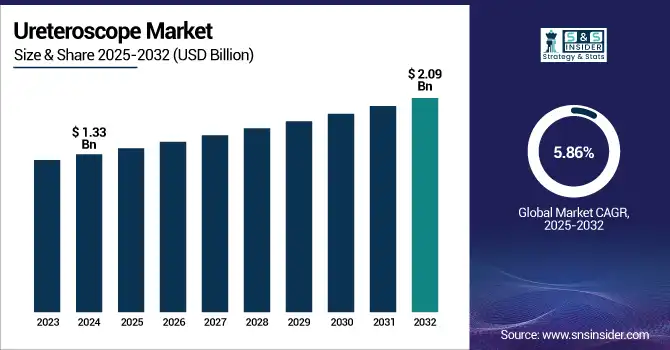

Ureteroscope Market Size Analysis:

The Ureteroscope Market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 2.09 billion by 2032 and grow at a CAGR of 5.86% over the forecast period of 2025-2032.

Get More Information on Ureteroscope Market - Request Sample Report

The ureteroscope market has undergone a massive transformation over the past few years and is practically at a very progressive stage, owing to the increase in the cases of kidney stones, the improvements in digital imaging, and the prevalence of minimally invasive procedures. Transition from reusable to disposable flexible ureteroscopes is characterizing the market landscape, which decreases the issue of cross-contamination and OR logistics. Recent FDA-approved innovations from big players like Boston Scientific’s LithoVue Elite and Olympus’ RenaFlex demonstrate how companies are rising to the clinical demand for sterility and speed.

High reoccurrence of kidney stones, up to 50% of patients within five years, and overall increased population of geriatrics are the main demand drivers. Furthermore, the FDA's approval of intrarenal pressure monitoring and suction-assisted devices, such as the CVAC device, indicates regulatory acceptance for newer technologies. By clinically demonstrating enhanced outcomes in terms of higher rates of stone-free status and fewer complications, we have increased the confidence level among providers. The supply side is ramping up manufacturing, strategic investments, and even with R&D spend of over USD 1 billion by Boston Scientific in 2023, optical quality, digital integration, and pressure management mechanisms will continue to evolve.

In December 2024, the ASPIRE Level 1 study reported that the CVAC System was significantly more effective than standard ureteroscopy in stone removal, a breakthrough in suction-assisted technology.

Ureteroscope Market Dynamics:

Drivers:

-

Growing Demand for Advanced, Single-Use, and Digital Ureteroscopes Fuels Market Growth

The ureteroscope market is influenced by technological advancement, an increase in prevalence of urolithiasis, and doctors' preference for single-use digital ureteroscopes. Kidney stones are reported to affect approximately 1 in 10 people in the world and have a 50% rate of recurrence in 5 years, therefore, minimally invasive treatment methods are needed. With the arrival of new digital ureteroscopes with improved mobility, high-definition imaging, and built-in irrigation, complex stone management is becoming simpler.

In 2024, Calyxo was granted FDA approval of its innovative new integrated device made to easily capture kidney stone fragments, greatly simplifying the procedure and enhancing patient success. Additionally, the increasing focus on the prevention of infections has resulted in the universal adoption of single-use scopes, reinforced by clinical guidance from organizations such as AORN that emphasize the removal of the risk of cross-contamination. On the supply side, companies are pumping funds into the development of next-gen products. Olympus and Karl Storz have increased R&D presence while concentrating on the strength and durability of scopes, visualization, and data integration. The FDA is incentivizing innovation and clearing new devices through fast tracks. Aggressive public and private investment in urological R&D is also helping to drive adoption and innovation, providing a positive backdrop for the continued incorporation of ureteroscopy in both hospital and ASC environments.

Restraints:

-

High Operational Costs, Sterilization Barriers, and Training Gaps Hinder the Broader Adoption of Advanced Ureteroscopes

Patients have little direct cost, but reusable digital ureteroscopes are expensive to purchase and maintain, which largely precludes many institutions from purchasing them. Replacements and repairs. Due to sensitive components that are easily damaged during procedures or reprocessing cycles, many times, costly replacements/repairs are necessary, therefore making the total cost of ownership much larger. Insufficient or variable sterilization facilities also elevate the risk of infection, and result in extended OR turn-over times, especially in hospitals where there are no automatic cleaning facilities available or where the personnel are not properly trained. These are the barriers to a complete shift to new or reusable systems for health care facilities. There is also a steep learning curve for contemporary digital and robotic ureteroscopes.

Many healthcare facilities, particularly some of the rural or lower-income centers, do not have access to an advanced simulation lab or a formalized training course, leading to suboptimal use of a scope and inordinate time taken to complete a procedure. Regulatory lag in some nations also hampers access to new technologies and uniformity in technology adoption globally. In addition, despite continual development, there are relatively few reimbursement models in some parts of the world, where they are unlikely to pay for an expensive ureteroscopic kit.

Ureteroscope Market Segmentation Analysis:

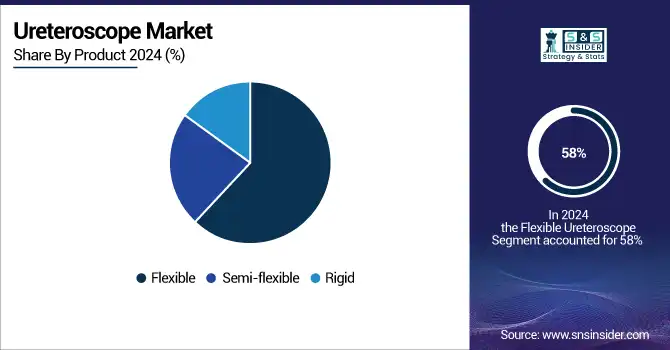

By Product

The flexible ureteroscope segment was the largest in the ureteroscope market in 2024, with over 58% of market share. It is explained by the superior flexibility, high-resolution images and minimally invasive access to both upper and lower urinary tracts provided for flexible endoscopes. They are also compatible with modern technology, including digital imaging and suction systems for more complex procedures such as kidney stone extraction.

The semi-flexible ureteroscopes represent the fastest growing segment with their cost effectiveness and the balance between maneuverability and durability. They are used more commonly in midrange institutions in smaller to medium-sized cities and in developing countries that cannot afford the more expensive, flexible, high-end endoscopes.

By Application

The urolithiasis application segment dominated the market in 2024, accounting for over 64% of the market share. This is attributed to the growing global prevalence of kidney stones and a transition to minimally invasive procedures. Ureteroscopes are indispensable in the identification and removal of stones, particularly in cases of recurrence or complexity, and are the backbone of stone treatment.

The urothelial cancer segment of applications is expected to register the highest CAGR during the forecast period due to increasing demand for early screening and endoscopic biopsy procedures. Improvements in imaging and targeting are leading to efficient tumor imaging and targeting, thus, there is a growing interest in oncological urology.

By End User

Hospitals led the market in terms of revenue in 2024, contributing more than 61% share of the ureteroscope market. They are well-established since the potential patient number is high, and advanced surgical equipment and reimbursement infrastructure are established. Moreover, urology units and experts with skills to perform procedures, such as complex ureteroscopy, are housed in hospitals.

Rising at the fastest pace among end users is the specialty clinic segment, due to the need for outpatient and minimally invasive surgeries. With the growing trend of these small, flexible, and disposable ureteroscopes, clinics are striving to create an efficient and cost-saving procedure that provides personalized care, especially in urban and suburban patient cohorts.

Ureteroscope Market Regional Insights:

North America accounted for a major revenue share of the ureteroscope market in 2024 due to well-established health care infrastructure, high rate of adoption of minimally invasive procedures, and presence of prominent market players. The sub-segment held the largest share of the market owing to technological advancement, surge in prevalence of urolithiasis, and favorable reimbursement scenario. The U.S. ureteroscope market size was valued at USD 0.38 billion in 2024 and is expected to reach USD 0.54 billion by 2032, growing at a CAGR of 4.74% over the forecast period of 2025-2032. The U.S. led the way with a large number of kidney stone cases (it affects almost 1-in-11 Americans) and strong R&D investments in digital and single-use ureteroscopes. The U.S. FDA also accelerated approvals for devices as LithoVue Elite, thereby enhancing the rapid entry of products into the market. Canada is experiencing increased numbers of procedures secondary to funding for endourology. Mexico is slowly increasing the availability of endoscopy equipment through joint ventures, above all at urban medical centres.

The Uroteroscope Europe was the second largest market in 2024, as the population ages, urology units at public hospitals grow, and favorable government policies are adopted. It is Germany that spearheads the market with an increased number of hospital-based procedures and availability of sophisticated diagnostics. There is also increasing demand for digital ureteroscopes in the UK and France, where treatment guidelines recommend early and minimally invasive treatment. Italy and Spain are investing in robot-assisted surgeries and outpatient clinics to clear their surgical backlogs. Meanwhile, higher access to cross-border healthcare under EU programs is driving technology acceptance in Poland and Turkey, with greater government efforts to purchase advanced surgical equipment in public hospitals.

Asia Pacific is growing fastest owing to the growing awareness about urological health, rapid urbanization, and growing healthcare spending. Demands are being fueled by countries such as China and India, which have large patient populations and greater access to advanced diagnostics. China leads locally in the production and procurement of ureteroscopes at tertiary hospitals, whereas outpatient surgeries and private urology clinics are growing in number in India. Japan is still contributing originality to medical devices, with many companies working on precision ureteroscopy. Increasing medical tourism in South Korea and Singapore, in addition to local R&D partnerships, are driving market growth in Asia Pacific. Asia Pacific has seen a double-digit year-over-year (YOY) rise in ureteroscope procedure volumes in 2024, the largest of any global region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Ureteroscope Market

Prominent ureteroscope companies operating in the market include Olympus Corporation, Stryker, KARL STORZ, Richard Wolf GmbH, PENTAX Medical, Elmed Electronics & Medical Industry & Trade Inc., AED.MD, Boston Scientific, Prosurg Inc., and Dornier MedTech.

Recent Developments and Trends:

In March 2025, researchers introduced the Navigated Augmented Reality Visualization for Ureteroscopic Surgery (NAVIUS) system. This system assists surgeons by providing 3D maps of the target anatomy, real-time scope positions, and preoperative imaging overlays.

In April 2024, Olympus announced that it had received U.S. FDA 510(k) clearance for its RenaFlex Single-Use Flexible Ureteroscope System. This device is designed to access and visualize the urinary tract for diagnosing and treating urinary diseases such as kidney stones.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.33 billion |

| Market Size by 2032 | USD 2.09 billion |

| CAGR | CAGR of 5.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Flexible, Semi-flexible, and Rigid) • By Application (Urolithiasis, Urolithial Cancer, and Others) • By End User (Hospitals, Specialty Clinics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Illumina Inc., Devyser, Ancestry, MyHeritage Ltd., Gene by Gene Ltd., Living DNA Ltd., EasyDNA, Fitness Genes, Helix OpCo LLC, Veritas, Genesis Healthcare Co., Mapmygenome, and Pathway Genomics. |