Endoscopes Market Size Analysis:

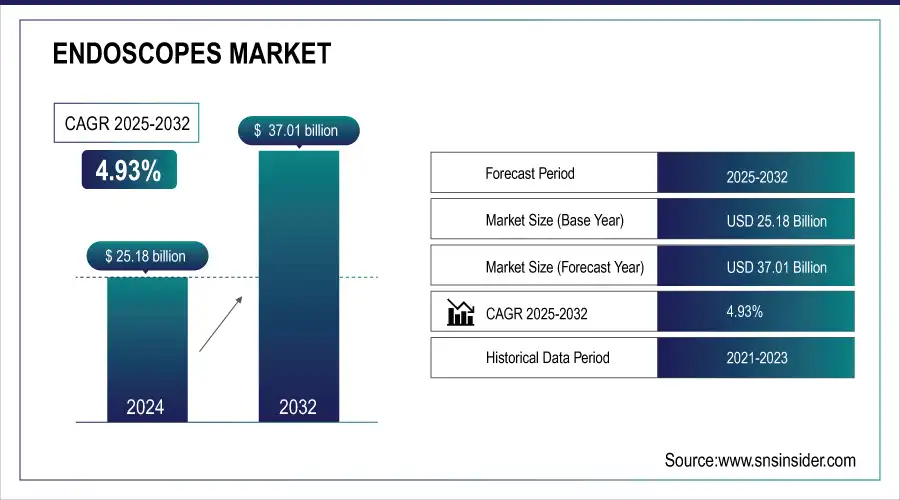

The Endoscopes Market was valued at USD 25.18 billion in 2024 and is expected to reach USD 37.01 billion by 2032, growing at a CAGR of 4.93% from 2025-2032.

To Get more information on Endoscopes Market - Request Free Sample Report

This report points to the increasing prevalence and incidence of endoscopy-requiring diseases, which fuel demand for advanced diagnostic and therapeutic procedures. The research looks into trends in the use of endoscopes by type and by medical specialty, highlighting the trend toward minimally invasive procedures and enhanced procedural efficiency. It also looks into healthcare expenditure on endoscopy procedures by region and by payer, mirroring increased investment in sophisticated medical technologies. The report also emphasizes the advances in technology, such as innovations in high-definition imaging, robotic-assisted endoscopy, and artificial intelligence-based diagnostics, and the growing use of these technologies to improve procedural accuracy and patient outcomes.

Endoscopes Market Size and Forecast

-

Endoscopes Market Size in 2024: USD 25.18 Billion

-

Endoscopes Market Size by 2032: USD 37.01 Billion

-

CAGR: 4.93% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Endoscopes Market Trends

-

Rising prevalence of gastrointestinal, respiratory, and urological disorders is driving demand for endoscopes.

-

Increasing preference for minimally invasive surgeries is boosting market growth.

-

Advancements in high-definition imaging, 3D, and capsule endoscopy are enhancing diagnostic accuracy.

-

Growing adoption of disposable and single-use endoscopes is reducing infection risks.

-

Expansion of outpatient and ambulatory surgical centers is fueling market adoption.

-

Integration with AI and robotics is improving precision, workflow efficiency, and real-time decision-making.

-

Collaborations between medical device manufacturers, hospitals, and research institutions are accelerating innovation and product development.

Endoscopes Market Growth Drivers:

-

Rising prevalence of gastrointestinal (GI) disorders, colorectal cancer, and respiratory diseases, increasing the demand for minimally invasive procedures.

As reported by the World Cancer Research Fund, colorectal cancer is one of the most frequent cancers in the world, needing periodic endoscopic screening. The development of AI-aided endoscopy, 4K imaging, and robotic procedures also enhances diagnostic efficiency and accuracy. The application of artificial intelligence in endoscopy has improved polyp detection rates, with fewer chances of misdiagnosis for colorectal cancer screenings. Additionally, the trend towards ambulatory surgical centers and outpatient endoscopy because of cost savings and reduced recovery periods is also driving market growth. The increasing use of disposable endoscopes to avoid cross-contamination and healthcare-associated infections is also a major driver, with leading players such as Ambu A/S and Boston Scientific increasing their single-use endoscope offerings. Further, rising government programs and reimbursement policies favoring endoscopic procedures are promoting increased adoption. For instance, in the U.S., Medicare is reimbursing preventive colonoscopies, which make early detection of colorectal cancer more feasible. Such factors on the whole help in fueling the high demand for advanced endoscopic technologies, pushing innovation and market growth.

Endoscopes Market Restraints:

-

The high cost of endoscopic procedures and devices remains a significant restraint.

Advanced endoscopic equipment, including robotic and AI-based endoscopes, are expensive to invest in, making them less acceptable for use in emerging healthcare markets. Reprocessing and sterilization of re-usable endoscopes also include high operation expenses and stringent regulatory requirements. The FDA and CDC have released rigorous regulations on the reprocessing of endoscopes to avoid cross-contamination, contributing to the economic costs of healthcare facilities. Further, limited reimbursement policies in some nations restrict patient access to endoscopy procedures. For example, endoscopic diagnostic private insurance coverage is still lacking in some areas, making it non-spread use. The service complexity of keeping endoscopes maintained, from frequent servicing and part replacement to a higher rate of maintenance activities, raises overall cost of ownership, which may discourage small outpatient facilities and clinics from purchasing up-market endoscopy equipment. Furthermore, inadequacy in qualified professionals able to handle upgraded endoscopic machinery slows down the penetration of markets. The reliance on skilled gastroenterologists and surgeons to conduct procedures efficiently means underdeveloped healthcare systems are at a loss to match demand. These operational and cost challenges act as brakes on widespread uptake of endoscopic technology.

Endoscopes Market Opportunities:

-

The rising adoption of AI-powered and robotic-assisted endoscopy presents a major opportunity for the market.

AI-based endoscopes optimize real-time lesion detection, polyp detection, and automated diagnosis to enhance clinical outcomes. Medtronic's GI Genius AI technology, for instance, has greatly enhanced the rate of polyp detection, resulting in the diagnosis of early-stage colorectal cancer. In addition, increased adoption for single-use endoscopes with infection control advantages presents new opportunities for market growth. With growing concern over hospital-acquired infections, disposable endoscopes obviate the necessity of reprocessing, minimizing the chances of contamination. The rising trend for minimally invasive procedures is yet another opportunity since patients are now opting more and more for outpatient and same-day surgical procedures in place of traditional surgery. Tele-endoscopy and remote diagnosis are also finding favor, facilitating expert consultation over geographies. The growth of healthcare infrastructure in developing economies is further driving demand, with governments stepping up investments in advanced medical equipment. For instance, India's Ayushman Bharat program seeks to enhance the availability of cutting-edge diagnostics, such as endoscopic intervention. The growing use of capsule endoscopy for non-invasive gastroenterology diagnostics, respiratory disease, and detecting internal bleeding is also picking up pace. These technological innovations and changing healthcare trends are poised to generate significant growth prospects in the years to come.

Endoscopes Market Challenges

-

The risk of infection transmission and cross-contamination remains one of the biggest challenges in the endoscopes market.

Even with stringent reprocessing protocols, infection reports associated with dirty endoscopes persist, and patient safety is brought into question. In 2019, the CDC reported more than 400 cases of infections due to poorly cleaned duodenoscopes, leading regulatory agencies to advocate for more stringent sterilization procedures. The other significant challenge is the lack of qualified endoscopists and technicians, especially in emerging healthcare markets. Specialized training is needed to perform advanced endoscopic procedures, and insufficient numbers of trained professionals restrict patient access to high-end diagnostics. In addition, regulatory barriers and long approval times for new endoscopic equipment delay market entry for manufacturers. FDA and CE approval criteria for medical devices demand lengthy clinical trials, which delay time-to-market. Data privacy issues related to AI-enabled endoscopy are another challenge. While AI-based endoscopic systems gather and interpret patient data, cybersecurity attacks and data breaches are a looming threat. The heavy price tag of innovation and R&D costs in AI and robotic endoscopy also keeps smaller entrants from competing with established majors such as Olympus and Boston Scientific. Meeting these challenges will be important for long-term market growth.

Endoscopes Market Segmentation Analysis

By Product, Reusable Endoscopes segment dominates the Endoscopes Market, Disposable Endoscopes segment is expected to grow fastest.

In 2024, the reusable endoscopes segment was the market leader in the endoscopes market, accounting for a substantial 83.3% revenue share. The supremacy of reusable endoscopes is largely fueled by their extensive usage in hospitals and specialty clinics on account of cost savings over multiple procedures, enhanced imaging capabilities, and the availability of high-definition visualization technologies. Moreover, well-established reprocessing and sterilization guidelines have bolstered their ongoing popularity among healthcare providers.

The disposable endoscopes market is expected to see the highest growth over the forecast period. Single-use endoscopes are driven by demands for minimizing cross-contamination and hospital-acquired infections (HAIs), strict infection control standards, and their expanding use in outpatient facilities. Their simplicity, lower turnaround time between procedures, and cost savings of preventing reprocessing costs drive their increased market presence.

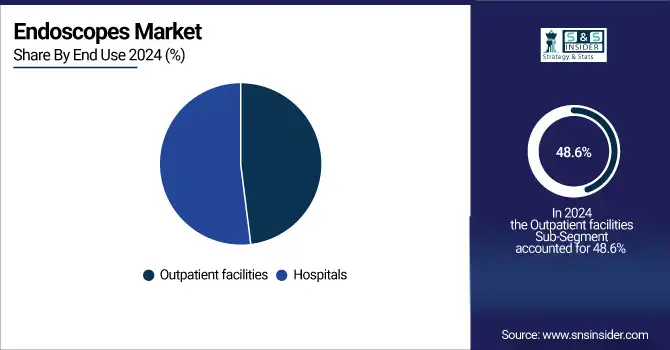

By End Use, Outpatient Facilities segment dominates the Endoscopes Market, Hospitals segment is expected to grow fastest.

Outpatient facilities was the highest revenue-generating segment in 2024, with a market share of 48.6%. This is because of the increasing demand for minimally invasive procedures in ambulatory surgical centers (ASCs) and diagnostic clinics, which are cost-effective and time-saving options compared to hospital-based procedures. The move towards outpatient endoscopic intervention is also fueled by the increasing patient preference for same-day procedures and the improvements in portable endoscopy systems.

The hospitals segment is expected to post high growth during the forecast period. Rising investments by hospitals in advanced endoscopic technology, growing volumes of complex endoscopic procedures, and adoption of AI-enabled and robot-assisted endoscopy systems are the main growth drivers for this segment. Moreover, hospitals remain the ideal place for high-risk and critical endoscopic procedures, and therefore the demand for endoscopic devices remains consistent within hospitals.

Endoscopes Market Regional Insights

North America Endoscopes Market Insights

In 2024, North America led the world in the endoscopes market with the highest 36.6% revenue share. The region's leadership is due to the high incidence of gastrointestinal (GI) diseases, colorectal cancer, and other chronic conditions that necessitate endoscopic procedures. The region is also supported by well-developed healthcare infrastructure, sophisticated endoscopic technologies, and a high rate of adoption of minimally invasive procedures. The expanding geriatric population, more susceptible to endoscopic therapy, and supportive reimbursement policies further fuel market growth across the region. Key industry players, coupled with ongoing R&D spending in AI-enabled and robotic endoscopy, further propel technological innovation across North America's endoscopy market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Endoscopes Market Insights

In contrast, the Asia-Pacific market is estimated to be the fastest-growing market for endoscopes over the forecasting period. The high growth is driven by growing healthcare spending, growing awareness of early disease detection, and an expanding patient base with digestive and respiratory diseases. Moreover, the development of healthcare infrastructure in emerging markets such as China and India, along with the increasing use of disposable endoscopes owing to infection control issues, drives market growth. The growth of medical tourism in nations like Thailand and South Korea also contributes significantly to the increasing demand for endoscopic procedures throughout the region.

Europe Endoscopes Market Insights

Europe holds a strong position in the endoscopes market, driven by advanced healthcare infrastructure, rising prevalence of gastrointestinal and chronic diseases, and growing adoption of minimally invasive procedures. Supportive government initiatives, coupled with increasing healthcare expenditure, are accelerating technology adoption. Moreover, the presence of leading medical device manufacturers and continuous product innovations enhance accessibility, improving diagnostic and therapeutic capabilities across the region and fueling market expansion steadily.

Middle East & Africa and Latin America Endoscopes Market Insights

The Middle East & Africa and Latin America endoscopes market is witnessing gradual growth, supported by expanding healthcare infrastructure, rising awareness of minimally invasive treatments, and increasing investment in advanced medical technologies. Government initiatives to improve access to modern healthcare and a growing burden of gastrointestinal and chronic diseases are boosting demand. Although cost constraints remain a challenge, improving affordability and private sector participation are creating opportunities for market expansion.

Endoscopes Market Competitive Landscape:

Olympus Corporation

Olympus Corporation is a global leader in precision optics and medical devices, specializing in endoscopic systems, imaging platforms, and AI-powered diagnostic solutions. The company focuses on enhancing clinical outcomes, improving workflow efficiency, and delivering high-quality, reliable technologies for hospitals, outpatient facilities, and specialized medical practices worldwide. Olympus continually innovates across medical, life science, and industrial applications, making it a trusted partner in advancing patient care.

-

In 2025, Olympus launched the VISERA S OTV-S500 imaging platform in the U.S. for ENT and urological applications, featuring white light, NBI, stroboscopy (via upgrade), compatibility with multiple endoscopes, and a compact design for office and outpatient settings.

-

In 2025, Olympus achieved FDA clearance for its EZ1500 series endoscopes (gastroscope & colonoscope) with EDOF™ technology in its EVIS X1 system, offering continuous sharp images with minimal focal adjustment for enhanced visualization.

-

In 2025, Olympus introduced ScopeLocker Air, a new endoscope drying cabinet with options for up to 18 scopes, HEPA-filtered air, continuous airflow, and multiple models for different facility sizes.

-

In 2024, Olympus secured CE approval for three cloud-based AI medical devices and announced plans to launch a full AI-powered endoscopy ecosystem in 2025.

Key Players in the Endoscopes Market

Some of the Endoscopes Market Companies

-

Olympus Corporation –

-

Boston Scientific Corporation

-

PENTAX Medical (Hoya Corporation)

-

FUJIFILM Holdings Corporation

-

Karl Storz GmbH & Co. KG

-

Stryker

-

Medtronic

-

Ambu A/S

-

STERIS plc

-

Richard Wolf GmbH

-

Cook Medical

-

Smith & Nephew plc

-

B. Braun Melsungen AG

-

Conmed Corporation

-

Arthrex, Inc.

-

Zimmer Biomet Holdings, Inc.

-

Johnson & Johnson (Ethicon Endo-Surgery, Inc.)

-

Cantel Medical (a Steris company)

-

Cogentix Medical (Laborie Medical Technologies)

-

Intuitive Surgical, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 25.18 billion |

| Market Size by 2032 | USD 37.01 billion |

| CAGR | CAGR of 4.93% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Endoscopes (Reusable Endoscopes, Disposable Endoscopes)] • By End Use [Hospitals, Outpatient Facilities] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olympus Corporation, Boston Scientific Corporation, PENTAX Medical (Hoya Corporation), FUJIFILM Holdings Corporation, Karl Storz GmbH & Co. KG, Stryker, Medtronic, Ambu A/S, STERIS plc, Richard Wolf GmbH. |