Hyper Converged Infrastructure Market Key Insights:

The Hyper Converged Infrastructure Market size was valued at USD 16.16 billion in 2025E and is expected to reach USD 84.72 billion by 2033, growing at a CAGR of 23.01% over the forecast period 2026-2033.

The hyper converged infrastructure (HCI) market has emerged as a transformative sector in IT, driven by the need for streamlined, efficient data management systems that simplify and consolidate traditionally siloed resources. The HCI market has experienced rapid growth due to the evolving demands of cloud-based applications and the increasing need for virtualized environments. The rapid rise in cloud services spending, projected to reach USD 679 billion globally in 2024, reflects the significant growth of cloud computing models, a trend closely tied to the expanding adoption of Hyper-Converged Infrastructure. With Infrastructure as a Service (IaaS) expected to grow by 26.6% in 2024, Platform as a Service (PaaS) by 21.5%, and Software as a Service (SaaS) up by 15.9% since 2022, organizations are increasingly adopting hybrid cloud environments. This shift is mirrored by the widespread adoption of HCI, which simplifies hybrid cloud deployment and cloud management by consolidating storage, computing, and networking within a single framework.

Hyper Converged Infrastructure Market Size and Forecast:

-

Market Size in 2025E: USD 16.16 Billion

-

Market Size by 2033: USD 84.72 Billion

-

CAGR: 23.01% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Hyper Converged Infrastructure Market - Request Sample Report

Hyper Converged Infrastructure Market Drivers

-

The simplified IT management offered by HCI systems is one of the primary drivers propelling its adoption in various sectors.

Conventional IT infrastructure typically includes intricate, multi-layered setups that need individual servers, storage networks, and dedicated storage arrays, each with specific management requirements. This complication frequently results in operational inefficiencies and higher management workloads, leading to delays and a greater chance of errors. On the other hand, HCI integrates computing, storage, and networking into one system, simplifying IT tasks and decreasing managerial intricacies. HCI's software-defined strategy allows for streamlined management with a centralized interface, decreasing the requirement for specialized expertise and enabling IT admins to efficiently tackle various tasks throughout the infrastructure. This streamlining helps companies with small IT teams by enabling them to efficiently handle resources and reduce expenses linked to extensive training or specialized staff. HCI's centralized management streamlines problem-solving and minimizes downtime, ultimately boosting IT performance and productivity.

- The scalability and flexibility of HCI systems are significant factors driving their increased adoption in diverse industries.

Scaling traditional infrastructures can be cumbersome and expensive, often involving the procurement of additional hardware, complex network setup with enterprise routers/switches, etc., and reconfiguration of the existing storage system. HCI has a modular design that allows organizations to simply expand by introducing more nodes as demands increase, without having any effect on ongoing operations. Scaling is especially beneficial to enterprises with workloads that can change on a dime or seasonal needs and they will be able to scale infrastructure in a cost-efficient and smooth manner. Furthermore, an HCI system enables organizations to respond to changing technology requirements by integrating into both on-premises and cloud-driven environments which is also an important factor for hybrid or multi-cloud strategies. HCI helps eliminate silos of applications and workloads by unifying around a single platform, enabling better resource utilization, and is flexible enough to adapt to changing business demands.

Hyper Converged Infrastructure Market Restraints

-

Vendor lock-in is a significant limitation in the HCI market, as numerous HCI solutions are proprietary and closely connected to specific hardware or software systems.

Even though HCI offers easier management and scalability, companies might have to rely on just one vendor for support, upgrades, and future scalability. This limitation in flexibility may restrict businesses from selecting compatible hardware and software solutions. Furthermore, the difficulty for organizations to transition to different platforms may increase due to the lack of compatibility with other systems as technology advances. Depending solely on one vendor can lead to increased expenses for assistance and updates, and companies may encounter difficulties in adjusting to new industry advancements if they are committed to a vendor's unique system.

Hyper Converged Infrastructure Market Segmentation

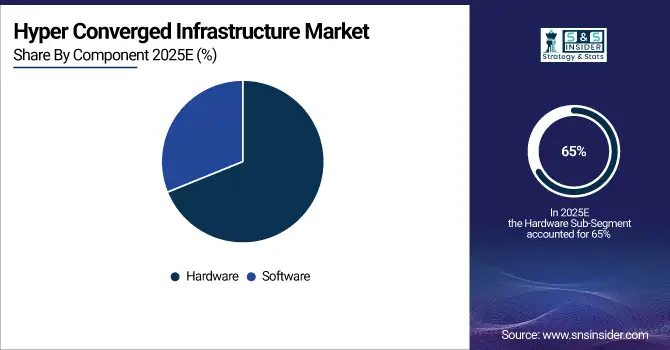

By Component

In 2025, the hardware segment claimed a majority market share of 65% by leading the market. The growth of this sector is driven by the need for high-performance servers and storage devices, with companies focusing on seamless integration and strong data management. Dell Technologies and Hewlett Packard Enterprise (HPE) are well-known for implementing hardware-focused HCI solutions that provide flexible and reliable infrastructure for businesses dealing with extensive workloads and intricate data environments.

The software component is projected to grow at a faster CAGR during 2026-2033, which improves infrastructure adaptability and streamlines processes. Software-defined solutions are crucial for the flexibility and automation of virtualized environments, decreasing the need for physical components and allowing organizations to streamline resource management. Nutanix and VMware are prime examples of top companies in this sector, offering software-based HCI that works with different cloud platforms and boosts management features.

By Enterprise Size

Large Enterprises dominated with a 59% market share in 2025. These organizations leverage HCI solutions to manage vast amounts of data and complex IT operations across multiple departments and global locations. Big companies profit from HCI's ability to grow, which allows for effective distribution of resources and lower IT costs. Corporations such as Microsoft and Cisco utilize HCI to enhance data centers, reduce operational expenses, and boost performance in different applications like VDI and cloud services. HCI's abilities assist in satisfying strict performance and security standards for big companies, making it an excellent option for high-pressure settings.

Small and Medium-Sized Enterprises (SMEs) are the fastest-growing segment within the HCI Market during 2026-2033. SMEs increasingly adopt HCI to consolidate resources, reduce hardware requirements, and simplify IT management without extensive budgets. For smaller companies, HCI offers a budget-friendly way to achieve strong performance and operational efficiency. Nutanix and VMware provide customized HCI solutions for small and medium enterprises, giving them dependable infrastructure for digital workloads, storage management, and data backup. By decreasing dependence on complicated, conventional IT systems, HCI allows small and medium-sized enterprises to remain flexible and competitive in a fast-changing technological environment.

Hyper Converged Infrastructure Market Regional Analysis

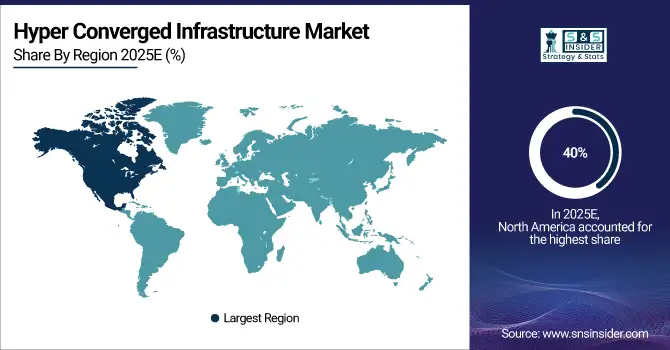

North America dominated with a 40% market share in 2025 because of its advanced technology infrastructure, high use of cloud-based and digital transformation services, and the strong presence of key companies such as VMware, Nutanix, and Dell EMC. Key sectors in North America, like healthcare, financial services, and IT, are more and more turning to HCI to make IT processes more efficient, cut expenses, and boost data protection. Healthcare organizations in the United States utilize HCI for secure data storage and simplified management, whereas financial firms use HCI for increased scalability and streamlined data center management.

Do You Need any Customization Research on Hyper Converged Infrastructure Market - Inquire Now

The APAC region is anticipated to become the fastest-growing during 2026-2033, primarily driven by the quick digitization in countries such as China, India, and Southeast Asian nations, fueled by rising investments in data centers and government projects. Companies such as Huawei and Lenovo in APAC are enthusiastically implementing HCI solutions to assist with the growth and digital requirements of businesses. Lenovo's HCI systems streamline IT management in Chinese manufacturing, while Huawei's solutions facilitate cloud migration for APAC telecommunications companies.

Key Players

The major key players in the Hyper Converged Infrastructure Market are:

-

Nutanix (AOS, Prism)

-

VMware (vSAN, vSphere)

-

Dell EMC (VxRail, VxFlex)

-

Cisco (HyperFlex, UCS)

-

Hewlett Packard Enterprise (HPE) (Simplivity, HPE Nimble Storage dHCI)

-

Lenovo (ThinkAgile HX, ThinkAgile MX)

-

Microsoft (Azure Stack HCI, Windows Server HCI)

-

NetApp (HCI, SolidFire)

-

Huawei (FusionCube, HyperConverged Infrastructure Solution)

-

Scale Computing (HC3, HE150)

-

Pivot3 (Acuity, vSTAC)

-

IBM (Spectrum Fusion, IBM Cloud Satellite)

-

DataCore (SANsymphony, vFilO)

-

Fujitsu (PRIMEFLEX, Integrated System PRIMEFLEX for Microsoft Azure Stack HCI)

-

Hitachi Vantara (Unified Compute Platform HC, HCI)

-

Oracle (OCI, Oracle Exadata)

-

Inspur (InCloudRail, InCloudSphere)

-

StarWind (Virtual SAN, HyperConverged Appliance)

-

Riverbed Technology (SteelFusion, SteelConnect EX)

-

Synology (UC3200, RS3621xs+)

Software providers for Hyper Converged Infrastructure:

-

Red Hat

-

Canonical

-

SUSE

-

Citrix

-

Oracle

-

Cloudera

-

NVIDIA

-

VMware

-

Pivotal (acquired by Vmware)

Recent Developments

-

August 2024: Dell Technologies and Nutanix are strengthening their longstanding partnership by introducing a new hyperconverged infrastructure appliance and integrating Dell's software-defined storage into Nutanix's HCI in the following year.

-

December 2023: Lenovo revealed the enhancement of its hybrid cloud platform for AI by introducing new ThinkAgile hyperconverged solutions and ThinkSystem servers. These advancements improve cloud deployment, hybrid connectivity, and AI capabilities, utilizing the latest Intel® Xeon® Scalable Processors.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 16.16 Billion |

| Market Size by 2033 | US$ 84.72 Billion |

| CAGR | CAGR of 23.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises) • By Application (Virtualizing Critical Applications, Data Centre Consolidation, Remote Office/Branch Office, Backup and Disaster Recovery, Virtual Desktop Infrastructure (VDI), Others) • By End User (Banking, Financial Services and Insurance (BFSI), IT and Telecom, Government, Healthcare, Manufacturing, Energy, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nutanix, VMware, Dell EMC, Cisco, Hewlett Packard Enterprise (HPE), Lenovo, Microsoft, NetApp, Huawei, Scale Computing, Pivot3, IBM, DataCore, Fujitsu, Hitachi Vantara, Oracle, Inspur, StarWind, Riverbed Technology, Synology |