Vehicle Electrification Market Report Scope & Overview:

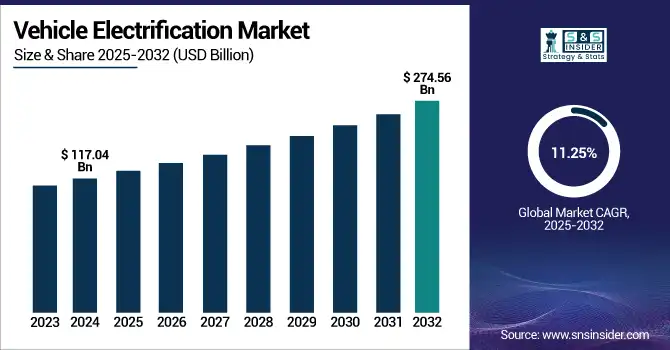

The Vehicle Electrification Market size was valued at USD 117.04 billion in 2024 and is expected to reach USD 274.56 billion by 2032, growing at a CAGR of 11.25% over the forecast period of 2025-2032.

To Get more information on Vehicle Electrification Market - Request Free Sample Report

The Vehicle Electrification Market is undergoing rapid transformation as the automotive sector shifts toward sustainable and energy-efficient solutions. This evolution is fueled by rising environmental concerns, stricter emission regulations, and advancements in electric powertrain technologies. Key vehicle electrification market trends include the integration of high-voltage architectures, the development of solid-state batteries, and the expansion of hybrid and electric vehicle models across commercial, passenger, and two-wheeler segments. Additionally, intelligent energy management systems and lightweight materials are being increasingly adopted to improve vehicle efficiency and performance. The vehicle electrification market growth is driven by government incentives and increased investment in charging infrastructure and research and development (R&D). A growing area of focus is the military vehicle electrification market, where electric and hybrid powertrains are being developed to enhance tactical performance and reduce fuel dependency. The global vehicle electrification market continues to evolve, attracting innovation in battery technology, power electronics, and thermal management. The broader vehicle electrification industry is also seeing collaborations between automakers and technology firms to scale up production and address range anxiety and charging speed challenges. As electrification becomes central to the future of mobility, this market is set to play a critical role in reshaping transportation systems worldwide.

In June 2025, President Trump revoked California’s long-standing authority to set its own vehicle emissions standards, including its 2035 gas car ban, sparking national controversy. The move affects 10 other states aligned with California’s EV rules and threatens federal EV tax credits and infrastructure funding. Experts warn this could hinder EV adoption by creating policy uncertainty. California has filed a lawsuit, calling the action “unlawful,” while automakers remain split on its impact.

Market Dynamics

Drivers

-

Fuel Efficiency and Emission Norms Drive Surge in Vehicle Electrification Adoption

The rising demand for fuel efficiency and emission reduction is a key driver accelerating the growth of the vehicle electrification market. With growing awareness of climate change and the environmental impact of conventional internal combustion engine (ICE) vehicles, both governments and consumers are pushing for cleaner mobility solutions. Strict emission regulations, such as Euro 6 and China VI standards, are compelling automakers to reduce vehicle emissions and improve fuel economy. Electrified powertrains ranging from mild hybrids to fully electric vehicles offer significant reductions in greenhouse gas emissions and fuel consumption. As a result, automotive manufacturers are increasingly investing in electric and hybrid technologies to comply with regulations, meet sustainability goals, and cater to the shifting consumer preference for eco-friendly transportation options.

Restraint

-

High Upfront Costs Hinder Electrified Vehicle Adoption in Developing Markets Despite Long-Term Benefits

The high initial cost of electrified vehicles poses a significant restraint on market growth, particularly in cost-sensitive and developing regions. While electric and hybrid vehicles offer long-term savings through reduced fuel and maintenance expenses, their upfront purchase cost remains substantially higher than conventional internal combustion engine (ICE) vehicles. This price gap is largely attributed to the high cost of lithium-ion batteries, which constitute a major portion of the total vehicle cost. Additionally, advanced electronics, electric drivetrains, and lightweight materials further elevate manufacturing expenses. In regions where government incentives are limited or unavailable, this cost disparity becomes even more prominent, discouraging potential buyers and slowing mass adoption despite growing awareness and environmental benefits associated with vehicle electrification.

In June 2025, A Shell survey of 15,000 drivers across major markets shows that the high upfront cost of EVs, up to 30% more than traditional vehicles, remains the top barrier to adoption. In Europe, willingness to switch to EVs dropped from 48% to 41%, and in the U.S., from 34% to 31%. Only 17% of European drivers see value in public charging, compared to 71% in the U.S.

Key Segmentation

By Product

In 2024, Electric Vacuum Pumps accounted for the largest share, dominating the product segment with 71.8% of the market. This dominance is attributed to their critical role in enhancing brake performance and reducing dependency on traditional vacuum generation systems in internal combustion engines. As automakers transition to electrified platforms, vacuum pumps offer greater design flexibility, efficiency, and support for safety-critical applications like advanced braking systems, especially in mild and full hybrids. Their reliability and cost-effectiveness make them the preferred choice for both OEMs and aftermarket installations.

Electric Power Steering (EPS) is the fastest-growing product segment in the vehicle electrification market. It is rapidly replacing traditional hydraulic systems due to its energy efficiency, lower maintenance, and compatibility with autonomous and driver-assist systems. EPS contributes significantly to fuel economy and CO₂ reduction, which aligns with tightening global emission regulations. Moreover, the surge in electric and hybrid vehicle production is accelerating EPS adoption, as it operates independently of the engine and offers better control and responsiveness, making it ideal for next-gen vehicles.

By Hybridization

In 2024, ICE & Micro-Hybrid Vehicles maintained dominance in the hybridization segment with 59% market share. This is primarily because micro-hybrid technologies, such as start-stop systems, require minimal changes to existing ICE architecture and are cost-effective. They serve as a transitional solution for OEMs and consumers hesitant to fully switch to plug-in or battery electric vehicles. High adoption rates in developing economies and their role in improving fuel efficiency without full electrification have cemented their position as the leading hybridization type.

PHEVs are the fastest-growing hybridization category, driven by their dual powertrain flexibility, enabling both electric and fuel-driven travel. This versatility appeals to consumers looking for a balance between zero-emission driving and longer range. Government incentives, expanding charging infrastructure, and emission mandates across Europe, China, and North America are pushing OEMs to invest heavily in PHEV models. Their ability to address range anxiety while complying with green policies makes PHEVs a crucial stepping stone toward full electrification.

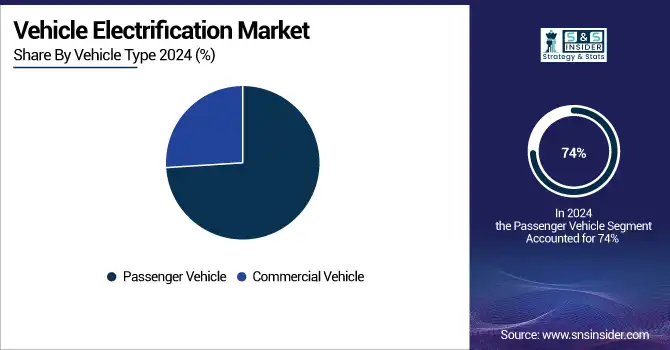

By Vehicle Type

Passenger vehicles held a dominant 74% market share in 2024 in the vehicle type category. This dominance stems from the sheer volume of personal vehicles on the road globally, especially in urbanized and emerging markets. Rising consumer preference for fuel-efficient, tech-enabled cars, coupled with favorable policies and incentives, is steering automakers toward electrification. Enhanced EV model availability, growing environmental consciousness among consumers, and supportive charging infrastructure have all contributed to the segment’s commanding presence in the market.

Commercial vehicles represent the fastest-growing vehicle type segment due to rising regulatory pressure to curb emissions from heavy-duty fleets and logistics operations. Governments and corporations are investing in electrified trucks, vans, and buses to meet sustainability goals and lower total cost of ownership over time. Additionally, advancements in battery technology and charging networks are making electrification more viable for commercial use. Growth is further fueled by e-commerce expansion, which demands cleaner, efficient last-mile delivery solutions.

Regional Analysis

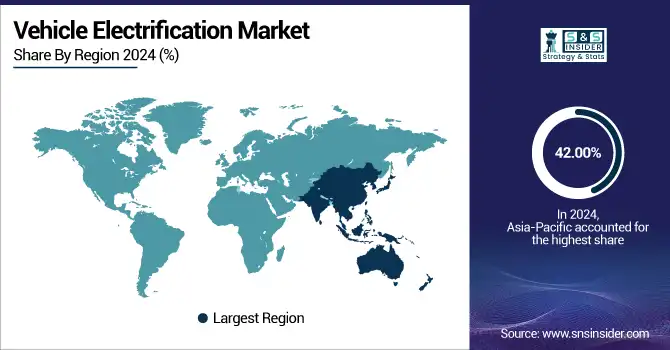

Asia-Pacific holds the dominant position in the global vehicle electrification market, capturing 42.00% share in 2024. This leadership is driven by the robust presence of EV manufacturing hubs in China, Japan, and South Korea, along with favorable government policies, large-scale investments, and rising demand for electric two-wheelers and passenger cars. China, in particular, leads with aggressive EV targets, extensive charging infrastructure, and subsidies. The region also benefits from the presence of top battery manufacturers and growing urbanization, which boosts demand for cleaner, efficient transportation systems. Additionally, strong domestic supply chains provide a competitive advantage in EV component manufacturing.

China is both the dominant and fastest-growing country in the Asia-Pacific vehicle electrification market. It leads due to strong government support, a well-developed EV manufacturing ecosystem, and widespread charging infrastructure. The presence of major domestic automakers and battery producers strengthens its position. Rapid urbanization, policy mandates, and expanding EV adoption across cities continue to drive high growth. China’s push for clean mobility and innovation ensures its dominance in both scale and momentum.

North America is the fastest-growing region in the vehicle electrification market, propelled by rising investments in EV production, increasing environmental awareness, and strong policy support. The United States and Canada are witnessing rapid advancements in EV infrastructure, tax incentives, and fleet electrification programs. Major automakers like Tesla, Ford, and GM are expanding their EV portfolios, while government regulations aim to reduce carbon emissions and phase out internal combustion engines. The Inflation Reduction Act (IRA) and EV tax credits further boost consumer adoption. Additionally, North America's emphasis on domestic battery production and R&D innovation supports its accelerated market growth.

The U.S. vehicle electrification market is projected to grow from USD 21.35 billion in 2024 to USD 51.54 billion by 2032, leading the North American region. This growth is driven by strong policy support, rising EV adoption, and major investments in infrastructure and manufacturing.

Europe holds a significant share in the vehicle electrification market, driven by strict emission norms, carbon neutrality goals, and strong government support for clean mobility. Countries like Germany, France, and the UK are at the forefront with aggressive EV adoption strategies, robust infrastructure, and incentives such as subsidies, tax breaks, and low-emission zones. The European Union's Green Deal and the 2035 ban on new ICE vehicle sales further strengthen market momentum. Moreover, the region is home to leading automakers and suppliers focused on EV technology, helping maintain its substantial market share despite emerging competition from Asia-Pacific and North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Vehicle Electrification Companies are:

Robert Bosch GmbH, DENSO CORPORATION, Magna International Inc., Valeo SA, ZF Friedrichshafen AG, Aptiv, Mitsubishi Electric Corporation, AISIN CORPORATION, Johnson Electric Holdings Limited, BorgWarner Inc.

Recent Development

In December 2024: Bosch reached a preliminary deal with the U.S. Department of Commerce for up to USD 225 million in CHIPS Act funding to support a $1.9 billion investment in its Roseville, California plant. The facility will produce silicon carbide (SiC) power semiconductors essential for EVs and clean energy tech. Bosch may also access USD 350 million in federal loans, with production expected to begin by 2026, covering over 40% of U.S. SiC capacity.

In May 2025: DENSO announced key leadership changes in its North American operations, effective April 1, 2025, to strengthen agility and customer focus. Satoki Ishikawa was appointed Head of Corporate Finance, Ryota Tosaka became SVP of Japanese Car Group Sales, and Ramy Sulaiman was promoted to VP of Ford Sales. These shifts reflect DENSO’s commitment to aligning talent with evolving industry needs.

| Report Attributes | Details |

| Market Size in 2024 | USD 117.04 Billion |

| Market Size by 2032 | USD 274.56 Billion |

| CAGR | CAGR of 11.25% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Start/Stop System, Electric Power Steering, Liquid Heater PTC, Electric Air Conditioner Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, Starter Motor & Alternator, Integrated Starter Generator, Actuators) • By Hybridization (Internal Combustion Engine (ICE) & Micro-Hybrid Vehicle, HEV, PHEV, BEV) • By Vehicle Type (Passenger Vehicle, Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, DENSO CORPORATION, Magna International Inc., Valeo SA, ZF Friedrichshafen AG, Aptiv, Mitsubishi Electric Corporation, AISIN CORPORATION, Johnson Electric Holdings Limited, BorgWarner Inc. |