Minimally Invasive Surgery Market Size & Overview:

The Minimally Invasive Surgery Market was valued at USD 68.93 billion in 2023 and is expected to reach USD 228.85 billion by 2032, growing at a CAGR of 16.18% from 2024-2032.

To get more information on Minimally Invasive Surgery Market - Request Free Sample Report

The global minimally invasive surgery market is witnessing notable expansion, fueled by innovations in surgical technologies and an increasing inclination towards techniques that reduce trauma and recovery duration. MIS methods, characterized by reduced incisions and minimal harm to adjacent tissues, have transformed surgical practices in various fields like orthopedics, gynecology, urology, and cardiology. The hospitals segment held the highest share of 73.3% in the global minimally invasive surgical systems market owing to the high availability of surgical treatment in hospitals. This transition is additionally reinforced by the growing incidence of chronic ailments like obesity, heart disease, and cancer, which frequently require surgical procedures.

Recent advancements in the MIS market have notably improved surgical accuracy and effectiveness. For example, in July 2023, Stryker introduced the initial fully autonomous surgical guidance system, tailored specifically for spinal and cranial surgeries. The system features enhanced navigation speeds, showcasing the swift progress of technological development in the area. Likewise, IRCAD launched an advanced training platform in September 2024, created in partnership with Medtronic. This platform is focused on providing healthcare professionals with sophisticated tools and methods to enhance results in robotic and minimally invasive procedures.

Regulatory changes are likewise influencing the market environment. In November 2023, Johnson & Johnson MedTech revealed intentions to seek FDA investigational device exemption for its OTTAVA robotic surgical system, demonstrating a dedication to enhancing robotic-assisted surgery's capabilities. These advancements emphasize the ongoing progression of MIS technology and its incorporation into standard surgical procedures.

The uptake of MIS is propelled by its many advantages, such as less postoperative discomfort, decreased hospital durations, and quicker recovery periods. Through continuous investments in innovation, training, and technology, the minimally invasive surgery sector is set to significantly impact global healthcare by enhancing patient outcomes and transforming surgical practices.

Minimally Invasive Surgery Market Dynamics

Drivers

-

One of the primary drivers of the minimally invasive surgery (MIS) market is the increasing patient preference for procedures that offer faster recovery, minimal scarring, and fewer postoperative complications.

A key factor fueling the minimally invasive surgery (MIS) market is the rising patient demand for treatments that provide quicker recovery, less scarring, and reduced postoperative complications. In contrast to conventional open surgeries, MIS methods utilize smaller incisions, resulting in less blood loss, a decreased risk of infection, and shorter hospital admissions. These advantages enhance patient satisfaction and reduce total healthcare expenses, making MIS a favored option for patients as well as healthcare professionals. The increasing incidence of chronic illnesses like cardiovascular diseases, obesity, and cancer, which frequently necessitate surgical procedures, has further hastened the embrace of MIS methods in numerous medical fields.

-

Advancements in technology have significantly enhanced the capabilities of minimally invasive procedures.

Improvements in technology have greatly increased the effectiveness of minimally invasive techniques. The implementation of robotic-assisted surgical systems, high-definition imaging tools, and sophisticated surgical instruments has enhanced the accuracy, safety, and effectiveness of these procedures. In 2024, robotic surgery simulation platforms are expected to make up around 74% of the worldwide market for robotic surgical simulation systems. For instance, autonomous surgical navigation systems, like Stryker’s newly released platform for cranial and spinal procedures, provide unmatched speed and precision in navigation. Moreover, advancements such as 3D imaging and augmented reality are assisting surgeons in visualizing complex anatomies more effectively and executing intricate procedures with improved accuracy. These technological advancements are propelling the use of MIS and fostering continuous investments in research and development to enhance surgical results.

Restraint

-

High Cost of Minimally Invasive Surgical Equipment and Procedures restraints the minimally invasive surgery market

A major limitation in the minimally invasive surgery (MIS) market is the elevated expense linked to sophisticated surgical tools, robotic technology, and the procedures involved. Innovative technologies, like robotic-assisted surgical systems and advanced imaging tools, necessitate significant upfront costs, posing financial difficulties for smaller healthcare institutions and those in resource-limited environments. Moreover, the upkeep and running expenses of these systems contribute to the financial strain.

For example, robotic surgical systems such as the da Vinci system require multimillion-dollar initial investments, along with extra costs for consumable instruments and system upkeep. These expenses are frequently transferred to patients, rendering MIS procedures less attainable for those in areas with inadequate insurance or elevated out-of-pocket costs. Moreover, educating healthcare workers to use these sophisticated systems demands substantial time and financial investment, making broad implementation more challenging. This expense obstacle restricts the adoption of MIS technologies in developing nations and rural regions, hindering overall market growth despite its clinical advantages.

Minimally Invasive Surgery Market Segmentaion Insights

By-Product

In 2023, The surgical devices Segment dominated the minimally invasive surgery (MIS) market with 25% of the market share due to its critical function in facilitating accurate and efficient procedures in multiple specialties, such as gynecology, orthopedics, and general surgery. Devices like laparoscopes, endoscopes, and suturing tools are essential for enabling smaller cuts and improved visibility. Technological innovations, including ergonomic designs and the incorporation of 3D imaging, have enhanced their functionality, rendering intricate procedures more efficient and less traumatic for patients. Moreover, the growing incidence of chronic illnesses and a heightened inclination for minimally invasive techniques stimulate the need for these devices. The constant requirement for updates and substitutions from wear and technological advancements guarantees ongoing growth, reinforcing this sector's leadership in the MIS market.

The endoscopy devices segment is the fastest growing in the minimally invasive surgery market with 18.46% CAGR throughout the forecast period, because of their essential function in providing accurate, real-time imagery during operations. Utilized in fields like gastroenterology, pulmonology, urology, and orthopedics, endoscopic instruments facilitate diagnosis, observation, and treatment with small incisions. Recent improvements in imaging technology, such as 4K and 3D visualization, have greatly increased the precision and safety of these devices, leading to their growing popularity in clinical environments. The increasing need for prompt diagnosis and treatment, especially for cancer and gastrointestinal issues, boosts the expansion of endoscopic instruments. Their capacity to shorten patient recovery periods, lessen risks, and enhance procedural results has resulted in broad acceptance, confirming their status as the fastest-expanding MIS segment.

By Application

The neurological surgery segment dominated the minimally invasive surgery (MIS) market with a 20% market share, driven by technological progress and the rising incidence of neurological diseases. Advancements like robotic-assisted surgery, advanced imaging techniques, and navigational tools have greatly improved surgical accuracy, allowing for minimally invasive operations with reduced incisions. These technologies minimize the risk of complications, blood loss, and recovery duration, making them perfect for intricate brain and spinal cord operations. Moreover, the increasing cases of ailments such as brain tumors, spinal cord injuries, and degenerative diseases are boosting the need for less invasive solutions. With the emphasis on patient-centered care and quicker recovery periods, neurological surgeries gain from MIS methods, setting this market up for ongoing swift expansion in the market.

The gastrointestinal (GI) and abdominal surgery segment is expected to show the fastest growth throughout the forecast period, propelled by the rising incidence of gastrointestinal conditions like colorectal cancer, Crohn's disease, and obesity. Such conditions frequently necessitate surgical intervention, and minimally invasive surgery (MIS) provides notable benefits, such as quicker recovery periods, fewer complications, and less postoperative discomfort. Improvements in laparoscopic tools, robotic surgery assistance, and imaging technology have significantly increased the accuracy and effectiveness of GI surgeries, facilitating intricate operations with smaller cuts and reducing interference to adjacent tissues. With patients showing a growing preference for less invasive procedures, the need for minimally invasive GI surgeries is on the rise, driving the expansion of this market. These aspects together contribute to gastrointestinal and abdominal surgery being the most rapidly expanding sector in the MIS market.

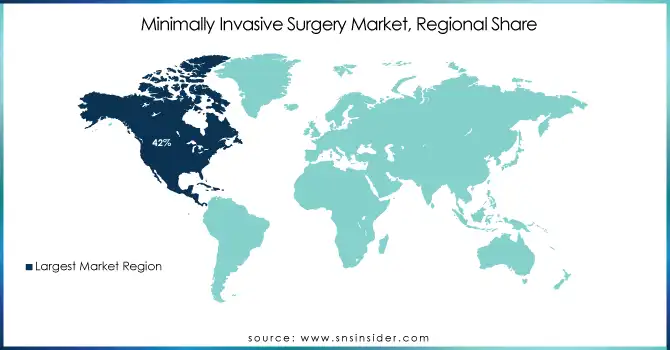

Minimally Invasive Surgery Market Regional Analysis

In 2023, North America dominated the MIS market with 42% of the market share, mainly because of its sophisticated healthcare infrastructure, significant uptake of innovative technologies, and robust network of experienced surgeons. The presence of significant market participants like Medtronic, Johnson & Johnson, and Stryker, along with their ongoing innovations, propels the regional market. Moreover, an increased occurrence of chronic illnesses such as cardiovascular diseases, obesity, and cancer requires minimally invasive techniques. Supportive reimbursement policies and substantial investments in robotic surgery systems also enhance the region's leadership.

The Asia Pacific is the fastest-growing region in the MIS market, driven by advancements in healthcare infrastructure, a rise in disposable income, and an aging population. This region is expected to show the fastest CAGR of 17.10% throughout the forecast period. Nations like China, India, and Japan are seeing an increase in demand for sophisticated surgical procedures because of their growing middle-class population and heightened awareness of minimally invasive methods. Efforts by the government to update healthcare systems and promote medical tourism also have a major impact. The comparatively lesser adoption of MIS technologies in the area presents unexploited growth opportunities, encouraging market participants to invest in training initiatives and distribution channels to broaden their presence.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Medtronic (Hugo Robotic System, Mazor X Stealth Edition)

-

Johnson & Johnson (Ethicon) (ECHELON FLEX Powered Stapler, Harmonic Scalpel)

-

Stryker Corporation (MAKO Robotic-Arm Assisted Surgery, 1688 AIM 4K Camera System)

-

Intuitive Surgical (da Vinci Surgical System, Ion Endoluminal System)

-

Olympus Corporation (ENDOEYE 3D Camera System, VISERA ELITE II Surgical Imaging System)

-

Zimmer Biomet (Rosa Knee System, Rosa Spine System)

-

Smith & Nephew (CORI Surgical System, VISIONAIRE Patient Matched Instrumentation)

-

Baxter International (Spectrum Infusion System, SurgiCount Safety System)

-

Karl Storz (Image 1 S 4K System, Telecam SL Camera System)

-

ConMed Corporation (Linvatec Instruments and Camera Systems, VisiGlide 2 Endoscopic Imaging System)

-

Boston Scientific (SpyGlass DS Direct Visualization System, VIVA 360 Endoscope)

-

Cook Medical (Cook Biopsy Instruments, Cook Endoscopic Imaging Systems)

-

Medline Industries (Micro-Cut Scissors, MicroAire Powered Liposuction)

-

Terumo Corporation (VascuGuard Surgical Patch, Pinnacle Biopsy Needle)

-

NuVera Medical (NuVera Laser System, Laparoscopic Instrumentation)

-

Raumedic (Biocompatible Tubing for MIS, Raumedic Endoscopic Instruments)

-

Hoya Corporation (Endoscopic Imaging System, Surgical Microscope)

-

Lumenis (VersaPulse Power Suite, UltraPulse DUO Laser System)

-

Welch Allyn (Hill-Rom) (3.5 V LED Surgical Headlight, SureTemp Plus Thermometer)

-

KARL STORZ (Arcus Video Endoscopy System, CytoCARE Cryotherapy System)

Key suppliers

These suppliers are instrumental in enabling market players to produce high-quality, advanced minimally invasive surgical products.

-

3M Health Care

-

Zeiss Group

-

Schott AG

-

Dow Corning

-

TE Connectivity

-

Precision Castparts Corp.

-

Mitsubishi Chemical

-

Nolato AB

-

Amphenol Corporation

-

DuPont

Recent Developments

-

September 2024 – IRCAD proudly unveiled its state-of-the-art training platform for minimally invasive and robotic surgery, developed in collaboration with Medtronic, a long-standing partner of the Institute. This cutting-edge center of excellence aims to equip healthcare professionals with advanced tools and resources to refine their skills in robotic surgery, marking a significant milestone in medical education and surgical innovation.

-

November 7, 2023 – Johnson & Johnson MedTech revealed its plans to submit the OTTAVA robotic surgical system for an investigational device exemption (IDE) application to the U.S. Food and Drug Administration (FDA). The submission, scheduled for the second half of 2024, will pave the way for initiating clinical trials, underscoring the company’s commitment to advancing robotic surgical technology.

-

July 2023 – Stryker announced the commercial launch of its first fully autonomous surgical guidance system for cranial and spinal surgery. The innovative system features a proprietary FP8000 camera, boasting navigation speeds four times faster than Medtronic’s StealthStation and 16 times faster than Globus Medical’s ExcelsiusGPS, redefining efficiency and precision in surgical procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 68.93 Billion |

| Market Size by 2032 | US$ 228.85 Billion |

| CAGR | CAGR of 16.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Surgical Devices, Imaging & Visualization Systems, Electrosurgical Devices, Endoscopy Devices, Medical Robotics, Robotic Systems, Robotic Instruments, Robotic Software & Services) • By Application (Cardiothoracic Surgery, Vascular Surgery, Neurological Surgery, ENT & Respiratory Surgery, Cosmetic Surgery, Gastrointestinal & Abdominal Surgery, Gynecological Surgery, Urological Surgery, Orthopedic Surgery, Oncological Surgery, Dental Surgery, Other Surgeries) • By End-User (Hospitals, Clinics, and Ablation Centers, Ambulatory Surgery Centers, Orthopedic, Emergency, and Trauma Centers, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Johnson & Johnson (Ethicon), Stryker Corporation, Intuitive Surgical, Olympus Corporation, Zimmer Biomet, Smith & Nephew, Baxter International, Karl Storz, ConMed Corporation, Boston Scientific, Cook Medical, Medline Industries, Terumo Corporation, NuVera Medical, Raumedic, Hoya Corporation, Lumenis, Welch Allyn (Hill-Rom), KARL STORZ. |

| Key Drivers | •One of the primary drivers of the minimally invasive surgery (MIS) market is the increasing patient preference for procedures that offer faster recovery, minimal scarring, and fewer postoperative complications. •Advancements in technology have significantly enhanced the capabilities of minimally invasive procedures. |

| Restraints | •High Cost of Minimally Invasive Surgical Equipment and Procedures restraints the minimally invasive surgery market |