Coin Cell Batteries Market Size & Trends:

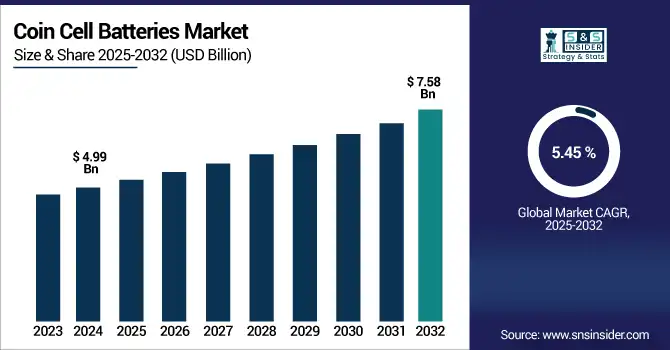

The Coin Cell Batteries Market Size was valued at USD 4.99 billion in 2024 and is expected to reach USD 7.58 billion by 2032 and grow at a CAGR of 5.45 % over the forecast period 2025-2032.

To Get more information on Coin Cell Batteries Market - Request Free Sample Report

Global market analysis covers in terms of market trends, regional outlook and analysis of key market players. Growth is predominantly attributed to increasing demand for coin cell batteries in wearable electronics, medical devices, and IoT devices. The evolution of battery technology and proliferation of consumer electronics are driving an increasing use of coin cells in diverse markets.

According to research, Zinc-air batteries, commonly used in hearing aids, represent 15–18% of global coin cell demand, particularly in North America and Europe.

The U.S. Coin Cell Batteries Market size was USD 0.85 billion in 2024 and is expected to reach USD 1.33 billion by 2032, growing at a CAGR of 5.83 % over the forecast period of 2025–2032.

The US coin cell batteries market growth is driven by the developments in the portable energy efficient devices such as hearing aids, smartwatches, fitness monitors and segments within consumer electronics. Moreover, increasing tendency for smaller and convenient electronic instruments coupled with rising health consciousness and technological developments is in turn expected to boost the demand for reliable and longer service life coin cells batteries across the U.S. market.

According to research, Over 60% of coin cell demand in the U.S. is driven by consumer electronics, including wearables, remotes, and medical devices.

Coin Cell Batteries Market Dynamics

Key Drivers:

-

Advancements in Battery Technology Enhance Efficiency and Battery Life

Ongoing advances in the chemistry and manufacturing processes of coin cell batteries have resulted in increasing energy density, prolonged shelf life, and increased safety. These developments improve the performance and reliability of coin cell batteries used in numerous applications such as medical devices and consumer electronics. Advancements in the lithium-based cells, in particular, have enabled them to perform better under different environmental conditions and have attracted a greater number of end-users, eventually growing the market size considerably. In addition, the advances on environmentally friendly materials and miniaturization approaches employed also promote sustainability and integration in new high-tech devices.

According to research, Coin cell batteries are used in over 70% of wearable and implantable medical devices, including hearing aids, glucose monitors, and pacemakers.

Restrain:

-

Environmental Concerns and Disposal Regulations Pose Challenges for Market Growth

There are serious environmental problems in the disposal of coin cell batteries because of toxic materials, heavy metals in particular.collider Shipment of dredged sludge which contain heavy metals is also an important source of contamination to soil. Tougher regulations and recycling targets have made compliance more expensive for manufacturers and sellers. Increasing environmental consciousness of consumers also leads to demand for eco-friendly solutions, which are yet to be matured. These factors combine to be barriers that hinder market development; they restrict the use of the product in some areas and result in additional complexity and cost for EOL battery disposal. Additionally, the patchwork nature of recycling facilities and uneven corporate standards guarantee that there are few viable disposal options.

Opportunities:

-

Growth in Wearable Technology and IoT Devices Drives New Market Prospects

With the increasing popularity of wearable electronics and IoT devices, there will be good chances for the coin cell batteries. With the increasing number of smart devices hitting the market the need for small, powerful and long life batteries is on the rise. This is magnified as recent advances in smart home technology, fitness tracking and wearable sensors – the latter all good applications for coin cells given their small form factor and reliability – open up new opportunities for market growth and product development. Moreover, rising consumer inclination towards connected devices and developments in miniaturized electronics are contributing to the demand in different sectors.

According to research, Over 70% of IoT sensors deployed in 2024 use compact batteries like coin cells due to low power draw and long standby requirements.

Challenges:

-

Battery Safety and Performance Concerns in Extreme Conditions Limit Market Usage

Coin cell batteries can perform poorly in extreme temperatures or under rugged environmental conditions, and this can make them unreliable in some applications. This constraint is a deterrent for industries which need a battery that works stably when subjected to such situations, for example, automobile and outdoor electronic industries. Manufacturers have to study and develop robustness and thermal stability in order to be cost effective and get exclusive, and introduce high-cost difficulties, may lead to the product by demanding applications into the market. In addition, strict safety levels and test standards contribute to the development period, constituting further barriers to be overcome for general application in demanding environments.

Coin Cell Batteries Market Segment Analysis:

By Type

CR (Lithium) / Lithium cells battery segment dominated the Coin Cell Batteries Market with the highest revenue share of about 34.26% in 2024 because of their better energy density, stable shelf life, and good performance in miniature instruments. Coin cell batteries companies such as Energizer Holdings takes advantage of these liabilities to produce lithium coin cells, which are commonly used in medical devices, remote controls and wearables. They are selected over other types in this space because they have high heat tolerance and a stable voltage output.

LR (Alkaline)/ Alkaline Watch Batteries segment is expected to grow at the fastest CAGR of about 6.66% from 2025-2032 due to their cost effectiveness, high availability, and the fact that they can be used in low-drain to moderate-drain devices, including watches and calculators. With the rapid expansion in demand in emerging markets, Panasonic Corporation is in the process of being a leading manufacturer in this market, producing low cost alkaline coin cells. Advancements in manufacturing technology that increases battery life are also fueling the segment’s tremendous growth.

By Application

Traditional Watch segment dominated the highest coin cell batteries market share of about 31.77% in 2024 due to continuous worldwide demand for wristwatches, analog or digital. There are reliable coin cells available as offered by Sony Corporation for watches needing small form factor long lasting power. This segment enjoys the dominant market share due to the long battery life replacement cycle of watches and preference for fashionable and utilitarian watches among customers.

Hearing Aid segment is expected to grow at the fastest CAGR of about 6.86% from 2025-2032 due to increasing number of people across the globe suffering from hearing loss, rising awareness and technological developments in hearing aid devices. Swatch Group owned subsidiary, Renata SA boasts of delivering high-quality coin cells to hearing aid producers. The increasing need of miniaturised, light weight, cost effective and high energy dense long life batteries in healthcare application is generating ground for the rapid growth in this segment.

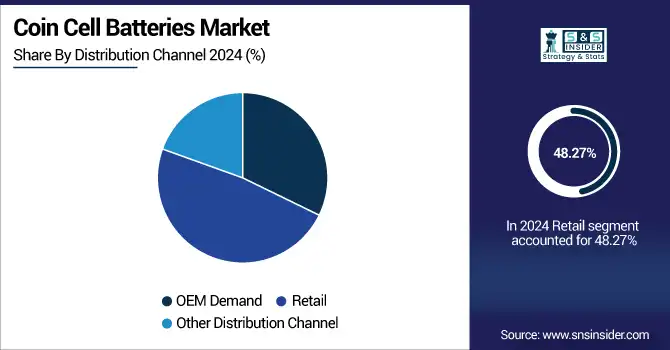

By Distribution Channel

Retail segment dominated the Coin Cell Batteries Market with the highest revenue share of about 48.27% in 2024 due to coin cell batteries being easily accessible from supermarkets, convenience stores, and electronics shops. Duracell Inc. is a well known brand at retail providing coin cell batteries to address immediate consumer needs for replacement. Due to convenience and product mix, significant sales are recorded at retailers.

OEM Demand segment is expected to grow at the fastest CAGR of about 6.74% from 2025-2032 because more and more coin cell batteries are integrated directly in newly producted electronic devices like wearables, medical devices and smart home applications. Maxell Holdings, Ltd. is a strategic supplier working closely with OEMs in delivering customized coin cell battery solutions for embedded applications. Rising smart device markets and product miniaturization drive OEM demand across this distribution channel.

Coin Cell Batteries Market Regional Overview:

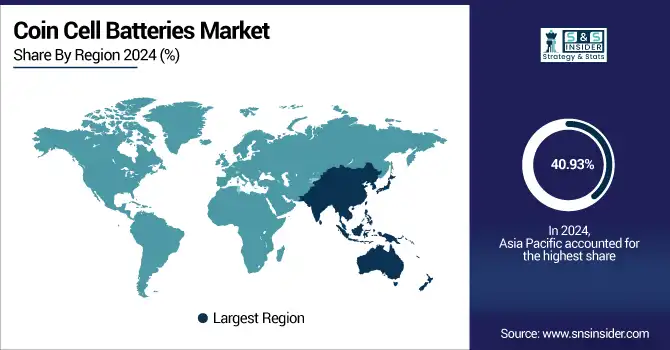

Asia Pacific dominated the Coin Cell Batteries Market with the highest revenue share of about 40.93% in 2024 because of the fact that big battery manufacturers and a vast consumer electronics industry exist in countries like China, Japan or South Korea. Together with rapid urbanization, increasing disposable income, and soaring demand for wearable and portable electronics, they also contribute to the regional dominance. Strong backing of the government in Asia Pacific for electronics manufacturing and exports also propels the market in the region.

-

China holds a significant market share in the Asia Pacific market of coin cell batteries, because of large production of the batteries, and inexpensive cost in manufacturing them and a strong supply chain. Strong domestic electronics demand, government support for tech and the ongoing migration of peoples to the cities also help support China at the top of the charts in this region.

North America segment is expected to grow at the fastest CAGR of about 6.52% from 2025-2032 driven by rising consumption of smart healthcare devices, smart wearables and IoT devices with coin cell batteries in use. The market in the region is driven by high awareness among the consumers, a robust R&D infrastructure, and huge investments for innovation from some of the major companies. Furthermore, increasing penetration of hearing aids and medical implants contribute toward rising growth rate in North America over the projected period.

-

US dominates the North America coin cell battery market owing to a developed technology, robust healthcare and electronics industry and a higher adoption of these devices. The strong R&D spend and existence of major industry players also contribute to its market leadership.

Europe holds a significant share in the Coin Cell Batteries Market, due to the robust requirement from medical devices, automotive, consumer electronics and peripherals sectors. The area also enjoys strict laws to encourage sustainable and high quality batteries and the increasing use of smart wearable devices. Moreover, growing research and development investments and heightened environmental awareness among consumers together with a steady increase in the market in the various European nations.

-

Germany is in the lead because of its strong industrial base, automotive and electronics manufacturing, and well-developed R&D infrastructure in battery technologies. The focus of the country on the innovation and sustainability is the important factor that promulgates the growth in the regional coin cell battery market in the region.

South Africa is a leading market in Middle East & Africa being the largest electronics market in the region and increasing penetration in the healthcare segment. Other Country specific markets in this region include Brazil in Latin America, as it has a huge consumer base, and increasing penetration of electronics, healthcare and automotive industry in the country. Both areas are the recipients of growing investment and government backing to support market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Coin Cell Batteries Companies are:

Major Key Players in Coin Cell Batteries Market are Panasonic Corporation, Sony Corporation, Maxell Holdings, Ltd., Murata Manufacturing Co., Ltd., Renata SA (Swatch Group), Energizer Holdings, Inc., Toshiba Corporation, VARTA AG, Duracell Inc., EVE Energy Co., Ltd and others.

Recent Development:

-

In August 2024, Energizer introduced a new 3-layered safety design for its coin-sized batteries to prevent accidental ingestion by children. This design includes child-resistant packaging, a bitter coating to deter swallowing, and color alert technology that turns the mouth blue upon contact with saliva, alerting caregivers.

-

In March 2024, EVE Energy, one of the leading battery suppliers in China, acquired Toshiba’s division that manufactures coin cells. This merger enables EVE to enhance its competitiveness in the international market, with an emphasis on increasing both the rechargeable and non-rechargeable coin cell markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.99 Billion |

| Market Size by 2032 | USD 7.58 Billion |

| CAGR | CAGR of 5.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LR (Alkaline)/ Alkaline Watch Batteries, SR (Silver Oxide) / Silver Oxide Cell, CR (Lithium) / Lithium cells battery, ZnAir, Other Types) • By Application (Hearing Aid, TWS Bluetooth Headset, Medical Device, Traditional Watch, Other applications) • By Distribution Channel (OEM Demand, Retail, Other Distribution Channel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Panasonic Corporation, Sony Corporation, Maxell Holdings, Ltd., Murata Manufacturing Co., Ltd., Renata SA (Swatch Group), Energizer Holdings, Inc., Toshiba Corporation, VARTA AG, Duracell Inc., EVE Energy Co., Ltd. |