Companion Animal Health Market Size Analysis:

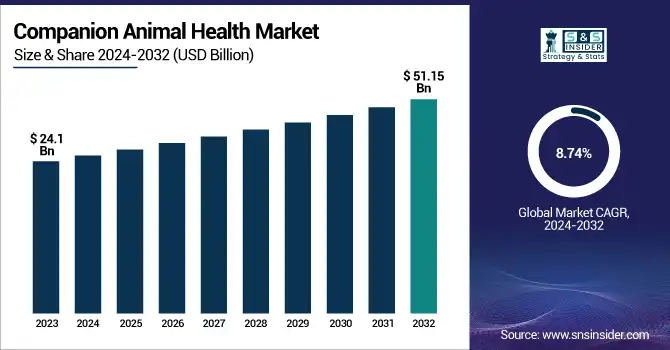

The Companion Animal Health Market Size was valued at USD 24.1 Billion in 2023 and is expected to reach USD 51.15 Billion by 2032, growing at a CAGR of 8.74% over the forecast period 2024-2032.

Key insights and statistics in relation to the Companion Animal Health Market along with driving variables and trends impacting the market. It describes the incidence, prevalence, and common disease rates, and shows regional differences. Antibiotics, vaccines, and specialty drugs are the popular medications examined in veterinary prescription trends. The report analyses volumes of professional manufacture of drugs and their applications and the volume of provision and consumption of veterinary medicines. Healthcare spending breakdown examines how much is spent on governments, insurers, and pet owners, increasingly on preventive care. The report also explores the adoption of veterinary telehealth and the growing number of virtual consultations and digital health solutions. Finally, pet insurance trends can shed light on market penetration, policy adoption, and market penetration and how it impacts veterinary care affordability. Such insights assist industry stakeholders in managing an ever-changing landscape in companion animal health.

To Get more information on Companion Animal Health Market - Request Free Sample Report

High demand for companion animals, growing initiatives for pets, and increasing knowledge about the health of companion animals is fuelling the growth of the companion animal health market. In 2023, there were 90.5 million pet-owning households in the U.S., according to the National Pet Owners Survey, of which 69 million owned dogs, a key demographic driving market demand. The US Companion Animal health market is growing steadily, The US distributed product size was USD 6.85 billion in 2023 and has anticipated rapid growth with an 8.63% CAGR across the forecast period. This steady growth reflects increased spending on pet healthcare, which is driven by an increase in pet ownership, greater use of advanced services in veterinary clinics, and growing awareness of animal well-being. Additional factors supporting the growth of this market are the initiatives taken by the governments such as the One Health Initiative to prevent a zoonotic disease that encourages the collaboration between organizations (AVMA, FAO, etc.) Public and private sector investments in veterinary research and development (R&D) are also rising, boosting the availability of advanced pharmaceuticals and vaccines. Furthermore, the increasing human-animal bond has driven significant expenditure on veterinary products and services, including insurance coverage for household pets.

Companion Animal Health Market Dynamics

Drivers

-

Growing awareness about animal welfare is encouraging pet owners to invest more in healthcare products and services for their companion animals.

The growing concern over animal welfare has profoundly affected the behaviour of pet owners who are increasingly spending more on their companion animals health care products and services. That trend is reflected in the large financial investments made to care for pets. As an example, in 2024, a survey found that pet owners spent an average of $2,085.60 each year on their pets including food, medical care, and accessories. The humanization of pets is also a major driver of this spending behaviour. In the UK, a Nationwide Bank market analysis showed Britons spent almost £52 million on pets in a year, compared to £37.1 million for childcare. This change highlights a growing relationship between owners and their animals, driving greater spending on pet gear, apparel, and health products.

Additionally, the demand for advanced healthcare services has risen. In China, the pet care market reached RMB 300 billion ($42 billion) last year, reflecting a 7.5% increase. Part of the reasoning for this growth is as the pet population ages, investments in proprietary nutrition, diagnostics, and end-of-life services are required. The commitment to pet health continues to be strong despite economic uncertainties. Companies such as Chewy posted earnings and active customer growth that beat expectations, buoyed by auto-ship programs and regular spending on pet care staples. This indicates a continued investment in companion animal health, displaying a growing trend towards understanding and accommodating the complex needs of pets in society.

Restraint

-

Rising costs of veterinary care, partly due to industry consolidation by private equity firms, are making services less affordable for pet owners.

The rising costs of vet care are particularly affecting pet owners' ability to afford essential medical help for their companion animals. According to recent data, 42% of pet owners are unable to pay for an unexpected veterinary bill of $999 or less without going into debt. Over 30% of pet owners have stayed away from the vet, trying to avoid high prices and surgery. Furthermore, about 27% have been forced to decline critical veterinary care for their pets because they simply cannot afford it. The arbitrary consolidation of veterinary practices by large corporations and private equity firms, for example, has resulted in a 60% increase in veterinary costs in the U.S. over the last decade. This consolidation can often result in less competition and increased prices for services. Consequently, some pet owners are compelled to surrender or rehome their pets, with 21% reporting rehoming a pet in the past year, primarily due to the cost of living. These financial problems only serve to highlight the importance of affordable veterinary care and the realization that pet insurance exists in the first place so we can avoid financial hardship when it comes time to give our animals the care they need.

Opportunity

-

Advancements in biotechnology are enabling the development of longevity-focused products aimed at extending the lifespan of pets.

Advancements in biotechnology are presenting significant opportunities in the companion animal health market, particularly in extending the lifespan and enhancing the well-being of pets. Companies like Loyal, a San Francisco-based biotech startup, are at the forefront of developing innovative solutions aimed at prolonging the healthy years of companion animals. Loyal has recently received approval from the U.S. Food and Drug Administration (FDA) for a meat-flavored pill designed to extend dogs' lifespans by at least one year. This drug mimics the benefits of fasting, promoting efficient metabolism without reducing appetite, and is expected to be available within the next year.

The increasing integration of artificial intelligence (AI) in veterinary healthcare further underscores the market's growth potential. AI technologies are enhancing disease detection, treatment planning, and overall animal welfare by enabling early diagnosis and precise treatment. These developments highlight a broader trend in the companion animal health market, where technological innovations are increasingly tailored to meet the growing demand for advanced pet care solutions. As pet owners become more invested in the health and longevity of their animals, the market is poised to continue its expansion, driven by breakthroughs in biotechnology and AI applications.

Challenge

-

Ethical and legal considerations in veterinary practices and product approvals are posing challenges for market players

The companion animal health market has significant ethical and legal challenges impacting veterinarians and the industry as a whole. More than 88% of vets felt intense distress because they were not able to provide appropriate care because of barriers in their way, as shown in a 2024 survey. Additionally, 73% reported being asked to administer treatments they considered futile, highlighting the prevalence of ethical dilemmas in veterinary practice. Veterinarians often must make hard decisions based on money, weighing the welfare of animals against clients’ ability to pay for care. This tension results in moral distress, with 52% of veterinarians calling ethical dilemmas a primary or equal caregiver-related cause of work-related stress. Moreover, 60% of practitioners said they opted for the needs of animal owners over their patients, highlighting the nuances of these ethical conflicts.

The increasing corporate ownership of veterinary practices raises even more ethical concerns. In the UK, the Competition & Markets Authority (CMA) launched an investigation into the £5 billion veterinary services industry amid fears that consolidation may lead to overcharging for pet medicines and reduced quality of care. The scrutiny reflects wider concerns about the effect of private equity on veterinary ethics and the delivery of services. Environmental consequences of veterinary treatments are another ethical challenge. For example, some widespread flea treatments with active ingredients like fipronil and imidacloprid are significantly polluting the environment and entering the human food chain by contaminating predators and water sources.

Companion Animal Health Market Segmentation Analysis

By Animal

In 2023, the dogs segment held the leading share of the companion animal health market revenue at 39%, due to increasing adoption rates and greater awareness of pet health. Government statistics show that as of 2023, dogs remained the most prevalent companion animals in the U.S., with 69 million households having at least one dog living in it. This wide level of adoption in turn drives demand for superior veterinary care, preventative health care, and higher-end pet products. Pet owners are constantly taking their dogs to the vet for illnesses related to arthritis, diabetes, obesity, chronic skin conditions, and so on, which are on the rise. Finally, the increased prevalence of pet insurance has allowed more owners to afford top-notch care for their pets.

This segment has also been propelled by governmental initiatives to improve animal welfare. These include programs such as the USDA's Animal Welfare Act, which regulates the proper care and treatment of animals, including companion pets. An increase in disposable income among pet owners has directed the spending towards premium healthcare products such as nutraceuticals and customized medications. Furthermore, recent advancements in veterinary diagnostics have facilitated the early identification of diseases in dogs, boosting treatment outcomes and fueling market expansion. As the humanization of pets where owners consider their pets as family members increases, the demand for innovative healthcare solutions will also grow, reinforcing the dog's segment's dominance in the overall companion animal health market.

By Product

In 2023, the pharmaceuticals segment of the companion animal health market held revenue was 43% due to the growing demand for novel therapeutics that treat chronic and acute conditions in pets. Pharmacy products like team players with anti-infection, anti-inflammatory, and analgesic effects are now mainstream necessities for one animal's health. Increasing cases of zoonotic diseases such as leptospirosis have pointed to the need for efficacious medications to halt transmission between humans and animals. It's the segment that has benefited most from government-sponsored scientific efforts. For example, Funding from agencies such as the National Institutes of Health (NIH), has enabled major advances in veterinary drug development. Moreover, the recent approvals of novel therapeutics from regulatory authorities also propelled growth for this segment. In recent years, agencies like the FDA's Center for Veterinary Medicine (CVM) have expedited approvals for cutting-edge pharmaceuticals tailored to companion animals' needs. Moreover, with precision medicine, veterinarians can now administer medications tailored to specific genetic make-ups of individual pets, ensuring maximum potency while reducing potential adverse effects. Oral medications and topical solutions are becoming more widely available and accessible for pet owners to administer treatments at home.

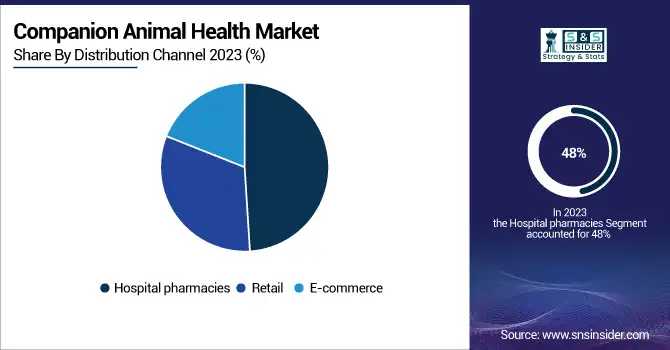

By Distribution Channel

The hospital pharmacies segment dominated the market with a revenue share of 48% in 2023 as hospitals play an important role in the safe and effective distribution of veterinary medications. Pharmacies like these are a vital part of veterinary hospitals and clinics, dispensing specialty drugs that meet the particular needs of companion animals. Hospital pharmacies are bound by strict quality control procedures, which have been a basis for building trust between pet owners and veterinarians. An increase in the number of veterinary hospitals with advanced infrastructure has played an important role in the growth of this segment. Today, hospitals are stocked with in-house pharmacies that provide a wide variety of items, from prescription drugs and vaccines to nutraceuticals. This eliminates the common waiting period for a pet's owner to go to a pharmacy for treatment to be prescribed, hence streamlining healthcare and ultimately improving the outcome for the pet. Government statistics show an increase in visits to veterinary hospitals because of increased awareness of preventive care among pet owners. USDA programs that support animal welfare, for instance, have led to increased annual health checks and vaccinations for companion animals. Furthermore, hospital pharmacies work with pharmaceutical companies to bring new products to market.

By End Use

In 2023, the hospitals & clinics segment led the end-use segment with a revenue share of up to 80% of the companion animal health market. This dominance is due to its wide array of services, sophisticated diagnostics, and ability to efficiently deliver treatments. One of the most advanced technologies at the disposal of both veterinarians and veterinary offices is dedicated imaging systems (MRI and CT scans), which ease diagnoses and treatment success. Government-supported programs intended to increase veterinary services have greatly enhanced the growth of this segment. In the example of USDA funding programs, new clinics have been built in underserved areas, while existing infrastructure underwent upgrading in developed areas such as North America. One-stop solution Hospitals & clinics offer pet owners a one-stop solution for preventive care, surgical procedures, vaccinations, and emergency services all under one roof. They are highly proficient in managing procedural throughput levels to ensure timely treatment delivery and reduce complications. In addition, hospitals now have wellness plans with routine check-ups and diagnostics for individual pets. All these factors together highlight the importance of hospitals & clinics in the companion animal health market.

Regional Insights

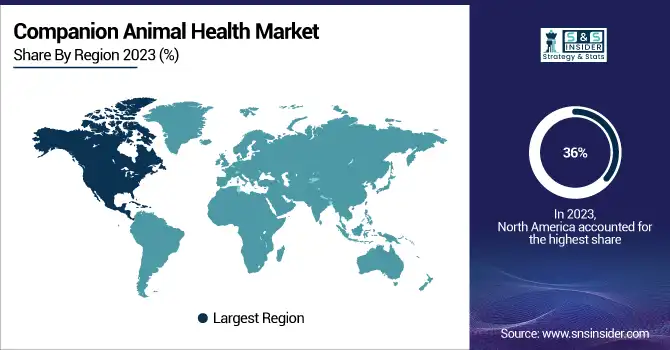

The North American companion animal health market generated 36% of the revenue share in 2023, attributed to growing pet adoption rates, modern veterinary infrastructure, and high investments in R&D. In 2024, 66% of U.S. households had a pet, accounting for 86.9 million homes, with dogs topping the list at 65.1 million households. Household owners of dogs and cats also remained strong in Canada, with pet ownership of 7.9 million dogs and 8.5 million cats reported in 2022. Stringent government programs, such as vaccination mandates, help to avert zoonotic diseases, such as rabies, in the region. For example, Health Canada has stringent import regulations on pets entering the country, including vaccination records. Moreover, the continuous development of therapeutic products and diagnostics further drives market growth. Companies such as Zoetis and Merck Animal Health are capitalizing on these advancements to enhance their portfolios.

Asia-Pacific region is expected to witness the fastest growth in the companion animal healthcare market, accounting for a prominent CAGR in the forecast period. This growth is driven by increasing pet adoption rates and growing consumer awareness of animal health. Rapidly growing cat and dog populations, combined with burgeoning demand for packaged pet food and preventive healthcare services, make India and Thailand particularly dynamic markets. National efforts toward animal welfare and health also provide additional market growth in countries such as China and Indonesia. Additionally, the humanization of pets is boosting demand for premium goods like dietary supplements and functional foods with components like probiotics and fish oil. Japan continues to be a prominent market, despite decreasing pet populations, while Southeast Asian nations such as Vietnam and Indonesia boast strong growth because of the changing consumer sentiment towards pet health.

Get Customized Report as per Your Business Requirement - Enquiry Now

Companion Animal Health Market Key Players

-

Zoetis Inc. – (Revolution, Simparica)

-

Merck Animal Health – (Bravecto, Nobivac)

-

Elanco Animal Health – (Interceptor Plus, Credelio)

-

Boehringer Ingelheim Animal Health – (Heartgard, NexGard)

-

Bayer Animal Health – (Advantage, Seresto)

-

Virbac – (Effitix, CaniLeish)

-

Ceva Santé Animale – (Feliway, Vectra)

-

IDEXX Laboratories – (SNAP Test Kits, VetLab Station)

-

Vetoquinol – (Zylkene, Clavaseptin)

-

Dechra Pharmaceuticals – (Vetoryl, Felimazole)

-

Royal Canin – (Size Health Nutrition, Breed Health Nutrition)

-

Hill's Pet Nutrition – (Science Diet, Prescription Diet)Reuters

-

Nestlé Purina PetCare – (Pro Plan, Purina ONE)

-

Mars Petcare – (Pedigree, Whiskas)

-

Nutreco N.V. – (Canex, Optiline)

-

Patterson Veterinary – (Equiplas, Patterson Brand Products)

-

Midmark Corporation – (Cardell Monitors, Midmark Dental Units)

-

Henry Schein Animal Health – (ProVet Logic, AVImark)

-

Animalcare Group – (Identichip, Plaqtiv+)

-

Neogen Corporation – (Igenity Canine Wellness, ThyroKare)

Recent Developments in the Companion Animal Health Market

-

Merck Animal Health launched BRAVECTO TriUNO for the prevention of internal and external parasites in dogs in November 2024 following under license from the European Commission.

-

In March 2025, Zoetis launched precision medicine solutions using AI-driven diagnostics to improve treatment efficacy for companion animals around the world.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.1 Billion |

| Market Size by 2032 | USD 51.15 Billion |

| CAGR | CAGR of 8.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal (Dogs, Equine, Cats, Others) • By Distribution Channel (Retail, E-commerce, Hospital pharmacies) • By Product (Vaccines, Pharmaceuticals, Feed Additives, Diagnostics, Others) • By End-Use (Point-of-care/In-house testing, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Bayer Animal Health, Virbac, Ceva Santé Animale, IDEXX Laboratories, Vetoquinol, Dechra Pharmaceuticals, Royal Canin, Hill's Pet Nutrition, Nestlé Purina PetCare, Mars Petcare, Nutreco N.V., Patterson Veterinary, Midmark Corporation, Henry Schein Animal Health, Animalcare Group, Neogen Corporation. |