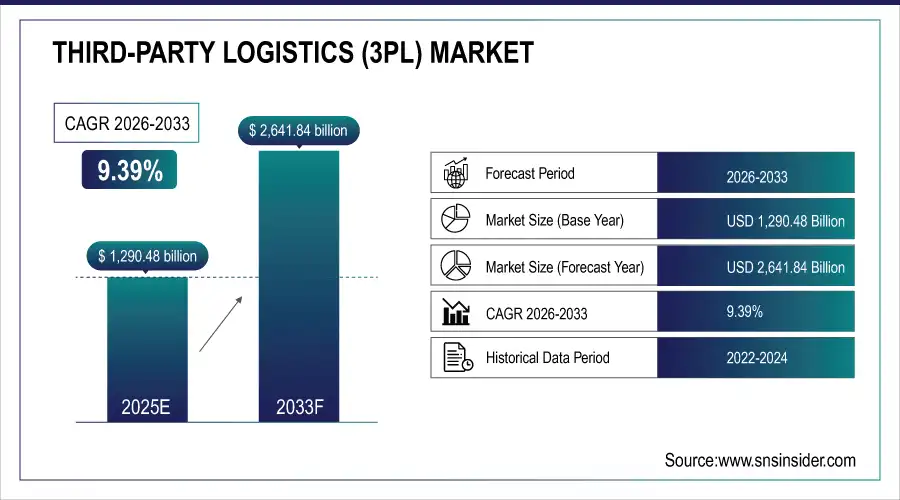

The Third-Party Logistics (3PL) Market was valued at USD 1,290.48 Billion in 2025E and is projected to reach USD 2,641.84 Billion by 2033, growing at a CAGR of 9.39% during the forecast period 2026–2033.

The Third-Party Logistics (3PL) analysis is also focusing on the 3PL service adoption, supply chain optimization and digital transformation. It is divided on the basis of service, mode of transportation, vertical and end-user sector. The growth is fueled by the upsurge in e-commerce, penetration of globalization and growing need for cost-effective, flexible and technology-based logistics solutions.

In 2025, road and air transport handled over 6.2 billion tons of freight, highlighting the need for faster, reliable, and efficient logistics solutions.

Market Size and Forecast:

-

Market Size in 2025: USD 1,290.48 Billion

-

Market Size by 2033: USD 2,641.84 Billion

-

CAGR: 9.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Third-Party Logistics (3PL) Market - Request Free Sample Report

Third-Party Logistics (3PL) Market Trends:

-

Growing e-commerce and international trade are fuelling demand for increasingly fast, flexible and integrated logistics solutions providers to all sectors.

-

Technology-enabled services such as live tracking, Ai-based route optimization, and automated warehouses are improving operational efficiency and customer satisfaction for e-Commerce companies.

-

Customized and value-added services including kitting, assembly, reverse logistics are becoming more significant to cater to specific supply chain requirements.

-

The rise of demand for sustainable logistics from renewable energy to electric vehicles and green warehousing, is shaping the service offerings from 3PLs.

-

Domestic collaboration between retailers, manufacturers, and 3PLs in order to build a stronger supply chains and save costs are developed as best practices.

U.S. Third-Party Logistics (3PL) Market Insights:

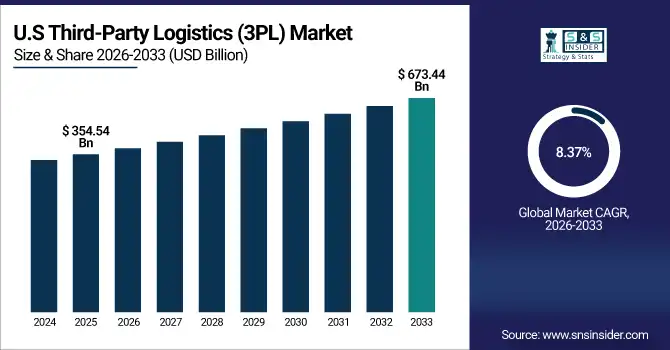

The U.S. Third-Party Logistics Market is projected to grow from USD 354.54 Billion in 2025E to USD 673.44 Billion by 2033 at a CAGR of 8.37%. The growth is supported by expansion of E-commerce, retail & FMCG requirement, advanced supply chain technologies, value-added services and increasing penetration in manufacturing & HoReCa.

Third-Party Logistics (3PL) Market Growth Drivers:

-

E-commerce expansion and globalization are accelerating demand for fast, flexible, and integrated logistics solutions globally.

The Market growth is underpinned by the rise of e-commerce and a globalisation trend, which makes for more challenging requirements for fast, flexible logistics. The total tonnage of cargo serviced by 3PLs exceeded 15 billion tons in 2025 and is projected to grow to nearly 28 billion tons in 2033. Markets exist in both developed and developing world and are driven by automation, AI powered route optimization, last mile delivery solutions and value-added services for retail, manufacturing, FMCG and e-commerce.

Rising e-commerce and trade drove handling of 6.8 billion tons of freight in 2025, fueled by retail, manufacturing, and FMCG sectors, along with last-mile delivery.

Third-Party Logistics (3PL) Market Restraints:

-

Infrastructure gaps and high operational costs are limiting 3PL adoption, especially in emerging and remote markets.

The growth of the 3PL market is limited by high operational costs and infrastructure gaps. In 2025, nearly 30% of the SMEs in emerging countries used onboard logistics that avoided external logistics due to the cost or absence of dependable transport modes. In remote Asia-Pacific and African areas, warehousing and transport links remain scarce. High fuel price, tangled regulations and fragmented product field were factors however that deterred lower convenience and cost-effective development notwithstanding the growth in logistics demand.

Third-Party Logistics (3PL) Market Opportunities:

-

Adoption of sustainable and green logistics solutions offers 3PL providers new growth in eco-conscious markets.

The implementation of eco-friendly and green logistics models is resulting in new opportunities for 3PLs. In 2025, more than 2.5 billion tons of cargo followed ecologically sound principles, which were to exceed five billion tons by 2033. Companies and consumers are increasingly seeking more sustainable supply chains, driving 3PLs to introduce electric vehicles fleets, green warehousing and carbon-efficient routing capabilities, delivering efficiencies, brand value and popularity across the retail, e-commerce and industrial sectors globally.

Sustainable and green logistics solutions accounted for 22% of new 3PL service offerings in 2025, driven by eco-conscious enterprises, carbon-reduction goals.

Third-Party Logistics (3PL) Market Segmentation Analysis:

-

By Service Type, Transportation held the largest market share of 38.45% in 2025, while Value-added Services are expected to grow at the fastest CAGR of 11.42%.

-

By Mode of Transport, Road dominated with a 42.13% share in 2025, while Air transport is projected to expand at the fastest CAGR of 12.15%.

-

By Industry Vertical, Retail & E-commerce accounted for the highest market share of 36.82% in 2025, and Pharmaceuticals & Healthcare are projected to record the fastest CAGR of 12.87%.

-

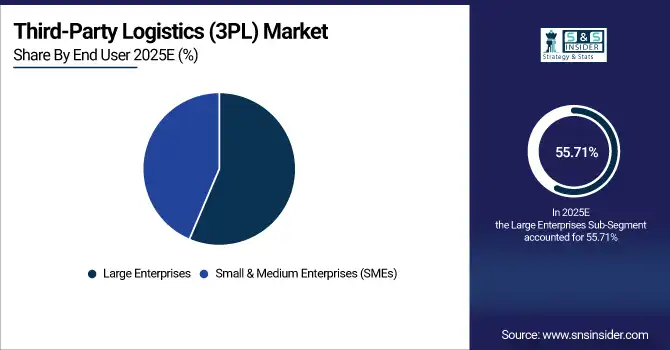

By End User, Large Enterprises held the largest share of 55.71% in 2025, while SMEs are expected to grow at the fastest CAGR of 11.33%.

By Service Type, Transportation Dominates While Value-Added Services Expand Rapidly:

Transportation sector dominated the Service Type segment, wherein transportation industry shipped more than 5.8 billion tons of freight by 2025, due to retail, manufacturing and FMCG supply chain demand for fast and cost-effective delivery. It continues to serve as the workhorse of logistics. The Value-added Services sector is the fastest growing Service Type segment with rising demand for kitting, assembly, reverse logistics, and customized packaging. These services are gaining ground at lightning-fast pace in e-commerce and industrial sectors to improve efficiency, reduce cost and increase supply chain flexibility.

By Mode of Transport, Road Dominates While Air Transport Expands Rapidly:

Road sector dominated the Mode of Transport segment, moving over 6.2 billion tons of freight in 2025, favored for its flexibility, wide network, and cost-effectiveness. It still stands as the major mode of the efficient linkage between urban and rural markets. Air sector is the fastest growing Mode of Transport segment, propelled by time-sensitive deliveries, valuable commodities and cross-border e-commerce. Adoption of integrated logistics solutions, improved airport infrastructure, and faster international services are fueling air freight growth globally.

By Industry Vertical, Retail & E-commerce Dominates While Pharmaceuticals & Healthcare Expands Rapidly:

Retail & E-commerce sector dominated the Industry Vertical segment in 2025, by successfully holding around 4.6 billion tons of cargo due to online sales, omnichannel fulfilment and urban consumer demand. It is still the largest source of volumes of 3PL. Pharmaceuticals & Healthcare sector is the fastest-growing Industry Vertical segment due to temperature-sensitive shipments, regulatory mandates and increasing healthcare demand. Cold chain storage, digital monitoring and specialised last mile services are making 3PL adoption in healthcare faster across developed and emerging market.

By End User, Large Enterprises Dominate While SMEs Expand Rapidly:

Large Enterprises sector dominated the End User segment in 2025, due to large enterprises outsource more than 8 billion tons of logistics operations benefiting from scale and integrate supply chains, networks. Due to large scale operation and long-term contracts, they have the biggest 3PL demand share. The SMEs sector is the fastest-growing End User segment that are adopting 3PL services for cost effective solutions and faster delivery of goods to gain competitive advantage. With digital platforms, cloud-based logistics tools and personalised services, SME adoption rates are being pushed up.

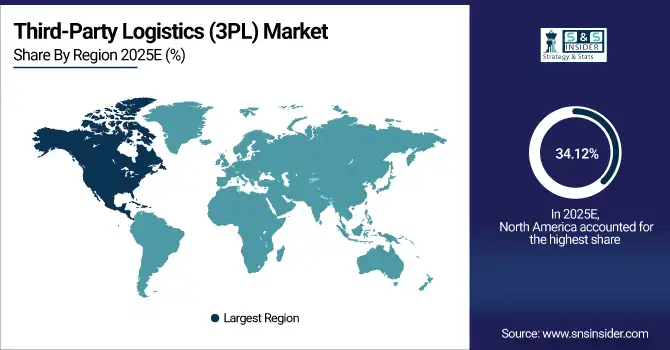

Third-Party Logistics (3PL) Market Regional Analysis:

North America Third-Party Logistics (3PL) Market Insights:

North America dominated the market across the 3PL by share of 34.12% in 2025, shipping more than 5.1 billion tons earmarked for US and Canada. The demand came from retail (organised) sector, e-commerce, FMCG, and manufacturing industries. An aging infrastructure, advanced technology penetration and integrated supply chains are key growth early drivers. Escalating e-commerce, digital apps and specialized value-added services are also driving logistics efficiency among households, HORECA and industrial clients.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Third-Party Logistics (3PL) Market Insights:

The US 3PL industry transported 4.2 billion tons of freight in 2025, of which 2.8 billion for retail/e-commerce and domestic clientele, and another 1.4 billion for industrial/HoReCa clients. The E-commerce growth, value added logistics, technology penetration, integrated supply chain and the increasing demand for quick, flexible and cost-effective delivery service continue to drive growth.

Asia-Pacific Third-Party Logistics (3PL) Market Insights:

Asia-Pacific is the fastest-growing region in the Third-Party Logistics market with a CAGR of 10.66%, owing to increasing e-commerce activities, growing manufacturing output and urban population. China processed more than 3.1 billion tons of freight in 2025 and India was in control of more than 1.2 billion tons. Growth is fuelled by the usage of technology-led logistics and digitisation, last-mile delivery (LMD), value-added services (VAS) and investments in smart warehousing in CBT across the region.

-

China Third-Party Logistics (3PL) Market Insights:

China handled over 3.1 billion tons of freight in 2025, with 2.1 billion tons domestic and 1.0 billion tons for industrial, retail, and HoReCa clients. Growth is driven by rapid urbanization, rising middle-class incomes, e-commerce expansion, technology adoption, value-added logistics, and increasing demand for faster, flexible, and integrated supply chain solutions.

Europe Third-Party Logistics (3PL) Market Insights:

Europe managed more than 2.7 billion tons of cargo in the year 2025, with Germany topping at 720 million tons, France second at 610 million tons and Italy third at 520 million. Domestic retail and e-commerce customers covered 1.5 billion tons while industrial and HoReCa clients represented 1.2 billion tons. The growth is led by sophisticated infrastructure, technology adoption, connected supply chain and increase in demand of cost-effective value-added logistics services throughout the region.

-

Germany Third-Party Logistics (3PL) Market Insights:

In 2025, the weight in Germany will reach more than 720 million tons for domestic retail and e-commerce (420 million tons) and industrial clients and HoReCa guests (300 million tons). Road transport dominated the market. Growth is possible in retail, manufacturing and services through E-commerce expansion, value added services, technology adoption and integrated supply chains.

Latin America Third-Party Logistics (3PL) Market Insights:

Latin America managed to more than 1.4 billion tons of freight in 2025, Brazil Brazil leading at 550 million tons, Argentina 480 and Chile at 220 million tons. Domestic retail and e-commerce claimed 850 million tons, and industrial and HoReCa clients processed 550 million tons. The e-Commerce boom, infrastructure improvement, and the usage of VAS (value-added service) and technology are fuelling market expansion for several countries in the region.

Middle East and Africa Third-Party Logistics (3PL) Market Insights:

The Middle East and Africa had a combined freight volume of over 1.0 billion tons, topped by the UAE with 320 million tons and South Africa with 280 million. 580 million tons was from domestic retail/e-commerce, while 420 million tons was served to industrial and HoReCa customers. Is enabling market growth across the region, on account of expanding infrastructural facilities and surge in e-commerce sector.

Third-Party Logistics (3PL) Market Competitive Landscape:

Amazon Logistics dominates the 3PL market with a vast fulfilment network, including over 175 centers globally. With cutting-edge technologies such as robotics, AI based route optimisation and real-time tracking, it allows for quick and dependable delivery of orders. And with seamless eBay integration all the teams are hitting their marketing channels at max efficiency and exposure. The continuing growth of last-mile services, targeted delivery programs and retailer partnerships further entrench its leadership and operational control in globally logistics and fulfilment activities.

-

In October 2025, Amazon launched its first trucking app, Relay, designed to streamline warehouse check-ins. Drivers can input cargo details and receive a QR code for expedited entry, reducing wait times and enhancing operational efficiency.

DHL Supply Chain & Global Forwarding is the leading logistics expert in warehousing, distribution and freight forwarding, operating from more than 220 countries and territories. With services ranging from contract logistics, e-commerce fulfillment, to international freight offerings. With a globally network and strategic acquisitions and innovative supply chain technology, DHL provides dependable services for scalable logistic solutions around the world, therefore being a dominant force in international 3PLs.

-

In October 2025, DHL Supply Chain introduced the ReTurn Network, a multi-client platform aimed at transforming reverse logistics. This initiative enables manufacturers, retailers, and e-commerce businesses to process returns more efficiently and sustainably, minimizing waste and optimizing resource utilization.

Kuehne + Nagel is a leader in the 3PL sector with a concentration on sea and air freight, contract logistics, and integrated supply chain offerings. With 100-plus offices in more than 60 countries, the firm offers a range of capabilities and specialized assets to clients. Powered by a presence and an active business model in all strategic gateways across the world, technology, and operational efficiency, it enables Freight Systems’ leadership to handle seamless logistics, freight forwarding & supply chain management services around markets.

-

In August 2025, Kuehne + Nagel partnered with MTU Maintenance Lease Services to establish an aero engine fulfilment hub in Zhuhai, China. This facility aims to streamline the supply of aircraft parts, enhancing service reliability and reducing lead times for the aviation industry.

Third-Party Logistics (3PL) Market Key Players:

Some of the Third-Party Logistics (3PL) Market Companies are:

-

Amazon Logistics

-

DHL Supply Chain & Global Forwarding

-

Kuehne + Nagel

-

C.H. Robinson

-

XPO Logistics

-

J.B. Hunt Transport Services

-

UPS Supply Chain Solutions

-

DB Schenker

-

DHL Express

-

DSV

-

Expeditors International

-

Kintetsu World Express

-

Nippon Express

-

Ryder Supply Chain Solutions

-

Penske Logistics

-

CEVA Logistics

-

Toll Group

-

CJ Logistics

-

Yusen Logistics

-

Lineage Logistics

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1290.48 Billion |

| Market Size by 2033 | USD 2641.84 Billion |

| CAGR | CAGR of 9.39% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Transportation, Warehousing, Freight Forwarding, Distribution & Fulfillment, Value-Added Services, Others) • By Mode of Transport (Road, Rail, Air, Sea, Others) • By Industry Vertical (Retail & E-Commerce, Manufacturing, Automotive, Pharmaceuticals, FMCG, Others) • By End User (Small & Medium Enterprises, Large Enterprises, Others) • By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Logistics, DHL Supply Chain & Global Forwarding, Kuehne + Nagel, C.H. Robinson, XPO Logistics, J.B. Hunt Transport Services, UPS Supply Chain Solutions, DB Schenker, DHL Express, DSV, Expeditors International, Kintetsu World Express, Nippon Express, Ryder Supply Chain Solutions, Penske Logistics, CEVA Logistics, Toll Group, CJ Logistics, Yusen Logistics, Lineage Logistics |