Transient Protection Device Market Report Scope & Overview:

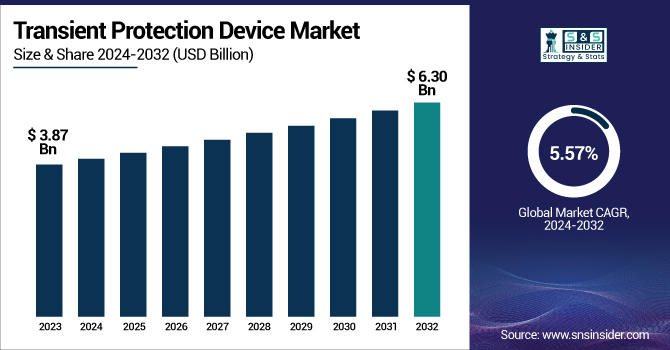

The Transient Protection Device Market Size was valued at 3.87 Billion in 2023 and is projected to reach USD 6.30 Billion by 2032, growing at a CAGR of 5.57% from 2024 to 2032.

To Get more information on Transient Protection Device Market - Request Free Sample Report

A key driver of this growth is the increasing electrification, particularly the rise of Electric Vehicles (EVs), which require robust surge protection in charging infrastructure and vehicle electronics. The proliferation of Internet of Things (IoT) devices and smart devices further fuels demand for TPDs, as these connected systems require protection from electrical transients. Additionally, the ongoing trend of miniaturization and microelectronics drives the need for smaller, more efficient protection solutions in increasingly compact devices. In the U.S., the TPD market, valued at USD 1.18 billion in 2023, is expected to reach USD 1.49 billion by 2032, growing at a CAGR of 2.62%. Another significant factor is the rise of smart cities, where surge protection is vital to safeguard critical infrastructure, including traffic systems, power grids, and public services. These developments underline the growing importance of transient protection solutions across various sectors.

Transient Protection Device Market Dynamics:

Drivers:

-

Rising Demand for Transient Protection Devices Driven by Smart Cities, Renewable Energy, and Energy-Efficient Systems

The growing demand for energy-efficient electrical systems, as exhibited in various prominent economies of USA, China, Japan and India, is boosting the growth of Transient Protection Devices (TPDs) market. Indian CAMTECH initiative has involved in generating good solutions based on performance of railway system by adopting transient protection based on that. Due to the fast-growing demand of renewable energy and urban infrastructure projects, the use of TPDs as the protective devices against lightning and surges has increased significantly. The rise in the number of Wi-Fi receptacle enabled power strips is one other instance of the products that there is increased demand for companies such as APC have begun making intelligent power strips that are more capable of absorbing surges. The U.S. Department of Energy is investing USD 61 million into the programs which will help homes and business become more energy-efficient. TPDs are increasingly needed as these regions embark on smart cities development, with sensitive electronic systems in smart buildings requiring shielding from damage.

Restraints:

-

Over-protection in transient protection devices balancing performance and protection

Over-protection (too much protection can create an undesirable effect), is a restraint in the transient protection device market, as more than suitable layers of protection will diminish efficiency and degrade performance and may create damage to protected components. Although these devices are vital to protecting electrical systems, excessive protective measures can introduce challenges, according to OEM data from several industry sources such as Mouser Electronics and Electrical Trade Magazine. Additionally, legacy system interoperability challenges, complex designs, and high costs can restrict the incident creation rate of advanced protection solutions. The rapid pace of technology development is another pressure point on protection devices existing becoming out-dated in very short order. Thus, manufacturers face the challenge of balance between protecting their products while maintaining performance to meet developing market needs, all without these budget-busting constraints.

Opportunities:

-

Impact of Renewable Energy, Smart Power Strips, and Smart Buildings on the Growth of the Transient Protection Device Market

The transient is an essential problem in the protection gadget enterprise and where very many layers of protection can decelerate the device and cause failure, low voltage use or additionally damage to the elemental protected elements. While these protectors are the electrical systems' life-savers, nonetheless, it should be emphasized that more than enough protectors can lead to other unwanted results beyond the ones mentioned, such as incompatibility and a plethora of problems with systems verified among the sector resources, Mouser Electronics and Electrical Trade Magazine. On top of everything else, design-related hurdles for these things, exorbitant prices, and a part of systems being incompatible with the old infrastructure may also act as deterrents and reduce odds of advanced protection solutions being instantaneously embraced. It follows that the role of producers are enabled partners able to propel innovation and excellence while safeguarding serious problems in these growing markets.

Challenges:

-

The transient protection device market's growth is influenced by the uneven distribution of electrical infrastructure and renewable energy sector expansion across regions.

The demand and usage of a transient protection device is closely associated with the growth and proliferation of electrical infrastructure, ranging from power generation to transmission and distribution networks. It is becoming even more relevant now with the advent of renewable energy sources such as solar and wind that experience damaging transients due to irregular power flows and therefore need strong protection systems. But electrical infrastructure is not developed evenly throughout the regions. In developed economies, the infrastructure is mostly in place, while in emerging markets, there are cost and finance constraints and pressure on old or non-invested systems, he concluded. The variability manifests in markets where places that have yet to finish building out their grids exhibit the slowest adoption of transient protection devices. Furthermore, the new unveiling energy systems out to be delivered in the following years, mainly after the infiltration of renewable energy, will coax this demand for protective mechanisms that also need sound and comprehensive globe-spanning infrastructure to guarantee secured power quality while protecting delicate equipment.

Transient Protection Device Market Segment Analysis:

By Type

The Metal-Oxide Varistor (MOV) segment, dominating 41% of the transient protection device market in 2023, is expected to see steady growth from 2024 to 2032, due to the rising requirement for surge protection across the automotive, telecommunications, and power distribution sectors. All of these work in conjunction make it have its main advantages, most of which are high capacity for energy absorption and quick response towards transient voltages that make the capacitor as one of the most common electronics components in industries such as telecommuncations, automotive, and power distribution. However, as the usage of electronic devices and systems rises and the renewable energy infrastructure expands, MOVs will likely continue to be the largest market segment during the forecast period as the need for surge protection continues to rise.

By Form Factor

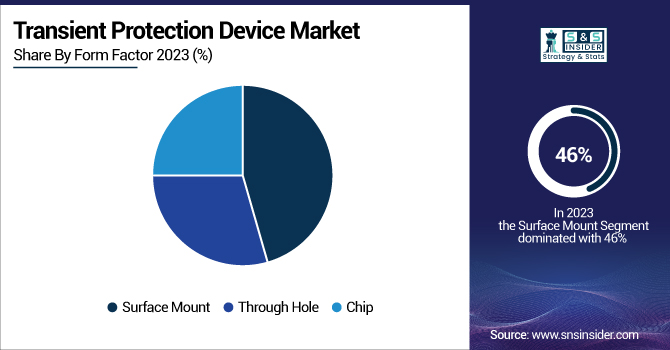

The Surface Mount segment, which held a dominant share of 46% in the transient protection device market in 2023, is expected to see continued growth from 2024 to 2032. Owing to rising need for compact, efficient, and easy-to-integrate solutions in consumer electronics, automotive, telecommunications, and industrial applications, the framed product type segment is expected to rise at a significant rate over the next few years. Modern electronic systems need protection at such high performance in a small area, so surface mount devices are preferred as they are high density (small size), easy to mount and less expensive. The upcoming generation of technologies such as IoT, smart devices, automation, surface mount transient protection devices, and several others need to be deployed for great effective protection devices in the devices. This growth will have a major impact on the overall market balance in the forthcoming years.

By Application

The Industrial Equipment segment accounted for a significant share of 23% in the transient protection device market in 2023 and is expected to continue its dominance through 2032. The expanding demand for reliable protection in private environments exposed to transients and voltage peaks, such as for instance industrial application, is one of the key factors of this growth. Industrial machinery—motors, transformers, control boxes are critical pieces of equipment for manufacturing processes, and any failure means expensive downtime or further damage. As industries such as manufacturing, energy, and utilities all going towards more premium gear, the demand for dependable transient protection devices to save these systems has increased. And the need for industrial equipment continues to rise with the increase in technology and industry use heavy duty machines which enhances growth of the Industrial equipment segment thus contributing to the growth of the market.

The Consumer Electronics segment is poised for significant growth in the transient protection device market from 2024 to 2032. As consumer electronics have surged in growth, so too has the demand for devices that can protect sensitive electronics such as smartphones, laptops, smart home devices, and gaming consoles. As users are gradually reliant on such home appliances and smart interrelated technology amalgamate, protecting these devices against power surges, lightning strikes and voltage transients is an imperative. As consumers increasingly seek device convenience, energy savings, and higher performance, demand for such components is surging. The consumer electronics market is also experiencing significant growth, and this growth will bring an increase in demand for transients protection solutions that offer effective protection from power fluctuations, which should continue to drive innovation as well as increased adoption of protective devices in this area.

By End Use

The Industrial segment holds a significant share of the transient protection device market, accounting for 35% of the revenue in 2023. This dominance is driven by the critical need for reliable protection in various industrial applications, including manufacturing plants, electrical grids, and heavy machinery. Industrial equipment is highly sensitive to power surges and lightning strikes, which can lead to expensive downtimes, equipment failures, and safety hazards. As industries increasingly adopt automation, robotics, and other high-tech systems, the demand for advanced transient protection devices has surged. These devices help maintain the efficiency and longevity of industrial equipment, ensuring smooth operations and minimizing operational risks. The growing industrial sector, combined with the ongoing shift toward digitalization and smart manufacturing, is expected to continue driving the demand for transient protection devices in this segment over the forecast period.

The Residential segment is expected to experience substantial growth over the forecast period from 2024 to 2032. The growing deployment of smart home devices, energy-efficient technologies, and emphasis on electrical safety remain to create a demand for transient protection devices in the residential space. These appliances are important to protect the house and appliances, electronics, HVAC systems, and others against electrical spikes, surges, lightning strikes, and transients. As demand grows for reliable protection solutions, consumers are becoming more educated about protecting themselves from investable electronics and boosting overall energy efficiency. Also, government policies promoting energy-saving residential buildings, along with smart dwelling technologies, will fuel the growth of this segment that will augmet the demand for transient protection device.

Transient Protection Device Market Regional Outlook:

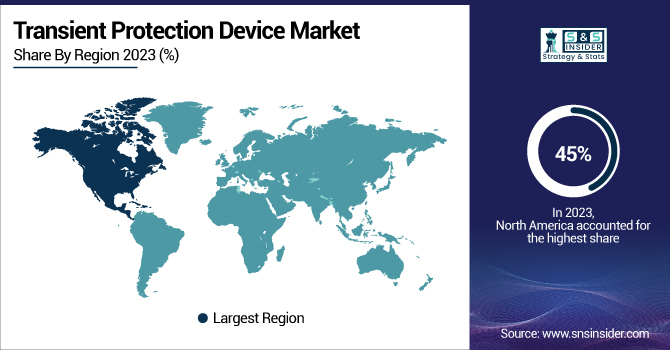

North America is expected to dominate the transient protection device market, holding a significant share of approximately 45% in 2023. This supremacy is due to the highly evolutionary infrastructure of the region, along with the high adoption of smart technologies and stringent regulatory standards for electrical safety. The market is being driven by the growing need for reliable protection against power surges, lightning strikes, and electrical transients in industrial equipment, consumer electronics, and the residential sector. North America's emphasis on renewable energy, grid reliability, and the implementation of energy-efficient systems in urban and rural hubs alike has catalyzed the demand for innovative transient protection solutions. The region's large market share can also be credited to the rapidly developing smart cities and the increased usage of the IoT-enabled devices.

The Asia-Pacific region is expected to experience the fastest growth in the transient protection device market from 2024 to 2032. The estimated expansion is attributed to rapid industrialization, infrastructure development, and high uptake of electronic devices and smart technologies. Countries like China, India, Japan are adopting advanced electrical systems, which require reliable transient protection. Furthermore, the rising focus on renewable energy projects, leading to the development of smart city, and expanding the telecommunications network in the region also are pushing the rise in demand of protection devices. Many APAC nations such as automotive, consumer electronics, & industrial equipment are growing at an impressive rate, which is expected to lead to growth of the market in the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Companies in Transient Protection Device Market along with their Products:

-

Schneider Electric (France) – Surge protection devices and power distribution systems

-

Mitsubishi Electric (Japan) – Protective relays and surge protectors

-

Littelfuse (USA) – Metal oxide varistors, TVS diodes, and fuse solutions

-

Panasonic (Japan) – Compact surge absorbers and circuit protection modules

-

Emerson Electric (USA) – Integrated surge protection for automation systems

-

Eaton (Ireland) – Power surge suppressors and industrial circuit protection

-

Infineon Technologies (Germany) – Surge arrestors and protection connectors

-

TE Connectivity (Switzerland) – Electrical surge protectors and interface systems

-

Bel Fuse (USA) – Telecom surge protection modules and circuit protection devices

-

Vishay Intertechnology (USA) – Varistors, TVS diodes, and surge suppressors

-

NXP Semiconductors (Netherlands) – Automotive surge protection ICs and ESD suppression devices

-

General Electric (USA) – Industrial surge arresters and grid protection systems

-

Siemens (Germany) – Surge protection for automation and smart infrastructure

-

ABB (Switzerland) – Power grid protection and surge suppression systems

-

Rockwell Automation (USA) – Surge protection for industrial control systems

-

Legrand (France) – Modular surge protection units for buildings

List of Key raw material and component suppliers for the Transient Protection Device Market:

-

Mitsubishi Materials (Japan)

-

Bourns Inc. (USA)

-

EPCOS, a TDK Group Company (Germany)

-

Littelfuse Inc. (USA)

-

Vishay Intertechnology (USA)

-

TE Connectivity (Switzerland)

-

Phoenix Contact (Germany)

-

Weidmüller Interface GmbH (Germany)

-

Murata Manufacturing Co., Ltd. (Japan)

-

AVX Corporation (USA/Japan)

-

Panasonic Industry (Japan)

-

Mersen (France)

-

KOA Corporation (Japan)

-

TDK Corporation (Japan)

Recent Development:

-

Oct 23, 2024, Schneider Electric unveils Miluz ZeTa range of designer switches & sockets with AQI (Air Quality Indicator) and Voltage Surge Protection in India Compatible with Wiser Smart Home technology, offering seamless connectivity and enhanced safety.

-

22 Aug 2024 , Automation Expo 2024 brings out Eaton Crouse-Hinds series solutions, highlights surge protection, LED lighting and CCTV technology in Mumbai. It mentioned that it also had local manufacturing capabilities and had been in operations in India for 25 years.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.87 Billion |

| Market Size by 2032 | USD 6.30 Billion |

| CAGR | CAGR of 5.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Metal-Oxide Varistor, Transient Voltage Suppressor, Gas Discharge Tube, Mixed Technology Devices) • By Form Factor (Surface Mount, Through Hole, Chip) • By Application (Consumer Electronics, Telecommunications, Automotive, Renewable Energy, Industrial Equipment) • By End Use (Residential, Commercial, Industrial, Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric (France) Mitsubishi Electric (Japan) Littelfuse (USA) Panasonic (Japan) Emerson Electric (USA) Eaton (Ireland) Infineon Technologies (Germany) TE Connectivity (Switzerland) Bel Fuse (USA) Vishay Intertechnology (USA) NXP Semiconductors (Netherlands) General Electric (USA) Siemens (Germany) ABB (Switzerland) Rockwell Automation (USA) Legrand (France) |