Vinyl Ester Market Report Scope & Overview:

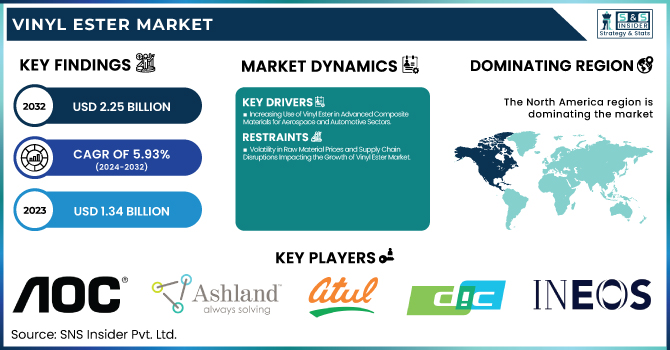

The Vinyl Ester Market Size was valued at USD 1.34 Billion in 2023 and is expected to reach USD 2.25 Billion by 2032, growing at a CAGR of 5.93% over the forecast period of 2024-2032.

To Get more information on Vinyl Ester Market - Request Free Sample Report

The Vinyl Ester Market is evolving with advancements in supply chain logistics, shifting end-use demand, and sustainability efforts. Our report explores supply chain efficiencies, from raw material sourcing to global distribution strategies. Rising demand in marine, wind energy, and industrial tanks reshapes consumption trends, while capital investment and production costs influence market competitiveness. Sustainability is key, driving waste management and recycling innovations to minimize environmental impact. Meanwhile, investment and funding trends highlight strategic acquisitions and technological advancements shaping future growth. With stricter fire and safety regulations, compliance in storage and handling is crucial. Our report provides a comprehensive analysis of these factors, offering a forward-looking perspective on the market’s transformation.

The US Vinyl Ester Market Size was valued at USD 393.2 Million in 2023 and is expected to reach USD 627.7 Million by 2032, growing at a CAGR of 5.34% over the forecast period of 2024-2032.

The U.S. Vinyl Ester Market is experiencing steady growth, driven by increasing demand in marine, chemical processing, and infrastructure sectors. Stringent EPA regulations on corrosion-resistant materials have accelerated adoption in pipes, tanks, and wastewater treatment facilities. The American Composites Manufacturers Association (ACMA) highlights vinyl ester’s role in advanced composites for high-performance applications. Additionally, rising investments in wind energy projects supported by the U.S. Department of Energy are boosting demand for durable resin systems. Major U.S.-based manufacturers, such as INEOS Composites and Interplastic Corporation, are expanding production capabilities, further strengthening the domestic market landscape.

Vinyl Ester Market Dynamics

Drivers

-

Increasing Use of Vinyl Ester in Advanced Composite Materials for Aerospace and Automotive Sectors

The Vinyl Ester Market is witnessing increased usage in composite applications across the automotive and aerospace industries due to its lightweight, high-strength, and durability characteristics. Automakers are increasingly using vinyl ester-based carbon fiber-reinforced composites to reduce vehicle weight, enhance fuel efficiency, and comply with stringent emission regulations set by organizations such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA). Vinyl ester resins are also finding applications in aircraft interiors, fuselage structures, and rotor blades, providing superior impact resistance while reducing overall aircraft weight. The National Aeronautics and Space Administration (NASA) and the U.S. Air Force Research Laboratory (AFRL) are investing in next-generation aerospace materials, where vinyl ester composites play a crucial role. Additionally, electric vehicle manufacturers are exploring vinyl ester-based structural battery enclosures, as they offer thermal stability and fire resistance, enhancing passenger safety. As industries focus on lightweighting strategies to meet sustainability goals, the demand for advanced composite materials containing vinyl ester resins is projected to grow significantly.

Restraints

-

Volatility in Raw Material Prices and Supply Chain Disruptions Impacting the Growth of Vinyl Ester Market

The Vinyl Ester Market is heavily influenced by fluctuations in raw material prices, particularly epoxy resins, methacrylic acid, and styrene monomers, which are derived from petroleum-based sources. The volatility in crude oil prices directly affects the production cost of vinyl ester resins, leading to uncertainty in pricing strategies for manufacturers. Additionally, supply chain disruptions caused by geopolitical tensions, trade restrictions, and transportation constraints have resulted in delays in raw material availability, impacting overall market stability. The National Association of Manufacturers (NAM) and the American Chemistry Council (ACC) have highlighted the challenges faced by industries due to rising raw material costs and supply chain disruptions, emphasizing the need for alternative sourcing strategies. Small and medium-sized enterprises are particularly vulnerable, as they lack the financial resilience to absorb unexpected cost hikes. Furthermore, stringent environmental regulations on petrochemical-based materials have led to increased compliance costs, further restricting market expansion. Overcoming these challenges requires diversifying raw material sourcing, localizing production facilities, and investing in sustainable supply chain solutions to ensure long-term market stability.

Opportunities

-

Growing Adoption of Vinyl Ester in High-Performance Wind Energy Blades and Renewable Infrastructure Projects

The rising global emphasis on renewable energy sources is driving demand for vinyl ester-based composites in wind turbine blade manufacturing and renewable infrastructure. Vinyl ester resins offer superior mechanical strength, fatigue resistance, and corrosion resistance, making them ideal for offshore and onshore wind energy applications. The U.S. Department of Energy (DOE) and the National Renewable Energy Laboratory (NREL) have highlighted the role of advanced composite materials in enhancing wind turbine efficiency and durability. As governments increase investments in clean energy projects, the demand for lightweight and high-strength materials is set to grow. Key manufacturers such as Ashland Global Holdings and Swancor Holding Company Limited are actively developing next-generation vinyl ester formulations optimized for longer turbine blade lifespans. Additionally, the expansion of offshore wind farms in regions such as North America and Europe is further accelerating market growth. This presents a lucrative opportunity for manufacturers to develop high-performance, weather-resistant vinyl ester composites catering to the evolving energy sector demands.

Challenge

-

Technical Limitations in Achieving High-Temperature Resistance and Toughness in Specialized Applications

Despite its chemical and corrosion resistance, vinyl ester resins struggle with high-temperature performance, limiting their application in extreme heat environments. Industries such as aerospace, automotive, and industrial processing require materials that can withstand prolonged exposure to temperatures exceeding 250°C, but standard vinyl ester formulations fall short. Research institutions, including NASA’s Advanced Materials Research Division, are actively investigating heat-resistant vinyl ester composites, but maintaining strength, flexibility, and cost-effectiveness remains a challenge. Additionally, applications such as high-performance brake components, aircraft engine parts, and industrial heat exchangers demand materials with enhanced thermal stability, which current vinyl ester formulations cannot fully provide. Developing modified vinyl ester resins with ceramic or nanocomposite reinforcements could enhance high-temperature resistance, but such solutions require extensive research and testing before commercial viability. Overcoming this challenge will require collaboration between material scientists, manufacturers, and regulatory bodies to create cost-effective, heat-resistant vinyl ester formulations that meet industry demands.

Vinyl Ester Market Segmental Analysis

By Type

In 2023, Bisphenol A Diglycidyl Ether (DGEBA) dominated the Vinyl Ester Market with a market share of 50.3%, driven by its high chemical resistance, mechanical strength, and widespread use in corrosion-resistant applications. This type is widely adopted in chemical storage tanks, pipelines, and industrial coatings, where superior durability and performance against acids, alkalis, and solvents are crucial. The American Composites Manufacturers Association (ACMA) has emphasized the increasing adoption of DGEBA-based vinyl ester resins in marine, automotive, and infrastructure applications, further solidifying its dominance. Additionally, the U.S. Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) have strict regulations on material performance in hazardous environments, leading industries to opt for DGEBA vinyl ester for its superior structural integrity and compliance with environmental standards. The growing demand for corrosion-resistant storage solutions in the oil & gas and wastewater treatment industries, particularly in the United States, Canada, and Germany, has further boosted the segment’s growth.

By Application

In 2023, Pipes & Tanks dominated the Vinyl Ester Market with a 42.8% market share, primarily due to the rising demand for corrosion-resistant solutions in chemical, oil & gas, and water treatment industries. The American Water Works Association (AWWA) and the U.S. Department of Energy (DOE) have highlighted the necessity for durable, chemical-resistant piping systems to prevent leakages, environmental contamination, and structural failures in harsh industrial conditions. The increasing focus on wastewater management and desalination projects, particularly in the United States and the Middle East, has fueled the demand for vinyl ester-based pipes and storage tanks. Additionally, the expansion of the shale gas industry in North America has accelerated the adoption of high-performance pipes resistant to aggressive chemicals and extreme temperatures. The Asia-Pacific region, particularly China and India, is also witnessing a surge in infrastructure projects requiring advanced composite materials, further supporting the dominance of pipes & tanks applications in the market.

Vinyl Ester Market Regional Analysis

In 2023, North America dominated the Vinyl Ester Market with a 38.6% market share, driven by technological advancements, stringent environmental regulations, and strong industrial demand across multiple sectors. The United States played a key role in this dominance, supported by government initiatives promoting sustainable and high-performance materials in construction, marine, and chemical processing applications. According to the American Chemistry Council (ACC), the U.S. chemical industry, which heavily relies on corrosion-resistant vinyl ester resins, accounted for over $500 billion in revenues in 2023. The Environmental Protection Agency (EPA) and the U.S. Occupational Safety and Health Administration (OSHA) have reinforced strict safety standards for industrial tanks, pipelines, and marine applications, increasing the adoption of vinyl ester-based composites. The National Association of Corrosion Engineers (NACE) has reported a surge in demand for corrosion-resistant materials, particularly in oil & gas refineries and water treatment plants, further bolstering market growth. Canada has also contributed to regional dominance, with significant investments in wastewater treatment plants and chemical processing industries adopting advanced composite materials. Mexico is rapidly expanding its marine industry and oil & gas infrastructure, leading to increased use of vinyl ester-based coatings and tanks. The combination of technological innovation, regulatory frameworks, and industrial expansion positions North America as the largest regional market for vinyl ester products.

During the forecast period, Asia Pacific emerged as the fastest-growing region in the Vinyl Ester Market, with a significant growth rate during the forecast period of 2024 to 2032. The growth is driven by rapid industrialization, expanding infrastructure, and rising investments in renewable energy projects. China, the largest contributor to regional growth, is witnessing a surge in demand for high-performance materials in wind energy, automotive, and chemical industries. According to the China National Chemical Information Center (CNCIC), the Chinese chemical processing industry has significantly increased its adoption of vinyl ester-based corrosion-resistant materials to enhance operational safety and efficiency. India is also emerging as a major market, with government-backed initiatives such as the Smart Cities Mission and "Make in India" campaign, which are driving demand for durable and lightweight composite materials in construction, marine, and infrastructure sectors. The Indian Ministry of New and Renewable Energy (MNRE) has emphasized the role of vinyl ester composites in wind turbine manufacturing, aligning with the country’s ambitious renewable energy targets. Additionally, Southeast Asian countries, including Indonesia, Malaysia, and Thailand, are experiencing a growing adoption of vinyl ester resins in marine and automotive applications, further boosting regional market expansion. With strong manufacturing capabilities, government support for industrial advancements, and increasing demand for high-performance materials, Asia Pacific is poised to witness substantial growth in the Vinyl Ester Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AOC (Vipel F010, Vipel F701, Vipel F764)

-

Ashland Global Holdings Inc. (Derakane 411, Derakane 8084, Derakane 510A)

-

Atul Ltd. (Lapox B-11, Lapox B-31, Lapox AH-713)

-

DIC Corporation (Dianyte VE-350, Dianyte VE-500, Dianyte VE-100)

-

Hexion Inc. (Epikote Resin 862, Epikote Resin 827, Epikote Resin 5019)

-

INEOS Composites (Atlac 580, Atlac 430, Atlac 590)

-

Interplastic Corporation (CoREZYN VE8301, CoREZYN VE8450, CoREZYN VE9790)

-

Kukdo Chemical Co., Ltd. (Kukdo KVE-810, Kukdo KVE-835, Kukdo KVE-890)

-

Lianyungang JTD Composites Co., Ltd. (JTD VE-100, JTD VE-200, JTD VE-500)

-

Nippon Shokubai Co., Ltd. (EPOLATE VE-800, EPOLATE VE-200, EPOLATE VE-450)

-

Poliya Composite Resins and Polymers, Inc. (Polives 701, Polives 901, Polives 710)

-

Polynt S.p.A. (Hetron 922, Hetron 980, Hetron 197)

-

Reichhold LLC (Polylite VE-9100, Polylite VE-8700, Polylite VE-9300)

-

Scott Bader Company Ltd. (Crystic VE679, Crystic VE680, Crystic VE684)

-

Sino Polymer Co., Ltd. (Bisphenol A VE-189, Novolac VE-196, Sino VE-120)

-

Swancor Holding Company Limited (Swancor 901, Swancor 970, Swancor 985)

-

U-Pica Company Ltd. (U-Pica VE-200, U-Pica VE-500, U-Pica VE-600)

-

Zhejiang Tianhe Resin Co., Ltd. (TH-VE200, TH-VE500, TH-VE800)

Recent Developments

-

February 2025: Allnex introduced high-performance vinyl ester resins at JEC World 2025, featuring enhanced durability, chemical resistance, and sustainability benefits for marine, automotive, and industrial applications.

-

January 2025: Ecoinvent released new LCA data for unsaturated polyester and vinyl ester resins, helping manufacturers assess carbon footprint, emissions, and sustainability performance.

-

December 2024: Nippon Paint Holdings planned to acquire AOC from Lone Star Funds, strengthening its resin technology portfolio and expanding in coatings and composites markets.

-

August 2024: INEOS started a vinyl ester resin expansion at its Changzhou facility, boosting production capacity to meet rising demand in automotive, aerospace, and industrial sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.34 Billion |

| Market Size by 2032 | USD 2.25 Billion |

| CAGR | CAGR of 5.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Bisphenol A Diglycidyl Ether (DGEBA), Epoxy Phenol Novolac (EPN), Brominated Fire Retardant, Others) •By Application (Pipes & Tanks, Marine, Wind Energy, FGD & Precipitators, Pulp & Paper, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AOC, DIC Corporation, INEOS Composites, Interplastic Corporation, Polynt S.p.A., Scott Bader Company Ltd., SHOWA DENKO K.K., Sino Polymer Co., Ltd., Swancor Holding Company Limited, Hexion Inc. and other key players |