Aerosol Packaging Market Report Scope & Overview:

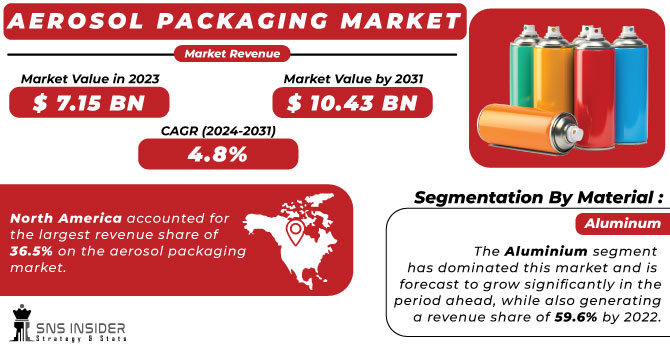

The Aerosol Packaging Market size was USD 7.15 billion in 2023 and is expected to Reach USD 10.43 billion by 2031 and grow at a CAGR of 4.8% over the forecast period of 2024-2031.

The United States represents a significant and rising aerosol industry, with an expected value of USD 14.10 billion in 2022. As a result of the growing Personal and Home Care Industry, the US aerosol market has grown. A positive impact on growth is expected in the US, where a strong production base for personal care products such as Estée Lauder, Johnson &Johnson and P&G are established.

Get E-PDF Sample Report on Aerosol Packaging Market - Request Sample Report

In addition, due to the increased preference for cleaning in the wake of the COVID-19 outbreak, the demand for sanitisation spray and disinfectants is expected to increase significantly in the country. The growing demand for aerosols in the household sector is expected to be supported.

MARKET DYNAMICS

KEY DRIVERS:

-

Increased consumption of aerosol packages made from aluminum and plastic

Due to the increased demand for aluminium and plastic aerosol packaging due to its lightweight, recyclable nature and its reduced carbon footprint, which is expected to increase the demand for personal care products, manufacturers are increasing the production of aluminium and plastic aerosol packaging.

-

Increasing demand in the pharmaceutical sector

RESTRAIN:

-

The growth of the aerosol container market is being hindered by price fluctuations in raw materials and regulatory issues

OPPORTUNITY:

-

Expansion into new applications

Aerosols are being applied in a broader range of applications, such as personal care, household goods, food and drink or pharmaceutical products. This gives rise to new growth opportunities on the market.

-

The increasing consumer demand for convenient and easy to use products makes aerosol packaging an attractive option in this regard, with many benefits

CHALLENGES:

-

Regulatory concerns related to aerosols production

Aerosols are subject to a wide range of laws at both domestic and International level. These Regulations are intended to safeguard human health and the environment, yet they can also have a detrimental impact on cost and complexity of production with regard to Aerosols.

IMPACT OF RUSSIAN UKRAINE WAR

The war has caused widespread disruption to global supply chains, especially for raw materials such as aluminum and steel that are essential in the manufacture of aerosol packaging. The closure of ports and maritime routes as well as the sanctions applied to Russia has put a strain on producers' ability to source these materials, resulting in shortages and delays. The price rise of raw materials, transportation and energy driven by disruptions in supply chains led to increased production costs for aerosol packaging. Since the beginning of the war, aluminium prices have risen by more than 40 % and steel prices are up over 20 %. Consumers are likely to be charged increased prices for aerosol products in response to these cost increases.

Prices of aluminum were about $2,900 per ton prior to the Second World War. Aluminum prices were around $4 000 per tonne in October 2023 and have increased by more than 37 %. Steel prices had been at least $800 per ton up until the war. Steel prices are currently at around $1,000 per ton and have gone up by over 25% since October 2023.

IMPACT OF ONGOING RECESSION

Aerosol products used in non-essential applications, such as personal care products and household cleaners, are likely to be more sensitive to the recession. Consumers may lose their appetite for these products or change to cheaper alternatives as a result of budgetary constraints.

The expected decline in demand for unessential aerosol products is between 5 and 10 % The anticipated decrease in demand for aerosols used on durable goods: 3% to 5%.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Steel

-

Aluminum

-

Tin Plated Steel

The aluminium segment has dominated this market and is forecast to grow significantly in the period ahead, while also generating a revenue share of 59.6% by 2022. Aluminium is an environmental-friendly material that can be recycled multiple times.

In recent years, low weight, low cost and high recyclability of PET plastic have led to considerable demand in the plastics material segment.

By Product Type

-

Cans

-

Jars

-

Bottles & Cylinders

By End Use

-

Personal Care & Cosmetics

-

Homecare

-

Automotive

-

Agriculture

-

Pharmaceutical

-

Others

In 2022, personal care was the dominant market segment, accounting for 35% of total revenues. The growth in demand of hair care products and deodorants is the driving force behind this segment. Due to changing lifestyles, rising consumer spending and emphasis on gender specific products, the demand for personal care products is increasing in emerging economies.

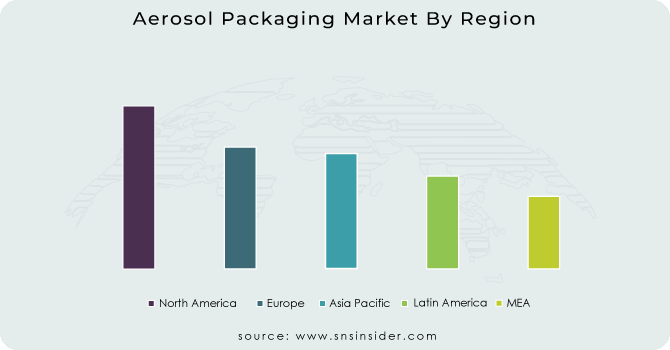

REGIONAL ANALYSIS

In 2022, North America accounted for the largest revenue share of 36.5% on the aerosol packaging market. The largest producer of aerosols is also located in the region. The large share of this sector is mainly due to the significant presence of the personal care industry. The growth of the regional market is driven by factors such as high demand for cosmetics, a fast-growing fragrance industry and increasing consumer spending.

The Asia Pacific region is one of the fastest growing regions over the forecast period. China and India's governments are working to encourage more favourable investment, which is likely to provide attractive growth prospects for the market over the forecast period. Aerosol demand for personal care products, cars and paints is driven by increased consumer spending in emerging Asian economies.

Over the forecast period, Middle East and Africa are also expected to see considerable growth due to increased spending on hair care products in countries like Saudi Arabia and the United Arab Emirates.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Aerosol Packaging market are Berry Global Inc, Ball Corporation, Silgan Holdings Inc, Allied Cans Limited, Graham Packaging Company, Nampak Limited, Bharat Containers, CCL Industries, Crown Holdings Inc, Aptar Group Inc and other players.

Ball Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

In April 2023, Ball Corporation announces that its global aerosol packaging division has been awarded an ASTI certification of performance and chain of custody standards for aluminum.

-

In September 2023, Aptar Beauty is launching a range of aerosol actuators with no cap. To prevent the need for over-caps, a new range of aerosol actuators made by Aptar Beauty has been designed with an emphasis on ensuring that formulae are protected.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.15 Bn |

| Market Size by 2031 | US$ 10.43 Bn |

| CAGR | CAGR of 4.8 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Steel, Aluminum, Tin Plated Steel) • by Product Type (Cans, Jars, Bottles & Cylinders) • by End Use (Personal Care & Cosmetics, Homecare, Automotive, Agriculture, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Berry Global Inc, Ball Corporation, Silgan Holdings Inc, Allied Cans Limited, Graham Packaging Company, Nampak Limited, Bharat Containers, CCL Industries, Crown Holdings Inc, Aptar Group Inc |

| Key Drivers | • Increased consumption of aerosol packages made from aluminum and plastic • Increasing demand in the pharmaceutical sector |

| Key Restraints | • The growth of the aerosol container market is being hindered by price fluctuations in raw materials and regulatory issues. |