Liquid Ring Vacuum Pumps Market Report Scope & Overview:

Get More Information on Liquid Ring Vacuum Pumps Market - Request Sample Report

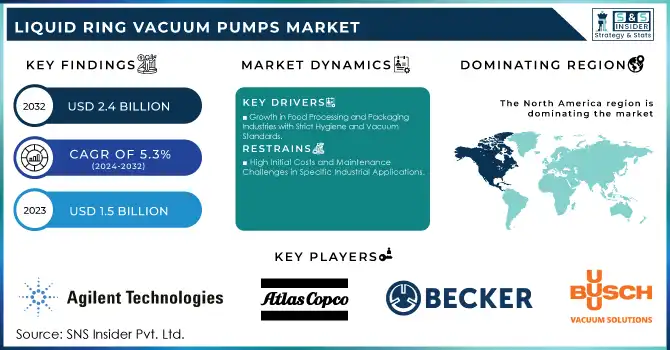

The Liquid Ring Vacuum Pumps Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.4 billion by 2032 and grow at a CAGR of 5.3% over the forecast period 2024-2032.

The liquid ring vacuum pumps market is experiencing continuous advancements driven by technology and various applications across sectors such as food packaging, chemical processing, and wastewater treatment. A key factor in the liquid ring vacuum pump market's growth is the increasing demand for energy-efficient and low-maintenance solutions that can help industries meet operational and environmental standards. Innovations such as variable-speed drive technology are transforming the landscape of liquid ring vacuum pumps, providing optimized energy use and enhancing performance. For instance, in February 2019, Atlas Copco launched its variable-speed drive liquid ring vacuum pump, a technology designed to provide more efficient and flexible operation, allowing industries to reduce their energy consumption while maintaining high performance. This innovative solution addresses the growing pressure on companies to reduce energy costs and improve sustainability in their operations.

The adoption of these pumps is also evident in industries that require specialized solutions. For example, in April 2024, Atlas Copco’s vacuum pump systems were installed at a Norwegian fish packaging facility, enhancing operational efficiency and reducing waste in the food packaging sector. This development highlights the adaptability of liquid ring vacuum pumps to highly regulated industries and demonstrates their ability to meet the specific needs of food preservation and packaging. These recent advancements by Atlas Copco exemplify how companies are not only meeting industry demands for energy-efficient solutions but are also playing a pivotal role in driving sustainability within critical sectors such as food and beverage production. Through such innovations, the liquid ring vacuum pumps market is poised for continued growth, driven by technological progress and the rising demand for sustainable, high-performance solutions across diverse industries.

Liquid Ring Vacuum Pumps Market Dynamics:

Drivers:

-

Rising Demand for Energy-Efficient Solutions to Minimize Industrial Operational Costs and Environmental Footprints

The increasing emphasis on reducing energy consumption in industrial processes has spurred demand for energy-efficient liquid ring vacuum pumps. These systems are particularly valuable in applications requiring high reliability and low energy usage, such as chemical processing and wastewater treatment. Industries worldwide are under pressure to comply with stringent environmental regulations, driving manufacturers to innovate pumps that are both efficient and environmentally friendly. Advances in variable-speed drives and enhanced material technology ensure better energy optimization, significantly lowering operational costs while meeting regulatory requirements. This trend is crucial as industries focus on balancing operational efficiency with sustainability.

-

Growth in Food Processing and Packaging Industries with Strict Hygiene and Vacuum Standards

-

Expanding Applications in the Pharmaceutical Industry for Sterile and Safe Production Environments

Restraint:

-

High Initial Costs and Maintenance Challenges in Specific Industrial Applications

Opportunity:

-

Integration of IoT and Smart Technologies in Vacuum Systems for Real-Time Monitoring and Efficiency Optimization

The integration of IoT and smart technologies into liquid ring vacuum pumps presents significant growth opportunities. Real-time monitoring capabilities allow for predictive maintenance, reducing downtime, and improving system efficiency. Smart-enabled pumps can also optimize performance by adjusting operations based on process requirements, making them highly attractive to industries aiming for automation and improved productivity.

-

Growing Investments in Renewable Energy and Green Technologies across Global Markets

-

Expanding Role in Emerging Wastewater Treatment Applications for Industrial and Municipal Systems

Challenge:

-

Competition from Alternative Technologies Offering Enhanced Performance and Lower Costs

Industry Adoption Trends of Liquid Ring Vacuum Pumps in 2023: A Sector-wise Overview

In 2023, the adoption of liquid ring vacuum pumps was most prominent in the petrochemical and chemical industries, accounting for 30% of the market share. This was followed by food and beverage processing, reflecting the increasing demand for reliable packaging and processing solutions in these sectors. The water treatment industry also contributed a significant amount of the adoption, driven by the need for efficient and sustainable systems in wastewater management. Pharmaceutical and oil & gas industries accounted for a significant percentage of adoption respectively, as these sectors increasingly rely on vacuum pumps for critical operations such as evaporation, distillation, and gas compression.

Liquid Ring Vacuum Pumps Market Segments Analysis

By Type

The single-stage segment dominated the liquid ring vacuum pumps market in 2023, accounting for approximately 60% of the market share. This segment's dominance is due to its simplicity, cost-effectiveness, and reliability in handling applications requiring moderate vacuum levels. Single-stage pumps are extensively used in industries like chemical processing, food packaging, and water treatment, where medium-range vacuum levels suffice. For instance, these pumps are ideal for degassing and distillation processes in chemical plants. Their lower maintenance requirements compared to multi-stage pumps also add to their popularity, especially in industries seeking efficiency and cost savings.

By Material Type

The cast iron segment dominated the liquid ring vacuum pumps market in 2023, holding around 45% of the total share. Cast iron's durability and ability to withstand high-pressure conditions make it a preferred choice for heavy-duty applications. It is widely used in sectors such as oil and gas, petrochemicals, and pulp and paper, where robust material is crucial for prolonged operational life. For example, cast iron pumps are commonly deployed in vacuum filtration in the pulp and paper industry. Although stainless steel is gaining traction due to its corrosion resistance, cast iron remains dominant for cost-sensitive and heavy-duty scenarios.

By Rate

The 600–3,000 m³/h rate segment dominated the liquid ring vacuum pumps market in 2023, accounting for about 40% of the market share. These pumps are favored in medium to large-scale industrial processes, including chemical processing, pharmaceuticals, and food manufacturing. Their versatility and efficiency in managing both vacuum generation and fluid handling make them suitable for diverse applications such as vacuum drying and steam condensation. This capacity range offers an ideal balance of performance and cost, appealing to industries requiring reliable operation in medium-scale setups.

By Application

The chemical and petrochemical segment dominated the liquid ring vacuum pumps market in 2023, capturing over 30% of the market share. These industries heavily rely on liquid ring vacuum pumps for critical applications such as distillation, evaporation, and extraction. The pumps' ability to handle wet and corrosive gases without compromising efficiency makes them indispensable in chemical processes. For instance, their use in vacuum distillation and solvent recovery ensures safety and operational efficiency, driving their adoption across chemical manufacturing plants globally. Other industries, such as pharmaceuticals and food processing, also contribute significantly to demand, albeit to a lesser extent.

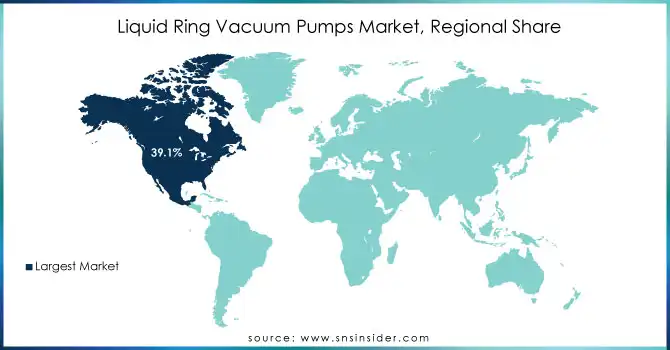

Liquid Ring Vacuum Pumps Market Regional Overview

In 2023, North America dominated the liquid ring vacuum pumps market, capturing a market share of approximately 39.1%. This leadership is primarily attributed to the region's significant industrial activities, particularly in sectors like oil and gas, chemical processing, and food manufacturing. The oil and gas industry in North America, with significant reserves and ongoing investments in exploration and refining, relies heavily on liquid ring vacuum pumps for vapor recovery and gas compression. For example, the United States has been a key contributor, with its vast chemical manufacturing facilities driving demand for these pumps due to their ability to handle volatile and corrosive gases effectively. Similarly, Canada has seen notable adoption in its oil sands operations, further bolstering the market's dominance in the region. The region's advanced technological infrastructure and emphasis on energy efficiency have also enhanced the adoption of innovative pump designs by leading manufacturers like Flowserve and Busch Vacuum Solutions.

On the other hand, the Asia-Pacific region emerged as the fastest-growing market in 2023, with a CAGR of 5.7% in the forecast period. Rapid industrialization and urbanization in countries like China and India have been major growth drivers. China leads the regional demand due to its extensive investments in chemical processing and water treatment industries, while India shows substantial growth in pharmaceutical and food manufacturing applications. For example, China's environmental regulations for industrial wastewater treatment have spurred the adoption of liquid ring vacuum pumps, which excel in moisture-laden environments. Additionally, Japan's technological advancements in manufacturing and South Korea's automotive sector have further fueled regional demand. This growth trajectory is supported by regional manufacturers focusing on cost-effective solutions and increasing local production capabilities, positioning Asia-Pacific as a critical player in the global market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

April 2024: Atlas Copco's liquid ring vacuum pumps were implemented by a Norwegian fish packaging facility to enhance efficiency and maintain product freshness. These pumps supported critical processes, such as vacuum packaging, ensuring extended shelf life and adherence to hygiene standards. The deployment highlights the technology's role in supporting sustainable practices within the food industry, particularly in cold-chain logistics.

Key Players in Liquid Ring Vacuum Pumps Market

-

Agilent Technologies Inc. (PHD-4 Leak Detector, DS 302 Rotary Vane Pump)

-

Atlas Copco Airpower N.V. (AWS Single-Stage Pumps, LRP 700 VSD+)

-

Becker Pump Corporation (SV Series Liquid Ring Pumps, O-Series Rotary Vane Pumps)

-

Busch Vacuum Technics Inc (Panda Vacuum Pump, Dolphin Liquid Ring Vacuum Pump)

-

Dekker Vacuum Technologies Inc. (Vmax Oil-Sealed Liquid Ring Pump, AquaSeal Water-Sealed Vacuum Pump)

-

Edwards Limited (nXDS Dry Scroll Pumps, EH Booster Pumps)

-

Ebara Corporation (LSE Series, A Series Liquid Ring Vacuum Pumps)

-

Flowserve Corporation (SIHI LPH Series, SIHI Compact Pump)

-

Gardner Denver Holdings Inc. (Elmo Rietschle Liquid Ring Pumps, NASH Series)

-

Graham Corporation (CL Series, Ejector-Liquid Ring Combination Systems)

-

Kinney Vacuum Company Inc. (KLRC Series, KT Series Liquid Ring Pumps)

-

Kashiyama Industries Ltd. (SDE Series, KMB Series)

-

Pfeiffer Vacuum GmbH (OktaLine Series, OnTool Booster Pumps)

-

Pompetravaini S.p.A. (TRS Series, TRV Series)

-

PPI Pumps Pvt. Ltd. (Two-Stage Liquid Ring Pumps, Single-Stage Monoblock Pumps)

-

Robuschi S.p.A. (RVS Liquid Ring Pumps, Robox Series Blowers)

-

Sterling SIHI GmbH (LPH Series, Sterling T Range)

-

Tsurumi Manufacturing Co., Ltd. (LSP Series, HSZ Series Pumps)

-

ULVAC Inc. (GHD Series, LR Series)

-

Zibo Zhaohan Vacuum Pump Co., Ltd. (2BE Series, 2BV Series)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.5 Billion |

| Market Size by 2032 | US$ 2.4 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Single-stage, Multi-stage) •By Material Type (Cast Iron, Stainless Steel, Others) •By Rate (25 – 600 M3H, 600 – 3,000 M3H, 3,000 – 12,000 M3H, Over 12,000 M3H) •By Application (Petrochemical & Chemical, Pharmaceutical, Food Manufacturing, Aircraft, Automobile, Water Treatment, Oil & Gas, Power Generation, EPS and Plastics, Pulp & Paper, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco Airpower N.V., Busch Vacuum Technics Inc., Dekker Vacuum Technologies Inc., Flowserve Corporation, PPI Pumps Pvt. Ltd., Tsurumi Manufacturing Co., Ltd., Pompetravaini S.p.A., Edwards Limited, Gardner Denver Holdings Inc., Graham Corporation and other key players |

| Key Drivers | • Rapid Industrialization in Emerging Economies Driving Investments in Infrastructure and Processing Plants • Adoption of Advanced Materials and Technologies to Improve Pump Performance and Longevity |

| RESTRAINTS | • High Initial Costs and Maintenance Challenges in Specific Industrial Applications |