Vodka Market Report Scope & Overview:

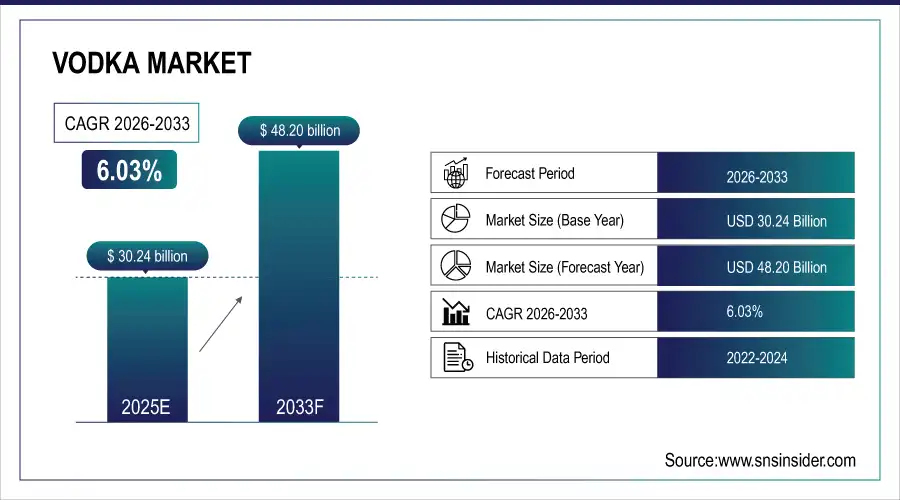

The Vodka Market Size is valued at USD 30.24 Billion in 2025E and is projected to reach USD 48.20 Billion by 2033, growing at a CAGR of 6.03% during the forecast period 2026–2033.

The Vodka Market analysis report provides a comprehensive overview of industry trends, highlighting premiumization, flavor innovation, and expanding on-trade and off-trade channels. Rising consumer preference for craft spirits, premium alcoholic beverages, and social consumption occasions is expected to drive steady market growth during the forecast period.

Vodka consumption surpassed 4.6 billion liters in 2025, supported by rising demand for premium and flavored variants across on-trade and off-trade channels.

Market Size and Forecast:

-

Market Size in 2025: USD 30.24 Billion

-

Market Size by 2033: USD 48.20 Billion

-

CAGR: 6.03% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Vodka Market - Request Free Sample Report

Vodka Market Trends:

-

Consumers are increasingly shifting toward premium, super-premium, and craft vodka, driven by rising disposable incomes and experiential drinking preferences.

-

Flavor innovation, including fruit-infused, botanical, and limited-edition variants, is expanding vodka’s appeal among younger consumers.

-

Growing preference for low-additive, organic, and clean-label spirits is influencing product positioning and brand differentiation.

-

Cocktail culture and mixology trends across bars, nightclubs, and home settings are accelerating vodka consumption.

-

Expansion of online alcohol retail and omnichannel distribution is improving product accessibility and brand visibility.

-

Sustainable packaging, ethical sourcing, and premium brand storytelling are emerging as key differentiators among eco-conscious consumers.

U.S. Vodka Market Insights:

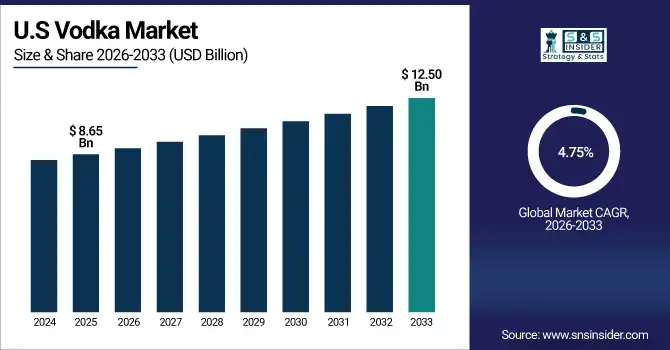

The U.S. Vodka Market is projected to grow from USD 8.65 Billion in 2025E to USD 12.50 Billion by 2033, at a CAGR of 4.75%. Growth is driven by rising demand for premium and flavored vodkas, expanding cocktail culture, home mixology trends, and increased adoption in bars, restaurants, and retail channels.

Vodka Market Growth Drivers:

-

Growing premiumization and expanding cocktail culture are accelerating vodka consumption across on-trade and retail channels.

Growing premiumization and the expanding cocktail culture are major drivers of Vodka Market growth. Consumers are increasingly seeking high-quality spirits that deliver superior taste, smoothness, and brand prestige. Vodka remains a cornerstone of classic and modern cocktails, driving strong demand across bars, nightclubs, and home mixology. Rising social gatherings, nightlife expansion, and experiential drinking trends are encouraging consumers to trade up from standard offerings to premium and super-premium vodka, supporting sustained market expansion across both on-trade and off-trade channels.

Vodka demand increased by 6.1% in 2025, driven by premiumization trends and rising cocktail consumption across bars, restaurants, and home entertainment channels.

Vodka Market Restraints:

-

Strict alcohol regulations, high excise duties, and advertising restrictions are limiting vodka market expansion across key regions.

Strict alcohol regulations, high excise duties, and advertising restrictions pose significant restraints for the Vodka Market. Compliance with varying regional laws increases production and distribution costs, limiting market expansion. Heavy taxation and import duties make premium products less affordable for consumers, while marketing constraints hinder brand visibility and consumer education. These regulatory challenges create entry barriers for new players and restrict large-scale distribution, particularly in emerging markets. Consequently, growth opportunities are constrained despite rising consumer demand and premiumization trends in established markets.

Vodka Market Opportunities:

-

Expanding craft cocktail culture and growing consumer preference for flavored, premium, and artisanal vodka present new market opportunities.

Expanding craft cocktail culture and growing preference for flavored, premium, and artisanal vodka present a significant opportunity for the Vodka Market. Consumers are increasingly seeking unique taste experiences, limited-edition releases, and innovative flavor infusions. Brands can leverage this trend by developing specialty vodkas, ready-to-drink cocktails, and mixology-focused products. This focus on creativity, quality, and experiential drinking enhances brand differentiation, increases consumer engagement, and opens new avenues for market expansion across on-trade, off-trade, and e-commerce channels.

Flavored, premium, and craft vodkas accounted for 28% of new spirit product launches in 2025, driven by rising demand for unique taste experiences and mixology-focused offerings.

Vodka Market Segmentation Analysis:

-

By Product Type, Plain / Unflavored Vodka held the largest market share of 35.42% in 2025, while Organic & Craft Vodka is expected to grow at the fastest CAGR of 9.21% during 2026–2033.

-

By Raw Material, Grains (Wheat, Rye, Barley) accounted for the highest market share of 41.55% in 2025, while Fruits & Others are projected to expand at the fastest CAGR of 8.94% during the forecast period.

-

By Flavor Profile, Unflavored dominated with a 38.67% share in 2025, while Infused / Specialty Flavors are anticipated to record the fastest CAGR of 9.03% through 2026–2033.

-

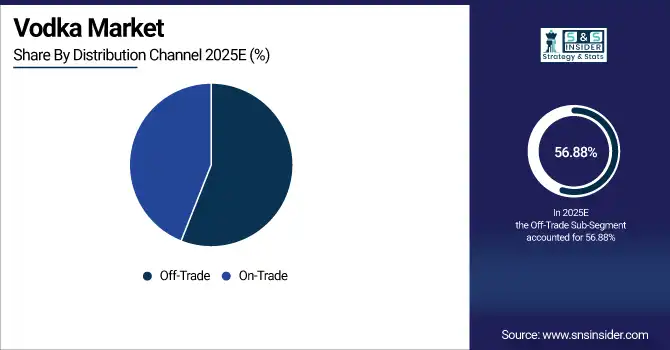

By Distribution Channel, Off-Trade held the largest share of 56.88% in 2025, while On-Trade is expected to grow at the fastest CAGR of 6.48% during 2026–2033.

-

By End-Use, Household / Individual Consumption accounted for the largest share of 42.39% in 2025, while Events & Catering are forecasted to register the fastest CAGR of 8.87% during 2026–2033.

By Product Type, Plain / Unflavored Vodka Dominates While Organic & Craft Vodka Expands Rapidly:

Plain / Unflavored Vodka segment dominated the market due to its classic taste, versatility in cocktails, and widespread adoption across bars, nightclubs, and home consumption. Its consistent quality and brand recognition make it a staple for consumers and mixologists alike. In 2025, plain vodka consumption surpassed 1.62 billion liters.

Organic & Craft Vodka is the fastest growing segment, reflecting consumers’ increasing preference for artisanal, small-batch, and eco-friendly products. Rising awareness of clean-label, sustainable spirits and premiumization trends are driving growth. In 2025, organic and craft vodka sales reached 312 million liters.

By Raw Material, Grains Dominate While Fruits & Others Expand Rapidly:

Grains (wheat, rye, barley) segment dominated the market due to their high yield, smooth flavor profile, and traditional production methods used by leading brands. Grain-based vodka is widely preferred for its versatility in mixing and long-standing consumer trust. In 2025, grain-based vodka production exceeded 1.85 billion liters.

Fruits & Others are the fastest growing segment, driven by the rising popularity of flavored, infused, and experimental vodka variants. Consumers are exploring unique taste experiences and premium offerings, leading to rapid adoption of fruit-based vodkas. In 2025, fruit and alternative raw material vodkas reached 410 million liters.

By Flavor Profile, Unflavored Dominates While Infused / Specialty Flavors Expand Rapidly:

Unflavored Vodka segment dominated the market due to its neutrality, adaptability in cocktails, and brand recognition. It remains the preferred choice for bartenders and households seeking a classic, consistent drinking experience. In 2025, unflavored vodka consumption reached 1.58 billion liters.

Infused / Specialty Flavors are the fastest growing segment, reflecting a shift toward innovation and personalized drinking experiences. Botanicals, spices, and limited-edition infusions are driving demand among younger, trend-conscious consumers. In 2025, infused and specialty vodka demand surpassed 385 million liters.

By Distribution Channel, Off-Trade Dominates While On-Trade Expands Rapidly:

Off-Trade segment dominated the market due to its widespread availability through supermarkets, hypermarkets, liquor stores, and online retail. Convenience, accessibility, and home consumption trends have strengthened its position. In 2025, off-trade vodka sales exceeded 2.45 billion liters.

On-Trade is the fastest growing segment, driven by cocktail culture, premiumization, and experiential drinking in bars, nightclubs, and restaurants. Social occasions and mixology trends are boosting vodka sales in on-trade venues. In 2025, on-trade vodka consumption reached 1.85 billion liters.

By End-Use, Household / Individual Consumption Dominates While Events & Catering Expands Rapidly:

Household / Individual Consumption segment dominated the market as consumers increasingly enjoy vodka at home for personal use, small gatherings, and home mixology. Brand familiarity, affordability, and availability in retail stores support its dominance. In 2025, household vodka consumption exceeded 1.92 billion liters.

Events & Catering is the fastest growing segment, fueled by demand in large social functions, weddings, corporate events, and premium catering services. This segment is also benefiting from rising disposable incomes and a growing culture of premium entertainment. In 2025, vodka consumption in events and catering reached 410 million liters.

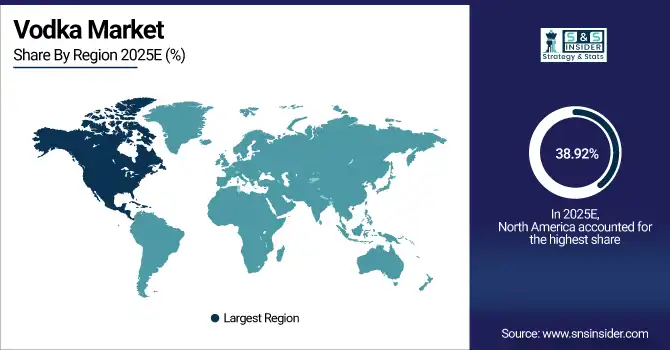

Vodka Market Regional Analysis:

North America Vodka Market Insights:

North America is the dominated the Vodka Market, accounting for 38.92% of the market in 2025. Strong brand recognition, widespread on-trade and off-trade availability, and high consumer preference for premium and super-premium vodkas are driving the region’s leadership. Rising cocktail culture, home mixology trends, and growing disposable incomes are further fueling demand. The region continues to witness new product launches, flavored innovations, and craft vodka adoption, reinforcing its position as the largest and most mature market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Vodka Market Insights:

The U.S. Vodka Market is driven by growing premiumization, rising popularity of flavored and craft vodkas, and expanding cocktail culture. Increased home consumption, bar and restaurant trends, and adoption of innovative ready-to-drink vodka cocktails strengthen the market. New product launches and brand innovations continue to reinforce U.S. dominance in North America.

Europe Vodka Market Insights:

Europe is the fastest-growing Vodka Market, expanding at a CAGR of 7.22%. Rising demand for premium, flavored, and craft vodkas is driving growth, particularly in Germany, the UK, France, and Poland. Strong cocktail culture, nightlife trends, and home mixology adoption support consumption. Innovative product launches, artisanal and organic offerings, and increasing consumer preference for unique taste experiences are further accelerating growth, establishing Europe as a key market for vodka expansion.

Germany Vodka Market Insights:

Germany is a key Vodka market driven by strong cocktail culture, rising demand for premium, flavored, and craft vodkas, and growing home mixology trends. Expanding on-trade and off-trade availability, innovative product launches, and adoption of artisanal and organic offerings further strengthen Germany’s position as a leading market in Europe.

Asia-Pacific Vodka Market Insights:

The Asia-Pacific Vodka Market is expanding rapidly due to rising consumer preference for premium, flavored, and craft vodkas, coupled with increasing cocktail culture and home mixology trends across China, Japan, South Korea, and India. Growing disposable incomes, urban nightlife expansion, and innovative product launches are driving market adoption. Increasing awareness of artisanal and organic offerings, along with investments in local production and distribution, position Asia-Pacific as one of the fastest-growing regions in the vodka market.

China Vodka Market Insights:

China’s Vodka Market is driven by rising urbanization, increasing disposable incomes, and growing demand for premium and flavored spirits. Expanding nightlife, cocktail culture, and Western dining influences are boosting consumption. Greater availability of imported and locally produced premium vodkas, along with innovative flavors, positions China as a key growth contributor within the Asia-Pacific vodka market.

Latin America Vodka Market Insights:

The Latin America Vodka Market is expected to grow steadily, driven by rising disposable incomes, expanding nightlife and cocktail culture, and increasing demand for premium and flavored vodkas in Brazil, Mexico, and Argentina. Growing urbanization, social drinking trends, and improved retail availability are supporting wider adoption and strengthening the region’s vodka market growth.

Middle East and Africa Vodka Market Insights:

The Middle East & Africa Vodka Market is gradually expanding, supported by rising urbanization, tourism growth, and increasing demand for premium spirits in select markets. Expanding hospitality sectors, nightlife development, and growing acceptance of international alcoholic beverages in the UAE, South Africa, and select African economies are contributing to steady regional market growth.

Vodka Market Competitive Landscape:

Smirnoff, owned by Diageo plc and headquartered in London, UK, is the world’s largest and most widely recognized vodka brand. Its dominance stems from distribution strength, consistent quality, and mass-market affordability combined with brand trust. Smirnoff offers an extensive portfolio spanning classic unflavored vodka, a wide variety of flavored options, and ready-to-drink formats, catering to diverse consumer segments. Strong marketing campaigns, deep penetration in on-trade and off-trade channels, and leadership in emerging markets have enabled Smirnoff to maintain its commanding position.

-

In March 2025, Smirnoff launched Miami Peach flavored vodka alongside an expanded ready-to-drink vodka cocktail range, enhancing its flavored portfolio and targeting younger consumers. The launch strengthened Smirnoff’s presence across on-trade, off-trade, and retail channels, reinforcing its leadership in accessible and innovative vodka offerings

Absolut, owned by Pernod Ricard and based in Stockholm, Sweden, is a premium vodka brand known for its purity, distinctive packaging, and innovative branding. The company dominates the premium vodka segment through single-source production, sustainable manufacturing practices, and a strong emphasis on quality and transparency. Absolut’s wide range of flavored vodkas and limited-edition collaborations have strengthened its appeal among younger and urban consumers. Strategic marketing, creative storytelling, and strong presence in cocktail culture have positioned Absolut as a leading premium vodka brand.

-

In June 2025, Absolut introduced Absolut Vodka & Sprite Watermelon ready-to-drink cans, expanding its RTD portfolio with a refreshing flavor profile. This launch aimed to capture rising demand for convenient, premium vodka-based cocktails among urban consumers, strengthening Absolut’s position in social and on-the-go drinking occasions across key markets.

Grey Goose, a flagship brand of Bacardi Limited, is headquartered in France and is synonymous with super-premium vodka. The brand dominates the luxury vodka segment through meticulous production using French winter wheat and limestone-filtered spring water. Grey Goose focuses on craftsmanship, smoothness, and exclusivity, appealing to high-income consumers and upscale on-trade establishments. Limited editions, elegant packaging, and strong associations with fine dining and nightlife have reinforced its premium image. Strategic positioning, experiential marketing, and hospitality partnerships have established Grey Goose as a benchmark for super-premium vodka.

-

In July 2025, Grey Goose launched Grey Goose Altius, an ultra-premium vodka inspired by Alpine glacial filtration and French craftsmanship. The product reinforced Grey Goose’s luxury positioning, targeting high-end consumers through selective distribution and premium travel retail channels, while elevating the brand’s association with exclusivity and refined drinking experiences.

Vodka Market Key Players:

Some of the Vodka Market Companies are:

-

Absolut

-

Grey Goose

-

Svedka

-

Ketel One

-

Eristoff

-

Russian Standard

-

Tito’s Handmade Vodka

-

Wyborowa

-

Skyy Vodka

-

Finlandia

-

Belenkaya

-

Khortytsa

-

Medoff

-

Zoladkowa Czysta De Luxe

-

Krupnik

-

Iceberg Vodka

-

Soyuz-Victan

-

Proximo Spirits

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 30.24 Billion |

| Market Size by 2033 | USD 48.20 Billion |

| CAGR | CAGR of 6.03% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Plain/Unflavored Vodka, Flavored Vodka, Premium Vodka, Super-Premium & Luxury Vodka, Organic & Craft Vodka, Others) • By Raw Material (Grains, Corn, Potatoes, Sugarcane/Molasses, Fruits & Others) • By Flavor Profile (Unflavored, Fruit-Based, Herbal & Botanical, Spiced, Infused/Specialty Flavors) • By Distribution Channel (On-Trade, Off-Trade) • By End-Use (Household / Individual Consumption, Commercial Consumption, Events & Catering, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Smirnoff, Absolut, Grey Goose, Svedka, Belvedere, Ketel One, Eristoff, Russian Standard, Tito’s Handmade Vodka, Wyborowa, Skyy Vodka, Finlandia, Belenkaya, Khortytsa, Medoff, Zoladkowa Czysta De Luxe, Krupnik, Iceberg Vodka, Soyuz-Victan, Proximo Spirits |