Vegan Chocolate Market Report Scope And Overview:

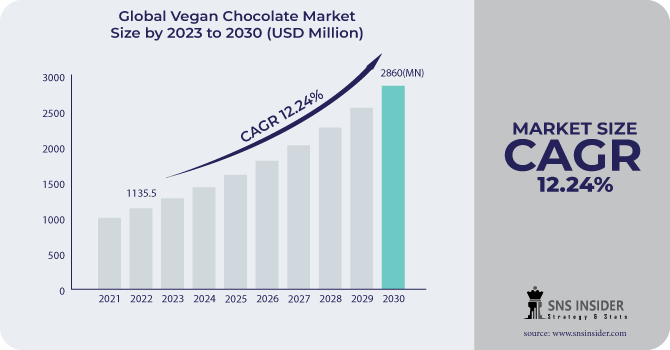

The Vegan Chocolate Market size was USD 1274.48 million in 2023 and is expected to Reach USD 3602.99 million by 2032 and grow at a CAGR of 12.24% over the forecast period of 2024-2032.

Vegan chocolate is chocolate that does not contain any animal products, including milk, butter, or eggs. Vegan chocolate is made with plant-based ingredients, such as cocoa butter, soy milk, or almond milk. Based on Chocolate type, the dark chocolate segment accounted for 53% of the total revenue in 2022. Dark chocolate has a significant amount of antioxidants and flavonoids, which have been linked to a variety of health advantages, including a lower risk of heart disease, stroke, cancer, and other chronic diseases.

Based on the distribution Channel, the online store's channels are anticipated to rise at a CAGR of 11.8%. Online stores can also sell vegan chocolate through marketplaces such as Amazon and eBay. As a result, internet retailers are able to reach a larger audience, but they also have less control over how their customers are treated. Supermarkets/hypermarkets are expected to have the largest market share.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing Popularity of Veganism

Many people opt to follow a vegan diet for ethical, environmental, or health reasons. As a result, there is an increasing demand for vegan food and beverage goods, including vegan chocolate. Vegan chocolate is becoming increasingly popular among flexitarians and those attempting to minimize their consumption of animal products. Flexitarians use animal products on occasion but eat predominantly plant-based cuisine. Drive market growth as well. Manufacturers are developing novel vegan chocolate goods, such as bars, truffles, and bonbons with distinct flavors and textures.

-

Availability and affordability of vegan chocolate

RESTRAIN

-

Limited availability of vegan chocolate in some markets

The vegan chocolate market remains in its early stages, with many firms not yet creating vegan chocolate products on a large scale. Vegan chocolate components can be more expensive than typical chocolate ingredients. Furthermore, because vegan chocolate products are not as well-known as regular chocolate goods, some businesses may be hesitant to stock them. The scarcity of vegan chocolate stifles the expansion of the vegan chocolate market.

OPPORTUNITY

• Collaboration with retailers and food service providers

E-commerce platforms make it easy for consumers to find and purchase vegan chocolate products from a variety of brands. Additionally, consumers may find vegan chocolate more inexpensive to online distribution channels frequently lower costs than those of conventional retail stores. Manufacturers are entering new areas and forging relationships with retailers to get their products into more stores. Retailers are setting aside specific sections for vegan chocolate items and running special deals on them. Also, Social media and other marketing platforms are being used by producers and merchants to inform consumers about vegan chocolate and increase its availability.

-

Growing Awareness of the Health Benefits of Vegan Chocolate

CHALLENGES

-

High Prices of Vegan Chocolate

Vegan chocolate materials are frequently more expensive than dairy chocolate ingredients. Almond milk and soy milk are more expensive than cow's milk. Furthermore, plant-based fats like coconut oil and palm kernel oil are frequently more expensive than dairy fats. Vegan chocolate manufacturing can be more sophisticated and time-consuming than traditional chocolate manufacturing. Vegan chocolate's high prices are a key hindrance to its commercial growth.

IMPACT OF RUSSIA-UKRAINE WAR

The conflict between Russia and Ukraine has influenced the vegan chocolate market. The war has hampered the availability of cocoa beans, sunflower oil, and other components needed to make vegan chocolate. The disruption in the supply chain makes vegan chocolate products more expensive in some marketplaces. The import of chocolate from a confectionery company in Ukraine has been prohibited by Russia. According to NielsenIQ, the Ukrainian vegan chocolate industry is expected to decline by 20% by 2022. According to a Euromonitor International analysis, the Russian market for vegan chocolate is predicted to expand by 10% in 2022.

IMPACT OF ONGOING RECESSION

A recession could lead to reduced consumer spending on chocolate, which would reduce demand for vegan chocolate products. Vegan chocolates are more expensive than conventional chocolate as almond milk and soy milk are increasing. According to NielsenIQ, the UK vegan chocolate market is anticipated to expand by 5% by 2022. However, according to the market analysis the UK economy suffers a recession, the market might fall by 1% in 2023. Consumers may be more inclined to switch to less expensive chocolate products, such as non-vegan chocolate.

MARKET SEGMENTATION

by Chocolate Type

-

Milk Chocolate & White Chocolate

-

Raw Chocolate

-

Dark Chocolate

by Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Stores

-

Other

.png)

REGIONAL ANALYSIS

Europe dominated the vegan chocolate market holding a market revenue share of 38% in 2022. Due to customers' increasing preference for conventional chocolate made with milk rather than dairy products, demand for dairy-free goods has increased. Growth is credited to growing concern for animal welfare.

The North American market is predicted to grow at a value CAGR of 11.5% during the forecast period. The demand for vegan chocolate has surged as customers become more health-conscious. Products made from vegan chocolate are getting easier to find in supermarkets and specialized shops in North America.

Asia Pacific is the fastest-growing market for vegan chocolate, accounting for over 20.5% of the global market. The rising popularity of plant-based diets, as well as an increasing demand for premium chocolate products, are driving this increase. The vegan chocolate market in China is expanding at a CAGR of more than 10.5%. The public is becoming more aware of the health benefits of vegan chocolate, such as its high antioxidant content and potential to lower the risk of chronic diseases.

Latin America is the emerging market for the vegan chocolate market. Brazil holds a 36% market share for vegan chocolate. Australia's market is anticipated to expand significantly in Oceania, with a CAGR of 10.6%, to reach USD 47.4 million by 2032.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Vegan Chocolate Market are Mondelēz International., Nestle SA, Endangered Species Chocolate, Tofutti Brands, Inc., The Hershey Company, Plamil Foods Ltd, Mars Incorporated, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Schmilk Chocolate, Ludwig Weinrich GmbH & Co. KG, Purdys Chocolatier, and other key players.

Mondelēz International-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Moon Magic, a vegan chocolate firm based in the United States, launched a range of vegan milk chocolate bars with no added sugar. The oat milk in the new beverage includes only 117 calories and 2g of sugar.

In 2022, Nestle announced the availability of KitKat V, the vegan version of its popular KitKat brand, in 15 European nations, following its initial testing in the United Kingdom and a few other countries in 2021. The original KitKat milk is replaced with a rice-based replacement, but the crispy wafer and smooth chocolate sensations remain.

In 2022, Chocoladefacriken Lindt & Sprungli AG has vegan chocolate bars manufactured from oat milk on the market. Lindt Classic Recipe OatMilk bars in original and salted caramel tastes are now available in supermarkets across the United States. The company substituted gluten-free oat milk powder & almond paste for regular dairy milk.

| Report Attributes | Details |

| Market Size in 2024 | US$ 1274.48 Million |

| Market Size by 2032 | US$ 3602.99 Million |

| CAGR | CAGR of 12.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chocolate Type (Milk Chocolate & White Chocolate, Raw Chocolate, Dark Chocolate) • By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mondelēz International., Nestle SA, Endangered Species Chocolate, Tofutti Brands, Inc., The Hershey Company, Plamil Foods Ltd, Mars Incorporated, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Schmilk Chocolate, Ludwig Weinrich GmbH & Co. KG, Purdys Chocolatier |

| Key Drivers | • Increasing Popularity of Veganism • Availability and affordability of vegan chocolate |

| Market Opportunity | • Collaboration with retailers and food service providers • Growing Awareness of the Health Benefits of Vegan Chocolate |