Modular Instruments Market Size Analysis:

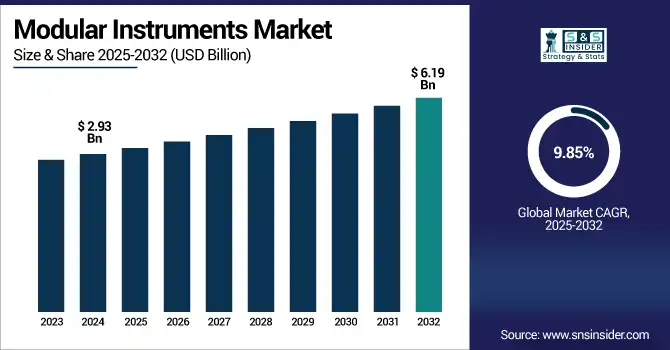

The Modular Instruments Market size was valued at USD 2.93 billion in 2024 and is expected to reach USD 6.19 billion by 2032, growing at a CAGR of 9.85% over the forecast period of 2025-2032. Modular Instruments Market trends are shifting toward increased adoption in automated test systems and wireless communication testing. Growing demand for compact, scalable, and cost-effective instrumentation is driving market innovation. The Modular instruments market growth is driven by the increasing need for flexible, scalable, and cost-effective testing solutions across various industries such as aerospace, defense, telecommunications, and automotive. This is fueling the trend of modular test systems, a long-established trend which can support the increasing sophistication of electronic entities along with the demand of rapid data acquisition and processing. Moreover, the growing adoption of 5G, IOT & Autonomous technologies is increasing the demand of product testing platforms that are customizable and help in faster product development cycles and performance validation, thereby propelling the growth of the market.

To Get more information on Modular Instruments Market- Request Free Sample Report

National Instruments (NI) reported a strong uptick in demand for PXI-based modular test systems in 2024, driven by R&D activities in 5G, EVs, and aerospace sectors, particularly in the U.S., Germany, and China.

The U.S Modular Instruments Market size was valued at USD 0.79 billion in 2024 and is expected to reach USD 1.64 billion by 2032, growing at a CAGR of 9.53% over the forecast period of 2025-2032. The U.S. Modular Instruments Market is driven by 5G/IoT networks expansion Increasing semiconductor and electronics testing requirements Federal investment in Defense and Aero-space modernization programs are supporting Modular Instruments Market trends in the U.S.

Modular Instruments Market Dynamics:

Drivers:

-

Rising Demand for Scalable High Performance Modular Instruments Driven by 5G IoT and Electronics Complexity

The expansion of the global modular instruments market is primarily due to the increasing demand for reliable, high-performance, scalable, and cost-effective testing solutions from various end-use verticals, especially aerospace, telecommunications, automotive, and defense verticals. Growing complexity of electronic components & devices and gradual transition to miniaturization & high-speed data processing scenarios is contributing to the demand for modular test systems with an emphasis on flexibility, rapid system level configuration, and real-time performance evaluation. In addition, the implementation of 5G infrastructure and the increasing adoption of IoT devices across the globe are fast-tracking the demand for effectiveness-based flexible testing platforms.

OEMs developing EVs and autonomous systems allocated 12–18% of R&D budgets to modular platforms Tesla’s use of 64‑channel modular DAQ reduced battery characterization time by 35% during Model Y development.

Restraints:

-

Lack of Standardization Limits Modular Instruments Growth and Slows Adoption Among Regulated and Emerging Industries

A major factor restraining the growth of the modular instruments market is the absence of any common standard followed across the modular instrument platforms and interfaces, which leads to a lack of interoperability for devices supplied by different vendors. Such fragmentation renders integration difficult and introduces delays before system deployment, which is critical in industries such as aerospace and defense that are governed by stringent regulations. This is particularly true in smaller or emerging companies who do not have R&D teams, and that also limited the technical expertise among end users to configure and optimize these modular systems to be slower to adopt.

Opportunities:

-

Modular Instruments Unlock Growth Opportunities Through Emerging Trends Smart Manufacturing and Global Digital Transformation

Modular instruments can benefit from the follow-on opportunities to emerging new mega trends like EVs, autonomous systems and Industry 4.0. It also spurs adoption due to the growth of smart manufacturing and AI-powered test automation platforms. Furthermore, regions like Asia-Pacific and Latin America are still emerging with this untapped potential because of the ongoing industrialization and transformation to digital.

An IoT-enabled smart manufacturing framework reported 18% energy savings, 22% less machine downtime, and 15% better resource utilization in industrial simulation models

Challenges:

-

Evolving Modular Instruments to Tackle Complex Testing Demands and Rising Cybersecurity Threats in Key Sectors

One of the major challenges is the growing complexity of testing novel technologies such as 6G, quantum computing and AI-enhanced systems. Modular instruments today need to evolve quickly with performance standards and test protocols. Besides, the connected testing environments and data-centric sectors like telecommunications and automotive represent cybersecurity challenges that can further threaten your modular instrumentation infrastructure.

Modular Instruments Market Segmentation Analysis:

By Platform Type

PXI (PCI eXtensions for Instrumentation) constituted 45.4% of total platform utilization for modular instruments in 2024. Its versatility and capability for high-speed data transfer, its wide spread adaption, as well as its compact form factors and multiple instrument capability in a single chassis, have fueled its adoption over the years. Where reproducibility, alligned measurments and real time analysis mean everything, PXI has become the standard in many aerospace, defense, and telecom industries.

AXIe (AdvancedTCA Extensions for Instrumentation) is expected to have the fastest growth in the forecast period of 2025 to 2032. The open standard used in AXIe, wide data throughput bandwidth, and scalable architecture late a perfect fit for high-performance applications such as 5G testing, semiconductor validation, and military-grade radar systems leads to an uptrend of utilization in advanced R&D environments.

By Application

In 2024, Manufacturing & Production Testing dominated the market with a share of 34.6% of the total application share. It is this dominance that is driven by the increasing demand for rapid high-throughput testing on automation production floors in areas such as electronics, automotive, and semiconductor. With the flexibility and scalability needed for end-of-line testing, modular instruments allow manufacturers to maintain fast cycle times and low downtime whilst assuring product quality.

The type of Field Testing is anticipated to witness the fastest CAGR from 2025 to 2032. Such growth is further propelled by the rising need for on-site diagnostics and validation across telecommunication, aerospace, and renewable energy sectors. Modular instruments are inherently portable, remotely accessible, ruggedized, and easy to deploy in the field in real time.

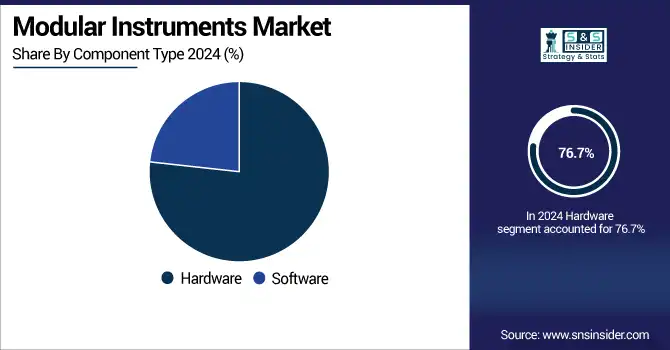

By Component Type

The modular instruments market was dominated by the hardware segment, which accounted for 76.7% of total revenue in 2024. This dominance is primarily attributed to the ubiquitous use of physical test Partners including chassis, controllers, and measurement modules for industries such as automotive, aerospace, and telecommunications. All of these hardware pieces are used to utilize highly scalable test systems, that are capable of real-time signal processing and multi-channel data acquisition.

The Software segment is anticipated to grow at the largest CAGR over the forecasted period from 2025 to 2032. Software platforms are growing due to increasing demand, specifically for advanced test automation, remote monitoring, and data analytics. Software has become intrinsic to modern-day modular test systems—especially for smart manufacturing and Internet of Things (IoT) applications—with user interfaces, AI-based test sequences, and cloud integration all expanding the role of software in test systems.

By End-Use Industry

The electronics and semiconductor segment led modular instruments market by application, contributing 28.5% to the overall application share of the market in 2024. The growth was mainly due to increasing complexities and advancements in semiconductor devices coupled with the growing requirement for accurate high-speed testing for chip design, validation, and production. They are commonly used for wafer-level and signal integrity testing, as well as T&M for performance validation and characterization, which together accelerate the pace of innovation and ensure quality in semiconductor manufacturing.

The telecommunications segment is estimated to be the fastest growing CAGR from 2025 to 2032. Increasing 5G penetration across the globe, rise in data traffic and groundwork of 6G technologies is stimulating the demand of scalable, advanced and real-time testing solutions. This flexibility allows them to easily adapt to accommodate the unique requirements of telecom, i.e. high-frequency signals and complex network simulations.

Modular Instruments Market Regional Overview:

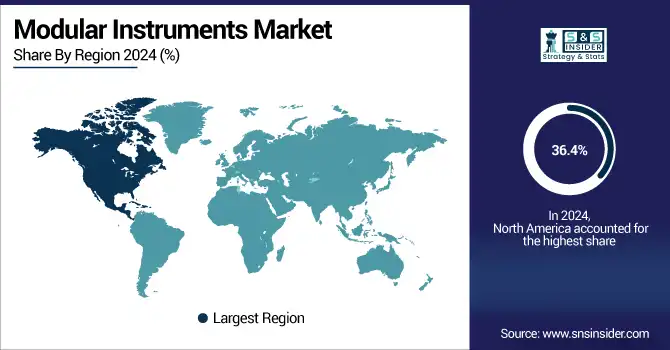

The modular instruments market in North America accounted for 36.4% of the global revenue share in 2024, owing to the well-established technological backbone, presence of major players, and high research and development expenditure across industries. Modular test platforms to deliver faster, reliable, and high-performing product development and validation were widely picked by the region's strong aerospace, defense, and semiconductor industries. Furthermore, the demand increased due to 5G rollout, initiatives related to smart manufacturing, and early implementation of AI-based testing frameworks. North American leadership in this domain was further bolstered by favorable government policies and ever-evolving approaches to test and measurement technologies.

The U.S. held a sizable share in North America owing to the developed defense industry, strong semiconductor sector, and faster 5G adoption.

The modular instruments market share in Asia Pacific will grow at the highest CAGR of 10.63% from 2025 to 2032, use of rapidly industrializing economies, increasing electronics manufacturing, and growing telecommunications infrastructure in the area. In the region, higher demand for modular test systems is driven by increasing need for high-speed data processing and automation, as well as semiconductor testing, particularly in manufacturing, automotive, and telecom sectors. The market growth is also boosting with the help of the government supporting digital transformation websites to accelerate research & development activities and the establishment of an electronics export hub. With 5G deployment and smart factory adoption soaring across the region, Asia Pacific is set to be the epicenter of growth for hundreds of modular instrumentation technologies.

China, with its substantial electronics manufacturing presence, relentless promotion of 5G, and extensive investment in semiconductors and the defense industry, seemed to take the lead in the Asia Pacific segment.

Europe held its position as a major region in the Modular Instruments Market during 2024 owing high level of sophistication in manufacturing abilities, stringent regulations, and heightened emphasis on sustainability, and precision engineering. Strong demand across automotive, food & beverage, electronics, and pharmaceutical sectors with growing focus on automation to improve productivity and mitigate operational risk were key trends in the region. With the permeation of Industry 4.0 practices and the incorporation of AI, IoT, and machine vision into robots, these automation capabilities are developing further. Furthermore, strong government backing for the development of smart factories and for robotics R&D, skilled labor, and the continuing growth of export-driven industries has spurred Modular Instruments adoption throughout Europe.

Latin America and Middle East & Africa maintained their steady growth trajectory in modular instruments market in 2024 owing to increasing industrial automation, infrastructure development & adoption of digital technologies. The two regions are slowly shifting towards the adoption of modular testing systems for telecom, energy and manufacturing applications respectively. Further accelerating demand are investments in smart city projects, renewable energy and defense modernization. Although nascent, an increasing number of scalable and flexible testing solutions open up fresh avenues for growth for modular instrumentation vendors in these expanding markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Modular Instruments Companies are:

The Key Players in Modular Instruments Market are National Instruments, Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Tektronix, Agilent Technologies, Cobham Advanced Electronic Solutions, Astronics Corporation, AMETEK Inc., Yokogawa Electric Corporation, Chroma ATE Inc., Advantest Corporation, VTI Instruments, Pickering Interfaces, ZTEC Instruments, B&K Precision Corporation, Scientech Technologies Pvt. Ltd, Abaco Systems, Giga-tronics Incorporated, Spectrum Instrumentation GmbH.

Recent Developments:

-

In February 2024, National Instruments announced the launch of a new PXIe data-acquisition module tailored for high-channel-count vibration measurements, enhancing modular system capabilities in industrial and aerospace testing environments.

-

In June 2024, Keysight demonstrated next-gen spectrum innovations aimed at accelerating 5G and 6G advancements, including wideband active load‑pull testing using a PXI‑based vector source paired with network analyzers for RF performance validation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.93 Billion |

| Market Size by 2032 | USD 6.19 Billion |

| CAGR | CAGR of 9.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform Type (PXI (PCI eXtensions for Instrumentation), VXI (VME eXtensions for Instrumentation), LXI (LAN eXtensions for Instrumentation), AXIe (AdvancedTCA Extensions for Instrumentation), PCI/PCIe, and GPIB) • By Application (Research & Development (R&D), Design & Validation, Manufacturing & Production Testing, Maintenance & Repair, and Field Testing) • By Component Type (Hardware, and Software) • By End-Use Industry (Aerospace & Defense, Automotive & Transportation, Electronics & Semiconductor, Telecommunications, Industrial Automation, Healthcare & Life Sciences, and Education & Research) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | National Instruments, Keysight, Rohde & Schwarz, Anritsu, Tektronix, Agilent, Cobham, Astronics, AMETEK, Yokogawa, Chroma, Advantest, VTI Instruments, Pickering, ZTEC, B&K Precision, Scientech, Abaco, Giga-tronics, and Spectrum Instrumentation. |