Molecular Diagnostics Market Size & Growth Analysis:

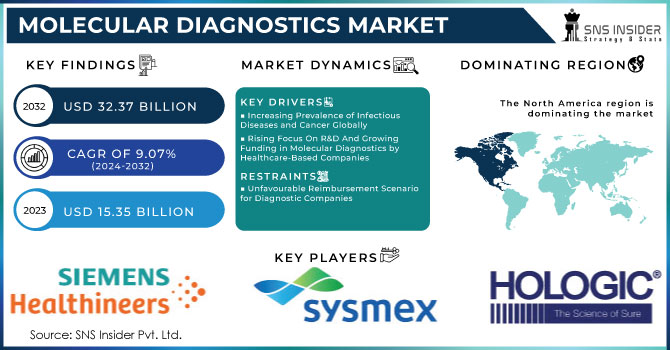

The Molecular Diagnostics Market Size was valued at USD 15.35 Billion in 2023, and is expected to reach USD 32.37 Billion by 2032, and grow at a CAGR of 9.07%. The molecular diagnostics market is surging due to several key advancements and growing applications. Recent years have seen the introduction of powerful tools like shotgun metagenomic next-generation sequencing (NGS). This technology provides a comprehensive analysis, identifying a vast range of microorganisms in a single test. Additionally, the MSI Analysis System aids in detecting microsatellite instability, a crucial marker for certain cancers. Advancements in sample preparation methods, like NANOPEC, further enhance accuracy by reducing the risk of false negatives. These innovations are making molecular diagnostics more reliable and versatile, driving market adoption.

Get More Information on Molecular Diagnostics Market - Request Sample Report

The growing significance of companion diagnostics in drug development presents another major growth factor. These tests help tailor treatment plans by identifying patients most likely to respond positively to specific therapies. This co-development approach with pharmaceuticals streamlines the drug development process, leading to safer and more effective medications reaching the market faster. The rising demand for personalized medicine and targeted therapies further fuels the need for companion diagnostics, creating significant growth opportunities within the molecular diagnostics market. The global aging population and increasing prevalence of chronic diseases like cancer and infectious diseases are creating a strong demand for advanced diagnostic tools. For instance, according to the American Cancer Society in 2023, with nearly 2 million new cancer cases reported in the US alone for 2023, there is a pressing need for rapid and reliable diagnostic tools. Molecular diagnostics offer faster, more accurate diagnoses, enabling earlier intervention and improved patient outcomes the growing need, particularly among the expanding elderly population, is a significant driver for the market.

Molecular Diagnostics Market Dynamics:

Key Drivers:

-

Increasing Prevalence of Infectious Diseases and Cancer Globally

-

Rising Focus On R&D And Growing Funding in Molecular Diagnostics by Healthcare-Based Companies

Restraints:

-

Unfavourable Reimbursement Scenario for Diagnostic Companies

-

High Cost of Molecular Diagnostic Instruments

Opportunity:

-

Growing Significance of Companion Diagnostics in Drug Development Process

-

Increasing Growth Opportunities for Molecular Diagnostics Companies in Emerging Economies.

Molecular Diagnostics Market Segmentation Overview:

by Type

In the molecular diagnostics market, the instruments segment is the leading category, commanding approximately 50% of the total market share. This dominance is largely driven by significant advancements in diagnostic technology and the increasing automation of laboratory processes. Instruments such as PCR machines, next-generation sequencing (NGS) platforms, and automated liquid handling systems are integral to modern laboratories, as they enhance throughput and precision in testing.

The rising demand for accurate and rapid diagnostic solutions, particularly in areas like infectious diseases and oncology, has propelled the growth of sophisticated diagnostic instruments. Moreover, the emphasis on point-of-care testing is transforming how healthcare providers approach diagnostics, shifting the focus from traditional laboratory settings to more accessible locations, including clinics and remote care environments. This trend necessitates the development of portable and user-friendly diagnostic devices that can deliver reliable results quickly.

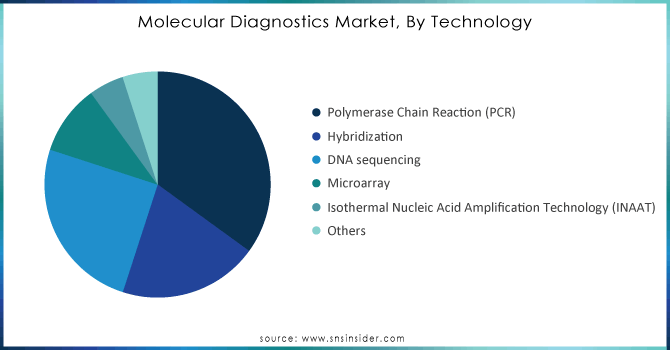

by Technology

Polymerase Chain Reaction (PCR) technology held 45% of the market share in 2023, as it serves as a cornerstone in the field of molecular diagnostics, fundamentally transforming how genetic material is analyzed and detected. This technique allows for the rapid and reliable amplification of specific DNA sequences, making it invaluable for a wide range of applications, including infectious disease detection, genetic testing, and forensic analysis. The versatility of PCR has led to its widespread adoption across clinical and research laboratories, significantly contributing to its leading market position.

The market dominance of PCR is further reinforced by ongoing innovations in the technology, such as real-time PCR (qPCR) and digital PCR. These advancements enhance the sensitivity and specificity of detection, enabling precise quantification of nucleic acids and allowing for the identification of low-abundance targets. Additionally, the adaptability of PCR to multiplexing techniques allows simultaneous detection of multiple pathogens or genetic variants in a single assay, streamlining testing processes. As the demand for accurate diagnostics continues to grow, especially in the wake of global health challenges, PCR technology remains pivotal in advancing molecular diagnostics and improving patient outcomes.

Get Customized Report as per Your Business Requirement - Request For Customized Report

by Application

The infectious diseases application segment in the molecular diagnostics market is currently the leading category, accounting for approximately 40% of the total market share. This prominence is primarily driven by the rising incidence of infectious pathogens and the critical need for rapid and accurate diagnostic solutions in clinical settings.

The increasing prevalence of antibiotic-resistant infections and the emergence of new infectious agents further amplify the demand for advanced diagnostic technologies. Healthcare providers require robust tools to facilitate rapid testing and accurate results, enabling prompt clinical decision-making. Moreover, technological innovations such as multiplex PCR assays and point-of-care testing devices enhance the capacity to detect multiple pathogens simultaneously, making diagnostics more efficient and accessible.

The emphasis on disease surveillance and outbreak preparedness has also prompted governments and health organizations to invest significantly in diagnostic infrastructure. As a result, the infectious diseases application segment continues to lead the market, playing a pivotal role in improving public health outcomes and responding effectively to global health crises.

Molecular Diagnostics Market Regional Outlook:

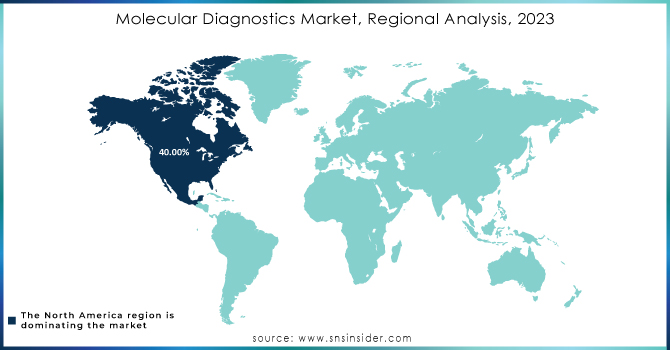

North America was the dominant region with 40% of the global share in 2023. This dominance stems from a confluence of factors like a high burden of infectious and chronic diseases, prompting companies to develop innovative tests (like QIAGEN's GIST diagnostic kit), and a well-established healthcare system with strong disease awareness. However, the Asia Pacific region is poised for the fastest growth with the increased market penetration of new technologies, like the CRISPR-based point-of-care tests being developed by CrisprBits and MolBio Diagnostics in India, which is a key driver. Additionally, a large unmet need for advanced diagnostics exists in this region. The rising adoption of NGS, increased testing for critical illnesses, and growing demand for personalized medicine are all creating significant market demand. Finally, the integration of artificial intelligence and machine learning into diagnostics is another factor propelling the Asia Pacific market forward.

Key Players:

The players operating in the Molecular Diagnostics market are the following:

-

Thermo Fisher Scientific (Applied Biosystems Real-Time PCR Systems, Ion Torrent Gene Sequencing Systems, TaqMan Real-Time PCR Assays)

-

Roche Diagnostics (cobas 6800/8000 Systems, LightCycler 480 II Real-Time PCR System, Cobas AmpliPrep/Cobas TaqMan Assays)

-

Illumina (NextSeq 500 System, NovaSeq 6000 System, MiSeq System)

-

Agilent Technologies (SureSelect Target Enrichment Systems, SureSeq RNA Library Prep Kits, Agilent 2100 Bioanalyzer)

-

Qiagen (QIAcube Automated RNA Extraction System, QIAseq RNA Library Prep Kits, Rotor-Gene Q Real-Time PCR System)

-

Bio-Rad Laboratories (CFX Connect Real-Time PCR Detection System, S1000 Thermal Cycler, iCycler iQ Real-Time PCR Detection System)

-

Beckman Coulter (DxI 8000 Chemistry System, DxI 6000 Chemistry System, Allegra X-22R Centrifuge)

-

Seegene (Allplex COVID-19 Assay, Allplex Respiratory Panel, Allplex STI Panel)

-

Cepheid (GeneXpert Systems, Xpert MTB/RIF Assay, Xpert HIV-1 RNA Assay)

-

Abbott Laboratories (m2000 Real-Time PCR System, Alinity m Systems, RealTime PCR Assays)

-

Oxford Nanopore Technologies (MinION System, GridION System)

-

MGI Tech Co., Ltd. (DNBSEQ-T7 System, DNBSEQ-G400 System)

-

BGI Group (GeneSeq Sequencers, BGISeq-500 System)

-

NanoString Technologies (nCounter Analysis System, GeoMx Digital Spatial Profiler)

-

Fluidigm Corporation (C1 Single-Cell Analysis System, BioMark HD System)

-

Fujifilm Holdings (Lumio Molecular Imaging Systems)

-

PerkinElmer (VICTOR Nivo Multimode Plate Reader)

-

BioMérieux (NucliSENS EasyQ Real-Time PCR System)

-

Siemens Healthineers (Versant Molecular Diagnostics Systems)

Recent Developments

-

In January 2024: Illumina joined forces with Janssen to develop a novel liquid biopsy test for detecting residual disease across various cancers. This test leverages cost-effective whole-genome sequencing to identify circulating tumor DNA (ctDNA).

- In November 2023: Co-Diagnostics received a significant grant from the Bill & Melinda Gates Foundation to develop a new tuberculosis test compatible with their Co-Dx PCR platform.

- In July 2023: T2 Biosystems secured a critical designation from the U.S. FDA for their C. Auris molecular diagnostic test. This innovative test allows for direct detection of the pathogen from blood samples.

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.35 Billion |

| Market Size by 2032 | US$ 32.37 Billion |

| CAGR | CAGR of 9.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Polymerase Chain Reaction (PCR), Hybridization, DNA Sequencing, Microarray, Isothermal Nucleic Acid Amplification Technology (INAAT), Others) •By Application (Infectious Diseases, Oncology, Genetic Testing, Blood Screening, Others) •By Type (Instruments, Reagents, Software & Services) •By End User (Hospital, Reference Laboratories, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Roche Diagnostics, Illumina, Agilent Technologies, Qiagen, Bio-Rad Laboratories, Beckman Coulter, Abbott Laboratories and Others |

| Key Drivers |

• Increasing Prevalence of Infectious Diseases and Cancer Globally • Rising Focus On R&D And Growing Funding in Molecular Diagnostics by Healthcare-Based Companies |

| Market Restraints |

• Unfavourable Reimbursement Scenario for Diagnostic Companies • High Cost of Molecular Diagnostic Instruments |