Veterinary Diagnostics Market Size

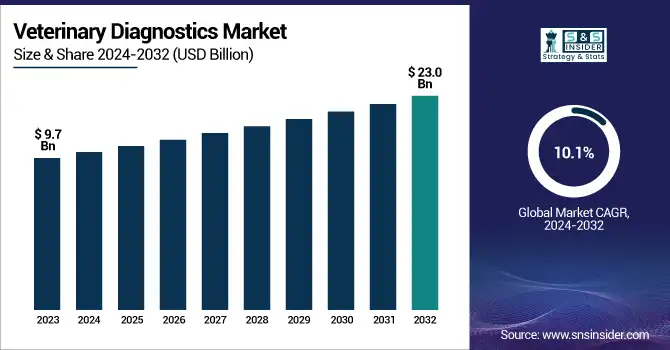

The Veterinary Diagnostics Market was valued at USD 9.7 billion in 2023 and is projected to reach USD 23 billion by 2032, driven by a 10.1% CAGR from 2024 to 2032.

To Get more information on Veterinary Diagnostics Market - Request Free Sample Report

This report covers new developments in the Veterinary Diagnostics Market including insights and trends based on the incidence and prevalence of animal diseases and prevailing regional trends in diagnostic test usage. The report also examines spending in the healthcare system, including veterinary diagnostics, encompassing prices paid for services from the government, insurers, and out-of-pocket. It examines product usage trends by animal type, with a focus on companion animals and livestock, as well as the impact of regulatory compliance and approval processes on the market. They also highlight the increasing significance of veterinary diagnostics in the management of animal health. The veterinary diagnostics market is witnessing robust growth, driven by the rising prevalence of zoonotic diseases and increasing pet ownership worldwide. The World Health Organization (WHO) estimates that 60% of emerging infectious diseases are of zoonotic origin, making the development of effective diagnostic tools essential for ensuring both animal and human health.

U.S. Veterinary Diagnostics Market Overview

The U.S. veterinary diagnostics market has maintained strong growth, this growth is attributed to the increasing demand for advanced diagnostic tools and rising awareness of animal health. By 2023, the market expanded significantly, with consistent growth in both diagnostic test volumes and healthcare expenditures year over year. Within the technological space, the United States market continues to outpace others, adopting innovative diagnostic devices and expanding its use of point-of-care testing, making service delivery for veterinary care more efficient. Due to the advanced veterinary healthcare infrastructure and high pet ownership in the region, the U.S. accounted for the majority share of the global veterinary diagnostics market in 2023.

Veterinary Diagnostics Market Dynamics

Drivers

-

The increasing prevalence of zoonotic diseases, such as avian influenza and rabies, underscores the need for advanced veterinary diagnostics to ensure early detection and control.

The growing incidence of zoonotic diseases that can be transferred from animals to humans has emerged as a major challenge to global health, driving the urgent demand for cutting-edge veterinary diagnostic capabilities. As a result, zoonoses are currently responsible for approximately 60% of all known human infectious diseases and emerging zoonotic events account for approximately 75% of all new infectious diseases. Recent outbreaks have emphasized the urgency of this problem. In the United States, infections of tularemia or “rabbit fever” have risen 56% from 2011 to 2022 compared with the previous decade. This zoonosis caused by the gram-negative bacterium Francisella tularensis infects primarily lagomorphs and rodents but represents a serious threat to humans via multiple transmission routes.

Similarly, the H5N1 strain of avian influenza has expanded its host range, infecting over 48 mammal species and causing substantial declines in wildlife populations, including seabirds and marine mammals. The transmission of the virus from animals to humans raises concerns about human infection and highlights the need for surveillance. Another zoonotic disease is leptospirosis, which causes about one million severe cases and nearly 59,000 deaths each year. Mainly affecting tropical and subtropical regions where climate change and poor sanitation infrastructure will continue to increase its incidence, there is an urgent need for better diagnostic ability in the regions most vulnerable to the disease. These statistics highlight the need for strong veterinary diagnostic systems that allow for early detection and management of zoonotic diseases to protect animal and human health alike.

Restraint

-

The high cost of advanced diagnostic technologies limits accessibility, particularly in developing regions, hindering market expansion.

The high cost of advanced diagnostic technologies presents a significant restraint for the veterinary diagnostics market. For instance, the latest veterinary diagnostic equipment, such as advanced imaging systems, molecular diagnostics, and automated analyzers, can be prohibitively expensive for smaller veterinary clinics and practices. A report by the American Veterinary Medical Association (AVMA) highlights that diagnostic equipment expenditures are one of the largest financial burdens faced by veterinary practices, often making it difficult for small-scale clinics to adopt the latest technologies.

Additionally, the high upfront cost of equipment often leads to increased service charges for diagnostics, which can be a barrier to pet owners, particularly in emerging markets where the demand for affordable veterinary services is rising. According to a survey by the National Animal Health Monitoring System (NAHMS), 68% of pet owners in the United States report concerns over the affordability of veterinary care, especially diagnostics, which impacts their willingness to seek necessary tests and treatments. This financial barrier also disproportionately affects rural areas, where fewer veterinary clinics are equipped with advanced diagnostic tools due to lower revenue generation and lower population density. As a result, the high cost of veterinary diagnostic technologies limits their widespread adoption, particularly in underfunded regions, hindering the market’s overall growth potential.

Opportunity

-

Emerging markets, including countries in the Asia-Pacific region, present significant growth potential due to increased investments in veterinary healthcare infrastructure and rising demand for animal products.

Asia Pacific is expected to witness lucrative growth opportunities in the veterinary diagnostics market owing to increasing investments in veterinary healthcare infrastructure as well as an increase in demand for animal products. The market growth can be attributed to myriad factors, including, but not limited to, a growing middle-class population, increasing disposable income, increased acceptance of pet ownership, and robust demand for animal proteins. The highest Compound Annual Growth Rate (CAGR) during this period is projected for countries such as India, driven by investments in veterinary healthcare and increased consumption of animal products.

The market does face challenges including the shortage of expertise in veterinary healthcare professionals. Take for example that Australia has a real shortage of vets, especially in the regions and in large animal practices. Vets are over-stretched, often receiving calls at all hours, and underpaid, leading to high vacancy rates and burnout. To combat this problem, the Australian Veterinary Association has proposed increasing training efforts and offering incentives like elimination or reduction of university debt for vets in rural Australia. In order to completely capitalize on its growth potential for the veterinary diagnostics market in the Asia Pacific region, emphasis should be placed on addressing the shortage of skilled veterinary professionals.

Challenge

-

A shortage of skilled veterinary professionals globally restricts the effective utilization of diagnostic services, impacting market growth.

There are severe shortages of veterinarians around the world threatening the provision of essential animal health services. In the USA, the American Association of Veterinary Medical Colleges (AAVMC) estimates a gap of 17,106 veterinarians will occur by 2032 which they attribute to increasing demand for services, coupled with an insufficient recent supply of new graduates.In Canada, the Canadian Veterinary Medical Association (CVMA) similarly has urged the federal government to tackle a chronic workforce shortage. The Employment and Social Development Canada's Canadian Occupational Projection System indicates a structural supply deficit of veterinarians, with projections extending until 2031.

These shortages are compounded by high turnover among veterinary professionals. In the U.S., veterinary technicians (25%) and veterinarians (16%) have significantly higher turnover rates than their counterparts in other sectors. These factors include poor work-life balance, burnout, and lack of compensation. So, tackling these major issues will be difficult, and will require a strong strategy improving work-life balance, amplifying veterinary school enrolment, adopting technology to help in alleviating workload, and ensuring a balance between demand and supply must be continued. Without significant intervention, the shortage of veterinary professionals is likely to continue, affecting the quality and accessibility of animal health care services worldwide.

Veterinary Diagnostics Market Segmentation Insights

By Testing Category

The clinical chemistry segment dominated the market in terms of revenue share in 2023, accounting for the largest revenue share of 24%. The segment has witnessed growth attributing to increasing adoption of automated biochemical analyzers and corresponding assay kits capable of generating accurate and rapid results for metabolic, renal and liver function testing. The tools are particularly important in detecting chronic conditions in animals, including diabetes and kidney disease. Through funding research to increase diagnostic accuracy for livestock diseases to help protect and comply with public health and food safety, the U.S. Department of Agriculture (USDA) has been critical in this process. Furthermore, recent development of diagnostic technologies especially portable chemistry analyzers has allowed veterinarians to perform tests in-house or point of care, hence reducing turnaround time. Increasing cognizance regarding preventive healthcare among pet owners has further remained a key factor that is boosting the demand for clinical chemistry solutions. For instance, the American Pet Products Association reported a significant increase in veterinary visits for preventive care in 2023, further bolstering this segment.

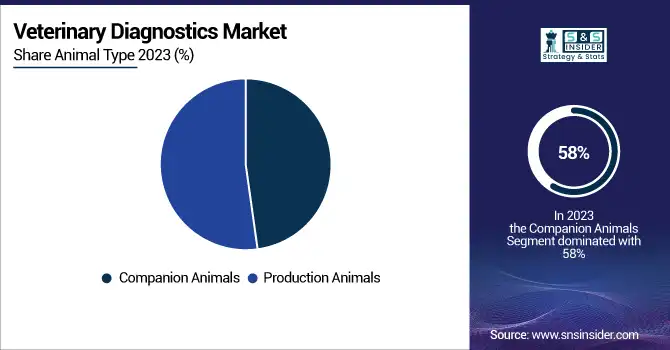

By Animal Type

In 2023, the companion animals segment was driving the veterinary diagnostics market and accounted for 58% of the total market. The dominance is due to the rise in pet ownership across the globe along with pet humanization. Increasing disposable incomes have allowed families to spend more on healthcare services for their pets, like high-tech diagnostics. According to the American Veterinary Medical Association (AVMA), almost 70% of the households in the U.S. had a pet in 2023, leading to an increased need for diagnostic tools that are tailored specifically toward companion animals. This segment's growth is also driven by government initiatives focusing on animal welfare. Receiving regulatory approval is one common form of validation. For example, new diagnostic products are subject to strict safety and efficacy standards set by the U.S. Food and Drug Administration (FDA). The introduction of wearable technology for diagnostic purposes coupled with the use of telemedicine has also increased accessibility and convenience for pet owners. Its innovations enable early disease detection and tailored veterinary care, fuelling the segment's growth.

By Product

The consumables, reagents & kits segment accounted for 53% of revenue in 2023 mainly due to their vital role in multiple diagnostic techniques, including, but not limited to, blood tests, urinalysis, and immunoassays. Their versatility and ease of use make these products irreplaceable in laboratories, veterinary clinics, and point-of-care settings. This segment has been endorsed by governments globally by investing in research to enhance the quality of reagents for achieving quicker and more reliable results. For example, the “Make in India” initiative, introduced by India, spurred innovations such as diagnostic kits like Bluetongue Sandwich ELISA, developed by the Indian Veterinary Research Institute (IVRI), which are widely used for livestock disease detection. In addition, the growing prevalence of chronic conditions, such as diabetes in pets, has resulted in a growing demand for consumables that facilitate regular monitoring.

By End Use

Veterinarians held a leading market share of 57% in 2023 due to their critical role in delivering diagnostic services. There is a growing trend of zoonotic diseases leading governments to spend on the order of millions for training veterinarians in new diagnostic approaches. For instance, SmartChip technology was introduced by Iowa State University in 2023, allowing veterinarians to process large numbers of samples simultaneously via quantitative PCR technologies. With precision, veterinary molecular diagnostics and imaging technologies are widely adopted for a closer look at a specific sample taken. This is in line with government goals of improving public health by containing outbreaks before they can spread through surveillance. Also, various national programs are being implemented to facilitate the provision of modern diagnostic tools in rural veterinary clinics to provide quality animal healthcare services.

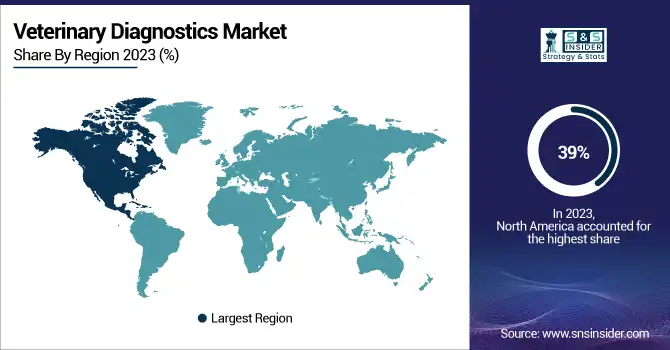

Veterinary Diagnostics Market Regional Analysis

The North American veterinary diagnostics market accounted for the highest share of 39% in 2023, owing to sophisticated veterinary infrastructure and high spending on pet care in the region. The region is well supported by government bodies to drive animal health research, as well as the wide adoption of sophisticated diagnostic technologies, such as molecular diagnostics and imaging tools. So does the United States, with its extensive patchwork of veterinary clinics and hospitals.

Asia-Pacific is expected to grow at the highest CAGR in the forecast duration due to a rise in pet ownership rates and disposable incomes. Countries such as China and India have seen a lot of investment in animal healthcare infrastructure. For example, annual milk production in India rose by more than 5% during 2021-2023, fuelling demand for livestock diagnostics. Additionally, government initiatives promoting food safety and zoonotic disease prevention further propel market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Veterinary Diagnostics Market

-

IDEXX Laboratories, Inc. (SNAP Test Kits, SediVue Dx Urine Sediment Analyzer)

-

Zoetis Inc. (Vetscan VS2 Chemistry Analyzer, Vetscan Imagyst)

-

Thermo Fisher Scientific Inc. (VetMAX PCR Test Kits, PrioCHECK Serology Assays)

-

bioMérieux SA (VITEK 2 Compact, VIDAS Immunoassay System)

-

Heska Corporation (Element HT5 Hematology Analyzer, Element i Immunodiagnostic Analyzer)

-

NEOGEN Corporation (GeneSeek Genomic Profiling, Reveal for Salmonella Test)

-

Bio-Rad Laboratories Inc. (BioPlex 2200 Multiplex System, iQ-Check Real-Time PCR Kits)

-

Virbac (Speed Reader, Speed Duo FeLV/FIV Test)

-

FUJIFILM Holdings Corporation DRI-CHEM NX500 Veterinary Chemistry Analyzer, FDC-VET Clinical Chemistry Reagents)

-

Shenzhen Mindray Animal Medical Technology Co. Ltd. (BC-5000Vet Hematology Analyzer, BS-240Vet Chemistry Analyzer)

-

INDICAL BIOSCIENCE GmbH (VetMAX Pathogen Detection Kits, IndiMag Pathogen Kit)

-

BioNote, Inc. (Vcheck V200 Analyzer, Vcheck Canine NT-proBNP Test Kit)

-

Biogal Galed Labs (PCRun Molecular Detection, VacciCheck Antibody Test Kit)

-

Agrolabo S.p.A. (Agroscan Diagnostic Kits, Rapid Test Kits)

-

Innovative Diagnostics SAS (ID Screen ELISA Kits, ID Gene PCR Kits)

-

Randox Laboratories Ltd. (Evidence Investigator Analyzer, VetBiochip Array Technology)

-

BioChek BV (Avian Influenza Antibody Test Kit, Salmonella Enteritidis Antibody Test Kit)

-

Fassisi GmbH (Fassisi Parvo Test, Fassisi FIP Test)

-

Alvedia (QuickTest DEA 1, QuickTest Feline AB)

-

Antech Diagnostics, Inc. (Mars Inc.) (Accuplex4, Imaging Services)

Recent Developments

-

In November 2023, IDEXX Laboratories launched the SNAP Leish 4Dx Test for vector-borne disease detection.

-

In June 2023, Boule Diagnostics introduced H50V an affordable veterinary solution equipped with advanced features for clinics.

-

In April 2023, BioCheck unveiled VetAssure a biosecurity diagnostic tool leveraging bioluminescence technology for pigs and poultry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.7 Billion |

| Market Size by 2032 | USD 23 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Reagents & Kits, Equipment & Instruments) • By Animal Type (Production Animals, Companion Animals) • By Testing Category (Clinical Chemistry, Microbiology, Parasitology, Histopathology, Cytopathology, Hematology, Immunology & Serology, Imaging, Molecular Diagnostics, Other Categories) • By End-use (Reference Laboratories, Veterinarians, Animal Owners/ Producers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., bioMérieux SA, Heska Corporation, NEOGEN Corporation, Bio-Rad Laboratories Inc., Virbac, FUJIFILM Holdings Corporation, Shenzhen Mindray Animal Medical Technology Co. Ltd., INDICAL BIOSCIENCE GmbH, BioNote, Inc., Biogal Galed Labs, Agrolabo S.p.A., Innovative Diagnostics SAS, Randox Laboratories Ltd., BioChek BV, Fassisi GmbH, Alvedia, Antech Diagnostics, Inc. |